Accounting summary report (v2)

This article explains the Accounting Summary report in the latest version of Zenoti Reports. Accountants can use this report to get an overview of sales, liabilities, receivables, redemptions, collections, discounts, and miscellaneous expenses at a center. The data is essential for reconciling collections with bank deposits and for tax filings. This report should not be compared with data from the previous version.

Overview

The Accounting Summary report consolidates financial and transactional data across various components such as services, products, memberships, liabilities, and payments. It provides a comprehensive view of business performance, enabling accountants and business managers to audit, reconcile, and report more accurately.

Prerequisites

You must have the Accounting summary report role permission enabled to view this report.

Access the report

At the organization or center level, click the Reports icon.

Search and select the required report by entering the report name.

If the report has many columns, scroll horizontally to the right or left to view all columns.

To view specific data on the report, select the desired filters. For more information, refer to report features on Zenoti.

Click Refresh.

If you generate the report for over a year, click the Email button.

Considerations

Zenoti allows loyalty point (LP) redemptions to be shown as non-taxable redemptions in several reports. This means that the portion of a sale paid using LPs is excluded from tax calculations, similar to how discounts are treated.

Example: If a guest pays for a service worth $100 using $20 worth of loyalty points, and if the LPs are configured as non-taxable, then the tax is calculated only on the remaining $80. This helps businesses align tax reporting with their internal accounting policies. LP redemptions will be excluded from the Sales (excl. Tax) column, as they are now categorized as discounts rather than sales.

This feature is turned off by default. Contact your Zenoti Customer Success Manager (CSM) to enable it.

This applies to businesses that have enabled the Pre-tax amount configuration for loyalty points from Organization > Loyalty program > Loyalty settings.

Note

If the Value checkbox is not selected, you will not see the Value column on the left side of the report and the Sales Realizedcolumn on the right side of the report.

You can generate the report using the following filters:

Filter | Description |

|---|---|

Invoice status |

|

If guests purchased items using liabilities (with tax), the Exc-Tax and Inc-Tax columns will show the same value.

Examples

Liability | Sale | Exc-Tax | Inc-Tax | Reason |

|---|---|---|---|---|

Gift card $100+ $ 10(tax) | Hair shampoo of $50 with $5 tax | $50 | $50 | $5 tax on the hair shampoo was already charged on the purchase of the gift card |

Package | A $100 package was sold with 10 services of $15 each. The Exc-Tax and Inc-Tax sales for the service is $10 each. | |||

Loyalty points $100 | $105 hair shampoo was purchased | $50 | $50 | loyalty points redemption configuration is set to Pre-Tax Amount |

Tax exemption | $60 hair shampoo (including $10 tax) was purchased at $50 | $50 | $50 | $10 tax was exempted |

Sales section

Sales include both open and closed invoices.

Column Name | Short Description | Details and Examples |

|---|---|---|

Service | ||

Sales | Total revenue generated from services within the selected time period. | Total revenue generated from services within the selected time period. |

Refunds | Total amount refunded for services within the selected time period. | Total amount refunded for services within the selected time period. |

No show Fees | Total amount collected from guests for missed appointments. | Total amount collected from guests for missed appointments. |

Cancellation Fees | Total amount collected from guest cancellations. | Total amount collected from guest cancellations. |

Products | ||

Sales | Total amount collected from selling products. | Total amount collected from selling products. |

Refunds | Total amount refunded for return of retail products. | Total amount refunded for return of retail products. |

Classes | ||

Sales/Fees | Total amount collected from memberships sold within the selected time period. | Represents the total value of memberships sold within the selected date range. This amount includes only memberships that have no remaining liability, meaning there are no unused service benefits or outstanding credit amounts during the chosen period. |

Refunds | Total amount refunded for memberships and membership setup fees within the selected time period. | Total amount refunded for memberships and membership setup fees within the selected time period. |

Membership Fee (memberships without service and credit benefits) | ||

Recurring Sales/Fees | Total amount generated from the sale of recurring memberships within the selected time period. | Total amount generated from the sale of recurring memberships within the selected time period. |

Freeze Fees | Total amount collected as fees for freezing recurring memberships. | Represents the charges collected when customers choose to temporarily suspend their recurring memberships. The total includes amounts recorded in both open and closed invoices. |

Setup Fees | Total amount collected for membership setup within the selected time period. | Represents the total amount collected for establishing memberships. The total comprises fees from both open and closed invoices during the chosen timeframe. |

Sales | Total amount collected from the sale of memberships within the selected time period. | Represents the total worth of memberships sold during the selected date range. It reflects closed invoice sales and excludes charges, recurring sales, and refunds. |

Sales Tax section

When an item is paid using a liability, the Amount column includes tax amount based on whether the liability was purchased with or without tax.

Sale is taxable: The item was paid using a liability, and the liability was purchased without tax, then the guest is charged the tax, which you can see in the Amount column.

Sale is not taxable: The item was paid using a liability, and the liability was purchased with tax, then the guest is not charged any amount. In the Amount column, you will see zero.

Sale is partially taxable: The item was paid using a cash equivalent and a liability, the taxable amount is calculated based on whether the liability was purchased with or without tax.

Example: Ana purchased a $110 ($100 + $10 for tax) hair shampoo at $105. She paid $50 in cash and the remaining $50 using a membership (purchased with tax). The tax amount is split between the two payments. As the membership was purchased with tax, Ana paid $5 as tax for the cash payment. In the Amountcolumn, you will see $5.

Gift card tax at redemption

For tax-inclusive organizations in France, the Sales Tax section includes a Tax redeemed through gift card tax component.

This component shows VAT collected when gift cards are redeemed.

VAT is calculated based on the items or services the gift card is applied to.

The gift card itself does not carry a separate tax amount.

This helps clearly distinguish VAT recognized at purchase from VAT recognized at redemption.

Liability section

Liability is the amount a business owes to its guests for the payment it has already received. The liability is settled by providing a service or a product to the guest.

Column Name | Short Description | Details and Examples |

|---|---|---|

Memberships (with service benefits, credits, or both) | ||

Sales | Total amount collected from the sale of memberships within the selected time period. | Represents the total worth of memberships sold during the selected date range. It reflects closed invoice sales and excludes charges, recurring sales, and refunds. |

Recurring | Total amount collected from recurring memberships sold during the selected time period. | Represents the total worth of recurring memberships sold during the selected date range. It includes only sales from closed invoices. |

Refunds | Total amount refunded for memberships within the selected time period. | Represents the total value of memberships refunded in the chosen timeframe. The total reflects only refunds recorded in closed invoices. |

Packages | ||

Sales | Total worth of packages sold during the date range | |

Refunds | Total worth of packages refunded during the date range | |

Prepaid Cards | ||

Sales | Total worth of prepaid cards sold within the selected time period. | Represents the total worth of prepaid cards sold during the selected date range. It includes sales from both open and closed invoices and excludes any refunded amounts. |

Refunds | Total worth of prepaid cards refunded within the selected time period. | Represents the total worth of prepaid cards refunded during the selected date range. It includes refunds processed through both open and closed invoices. |

Issued by Refund | Total worth of prepaid cards issued while refunding items within the selected time period. | Total worth of prepaid cards issued while refunding items within the selected time period. |

Gift Cards | ||

Sales | Total worth of gift cards sold within the selected time period. | Represents the total worth of gift cards sold during the selected date range. It includes sales from both open and closed invoices and excludes any refunded amounts. |

Promo Gift Card | Total worth of promo gift cards issued within the selected time period. | Total worth of promo gift cards issued within the selected time period. |

Refunds | Total worth of gift cards refunded within the selected time period. | Represents the total worth of gift cards refunded during the selected date range. It includes refunds processed through both open and closed invoices. |

Advance/Unearned Sales | Total amount collected within the selected time period for future appointments. | Represents payment collected in advance during the selected date range for appointments scheduled in the future. It reflects cases where the sale date is later than the collection date. |

Loyalty Points | ||

Accrued | Total value of loyalty points accrued within the selected time period. | Total value of loyalty points accrued within the selected time period. |

Added Manually | Total worth of loyalty points manually added within the selected time period. | Total worth of loyalty points manually added within the selected time period. |

Refunded | Total worth of loyalty points refunded within the selected time period. | Total worth of loyalty points refunded within the selected time period. |

Register Closure section | ||

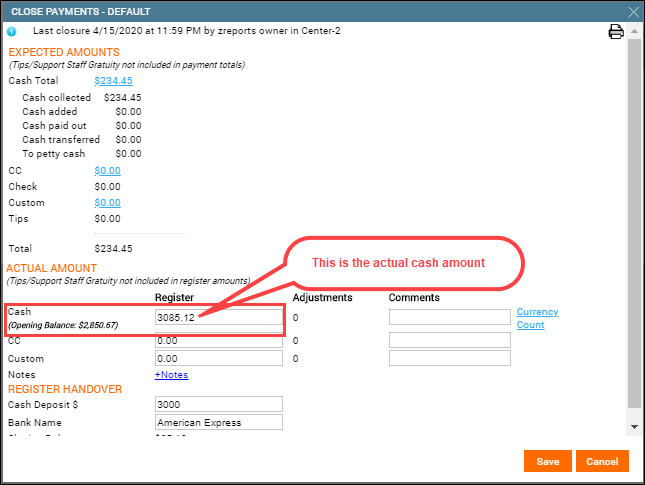

Opening balance | Cash in all registers at the start of the day. | Amount in all the cash registers at the start of the day |

Cash | Transactions paid with cash. | Total cash amount collected and submitted from all the cash registers |

Card | Transactions paid with cards. | Total amount collected using cards from all cash registers and submitted |

Cheque | Transactions paid with cheques. | Total amount collected in check from all cash registers and submitted |

Custom | Amount received via custom payment methods. | Total amount collected using custom payment from all cash registers and submitted |

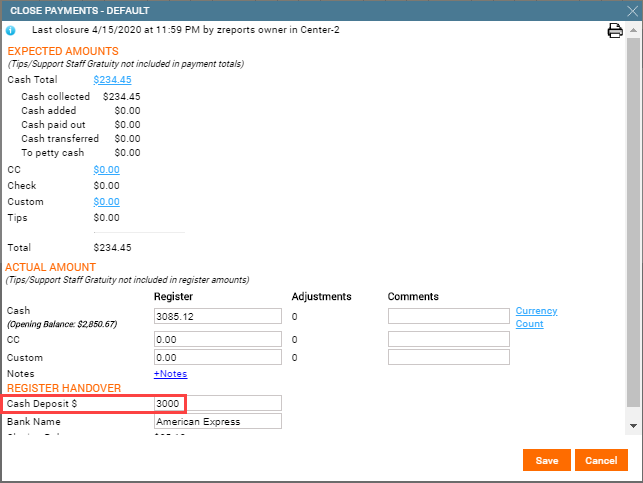

Cash deposit | Cash submitted to the register or vault. | Total cash deposited and submitted from all the cash registers |

Cash Added | Float cash added to the register at start or during the day. | Amount of float cash added at the beginning of the day or during operating hours. |

Cash Transferred | Excess cash moved from one register to another. | Excess cash transferred from one register to another mid-day. |

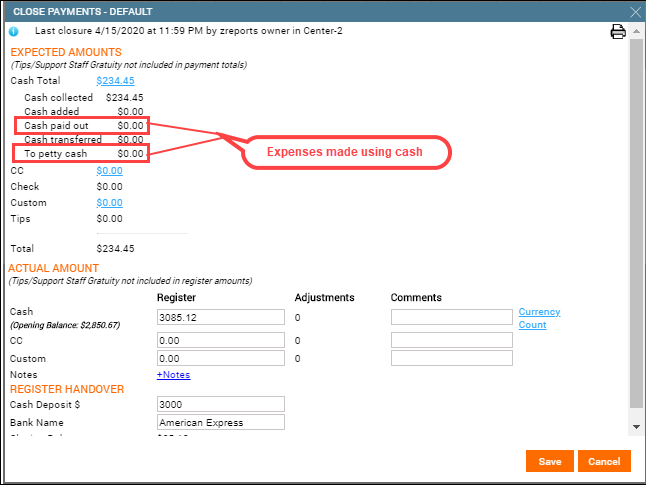

Petty Cash | Cash used for minor purchases or daily operational needs. | Cash paid out for minor purchases or inventory restocking during the day. |

Cashback Amount | Cash returned to guests during a card transaction. | Cashback issued to guests as part of card payment transactions. |

Card Adjustment | Adjustments made to reconcile card payment discrepancies. | Adjustments made to card transactions to reconcile differences between expected and collected card amounts. |

Other fees

Other fees include shipping charges and associated fees to seamlessly reconcile accounts.

Column Name | Short Description | Details and Examples |

|---|---|---|

Other fees | ||

Shipping charge | Total amount collected from shipping charges for products delivered to guests. | Total amount collected from shipping charges for products delivered to guests. |

Other fees | This includes additional fees such as environmental charges. |

|

Column Name | Short Description | Details and Examples |

|---|---|---|

Total to collect | ||

Advance / Unearned Sales | Payments collected for services scheduled outside the selected reporting period. These amounts represent unearned revenue and are excluded from the Grand Total. | Includes payments received before the service date when the service has not yet been delivered within the reporting period. These amounts are shown under Total to Collect and are excluded from the Grand Total because revenue recognition has not occurred. |

Receivables | Payments collected during the selected period for invoices generated in prior periods. These amounts are excluded from the Grand Total. | Includes cash, card, cheque, or custom payments applied to unpaid invoices from earlier dates. Since the related revenue was already recognized in a prior period, these collections are excluded from the Grand Total and included in Total to Collect. |

Total collected | ||

Advance | Advance payments applied to services delivered within the selected reporting period. These amounts are excluded from the Grand Total. | Includes advance payments collected in an earlier period and applied when the service is completed in the current period. To avoid double counting, these amounts are excluded from the Grand Total and included in Total Collected. |

Receivables | Outstanding invoice amounts for services delivered within the selected period but not yet collected. These amounts are excluded from the Grand Total. | Includes unpaid balances for services completed during the reporting period. These amounts represent revenue that is accrued but not collected and are excluded from the Grand Total to maintain consistency with accrual-based revenue reporting. |

Total to Collect: Sum of all outstanding amounts not included in the Grand Total, including unearned advances and collections of prior-period receivables.

Total Collected: Sum of all payments received during the selected period that are excluded from the Grand Total, including advance redemptions and receivable settlements.

Grand Total: Total realized revenue for services and items delivered within the selected reporting period. This value excludes advance collections, advance redemptions, receivable settlements, and outstanding receivables, ensuring alignment with the Sales – Accrual report.

Deposit Details

This section provides enhanced reconciliation for deposits.

Shows transaction-level subtotals by processor (for example, Ayden or Stripe).

Displays a Total Deposits row for clear alignment of collections with bank deposits.

Helps accountants validate that collections by payment type, including Other Fees, match the actual bank deposits.

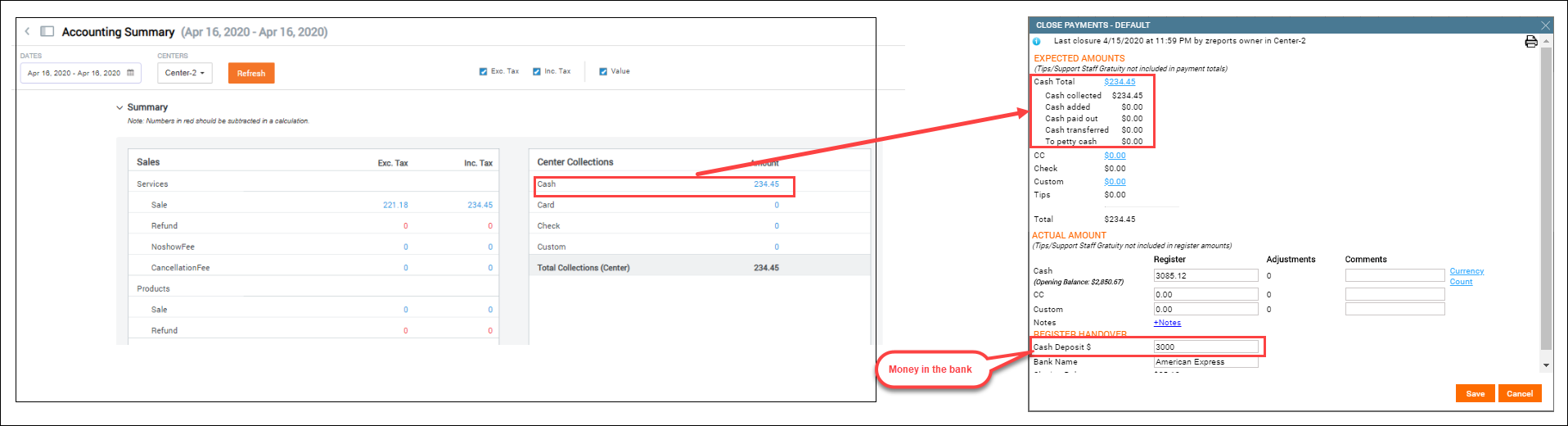

Center Collections section

Collections are based on the date on which payments are collected that includes past dues and advance amount for future sales.

Column Name | Short Description | Details and Examples |

|---|---|---|

Center collections | ||

Cash | Net amount collected in cash within the selected time period. | Net amount collected in cash within the selected time period. |

Card | Net amount collected through card payments within the selected time period. | Net amount collected through card payments within the selected time period. |

Cheque | Net amount collected via cheques within the selected time period. | Net amount collected via checques within the selected time period. |

Custom | Total amount collected from financial and non-financial custom payments excluding refunds within the selected time period. | Represents the difference between the total amount collected and the total amount refunded for both financial and non-financial custom payments made for sales at the current center. Financial custom payments may include methods like bank transfers or mobile wallet payments configured as custom options, while non-financial custom payments might include loyalty point redemptions or complimentary services provided. The value reflects net collections after any refunds in these categories. |

Center Redemption section

This section shows the amount redeemed using liabilities sold at the current center.

In the Cross-Center Redemption section, you can view the value of liabilities sold at other centers but redeemed at the current center.

Column Name | Short Description | Details and Examples |

|---|---|---|

Center redemptions | ||

Memberships | Total amount redeemed from memberships with service benefits, dollar credits, or both within the selected time period. | Represents the total amount redeemed from memberships with service benefits, dollar credits, or both during the selected date range. It includes the value of dollar credits used for item sales, the prorated value of redeemed service benefits, and sales realized as the prorated sale amount for items where membership credits are applied, reflecting the value redeemed from memberships at the center. |

Packages | Prorated amount redeemed from packages within the selected time period, excluding initial revenue recognition (IRR) percentage if enabled. | Represents the prorated amount redeemed from packages during the selected date range. If IRR is enabled for packages, the sales realized is calculated excluding the IRR percentage. |

Prepaid Cards | Value redeemed from prepaid cards within the selected time period. | Represents the amount redeemed from prepaid cards during the selected period. If the value of a prepaid card exceeds or differs from its purchase price, sales realized are calculated on a prorated basis for the items where the card’s benefits are used. |

Gift Cards | Value redeemed from gift cards within the selected time period. | Represents the value redeemed from gift cards during the selected date range. If the value of a gift card differs from its purchase price, the sales realized reflects the prorated sale amount for the items where the benefits are redeemed. |

Advance | Value of advance payments applied to services performed within the selected time period. | Value of advance payments applied to services performed within the selected time period. |

Loyalty Points | Total worth of services paid for using loyalty points within the selected time period. | Total worth of services paid for using loyalty points within the selected time period. |

Cross-Center Redemption section

This section shows the amount redeemed from liabilities sold at other centers but redeemed at the current center.

In the Center Redemption section, you can view the value of liabilities sold at and redeemed at the current center.

Column Name | Short Description | Details and Examples |

|---|---|---|

Cross center redemptions | ||

Memberships | Total worth of membership redemptions at centers different from the original sale location of that membership. | Total worth of membership redemptions at centers different from the original sale location of that membership. |

Packages | Total worth of packages used at centers different from the one where it was purchased. | Total worth of packages used at centers different from the one where it was purchased. |

Prepaid Cards | Total worth of prepaid cards used at centers different from the one where it was purchased. | Total worth of prepaid cards used at centers different from the one where it was purchased. |

Gift Cards | Total value of gift card redemptions at centers different from the one where it was purchased. | Total value of gift card redemptions at centers different from the one where it was purchased. |

Loyalty Points | Total value of loyalty points redeemed at centers different from the one where the loyalty program was purchased. | Total value of loyalty points redeemed at centers different from the one where the loyalty program was purchased. |

Receivables section

Receivables is the amount the guests owe to the business for the item that is already purchased. This also includes the amount the other centers owe to the current center due to cross-center redemption.

Note

If you generate the report for a date range, you can see the amount for the past sales in both the Receivables – Paid and Receivables – Dues columns.

Column Name | Short Description | Details and Examples |

|---|---|---|

Receivables -Paid | Total amount collected for earlier receivables, including taxes. | Total amount collected for earlier receivables, including taxes. |

Receivables - Dues | Total amount due, including tax, for unpaid invoices from prior periods. | Represents the total amount due, including tax, for all items sold where payment has not yet been collected from prior periods. The receivables shown reflect dues for the day, and if the report is generated for a date range, some of this amount may already have been paid, which is captured under the Receivables - Paid section. |

Collections for other centers section

This section shows the total amount collected at the current center for the items sold in other centers (in the past).

Column Name | Short Description | Details and Examples |

|---|---|---|

Collections for other centers | ||

Cash | Total cash collected at this center for the sales at another center, excluding the refunds. | Total cash collected at this center for the sales at another center, excluding the refunds. |

Card | Total payments collected via cards at this center for the sales at another center, excluding the refunds. | Total payments collected via cards at this center for the sales at another center, excluding the refunds. |

Cheque | Total payments collected via cheque at this center for the sales at another center, excluding the refunds. | Total payments collected via cheque at this center for the sales at another center, excluding the refunds. |

Custom | Total amount collected via financial and non-financial custom payments at this center for the sales at another center, excluding the refunds. | Represents the net amount collected through financial and non-financial custom payment methods at the current center for sales made at other centers. It reflects the difference between the total collected and the total refunded amounts for these custom payments. |