Download and provide consent for the 1099-K form

This article explains how to download and provide consent for the IRS Form 1099-K within Zenoti Payments. You’ll learn how to access your form, choose between electronic or mailed delivery, and understand the submission timelines for consent.

Overview

Form 1099-K, also known as Payment Card and Third Party Network Transactions, is used to report payments received through payment card transactions and/or settlement of third-party payment network transactions.

If you use Zenoti Payments as the processor for your daily payment transactions, you are required to report the income to the IRS (Internal Revenue Service) and pay taxes accordingly. The 1099-K form helps you report your income.

You must access your 1099-K form in Zenoti and provide consent on whether you want to receive a digital copy of the form, or you want a physical copy of the form mailed to you via the postal service.

Important

Important: Once submitted, you cannot change your consent till January 31.

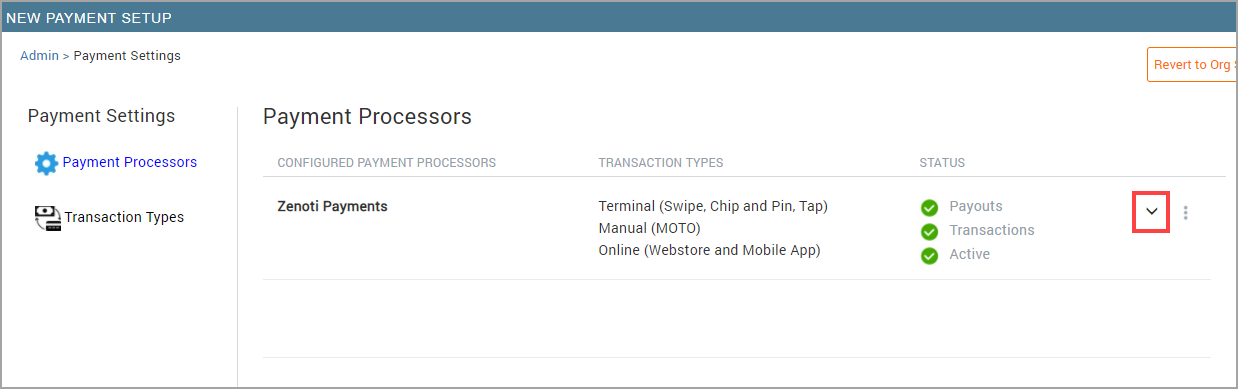

At the organization or the center level, click the Configuration icon.

Search for and select Payment processor onboarding.

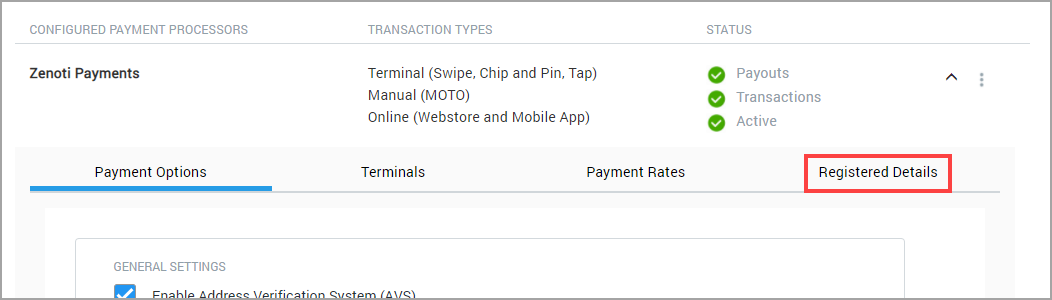

For Zenoti payments, expand the details.

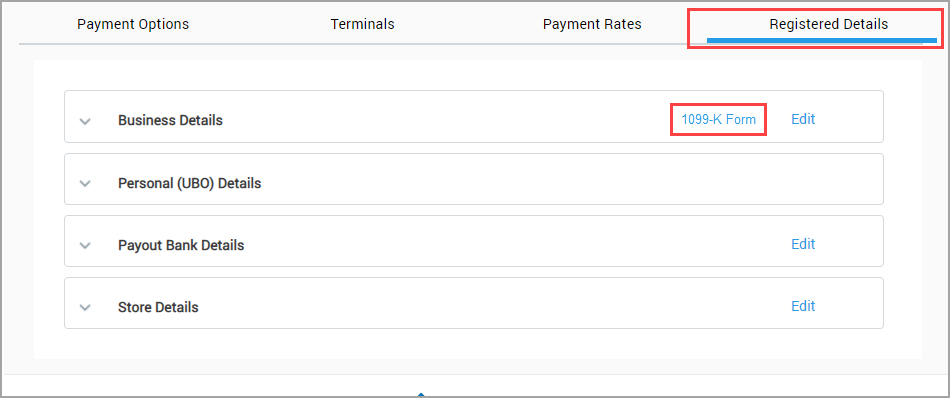

Under the Registered details login to your Zenoti Payments account.

Enter the verification code sent to your email and click Verify.

Click 1099-K form.

Provide your consent for any one of the following:

E-Delivery: If you want to download a PDF copy of the 1099-K form, choose this option and click Submit.

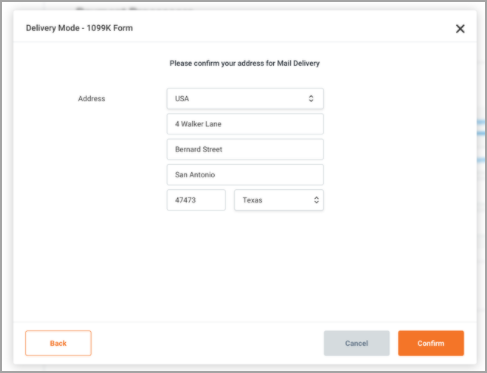

Mail: If you want to receive a physical copy of the 1099-K form via postal service, choose this option and click Submit.

Check the auto-populated address in the pop-up and click Confirm.

Click Done.

Disclaimer

Refer to this external article by the IRS to understand your 1099-K form and how to fill it out.

The external resource provided in the sentence above is for information on the 1099-K form only. Zenoti bears no responsibility for the accuracy, legality, or content of the external site or subsequent links.

Key words

Term | Description |

|---|---|

Form 1099-K | A tax document issued by the IRS to report income from payment card and third-party network transactions. |

E-Delivery | Option to receive and download your 1099-K form digitally as a PDF. |

Mail Delivery | Option to receive a physical copy of your 1099-K form by postal service. |

Consent | Your confirmation of how you wish to receive the 1099-K form. Once submitted, consent cannot be changed until January 31. |

Zenoti Payments | Zenoti’s integrated payment processing solution used to manage and report business transactions. |