Set Up an Employee for Work From Home Tax Calculation

This article explains how to set an employee as a Work From Home (WFH) employee in Zenoti Payroll. Use this option when the employee works remotely from a state different from the business or center location. Enabling this ensures that taxes are calculated based on the employee’s home address, keeping payroll compliant with state and local tax laws.

Overview

In Zenoti Integrated Payroll, the Work From Home (WFH) setting lets you calculate payroll taxes using the employee’s residential address instead of the center’s address. This is especially useful when employees work remotely from a different state, , which may have different tax requirements. The WFH setting supports multistate payroll compliance by ensuring taxes are withheld and reported accurately for remote employees.

Prerequisites

To enable the setting:

The employee must live and work in a different state than the assigned center.

The employee’s residential address must be correctly entered in their profile under the Address section.

When to use the Work From Home setting

Enable the WFH setting for employees who work remotely from a different state than the center they’re assigned to. This is common for administrative and backend roles such as:

Payroll Managers

Accountants

Support Staff

IT Personnel

Marking these employees as WFH ensures taxes are calculated based on their home address, which helps you stay compliant with state and local tax laws.

How to set an employee as a Work From Home Employee

To enable the Work From Home setting for an employee:

Navigate to Employee > Zenoti Integrated Payroll > Employees (side menu on the ZIP dashboard).

Click View details against required employee.

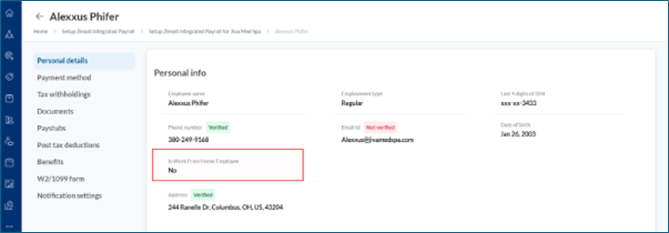

Find the Is Work From Home Employee field in Personal Details tab.

Select Yes from the dropdown (Default is No).

Make sure the employee’s home address is correctly filled under the Address section.

Click Save.

Note

Once enabled, Zenoti will use the home address for tax withholding and remittance purposes instead of the address of the associated center or centers.

Example scenario

An Accountant works remotely from Oregon, but is associated with a Zenoti center located in California.

If WFH is disabled, Zenoti applies California tax rules. California’s tax rules.

If WFH is enabled, Zenoti applies Oregon tax rules—avoiding incorrect withholdings.

Frequently asked questions (FAQs)

Q. Who should be marked as a Work From Home employee?

A. Employees who do not report physically to a center regularly and work from their home state, especially if it differs from the center’s state, should be marked as WFH. Examples: Payroll Managers, Finance/Admin staff, IT personnel.

Q. Will this setting affect employees who live and work in the same state?

A. No. If the employee's home address and center address are in the same state, tax calculation remains the same whether the WFH setting is on or off.

Q. What happens if I forget to mark a remote employee as WFH?

A. Zenoti will calculate taxes based on the center’s location, which may lead to incorrect state/local tax withholdings, especially if the employee lives in a state with different tax rules or no state income tax.

Q. Can an employee be linked to multiple centers and still be marked as Work From Home?

A. Yes. Regardless of how many centers they’re associated with, if the WFH setting is enabled, only the home address is used for tax calculations.

Q. Is this compliant with U.S. state tax regulations?

A. Yes. Most U.S. states require employers to withhold state and local taxes based on where work is performed, which, in the case of remote employees, is their residence. This setting aligns with tax laws followed by major payroll providers like Gusto, ADP, and QuickBooks Payroll.

Best practices

Review WFH eligibility during onboarding and role changes.

Regularly audit employee addresses and WFH settings.

Communicate with remote employees to confirm residential address accuracy.