Enable Address Verification Service (AVS)

This article explains how to configure the Address Verification Service (AVS) in Zenoti, enabling businesses to reduce fraud, minimize risks, and optimize payment processing fees.

Overview

AVS is a crucial fraud prevention tool that checks if a customer's billing address — specifically the ZIP code and issuing country— matches the one on file with the issuing bank. This service helps businesses reduce fraudulent transactions, minimize risks, and optimize processing fees.

Major card networks, such as Visa, Mastercard, Discover, and American Express, support AVS in the United States, United Kingdom, and Canada.

Enable AVS

Enabling AVS ensures that front desk operators (FDOs) can enter billing address details. After you enable AVS, you can configure additional settings that give you better control over how you want to handle transactions.

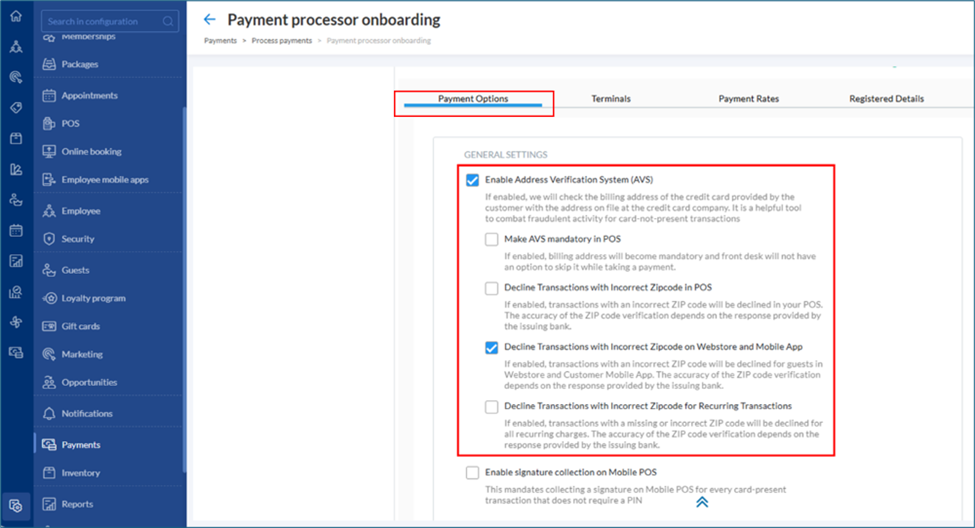

From the organization or center level, click Configuration > Payments > Process payments > Payment processor onboarding.

Under Payment Options > General settings, select the Enable Address Verification System (AVS) checkbox.

Enable the following configurations, as required.

Make AVS mandatory in POS

If enabled, FDOs must enter AVS details. Skipping is not allowed.

If disabled, FDOs can skip AVS details, but this may increase processing fees for transactions completed without AVS details.

Decline Transactions with incorrect Zipcode in POS

Transactions with an incorrect ZIP code in the POS (Point of Sale) may incur higher fees if not declined. Additionally, a correct AVS setup helps reduce fraudulent transactions and aids in winning disputes.

Decline transactions with incorrect Zipcode on Webstore and Mobile App

Transactions processed online with an incorrect ZIP code may incur higher fees if not declined. Additionally, a correct AVS setup helps reduce fraudulent transactions and aids in winning disputes.

Decline Transactions with incorrect Zipcode for Recurring Transactions

Recurring transactions processed through POS with an incorrect ZIP code may incur higher fees if not declined.

Note: These settings apply to Zenoti Payments (Adyen and Stripe).

Click Save.

When AVS is enabled, Zenoti verifies the billing address entered by the customer against the address on file with the credit card issuer.

Note: Please ensure you save the configurations after making any changes to it.

AVS fees and best practices

We recommend you enable AVS and collect billing addresses to prevent fraudulent transactions.

No AVS fee is charged if a transaction includes a valid ZIP code.

Note: Zenoti always requires AVS for online transactions (Webstore/CMA), even if AVS is disabled for a center. This ensures secure transactions and minimizes fraud risks.

FAQs

Q: Will I be charged an AVS failed fee even if AVS is enabled?

A: Yes, if the FDO skips entering AVS details for a transaction, an AVS failed fee may apply.

Q: Will I be charged an AVS failed fee if AVS is mandatory?

A: No, if AVS is mandatory, all transactions will include a valid billing address, preventing AVS failure fees.

Q: Where do I see AVS failed fee?

A: Please refer to the payments rate.

Q: Does the AVS failed fee apply on top of the standard transaction fee?

A: No, the AVS failed fee replaces the standard processing fee when transaction is completed without AVS.

Q: Is AVS applicable in all countries?

A: While AVS as a fraud mitigation tool is applicable in many countries including the US, the UK and Canada, currently, the AVS failed fee applies only in the US. This may change based on card network updates.

Q: Do all card networks charge an AVS failed fee?

A: Currently, only Visa charges an AVS failed fee. Other networks may introduce similar fees in the future.

Q: Why does Zenoti impose the AVS failed fee?

A: Zenoti does not charge the fee directly; it is a pass-through charge from the card network.

Q: How does AVS impact recurring transactions?

A: Recurring transactions are business-initiated, meaning AVS is not required for every charge. However, collecting the billing address when saving a card for recurring payments is strongly recommended. Ensuring stored cards have a valid ZIP code minimizes AVS failed fees.

Q: What should I do if I have stored cards without a ZIP code?

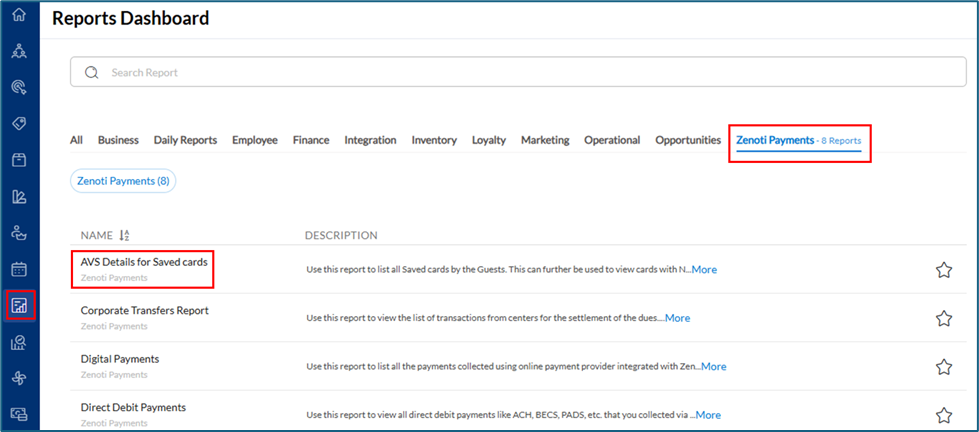

A: Collect AVS details for stored cards when customers visit in person. Use the AVS Details for Saved Card report to request missing billing addresses via email.

To view AVS Details for Saved Card report, navigate to:

Reports Dashboard (from either Org or Center) > Zenoti Payments > AVS Details for Saved Card

Q: How do I identify stored cards without a ZIP code?

A: In POS, saved cards for a guest will display labels indicating the ZIP code status from the billing address:

ZIP code unavailable

Incorrect ZIP code

No ZIP code