Run Payroll Using Zenoti Integrated Payroll

This article explains how to run payroll using Zenoti Integrated Payroll (ZIP), from preparing earnings and handling multi-center setups to confirming pay dates and submitting payroll. It also provides answers to common scenarios and troubleshooting tips for accurate, compliant payroll processing.

Overview

Zenoti Integrated Payroll simplifies payroll management for both single-center and multiple-center operations. It allows businesses to consolidate wages, commissions, reimbursements, taxes, and deductions into a single, streamlined payroll cycle.

ZIP ensures payroll is compliant and complete—whether you're processing regular employee pay, managing contractors, or addressing cross-center payments.

You will learn how to:

Prepare and calculate earnings for each pay period

Initiate payroll and manage input data

Review earnings across locations and employment types

Adjust pay days and preview final calculations

Submit payroll for processing and track outcomes

Role permission prerequisite

To run payroll in ZIP, the user must be assigned the Process Payroll Payouts role permission. Ensure this role is enabled before accessing payroll features.

Calculate earnings

Before initiating a payroll run:

Make sure all employee earnings are updated for the selected pay period.

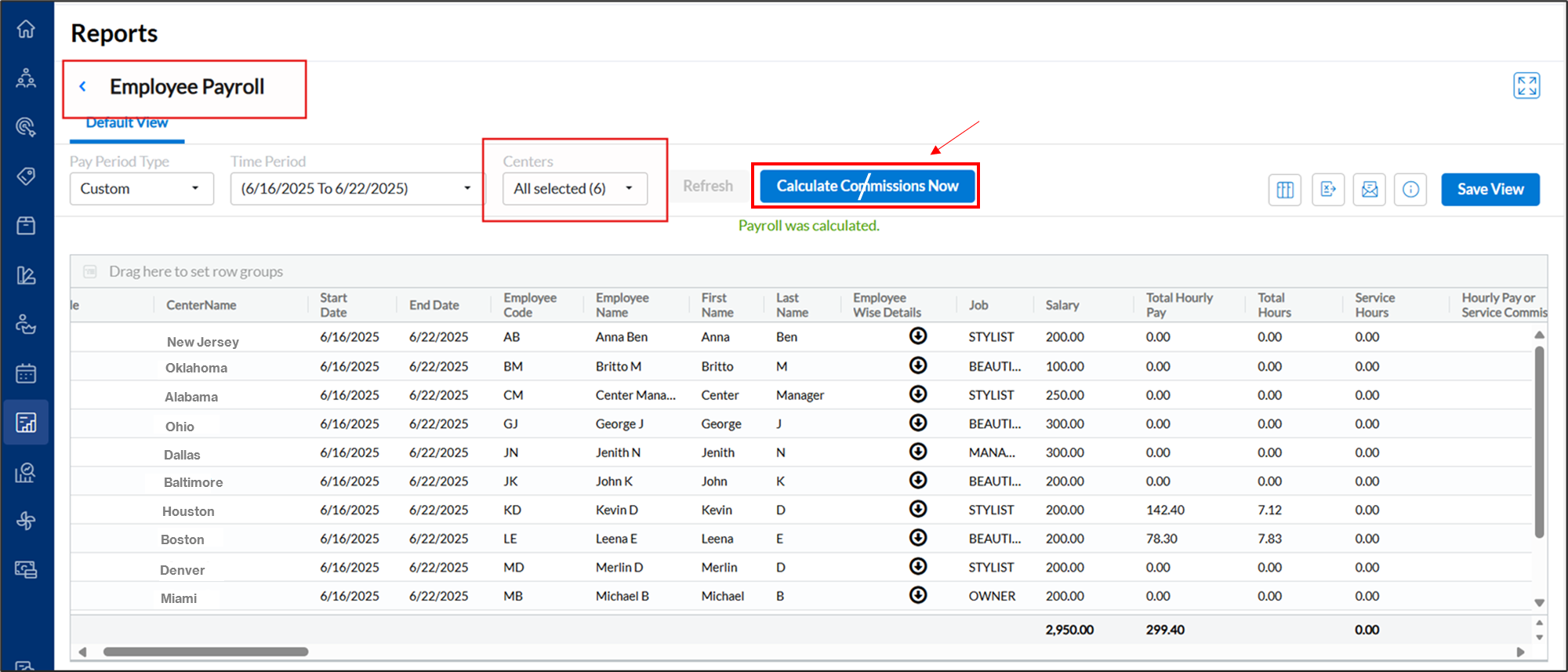

For single-center payroll, navigate to Reports > Payroll Summary Report.

For multi-center payroll, use the Zone-level or Org-level Payroll Summary Report for a consolidated view.

From here, you can calculate earnings and then click the Run Payroll (or Resume Payroll, if already initiated) option to proceed.

This action takes you to the ZIP dashboard, where you can continue with payroll processing.

Click Calculate Commissions/Earnings to refresh the data.

Note

If any changes were made to invoices or attendance data, recalculate earnings before initiating payroll to ensure accuracy.

Note

The Run Payroll option becomes available only after commissions and earnings are calculated.

If payroll has already been initiated, the option changes to Resume Payroll.

Once payroll is initiated, you cannot recalculate earnings for that pay period.

Initiate payroll for a pay period

To begin processing payroll for a specific pay period:

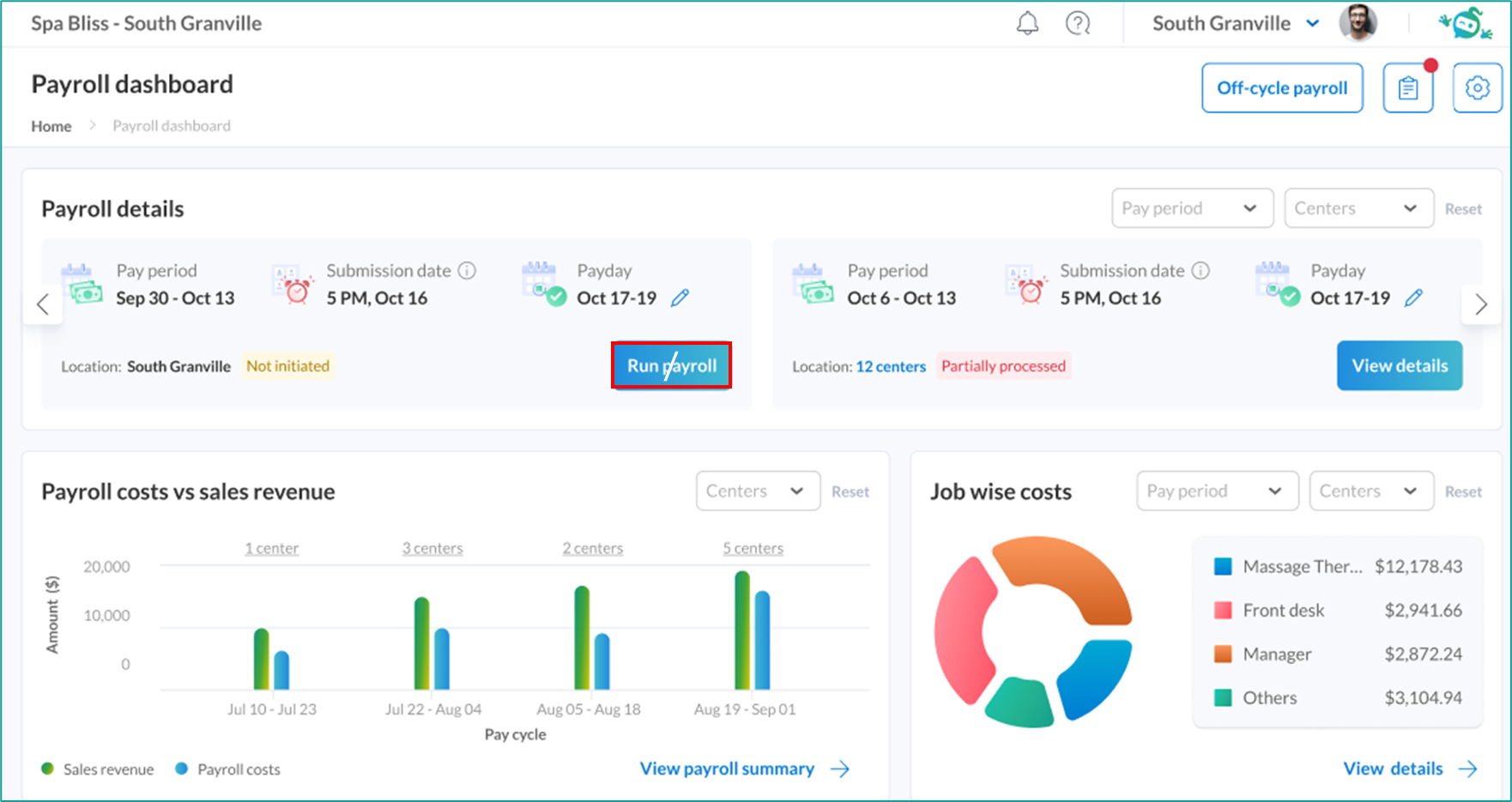

Navigate to Employees > Zenoti Integrated Payroll.

On the dashboard, locate the relevant Pay Period you want to process.

You can also access this flow by clicking the Run Payroll (or Resume Payroll, if already initiated) option in from the Payroll Summary Report, which opens the ZIP dashboard with the selected pay period automatically applied.

Click Run Payroll to check the timestamp of the most recent earnings calculation.

If payroll is already initiated, the button displays as Resume Payroll.

Click Run Payroll to load calculated earnings into the Payroll Input screen.

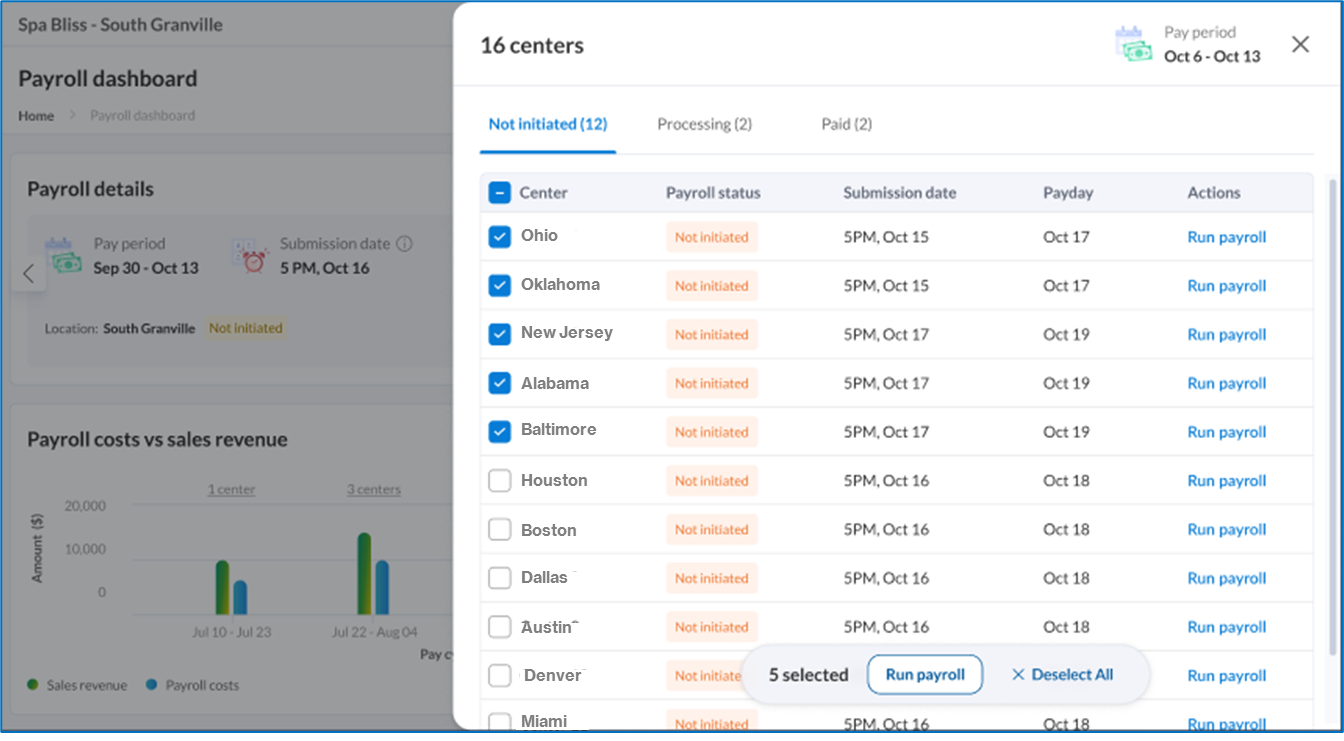

ZIP allows you to run payroll across multiple centers and business entities in a single batch.

Important

Once payroll is initiated—even in draft—you can no longer modify invoices, attendance, or commission data for that pay period.

If changes are needed after initiation:

Discard the draft payroll run.

Update the relevant records

Recalculate earnings using the Payroll Summary Report.

Re-initiate payroll.

Note

Payroll can be initiated any time after the pay period ends, starting from the next calendar day.

Review and manage payroll in the Payroll Input Screen

Once payroll is initiated, the Payroll Input screen displays all employee records for the selected pay period. This screen allows you to:

Review default earnings

Add custom earnings and reimbursements

Filter employee records

Finalize payroll before submission

Default and custom earnings

ZIP automatically populates earnings based on earning types configured in Payroll Settings > Earnings Configuration. These configurations may apply at either the center or business entity level.

Add custom earnings

You can also include additional earnings as needed:

Recurring custom earnings (example, monthly performance bonuses): Configure in Payroll Settings so they are applied automatically in every cycle.

One-time custom payments (example, spot bonus or incentive): Add directly using the Custom Pay option within the Payroll Input screen.

Record reimbursements (non-taxable)

To account for non-taxable payouts such as travel or supply reimbursements, use the Reimbursement section under Custom Pay. These entries are processed separately from taxable income and do not affect net taxable wages.

Filter and manage employee records

ZIP offers flexible filters to help you manage which employees appear in a payroll run. You can filter by:

Center

Employment Type (Regular/W2 or Contractor)

Employee Status (Active, Terminated)

Onboarding Status (Active, Pending)

Use Cases

Exclude contractors when running payroll for regular employees.

Run payroll for contractors only.

Exclude terminated employees who were already paid via an off-cycle payroll.

If an employee’s payroll setup is incomplete, they appear at the top of the screen. You can either complete their setup or remove them by clicking the delete icon next to their name.

Handle earnings for employees working across multiple centers

If an employee work across multiple centers:

If the Do not consider other center invoices for payroll setting is enabled, ZIP lists separate line items for each center.

If the setting is disabled, ZIP consolidates all earnings into a single entry under the employee’s base center.

In cases where an employee has only a fixed salary and no additional data (example, commissions or attendance), they may appear only under the base center. If an expected record is missing, use the Not Included in Payroll link to view and restore it.

Edit the pay day

You can edit the scheduled Pay Day if it falls on a public holiday or needs to be adjusted for other reasons.

Example: if the regular Pay Day is Friday, July 4 (holiday), you can edit it to Thursday, July 3. Use the edit icon on the Payroll Input or Preview screen to update the date.

Submission Deadline: Payroll must be submitted one business day before the selected Pay Day by 5 PM (center time).

For a July 3 pay day, submit payroll by July 2, 5 PM (center time).

For a July 7 pay day, submit payroll by July 3, 5 PM (center time).

Preview and submission

Before final submission, click Preview to review all details:

Net pay per employee

Payroll grouped by business entity

Expandable employee records showing detailed breakdowns

ZIP manages:

Federal and state tax calculations

Benefits deductions (example, 401k, health insurance)

Post-tax deductions (e.g., garnishments)

Note

For First-Time Payroll: Review benefit and tax setup for all employees to avoid incorrect deductions. You can view associated tax transactions under the Tax Deposits screen.

Final submission

After everything has been reviewed and verified:

Click Submit Payroll.

On Pay Day, ZIP will:

Debit amounts from the relevant business bank account(s)

Initiate direct deposits for all eligible employees

Frequently asked questions

Q1: Can I make changes after payroll is initiated?

A. No. Once payroll is initiated—even in draft mode—you cannot modify attendance records, invoices, or commission data for that pay period. To make changes:

Discard the draft payroll

Update the required records

Recalculate earnings

Re-initiate payroll

Q2: What is a custom deduction, and how do I add one?

A. Custom deductions refer to amounts withheld from an employee’s pay for specific reasons, such as equipment purchases or uniform costs. You can add these deductions in the Custom Pay section of the Payroll Input screen. Be sure to assign the correct classification so the system can apply the appropriate tax treatment.

Q3: Why is there an amount in the Paid Tips column that doesn't affect Net Pay?

A. ZIP includes Paid Tips such as tips paid through Zenoti Wallet or declared cash tips, as taxable earnings. These are included for tax calculation purposes but are not paid out again through direct deposit or paycheck.

Q4: When can I initiate payroll?

A. Payroll can be initiated any time after the pay period ends, startingfrom the next calendar day.

Q5: How do filters help during payroll?

A. Filters allow you to control which employees are included in a payroll run. You can:

Exclude contractors from regular payroll

Run payroll only for contractors

Remove terminated employees already paid via off-cycle payroll

Q6: What should I verify in my first payroll run?

A. Before submitting your first payroll, make sure:

All employee tax information is correct

Benefit deductions (example, 401k, health insurance) are correctly configured

Payment methods are validated for direct deposit

Q. Why can’t I run payroll before the pay period is completed?

A: You can run payroll only after the pay period is completed. If your payroll provider’s submission deadline falls on or before the pay-period end date, update the Payday to the next feasible submission date.

For example, if the pay period is Nov 1–Nov 15 and the default Payday is Nov 17, the default submission date may show as Nov 14. You can process payroll only starting Nov 16. In this case, update the Payday to Nov 18 so that the submission deadline moves to Nov 17, allowing you to submit payroll on time.