- Zenoti Help

- Point of Sale

- Check out

- Redeem Gift Cards

Redeem Gift Cards

Note

This article provides instructions for redeeming gift cards that are sold without tax. If your center applies tax on the sale of gift cards, then read Redeem a Taxed Gift Card.

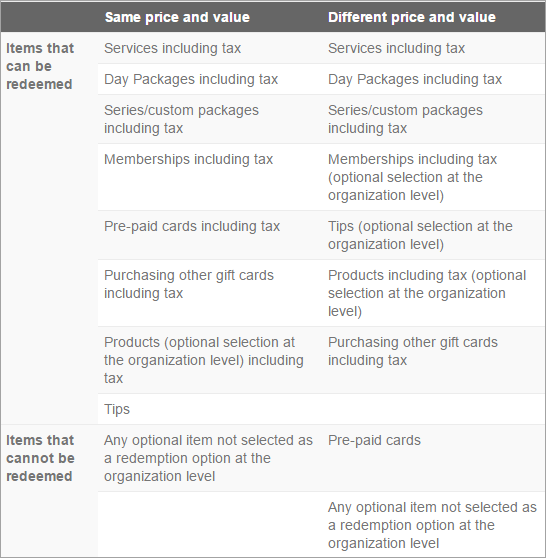

The following gift cards are sold and they are redeemable only for the items configured at the organization level:

Same price and value

Different price and value

The guest can redeem the card only for the items provided in the following table:

Note

If you are unable to apply a gift card in the POS window, verify if your organization allows the gift card to be redeemed for the selected item.

If your organization allows redemption of gift cards across the centers then, ensure your Admin has selected the checkbox: Enable cross center redemptions for gift cards at organization level.

Note

This article provides instructions for redeeming gift cards sold without tax. If tax was applied to the sale of the gift card, the card cannot be redeemed for a membership or a membership service.

If your organization offers membership programs, gift card holders can use their card to pay for a membership or a membership service. Gift cards can be redeemed to pay for memberships when price and value is equal on the gift card. If the gift card has a different price and value, it can be used to pay for the membership only if it is selected as a payment option at the organization level.

If tax is applied to the membership during its purchase, then the services associated to it cannot be taxed when they are redeemed. When a guest redeems a service that is part of the taxed membership, any tax applicable to the service is automatically removed from the invoice at the time of payment.

Launch the POS from the appointment book.

In the guest details section at the top of the POS, enter either the mobile number, email address, first name, or last name of the guest, and select a matching record from the list of suggestions. If the guest record doesn't exist in system, then create a new guest record.

In the lower left pane of the POS screen, click the Service tab and select the service that is part of the membership.

Click Add Service to add the service to the invoice.

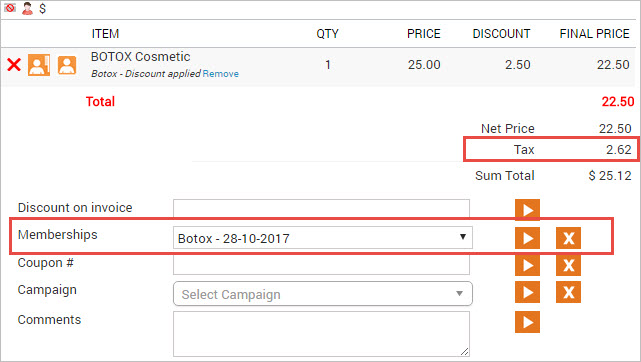

In the Memberships field, select the membership that applies to this service (the drop-down lists all the active memberships for the guest).

Apply the membership to the invoice.

Any applicable tax component for the service displays below the net price.

In the Collect Payment section, select PRE-PAID/GIFT as the payment option. The sum total (net price + tax) and applicable tips automatically populate in the Amount and Tips fields respectively.

Edit the Amount field and replace the sum total (net price + tax) value with just the net price.

Enter the Card# manually (or)

click on the gift card balance link beside the gift card icon . The purchase/received gift card information populates in the Gift cards page. Click the Use This link beside the appropriate Gift Card number.

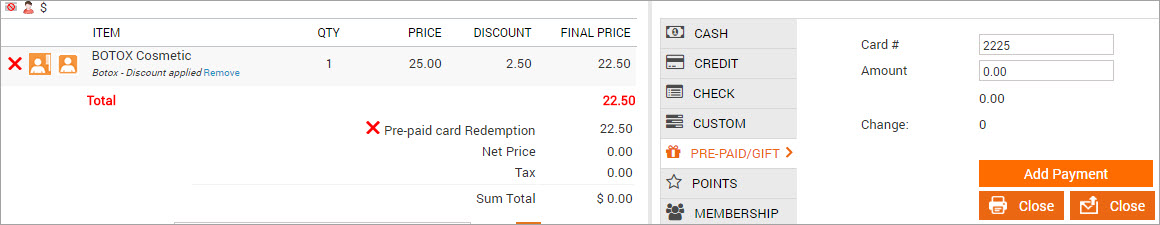

Click Add Payment.

The tax component of the service gets removed from the payment section. It appears as pre-paid card Redemption in the invoice.

Close the invoice.

Zenoti allows you to refund an amount to a gift card that was used to make a purchase. For instance, if a guest used a gift card to pay for a service and then requests a refund, you can process the refund to the same gift card.

Important

You can only refund to the same gift card that the guest had used for the payment.

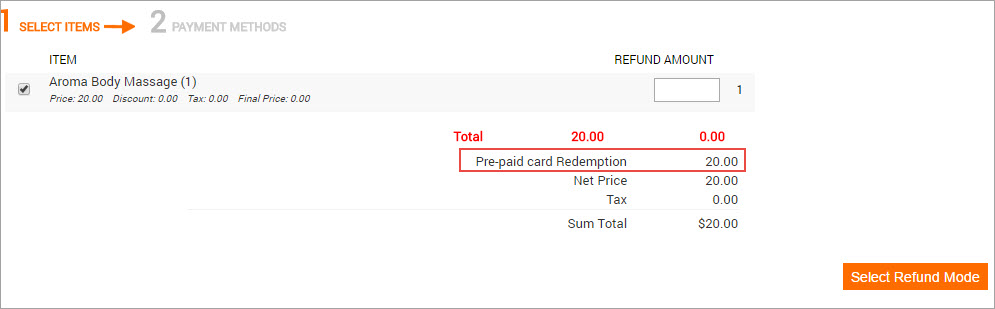

If the purchase appears as a Redemption, then you cannot process a refund (gift card purchased with tax included in its sales price, appears as redemption when used as a payment method).

Below is an example of how a gift card appears as a redemption:

The refund amount must be equal to or less than the payment made with the gift card. If necessary, you can split the amount between the gift card and other payment methods.

Before you begin

The Allow gift card amount to be refunded to same card option is selected at the organization level.

To learn more read: Setting up Gift Cards.

The employee has the required permission to process a refund to a gift card.

Note: Administrator and owner roles have this permission enabled by default.

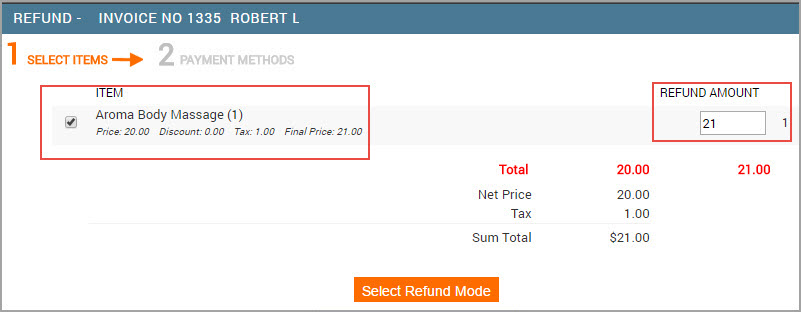

Search for an invoice or receipt.

From the I want to menu, select Refund Invoice.

Select the item to refund.

In the Refund Amount field , enter the amount to refund.

If there are many items in the invoice, enter the refund amount against each item selected.

Click Select Refund Mode.

Select the option Refund amount can be split across one or more below options and enter the refund amount in the Paid Amount field adjacent to the Gift card payment type.

Note

The refund amount must be equal to Total Refund Amount entered in the Select Items section.

The refund amount must be equal to or less than the amount used on the gift card.

You can split the refund amount between the gift cards and other payment methods such as cash, check, credit card, custom, or issue a prepaid card for the amount.

Click Refund.

Verify the details and click Close & Print on the invoice.

An Invoice Refund pop-up window opens.

Click OK.