Access Tax Deposits Report in Zenoti Integrated Payroll

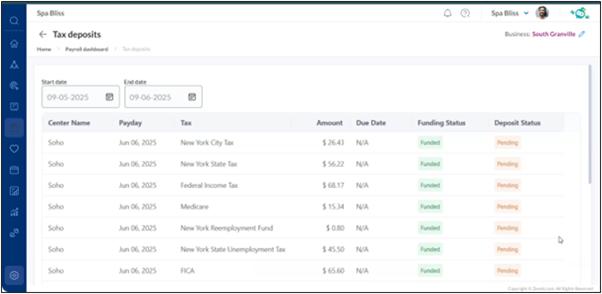

Tracking tax payments associated with payroll can be complex—but Zenoti makes it easier. Within the Zenoti Integrated Payroll (ZIP) dashboard, the Tax Deposits section centralizes your payroll tax obligations in one location. This report shows the current status of tax deposits—what’s funded, what’s pending, and what’s been successfully deposited. Use this article to learn how to access the report, understand status labels, and interpret tax deposit frequencies.

Overview

The Tax Deposits section in the Zenoti Integrated Payroll (ZIP) dashboard provides a consolidated view of payroll-related tax obligations. Once payroll is approved in Zenoti or through our partner, Check, the system generates tax deposit reocrds for each applicable tax type. These deposits are tracked until the corresponding taxes are paid to federal, state, or local agencies.

This feature helps ensure compliance by showing when funding is complete, when deposits are pending, and when taxes have officially been paid. It supports timely follow-up actions if any status requires attention.

Prerequisites

Your organization must use Zenoti Integrated Payroll (ZIP).

You must have Process Payroll Payouts or Configure Payroll Payouts role permission to access payroll reports.

Payroll must be approved for tax deposits to be generated.

Key features

Tax deposit lifecycle

When a payroll is approved, tax deposits are created based on the payroll’s tax liabilities.

These deposits may take up to 24 hours for their due dates to populate.

Access the Tax Deposits Report

To view tax deposits:

Navigate to Employees > Zenoti Integrated Payroll to open the ZIP Dashboard.

Click Tax Deposits in the right-hand menu.

If you don’t see this option, click More to reveal additional items.

Statuses in the report

Funding Status

Status | Meaning |

|---|---|

Funded | Payroll funds were successfully processed. |

Pending | Funding is in progress or not yet completed. |

Failed | Payroll funding failed. Tax deposits will not be sent. |

Note

Zenoti only sends tax deposits when Funding Status is Funded.

Deposit Status

Status | Meaning |

|---|---|

Deposited | The taxes have been successfully paid to the tax agency. |

Pending | The taxes are yet to be paid. |

Examples of tax deposit frequencies

Tax deposits may vary based on the type of tax and the agency’s requirements:

Tax type | Frequency | Example |

|---|---|---|

Federal Income Tax | Monthly | IRS Form 941 |

State Unemployment Tax | Quarterly | State-specific SUTA filings |

Local Payroll Taxes | Monthly | City or county payroll taxes |

Social Security & Medicare | Monthly | FICA contributions |

Frequently Asked Questions (FAQs)

Q: Why don’t I see a due date for a deposit?

A: Deposits may take up to 24 hours to populate due dates after payroll approval.

Q: What happens if the funding status is “Failed”?

A: Check (our payroll partner) does not process tax payments unless the funding status is “Funded.” You may need to re-initiate payroll funding.

Q: Can I export the Tax Deposits report?

A: Currently, exporting the Tax Deposits report is not supported in Zenoti. If you need specific data from the report, please contact your Zenoti representative or the Zenoti Payroll Support team for assistance.

Q: How often should I check the Tax Deposits tab?

A: You don’t need to check it after every payroll run, but it’s a good practice to review the tab before respective tax due dates—for your reference. This helps ensure all deposits are on track and nothing is missed.