Accounting Connection: Quickbooks Online to Zenoti Integrated Payroll

Once Zenoti Integrated Payroll is connected to QuickBooks Online through the accounting integration, payroll data flows directly into your QuickBooks account. This reduces manual effort and ensures accuracy in your general ledger. Here’s what to expect from the integration:

Exports payroll details directly to QuickBooks Online.

Supports direct deposit and manual payroll entries.

Automatically creates journal entries when payroll moves to the "processing" status, if the Auto-Push feature is enabled.

Maintains an accurate General Ledger by mapping payroll categories to your Chart of Accounts.

Follow the steps below to connect your Quickbooks Online account to Zenoti Integrated Payroll.

Note:

The transaction date for journal entries will be the payroll approval deadline or payday if no deadline exists.

For questions about mapping categories, please reach out to your Quickbooks Online professional.

The integration exports lump-sum totals for payroll categories (e.g., wages, taxes, benefits). However, individual withholdings or employee-specific breakdowns are not included in the journal entries. To access this level of data granularity, you can manually import the daily data into QuickBooks Online.

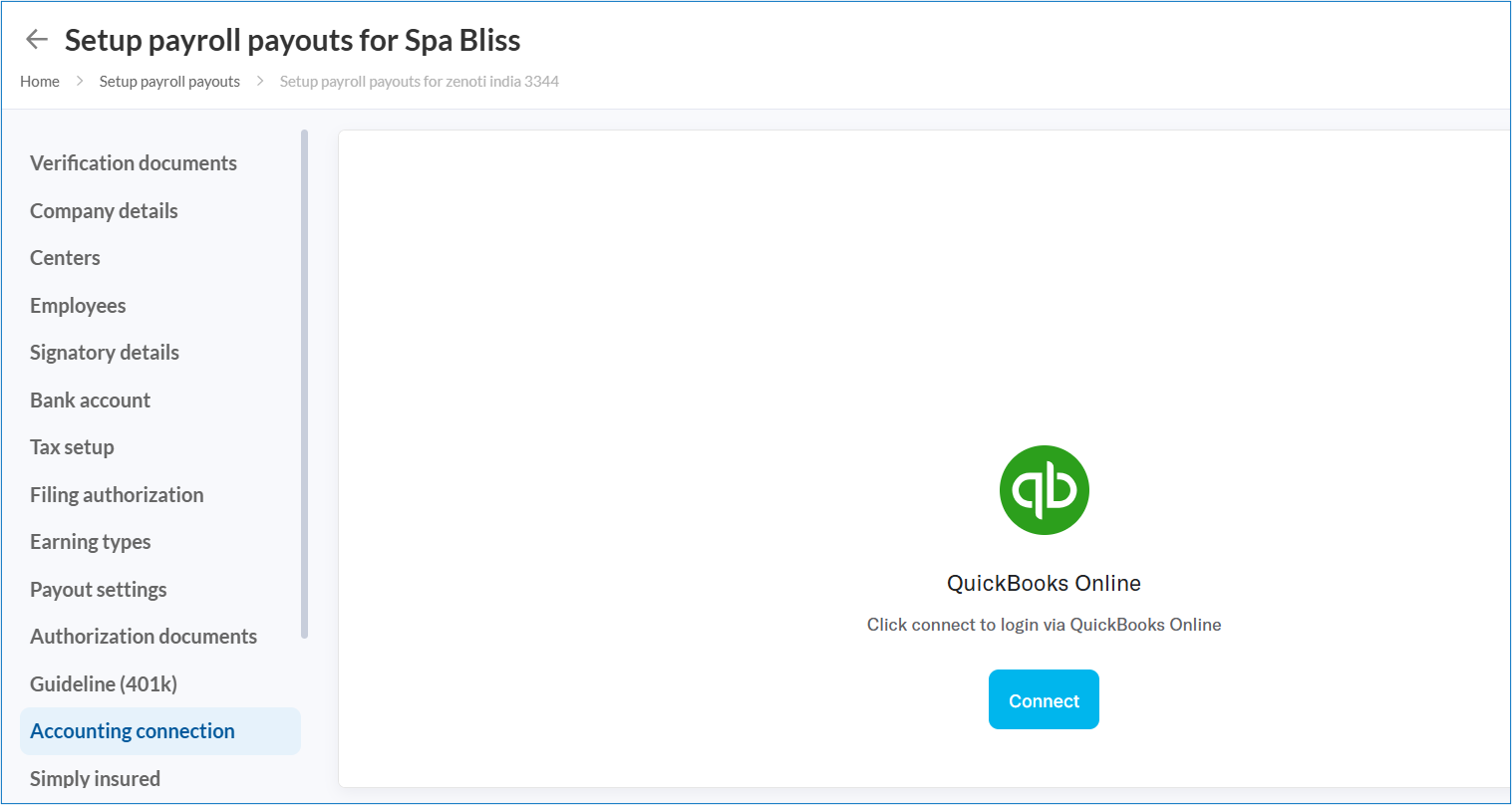

Connect QuickBooks Online to Zenoti Integrated Payroll

Go to business set up tab view.

In the left navigation bar, click Accounting connection.

Select QuickBooks online.

Click Connect.

Log in to your QuickBooks Online account when prompted.

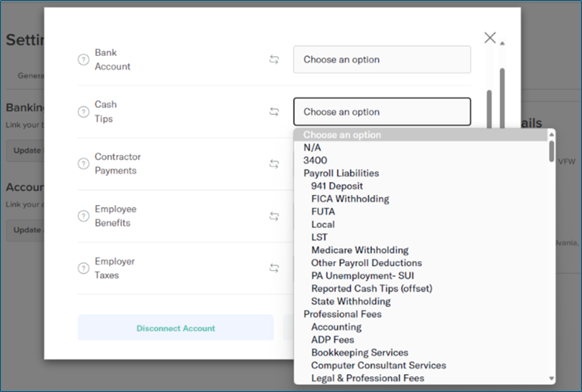

Follow the on-screen instructions to map your payroll fields to the appropriate accounts in your general ledger.

Mapping payroll categories ensures that journal entries align with your Chart of Accounts, reducing the risk of discrepancies. Although the data is summarized, it provides a high-level overview that accurately reflects your payroll records.

Note: Unmapped payroll categories will not be transferred to your General Ledger. To prevent future errors, ensure that all relevant categories are mapped, even if they are currently unused.

The following payroll categories must be mapped to your Chart of Accounts to ensure the proper flow of payroll data into QuickBooks Online.

Optional categories can be marked as 'N/A' in the dropdown. It is recommended to map all categories to an account to prevent errors if you decide to use them in the future.

Category

Flow

Description

Sample Entries

Wages and Salaries

Expense, Debit

All earnings paid to employees and contractors in the pay period. (Also known as “Compensation”. )

Employee Wages & Salaries (Gross Pay excluding Reimbursements)

Contractor Payments

Expense, Debit

All earnings paid to contractors in the pay period. (Also known as “Compensation”. )

Contractor Payments(Gross Pay excluding Reimbursements)

Expense Reimbursements

Expense, Debit

All reimbursements paid to employees and contractors in the pay period.

Employee Reimbursements

Contractor Reimbursements

Employer Taxes

Expense, Debit

All employer taxes for the pay period.

Employer Taxes

Employee Benefits

Expense, Debit

All benefits paid by the employer and remitted by the employer for the pay period.

Employee Benefits

Bank Account

Liability, Credit

The account that funds the amount that the employer is liable for over a given pay period.

Cash Requirement (ACH) -- including any taxes and/or garnishments paid by Check

Checks, ie. Check #122 -- broken out individually

Payroll Taxes Payable

Liability, Credit

All employer taxes to be paid

Non-remittable Taxes

Cash Tips

Liability, Credit

All cash tips paid to employees directly

Cash Tips

Imputed Income

Liability, Credit

Other imputed income such as use of a company car or gym membership

Other Imputed Income

Other Payroll Liabilities

Liability, Credit

All employer benefits and PTDs to be paid out by the employer

Employee Benefits Liabilities

Garnishments

(Optional) Enable Auto-Push to automatically send payroll journal entries to the General Ledger as a new journal entry when payroll reaches the Processing status.

Click Save.

Once the setup is complete, payroll data will sync to QuickBooks Online as journal entries based on your selected mapping.

If you need to re-sync data after adjusting categories or need assistance with pushing past payrolls, feel free to reach out to your Zenoti representative.