Manage employee benefits in Zenoti Integrated Payroll (ZIP)

(ZIP) This article explains how businesses configure employee benefits in Zenoti Integrated Payroll (ZIP). You can define employer and employee contributions, track pre-tax and post-tax benefits, and ensure payroll accurately reflects deductions.

Overview

Zenoti Integrated Payroll (ZIP) centralizes benefit management for employees. Businesses set up benefits directly in the employee profile, ensuring accurate payroll calculations. Employers configure contributions as fixed amounts or percentages, while employees only view the results in their paycheck.

ZIP supports two approaches for managing benefits:

Zenoti partners: Businesses can choose Guideline (for retirement plans) or Simply Insured (for medical, dental, and vision). In this case, benefits configured in the partner’s portal automatically sync to ZIP, and businesses do not need to configure them separately in Zenoti.

External vendors: Businesses may also use other providers (for example, Fidelity). In this case, a one-time setup is done in each employee profile, and ZIP applies the configured deductions during payroll. If migrating from a previous vendor, employee benefit configurations are retrieved as part of employee data migration, and only new hires require setup.

Supported benefit types

Category | Benefit types |

|---|---|

Section 125 Cafeteria Plan (Pre-tax) | Medical, Vision, Dental, Disability, Accident, Cancer, Critical Illness, Hospital, Life Insurance, Other Medical |

Retirement Plans (Pre-tax) | 401(k), 403(b), 457 Deferred Compensation |

Flexible Spending Accounts (Pre-tax) | Medical FSA, Dependent Care FSA |

Health Savings Account (Pre-tax) | HSA |

Commuter Benefits (Pre-tax) | Transit, Parking |

Miscellaneous (Pre-tax) | Non-taxable Fringe Benefits, Non-Qualified Deferred Compensation (NQDC) |

Roth Retirement Plans (Post-tax) | Roth 401(k), Roth 403(b), Roth 457 |

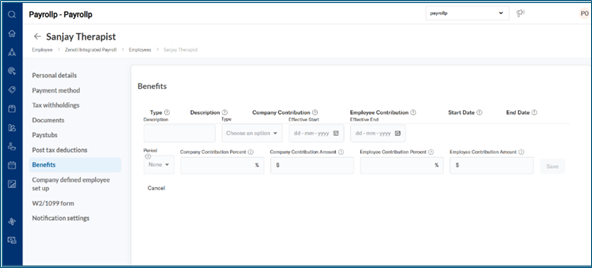

Configure a benefit for an employee

To manually add a benefit (if not managed by a partner):

Go to Employees > Zenoti Integrated Payroll.

From the right-side menu, click Employees.

Use the search bar to find and select the required employee.

Click View details to open the employee’s payroll profile.

Navigate to the Benefits tab.

Click +Add Benefit.

Complete the fields:

Type: Select the benefit type.

Period & Description: Defines how and when the benefit amount is deducted from payrol.

Company Contribution: Enter the employer contribution amount or percentage.

Employee Contribution: Enter the employee contribution amount or percentage.

Start Date: Select the effective start date for the benefit.

End date (optional): Select an end date if the benefit is time-bound

Click Save.

Note

Only business administrators configure employee benefits.

Employees do not self-select or update benefits in ZIP.

Contributions and deductions are visible to employees only in their paystub.

Partner-managed benefits (Zenoti partners: Guideline, Simply Insured) sync automatically. Updates must be made in the partner’s dashboard.

Guideline → For 401k and Roth 401k plans.

Simply Insured → For Medical, Dental, and Vision Insurance.

How the Period field affects benefit deductions

The Period field determines whether the benefit amount is deducted from every payroll or distributed across payrolls within a month

Period = None

The configured amount is deducted from every regular payroll.

This option is typically used for payroll-level contributions such as 401(k) or ROTH deductions.

Period = Monthly

The total monthly amount is split equally across all payrolls processed in that month.

This option is commonly used for monthly benefits such as health insurance.

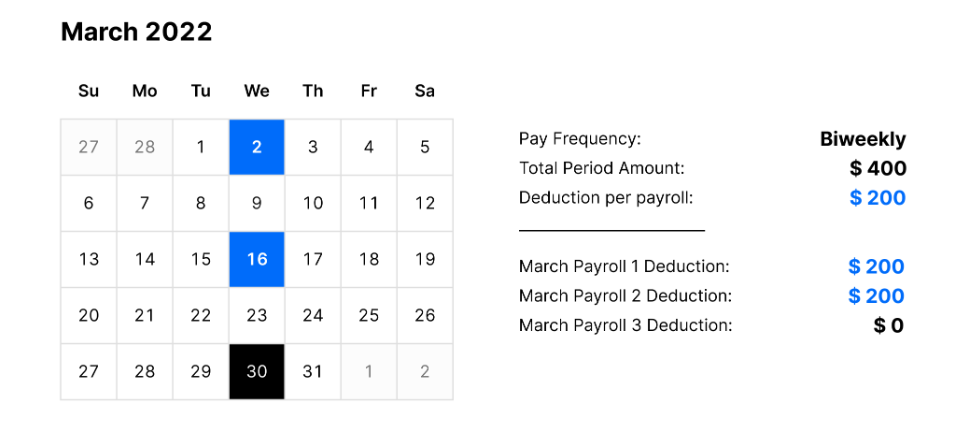

Example: Monthly benefit with bi-weekly payroll

If a health insurance benefit is configured with:

Period: Monthly

Total monthly amount: $200

Payroll frequency: Bi-weekly

Then the $200 monthly amount is split evenly across the payrolls processed in that month.

For example:

Payroll 1 deduction: $100

Payroll 2 deduction: $100

Any additional payrolls in the same month: $0

This ensures the full monthly benefit amount is withheld without over-deducting from a single payroll.

Note

Zenoti calculates and withholds benefit amounts during payroll processing based on the configured Period. Businesses are responsible for making benefit premium payments directly to their benefit providers.

Frequently Asked Questions (FAQs)

Q: Can employees log in to ZIP and configure their own benefits?

A. No. Only businesses configure benefits. Employees only view deductions in their paystub.

Q: Can employees choose their benefits package during onboarding?

A. No. ZIP does not support benefit self-selection during onboarding.

Q: Can businesses define both employer and employee contributions?

A. Yes. ZIP supports fixed amounts or percentage contributions for both employers and employees.

Q: What is the difference between pre-tax and post-tax benefits?

A. Here:

Pre-tax: Deducted before taxes, lowering taxable income.

Post-tax: Deducted after taxes, with no impact on taxable income.

Q: Do I need to enter benefits if I use a Zenoti partner?

A. No. Benefits from Guideline or Simply Insured sync automatically. Manage updates in the partner portal.

Q: Does ZIP support open enrolment for employees to choose benefits at year-end?

A. No. ZIP does not support open enrolment. Businesses must configure or update employee benefits directly.