Manage Historical Tax Liabilities with Zenoti Integrated Payroll

This article explains what the Historical Liability Debit (HLD) is, why it is collected it, when the debit occurs, and how you can view the details in your Zenoti account.

Overview

When your business transitions from a previous payroll provider to Zenoti Integrated Payroll, any unpaid payroll taxes from the old system may be refunded back to your bank account. These are taxes that were initially withheld but not yet sent to the appropriate tax authorities.

To ensure compliance, Zenoti collects these unpaid amounts through a HLD and forwards them to the correct federal, state, or local agencies. This process helps maintain accurate tax records and ensures your payroll remains fully compliant with government regulations.

When HLD is collected by Zenoti

Zenoti schedules the HLD after your first payroll is processed and approved in the system. The HLD amount is then debited from your business bank account 10 days after your first payday.

Important

Ensure there are sufficient funds in your account on that date so Zenoti can remit the appropriate taxes to government agencies on your behalf.

How Zenoti determines which taxes to collect

Zenoti only collects tax liabilities that fall within an open period — The payroll check date from your previous provider, and a valid timeframe (monthly, quarterly, or annually) in taxes are still due and can be legally paid.

A liability is considered within an open period if:

The payroll check date from your previous provider, and

The company’s start date in Zenoti

both fall within the same tax period.

Use Case: How HLD is calculated based on Open and Closed Tax Periods

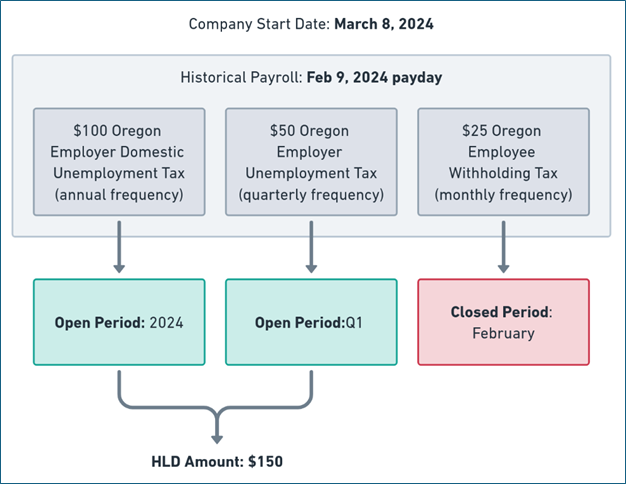

The following image shows how Zenoti determines which historical payroll taxes fall into an open or closed period, directly impacting the HLD amount collected.

Scenario: A company begins using Zenoti Integrated Payroll on March 8, 2024. Before the switch, the company issued payroll through a previous provider, with the most recent payday on February 9, 2024. As part of the transition, Zenoti evaluates historical tax liabilities from that payroll date to determine which ones are still within an open tax period.

Tax liabilities identified:

$100 – Oregon Employer Domestic Unemployment Tax (Annual frequency)

$50 – Oregon Employer Unemployment Tax (Quarterly frequency)

$25 – Oregon Employee Withholding Tax (Monthly frequency)

Assessment:

The annual and quarterly taxes fall within open periods (2024 and Q1, respectively) based on the company's Zenoti start date.

The monthly tax falls in February, which is a closed period since the company started in March.

Outcome:

Only the taxes within open periods are included in the HLD calculation.

The total HLD amount is $150 ($100 + $50).

The $25 monthly liability is excluded from the debit as it falls outside the eligible window.

View the HLD report

You can review the taxes included in the HLD amount directly within Zenoti.

To access the report:

Navigate to Payroll Setup for the respective company.

Under Setup Documents, locate the Historical Liability Debit Analysis Report.

Download the PDF to view:

A detailed breakdown of the tax liabilities included in the HLD.

The scheduled HLD collection date.

Note

You can also view the Historical Liability Debit in the Company Transactions section of the ZIP dashboard. Use the Collection filter to easily find this debit.