Register Summary v1 report

Business owner and center managers can use this report to get a summary of sales, collections, tips, and register closure information of a center for the day. To view register summary for any other day, select the date from the date picker at the top of the screen.

Click the Reports icon.

On the Reports page, search for and select the General - Register Summary report.

Select the desired filters.

Click Refresh.

Sales

Sale is the list price of an item without tax and discount.

Net amount = List price - Discount - Tax

Zenoti considers membership, package, gift card, prepaid card, loyalty points, and cashback as liabilities.

In this section, you can view details of all the sales made on open and closed invoices for the day or during the date range.

Column description

Item | Revenue |

|---|---|

Service | Revenue: Net amount received from all services performed NoteIf No Show or Canceled fees are set up, these amounts are displayed under service sales. Refund: The amount paid back to the guest for services. |

Product | Revenue: Net amount received from all products sold Refund: The amount paid back to the guest for products. |

Membership | Revenue: Net amount received from all memberships sold or billed Refund: The amount paid back to the guest for memberships. |

Package | Revenue: Net amount received from packages sold or billed Refund: The amount paid back to the guest for packages. |

Gift card | Revenue: Net amount received from gift cards sold or billed Refund: The amount paid back to the guest for gift cards. |

Prepaid card | Revenue: Net amount received from prepaid cards sold or billed Refund: The amount paid back to the guest for services. |

Item | Points to consider |

|---|---|

Redemptions (this center) Amount redeemed from liability sold in the center |

|

Redemptions (others) Amount redeemed from liability sold in other centers |

|

Total Sales Total amount received from sales of all items Total Sales = Sum of price of all items sold - Discount - Tax | |

Taxes Total tax liability on invoices with sale date as today or the start date of the report |

|

Total To Collect Total amount of sales done after deducting discounts, refunds, and tax Total to Collect = Sum of price of all items sold - Discounts - Redemption (including tax) - Tax | This value matches with the total collections only if all the invoices are fully collected. Tips are excluded in this column but shown separately. This is because tips are not part of sales, collections, or business revenue. |

Tips Total amount collected using cash, card, check, or custom payment towards tips | |

SSG Total amount collected using cash, card, check, or custom payment towards staff gratuity | |

Cashback Total additional amount charged to guests’ cards,but returned to the guests in cash for tips payment |

Collections

Collection is the sale amount (including discounts and taxes) received from guests on open and closed invoices using a payment method or by redeeming a liability.

In this section, you can view collections details for the day or during a date range.

Column | Description |

Cash | Total amount collected in cash after deducting cash refunds and tips that were paid in cash |

Credit Card | Total amount collected using cards after deducting card refunds and tips that were paid using cards |

Cheque or Check | Total amount collected in check after deducting refunds and tips that were paid over a check |

Custom | Total amount collected using custom payments after deducting refunds and tips paid using custom payments You can only see the amount collected using custom payments that are marked as Monetary-Financials. |

Total Collected | Total amount collected using non-monetary (sold without tax) and monetary payment types Non-monetary payment types considered: Gift card, Prepaid card, and Membership credits Monetary payment types: Cash, check, credit card, and custom payments |

Collections (outside time period) | Total amount collected on invoices where the sale date is either before or after the day or date range |

Collections (from past for time period) | Total amount collected on invoices with today's sale date, but payments (full or partial) were made in advance |

Collections (other center) | Total amount collected by another center for invoices created at the center |

Outstanding Balance | Total amount that is yet to be collected for the sales on the day or during the date range |

Current Outstanding Balance | Total outstanding amount that you are yet to collect for the sales made on the day or during the date range |

Tips | Total amount collected using cash, card, cheque or check, or custom payments towards tips on the day or during the date range |

Support Staff Gratuity (SSG) | Total amount collected using cash, card, cheque or check, or custom payments towards SSG on the day or during the date range |

Cashback | Total additional amount charged to guests’ cards and returned to guests in cash for tips payment on the day or during the date range |

Tips and gratuity

In this section, you can view details of the tips and staff gratuity (SSG) collected using cash, card, check, and custom payments for the day or during a date range.

Column | Description |

Cash | Total tip amount collected in cash |

Credit Card | Total tip amount collected using cards |

Cheque or Check | Total tip amount collected in check |

Custom | Total tip amount collected using custom payments (both monetary and non-monetary) |

Total Tips | Total tip amount collected using all payment methods |

Support staff gratuity Details | Total SSG amount collected using cash, card, check, or custom payments (monetary and non-monetary) |

Cashback Details | Total additional amount charged to guests’ cards and returned to guests in cash for tips payment Note that cashback is for businesses that don’t record tips in Zenoti.

|

Cross-center redemption

In this section, you can view details of the amount that you must collect from other centers and pay to other centers for the day or during a date range.

To Collect: For liabilities that were redeemed at the center but purchased at other centers; it's indicated by a positive number in the report.

To Pay: For liabilities that were purchased at the center but redeemed at other centers; it's indicated by a negative number in the report.

Net : The balance amount in the register after collection and payment of cross-center redemptions.

Net = To Collect - To Pay

Column | To Collect (for liabilities purchased at other centers) | To Pay (for liabilities purchased at current center) |

|---|---|---|

Membership Credits Total value of membership credits consumed on the day | Total amount that the current center must collect for memberships credits redeemed at current center | Total amount that the center must pay for memberships credits redeemed at other centers |

Membership Services Total value of membership services consumed on the day | Total amount that the current center must collect for memberships services redeemed at the center | Total amount that the center must pay for memberships services redeemed at other centers |

Packages Total value of package benefits consumed on the day | Total amount that the current center must collect for packages redeemed at the center | Total amount that the center must pay for packages redeemed at other centers |

Gift Cards Total value of gift card benefits consumed on the day | Total amount that the current center must collect for gift cards redeemed at the center | Total amount that the center must pay for gift cards redeemed at other centers |

Prepaid Cards Total value of prepaid card benefits consumed on the day | Total amount that the current center must collect for prepaid cards redeemed at the center | Total amount that the center must pay for prepaid cards redeemed at other centers |

Loyalty Points Total value of benefits consumed in loyalty programs on the day | Total amount that the current center must collect for loyalty points redeemed at the center | Total amount that the center must pay for loyalty points redeemed at other centers |

Total Total value of all benefits on the day | Total amount that the current center must collect for memberships, packages, gift cards, prepaid cards, and loyalty points redeemed at the center | Total amount that the center must pay for memberships, packages, gift cards, prepaid cards, and loyalty points redeemed at other centers |

Register closure

In this section, you can view details of collections, opening balance, and closing balance in the center during a date range.

Column | Description |

Opening Balance (Cash) | Cash available in the register at the start of the date |

Cash | Total amount collected in cash after deducting tips |

Card | Total amount collected using cards after deducting tips |

Cheque or Check | Total amount collected in check |

Deposit (Cash) | Total cash deposited in the bank |

Closing Balance (Cash) | Cash available in the register at the end of the day |

Outstanding Balance | Amount that is yet to be collected from today's sales |

Discounts

In this section, you can view details of the amount offered as a discount or redemption as part of a campaign, membership, package, or manual discount.

Column | Description |

Discounts | Total discount given on items sold

|

Register Summary: Reconcile Cash Collections

Open Collections by Transactions report (Reports > Finance > Collections > Collections by Transactions).

Set the filter criteria to Cash

Make a note of the number in thePayment Amountcolumn. This is the amount collected by cash.: Cash refunds (if any) in the Payment Amountcolumn are indicated by a negative symbol.

(Optional) If you are viewing the Register Summary for a particular day and not a time period, you can use the Cash column in the Today’s collection in Appointment Book report to validate the amount paid in cash.

FAQs on Register Summary report

The following are some of the frequently asked questions on the Register Summary report.

Why do the sale value numbers in organization-level Sales report and Daily Summary report not match the sale value in the Register Summary report?

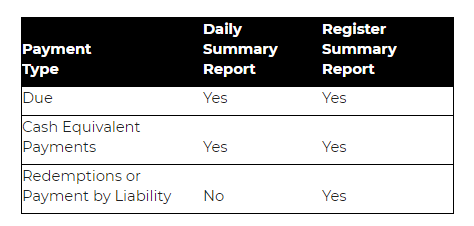

The Daily Summary report shows data based on the Sale-Value calculation. This means the report shows the paid and unpaid amounts for transactions of sales done using the Cash, Card, Check, or Custom payment types.

The Register Summary report shows data based on the Accrual-Sales calculation.

You may find similar sales information in both the reports. However, the Register Summary report also includes redemptions, so the sales values don’t match.

In the Register Summary report, when redemptions are included in the Sales column, why do we also see the ‘Redemptions (Current)’ and ‘Redemptions (Other)’ columns?

In accrual-based accounting, we treat redemptions as delayed payments. In other words, when you sell liabilities such as a gift card, prepaid card, membership, or package, its value is realized only after redemption.

Therefore, Zenoti considers redemption of liabilities on core items such as services, products, and classes as 'Sale' but not the purchase of liabilities.

For example, the sale of a gift card is an accrued liability. A gift card becomes income only when a guest redeems it. To make sure the numbers tally across, you should include redemptions as part of sales.

Important

Zenoti treats liabilities purchased at other centers and redeemed at the current center differently. This is because, as per the accounting process, cross-purchased liabilities are not considered for the current center and posting such redemptions will not tally.

Zenoti treats cross-center redemptions as 'Receivables' - the amount the current center will collect from the other center for cross-center redemption.

Why are the values in the Total to Collect and Total Collected fields not matching when there are no open invoices?

The value in the Total to Collect and Total Collected fields may not match in the

following scenarios:

If past or future sales were collected in the reporting period: This happens if any outstanding invoice had a sale date in the past but the collection date is within the reporting period. This amount will reflect under Collections (outside time period). For example, a service was performed on 25/2/2019, but payment was received on 01/03/2019. For the Register Summary report generated on 01/03/2019, the sale of the service is not considered, however the collection is considered and hence the discrepancy.

Current service sale was done but advance payment was received in past: For any service booked for a future date, its payment can be collected today. However, on the day of service since there will be no payment to collect, this already collected amount will reflect under the Collections (from past for time period) field and hence the discrepancy.

Outstanding balance or dues were not paid: If there are items sold for which the payment has not been received, that amount appears in Current Outstanding.

For example, a product is sold for $400 but payment is not collected yet. The $400 amount appears in the Current Outstanding column.

Collections from Other Center: Any invoice that is created in the current center but paid at another center, as these invoices are not part of the sale in the current center. This amount will reflect under Collections (other center).

For example, a product worth $500 was sold in Center A for $500 but only $250 was collected. The following week the customer visits Center B and pays the remaining $250. This $250 will appear in the Collections (other center) column.

What is the ‘Collections (outside time period)’ column? Can you give an example of how the values appear in this column?

If you have any unpaid amounts or advance payments collected on an invoice with a sale date in the past and the collection date is within the reporting period, the values appear in the Collections (outside time period) column.

For example, a guest has called on Jan 5th to book an appointment for Feb 25th.

The front-desk staff has collected payment of $500 for that future appointment on the current day, i.e., Jan 5th.

When you generate the Register Summary report, on Jan 5th, the collection amount shows $500 as the amount has been collected. However, since the service is not performed yet, the sale of service is not considered in the report. This $500 appears in the Collections (outside time period) column.

What is the Collections (from past for time period) column? Can you give an example of how the values appear in this column?

Let’s say you have collected payment for a service booked for a future date, if you are running the Register Summary report on the day the service is performed, you will notice there is no payment to collect as this was already collected. So, this previously collected amount will reflect under the Collections (from past for time period) column.

For example, a guest has called on Jan 5th to book an appointment for Feb 25th.

The front-desk staff has collected payment of $500 for that future appointment on the current day, i.e., Jan 5th.

When you generate the Register Summary report, on Feb 25th, the Collections (from past for time period) column shows $500 as this was already collected. Since the service is performed, the sale of service is considered in the report.

What is the Collections (other center) column? Can you give an example of how the values appear in this column?

If an invoice is created at another center but paid in the current center, the amount in these invoices is not part of the sale value in the current center. Any such amount collected on behalf of other centers will reflect in the Collections (other center) column.

For example, a guest bought a $500 product at Center A but the guest paid only $300. The following week, if the guest visits Center B and pays the remaining $200 the Collections (other center) column shows $200.

Explain the definitions and calculations for Current Outstanding with examples?

In your business, you may have sold items for which you have not received payment yet. Such amounts appear in the Current Outstanding column.

For example, a product is sold for $400 but payment is not collected yet. This $400 amount appears in the Current Outstanding column.

What reports should I compare to match the sales figures on the Register Summary?

You can compare the sales figure available in the Register Summary with any sales reports. However, we have to total up the Sale Value column with total redemptions.

Hint: To match the values easily for sales, enable the Include Redemption in Sales setting at the organization level for your business.

Will Open invoices also be considered as sales in Register Summary?

Yes. Open invoices are also considered as sales in the Register Summary report.

What is the Total Collected column? Can you share an example?

The total amount collected through monetary and non-monetary payment types appear in the Total Collected column.

Monetary payment types include cash, check, credit card, and other custom payment methods.

Non-monetary payment types include gift cards, loyalty points, prepaid cards, membership credits.

Total Collected values are calculated as the sum of Total Cash/Check/CC/Custom plus total custom non-financial and redemption done using liabilities such as membership credits, loyalty points, gift cards, prepaid cards except packages.

Why am I seeing Redemption both on the right and left side of the Register Summary report?

Redemptions in Zenoti differ based on liability, irrespective of the tax.

So, if the liability sale is inclusive of tax, the redemptions value appears on the left side. If liability was sold without tax redemptions value appears on the right side.

For example: A gift card is sold for $100 to a guest. That guest uses a gift card to purchase a product that has a sale price of $90 and tax of $10.

If the same gift card was sold for $90 with $10 as tax, $90 will be redeemed from the gift card towards product payment and no tax is charged on the product. This is because during the purchase of a gift card, the tax was already collected.

How do we determine the sales value for Service or Classes?

We recognize the amount on the sales of Services or Classes on the day they are performed and not on the day of booking.

What is the difference between the Outstanding Balance and Current Outstanding columns? Can you give an example?

The Outstanding Balance column shows you the amount you are yet to collect for the sales done for the current or selected date.

The Current Outstanding Balance column shows the present day outstanding amount that you are yet to collect for the sales made today or on the selected date.

Example: You run the report on 5th December to check for collections made on 30th November.

If the Outstanding Balance shows $1000 and Current Outstanding shows $600, it means the following:

On 30th November, the amount to be collected was $1000.

On 5th December, the amount to be collected is $600. This means you have received the payment of $400 between 1st and 5th December. As on the present date (in this case, 5th December), the amount yet to be collected for the sales between 1st November to 30th, November is $600. Meaning, guests have made payments worth $400 between 1st and 5th December.