Access the Payroll Register Report in Zenoti Integrated Payroll

This article explains how to access and use the Payroll Register Report in Zenoti.

Overview

The Payroll Register Report in Zenoti’s Integrated Payroll system provides a detailed view of individual employee payroll data within a selected pay period. It allows you to review gross earnings, taxes, deductions, reimbursements, and net pay for each employee—helping you validate and troubleshoot payroll outcomes with precision.

You can also export the Payroll Register Report in CSV or XLSX format with a clear breakdown of all payroll components. The export includes separate columns for employee (EE) and employer/business (ER) contributions to earnings, taxes, and benefits—giving you greater accuracy for reconciliation, compliance, and reporting.

Use this report to:

Review payroll breakdown for each employee.

Confirm payment statuses and payout details.

Track regular and off-cycle payrolls.

Reconcile with your payroll journal report.

Prerequisites

To access the Payroll Register Report, you must:

Have the Access Payroll Payouts Reports security role permission.

Be logged in at the organization, zone, or center level.

Access the Payroll Register Report

Follow the steps below to access the Payroll Register Report and view employee-level payroll details.

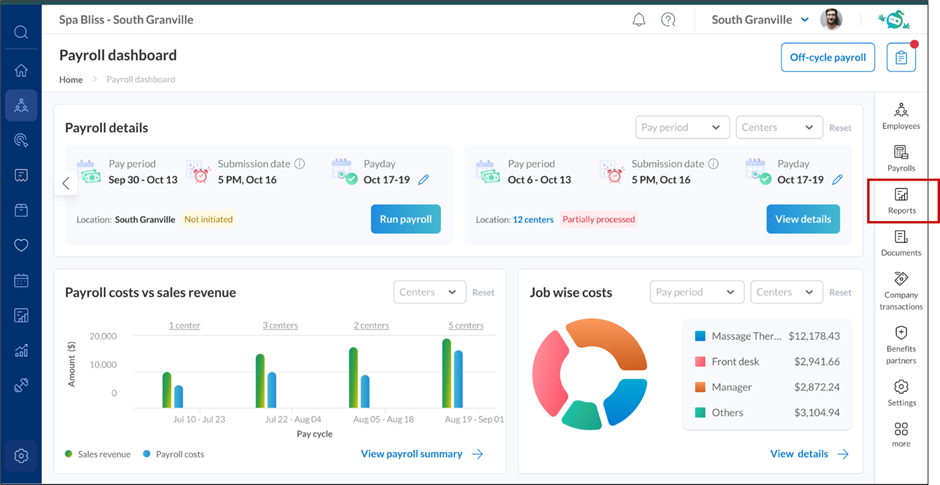

Navigate to Employee > Zenoti Integrated Payroll > Reports.

Select Payroll Register report.

Use the available filters to narrow the report view:

Employee Name: Search for a specific employee

Centers: Select one or more centers

Date: Choose a specific date range or pay period

Payroll Type: Select either Regular or Off-cycle

Employment Type: Choose from available types such as Regular or Contractor

The report displays results based on the filters and permissions applied.

Report column details

Column | Description |

|---|---|

Employee Name | Name of the employee included in the payroll run. |

Pay Period | Start and end dates of the payroll cycle. |

Gross Earnings | Total wages before any deductions. |

Already Paid | Amount already disbursed to the employee. |

Tax Deductions | Withheld employee taxes. |

Emp Benefits | Any applicable employee benefit deductions. |

Post-Tax Deductions | Deductions applied after tax such as voluntary contributions. |

Reimbursements | Non-taxable reimbursements, if applicable. |

Net Pay | Final take-home pay after all deductions and taxes. On click of Download icon, the pay stub of respective employee for that payroll can be accessed. |

Payout Status | Status of the employee's payment: Draft, Processing, Paid, or Failed. Refer Handle Failed Employee Payments in Zenoti Integrated Payroll for failed payments. |

Pay Day | Date on which the payment is scheduled or made. |

Payroll Type | Indicates whether the payroll is Regular or Off-cycle. |

Name of Payroll | Optional label given to the payroll run, such as “Final Settlement.” |

Employment Type | Type of employment such as Regular, Contractor. |

Paid From | Source of payment such as QRBusiness, WFH. |

Centers | Center or business unit associated with the employee. |

Note

By default, the report sorts records by Pay Day. If multiple records have the same Pay Day, they are further sorted by Pay Period Start Date.

Export details

When you export the Payroll Register Report (CSV/XLSX):

Earnings: Includes regular pay, overtime, bonuses, commissions, tips, etc.

Taxes:

EE Taxes – Withheld from employee pay

ER Taxes – Paid by the employer (for example, FUTA, SUTA, employer share of FICA)

Benefits:

EE Contributions – Deducted from employee pay (for example, employee 401k, health premium)

ER Contributions – Paid by the employer (for example, employer 401k match, employer health premium)

Other Deductions: Post-tax deductions such as child support, garnishments, loan repayments, and miscellaneous deductions

Totals: Shown at both employee and overall report levels

Download pay statement

You can download the Pay statement to view the detailed Net Pay breakdown for any employee:

Click the download icon in the Net Pay column for that employee to view details:

Gross earnings

Tax deductions

Benefit contributions

Post-tax deductions like garnishments if any

Final take-home calculation

Business and Employee details

This helps businesses to access pay statement of employees or contractors and useful for auditing, financial reconciliation, and payroll inquiries.

Frequently asked questions

Q: How do I know if an employee's payment is processed?

A: Check the Payout Status column. If it says “Paid,” the transfer has been completed.

Q: Can I download the Payroll Register Report?

A: Yes. Use the download icon next to each Net Pay value for detailed breakdowns.

Q: Why does the Net Pay not match Gross Earnings?

A: Net Pay accounts for all taxes, benefits, and deductions. Use the breakdown download to investigate.

Q: Can I export the Payroll Register Report with detailed payroll components?

A: Yes. When you export the report in CSV or XLSX format, you will see separate columns for Earnings, Taxes (EE and ER), Benefits (EE and ER), and Other Deductions, along with totals for each category.

Q: Why are EE and ER contributions shown separately in the export?

A: The separation allows you to reconcile payroll data more accurately, differentiate employer costs from employee deductions, and meet compliance and reporting requirements.

Q: How does the export help with reconciliation?

A: The detailed breakdown makes it easier to align payroll data with your internal accounting system, benefit provider statements, and tax filings.

Q: How can I see employee deductions broken down by type, including retirement contributions?

A: Export the Payroll Register Report in CSV or XLSX format. The export provides separate columns for all deduction types, including employee (EE) and employer (ER) contributions to benefits such as retirement savings, health insurance, and other post-tax deductions. This helps you confirm exactly what has been deducted from employee pay and what the business has contributed.

Q: Can I generate a General Ledger-style report that shows payroll entries as debits and credits?

A: While the Payroll Register export is not a full GL report, it gives you a detailed breakdown of payroll components—Earnings, Taxes, Benefits, and Other Deductions—with separate EE and ER totals. You can use this detailed export to map payroll categories to your financial system, making it easier to reconcile debits and credits.

Q: How can I view totals for each earning type (Salary, Hourly, Bonus, PTO, Holiday, Employer Taxes) by center?

A: Use the Payroll Register export with filters for center and date range. The export provides category-wise totals at both employee and overall report levels, so you can quickly see how much was paid under each earning type as well as employer taxes for a given pay period.