GST - Malaysia

Configure Zenoti for zero-rated GST

Starting June 1, 2018, Goods and Services Tax (GST) in Malaysia is set to reduce from 6% to 0%.

To be compliant with the change in GST rate, you must update your existing GST rate from 6% to 0% on the midnight of May 31, 2018.

Optionally, if your list price for services and products includes the GST rate of 6%, you can consider updating the price of each service and product to reflect the GST rate change.

Example: If the list price of a Green Tea Shampoo is 100 ringgits inclusive of 6% GST, after the GST tax rate change, you can change the price to 94.36 ringgits (at 0% GST).

In this article, you will learn how to update your tax rate from 6% to 0% and also how to update the price of your services and products.

Update the tax rate from 6% to 0%

At the organization level, click the Configurations icon.

Search for and select Tax groups from the Business details section.

Click the tax group name you created for GST.

Click the Component tab.

Locate your existing tax component and change the TAX (%) from 6 to 0.

Important

You do not have an option to save the changes in the Component tab.

Click the Centers tab.

Ensure all your centers that are located in Malaysia are selected and click Save.

Update the price of a service

If the list price for your services includes the GST rate of 6%, you can consider updating the price of each service to reflect the GST rate change.

At the organization level, click the Master data icon.

Click Services.

Click the name of the service you wish to edit.

Click the Centers tab.

Change the Sale Price as required.

Click Save.

Repeat steps 2 to 6 for all other services whose price you wish to update.

Update the price of a product

If the list price for your products includes the GST rate of 6%, you can consider updating the price of each product to reflect the GST rate change.

At the organization level, click the Master data icon.

Click Products.

Click the name of the product you wish to edit.

Click the Price tab.

Change the Sale Price as required.

Click Save.

Repeat steps 2 to 6 for all other products whose price you wish to update.

FAQ on transitioning to zero-rated GST

Refunds, collections, and commissions

Do I need to refund tax collected on gift cards, packages, and memberships sold before the GST rate change?

No. You do not need to refund the tax amount collected on any closed invoices.

Due to GST rate change, will there be an effect on refunds?No. If a guest asks for a refund, you can refund the entire amount that the guest paid.

Do I need to collect GST at 6% for future appointments (created before the GST rate change) where no payments were added?No. Zero rated GST will be applicable on future appointments even though they have been booked before the GST rate change.

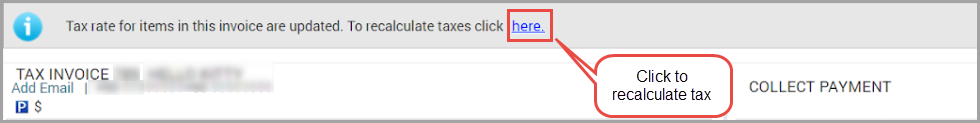

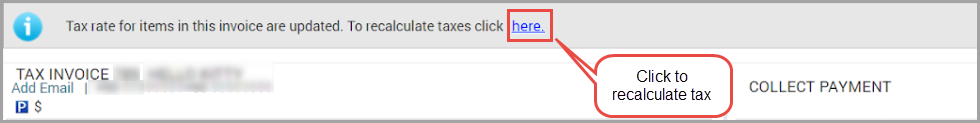

After you change the tax group rate from 6% to 0% in Zenoti , when you open any invoice that has a GST rate of 6%, a link to recalculate appears.

When you click the link, a 0% tax is applied on the invoice and the price is recalculated.

Will my employee commissions take a hit due to the GST rate change?No. Employee commissions will not reduce due to the GST rate change. This is because commissions are based on revenue, and revenue does not include GST.

Services

Service is taken before the GST rate changeIf a guest takes a service before the GST rate change by making a partial or no payment, and wishes to pay the due amount after the GST rate change, you must make no changes to the guest's invoice.

As the service was taken before the GST rate change, GST rate of 6% is applicable on the invoice.

Service is scheduled for a date after the GST rate change

If a guest makes booking or pays a partial payment for a service that is scheduled to be done after the GST rate change, use the recalculate link on the invoice (that appears after you change the tax rate) and collect the revised amount.

Packages

Partial payment with no redemptions If a guest purchased a package by making a partial payment, and has not made any redemptions before the GST rate change, do the following:

Close the invoice by applying a discount on the due amount.

Refund the closed invoice to a prepaid card.

Sell a new package to the guest and redeem the prepaid card towards the payment.

Partial payment with partial redemptions If a guest purchased a package by making a partial payment, and has made partial redemptions before the GST rate change, do the following:

Close the invoice by applying a discount on the due amount.

Refund the closed invoice to a prepaid card.

Create a custom package for the guest and redeem the prepaid card towards the payment.

Partial payment and full redemptionsIf a guest purchased a package by making a partial payment, and has redeemed the package benefits before the GST rate change, do the following:

Close the invoice by applying a discount on the due amount.

Set an expiry date for the guest's package to the current date.

Create a custom package for the remaining benefits of the original package.

Collect payment from the guest for the custom package. The new tax of 0% is applied on the custom package.

Memberships

Discount only memberships

On the sale of memberships before GST rate change that offer only discounts, no action is required.

Memberships with Service Credits

Partial payment with no redemptions

If a guest purchased a membership (with service credits) by making a partial payment, and has not made any redemptions before the GST rate change, do the following:

Close the invoice by applying a discount on the due amount.

Refund the closed invoice to a prepaid card.

For the balance service credits, create a custom package for the guest and redeem the prepaid card towards the payment.

Partial payment with partial redemptions If a guest purchased a membership (with service credits) by making a partial payment, and has made partial redemptions before the GST rate change, do the following:

Close the invoice by applying a discount on the due amount.

Refund the closed invoice to a prepaid card.

Sell the same membership to the guest and redeem the prepaid card towards the payment.

Partial payment and full redemptions If a guest purchased a membership (with service credits) by making a partial payment, and has redeemed all the service credits before the GST rate change, do the following:

Close the invoice by applying a discount on the due amount.

For the balance service credits, create a custom package for the guest and have the guest pay for the custom package.

Memberships with Credit Balance

Partial payment with no redemptions

Close the invoice by applying a discount on the due amount.

Refund the closed invoice to a prepaid card.

Sell the same membership to the guest and redeem the prepaid card towards the payment.

If a guest purchased a membership (with credit balance) by making a partial payment, and has not made any redemptions before the GST rate change, do the following:

Partial payment with partial or full redemptions

If a guest purchased a membership (with credit balance) by making a partial payment, and has partially or fully redeemed the credits before the GST rate change, do the following:

Recommended Method Attempt to collect the due amount on all memberships (with partial payments) before 1st June, 2018.

After 31st May, 2018 1. Close the invoice by applying a discount on the due amount.

2. Sell a new membership to the guest.

Inventory

What about my open purchase or transfer orders? If on June 1st, 2018, your purchase or transfer order is in a Create status, we recommend that you delete and create the purchase or transfer order afresh.

Note

If the purchase or transfer order is in any other status, you are required to pay 6% GST rate.

What about purchase returns to vendors? There is no change in how you return purchases to vendors. You can return purchases to vendors as you have been doing so far.

Loyalty points

There is no impact on the loyalty points. Your guests can continue to accrue or redeem loyalty points as they have been doing so far.

Tax inclusive pricing

My pricing includes the tax rate. What should I do?If your list price for services and products includes the tax amount of 6%, you can consider updating the price of each service and product to reflect that GST rate change. Learn how.

Example: If the list price of a Green Tea Shampoo is 100 ringgits inclusive of 6% GST, after the GST tax rate change, you can change the price to 94.36 ringgits (at 0% GST).