Guide to the Zenoti Integrated Payroll Dashboard

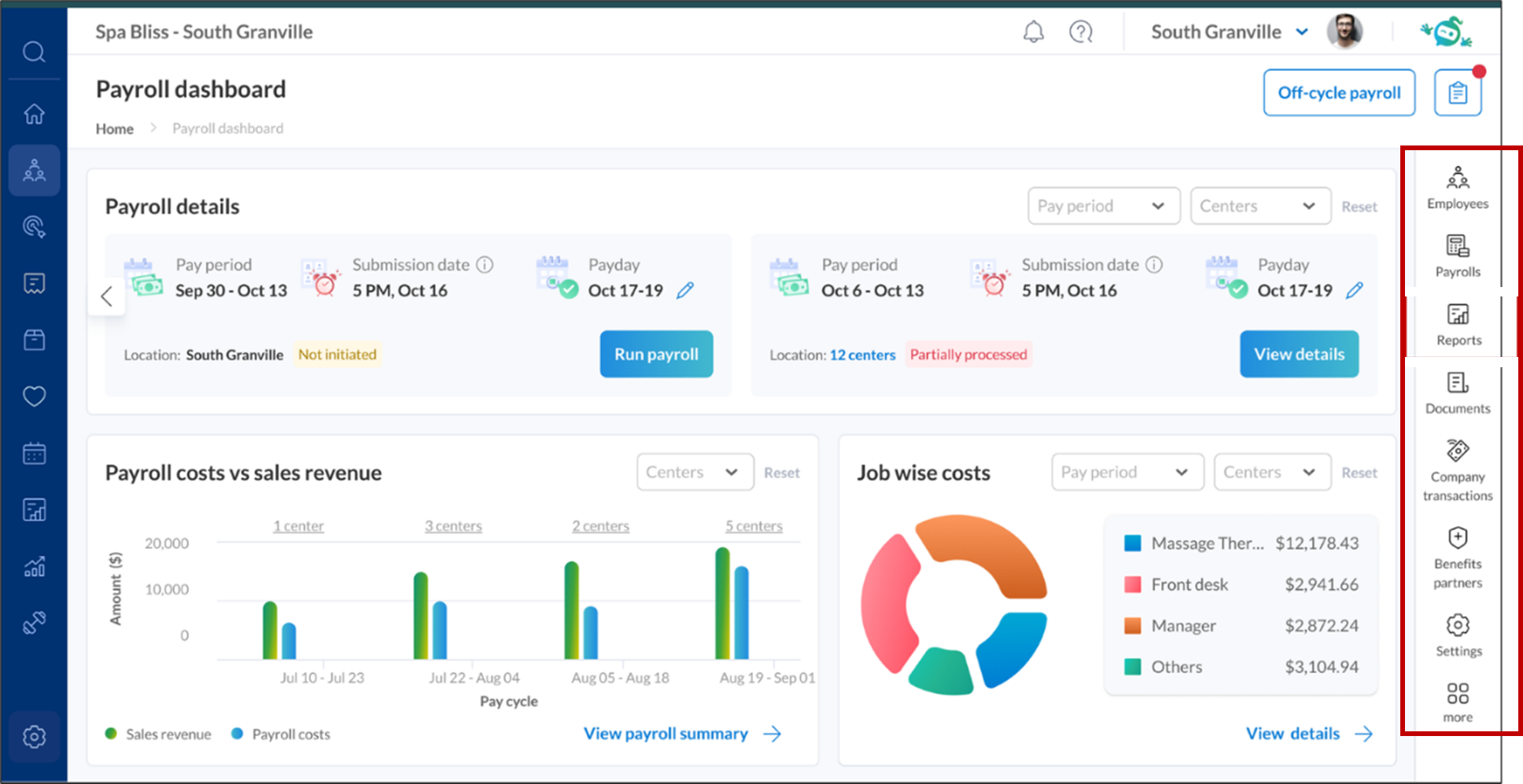

This article explains the key features and layout of the Zenoti Integrated Payroll (ZIP) dashboard. The dashboard acts as a central landing page where you can easily access and manage all payroll-related tasks. With a vertical Settings menu, navigating payroll functions and reports is simple and intuitive.

Overview

The ZIP dashboard helps you manage payroll with clarity and convenience. Key sections—such as Payrolls, Reports, Documents, Employees, Company Transactions, Tax Deposits, Benefits Partners, and QuickBooks Online Integration—are accessible from a visible vertical menu on the right. This layout allows you to access important payroll features easily.

All core payroll actions—like running payroll, viewing reports, or setting up employee data—are available in one unified interface.

Prerequisites

Ensure you have the required payroll role access.

Using the ZIP dashboard

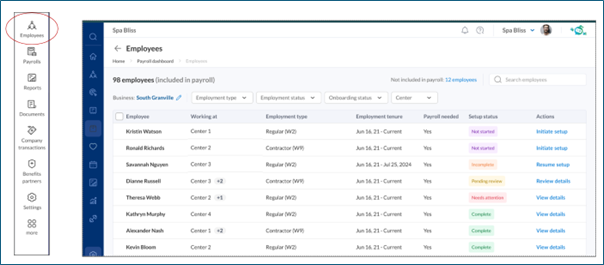

Employees

View a list of all employees included in payroll, along with their onboarding and setup status. Filter by employment type, status, or center, and take actions such as initiating, resuming, or reviewing setup.

For more information, refer to the Onboard Employee for Zenoti Integrated Payroll article.

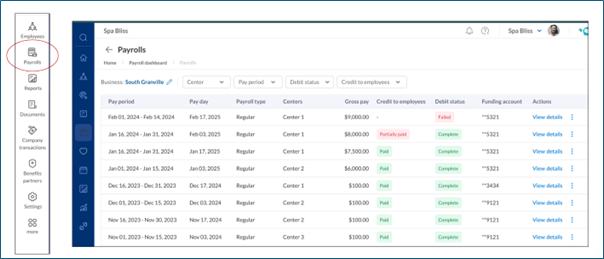

Payrolls

Track current and historical pay periods. View details like pay dates, payroll type, gross pay, credit status, and funding account. Drill into any payroll to see payment processing and completion.

For more information, refer to the below articles:

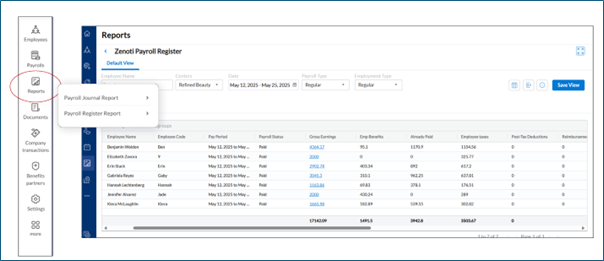

Reports

Access payroll-specific reports, including the Payroll Journal and Payroll Register. These reports provide insights into earnings, benefits, deductions, and taxes for each pay run.

For more information, refer to Reports & Insights.

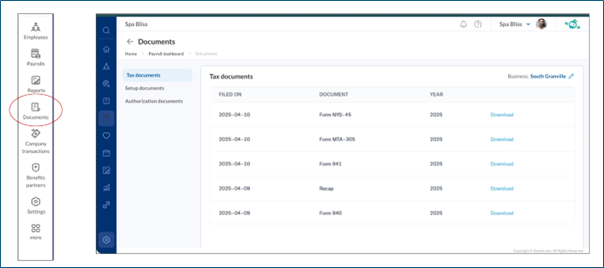

Documents

Access three document types:

Tax Documents: Download filed tax forms such as Form 941 and 940.

Setup Documents: View payroll setup-related files like employee configuration and benefit settings.

Authorization Documents: Manage authorizations for payroll and tax compliance.

For more information, refer to the Access Payroll Tax Documents in Zenoti Integrated Payroll (ZIP) article.

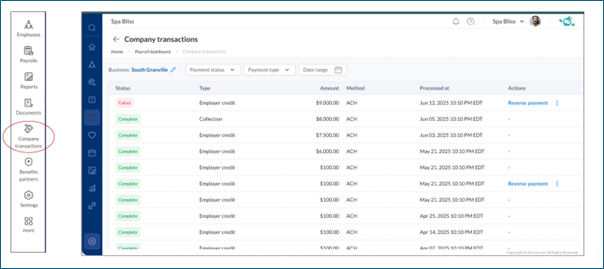

Company transactions

Review all employer-level payroll transactions such as tax deposits, funding credits, and collections. Each entry includes the transaction amount, method (ACH), status, and processing time. Failed transactions can be reversed directly.

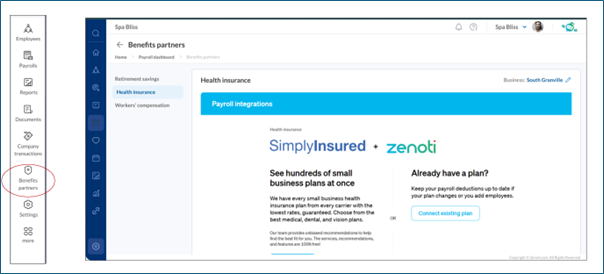

Benefit partners

Integrate Zenoti with providers offering health insurance, retirement savings, and workers’ compensation. For example, you can use SimplyInsured to offer medical, dental, and vision coverage or connect existing benefit plans for automated deductions.

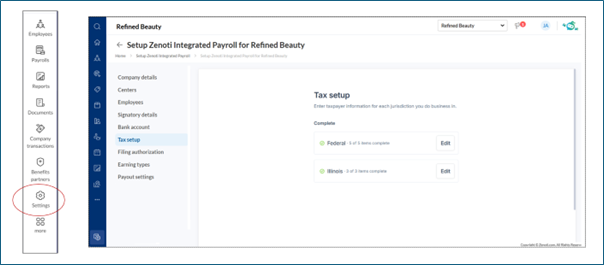

Settings

Configure your payroll environment:

Tax Setup: Enter taxpayer details for federal and state jurisdictions.

Bank Accounts: Set up and manage funding sources.

Other Settings: Define payout rules, earning types, and filing authorizations. The Settings panel is organized to help you manage setup quickly and accurately.

For more information, refer to Payroll Set up - Business Owner.

Additional options (under More)

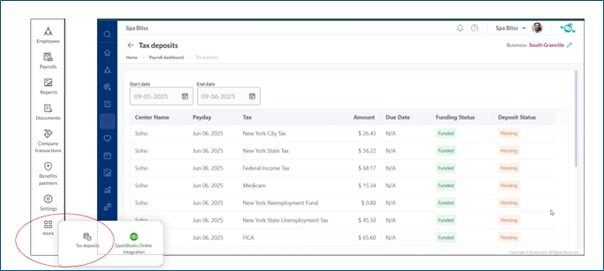

Tax Deposits

Monitor your tax obligations by tax type. The screen displays deposit amounts, payday alignment, funding status, and whether each deposit is pending or complete.

QuickBooks Online Integration

Sync payroll transactions with QuickBooks Online for seamless accounting and reconciliation. Access this from the More menu.

For more information, refer to the Accounting Connection: Quickbooks Online to Zenoti Integrated Payroll article.

Frequently Asked Questions (FAQs)

Q. Where do I start if I’m setting up payroll for the first time?

A. Use the Settings menu to configure tax setup, bank details, and earning types. Then, navigate to the Employees section to complete onboarding and payroll setup.

Q. Why can't I see a specific employee in the payroll run?

A. Check their Setup Status under the Employees screen. If setup is marked as "Not Started" or "Incomplete," that employee won't be included in the run.

Q. I see an unknown payroll debit by “Check”—what is it?

A. If you see an unexpected debit in your bank account labeled “Check” (Zenoti’s payroll partner), go to the Company Transactions screen to verify the entry. You can identify if the debit is related to payroll funding, a tax variance adjustment, or a collection. This helps you reconcile the charge against your payroll activity.

Q. What reports are available for download?

A. You can access the Payroll Journal Report and Payroll Register Report under the Reports section for detailed breakdowns of each payroll.

Q. How do I integrate my payroll data with QuickBooks?

A. Click on More > QuickBooks Online Integration, and follow the steps to authenticate and sync your data.