Accounting Integration (Onboarding)

Onboarding: Set up and authorize QuickBooks Online

Depending on whether you use the cash or accrual accounting method, the procedure to set up and authorize QBO will differ slightly. For each method, you also have to set up how Zenoti posts journal entries and invoices to QBO.

Important

Ensure that you have an account created on QuickBooks Online (QBO).

Based on the accounting method and the data type of posting, you can configure QBO in one of the following ways:

Cash accounting - Invoices

To enable posting Invoices created in Zenoti in to QBO, you must set up the following:

In QBO, create the following chart of accounts and items for Revenue.

Item type

(in Zenoti)

Item name

(create in QBO)

Item code

Item type

Account name

(create in QBO)

Account type

Service

Service

Service

Service

Zenoti Service Revenue

Revenue

Product

Product

Product

Inventory/Service

Zenoti Product Revenue

Revenue

Classes

Class

Class

Service

Zenoti Class Revenue

Revenue

Gift cards

Gift cards

Gift cards

Service

Zenoti Gift Cards Revenue

Revenue

Prepaid cards

Prepaid cards

Prepaid cards

Service

Zenoti Prepaid Cards Revenue

Revenue

Memberships

Membership

Membership

Service

Zenoti Membership Revenue

Revenue

Package

Package

Package

Service

Zenoti Package Revenue

Revenue

In QBO, create the following chart of accounts for Redemption and Collections.

Payment type

Account name

(create in QBO)

Account type

Cash

Zenoti Undeposited Funds - Cash

Bank or Other Current Asset

Card

Zenoti Undeposited - Card

Bank or Other Current Asset

Check

Zenoti Undeposited - Check

Bank or Other Current Asset

Custom

Zenoti Undeposited - Custom

Bank or Other Current Asset

Gift card redemption

Zenoti Gift Cards Revenue

Revenue

Prepaid card redemption

Zenoti Prepaid Cards Revenue

Revenue

Membership redemption

Zenoti Membership Revenue

Revenue

Package redemption

Zenoti Package Revenue

Revenue

For the US region: In QBO, enable Automated Sales Tax. More information

For other regions: In QBO, configure tax rates as per local requirements. More information

Navigate to the Integrations tab as follows,

At the organization level, click the Configuration icon.

Search for and select Accounting from the Integrations section.

Expand the Accounting tab.

Under the Configuration tab, expand the Provider section.

Select QuickBooks Online as the accounting platform, then click Continue.

On the Financials dialog box, click Advanced Configuration.

Set the Use Live Key toggle to Yes.

Important

This tab is visible only after you configure the invoice and sync settings in the Configuration tab.

Important

If you have multiple locations, you must configure locations in QBO and switch on the Multi-Location switch in Zenoti.

Expand the Authorize tab.

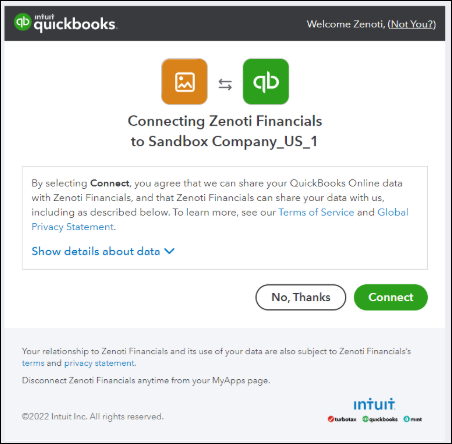

Click Authorize . A new tab opens in the browser asking for access to your QBO account.

Note

If you have a single organization created for your business on QBO, you will see the following window:

Sync Guest, Items, Chart of Accounts, and Locations.

Expand the Manual Sync section.

For Accounts, click Get.

For All Items, click Get.

For Guests, click Post.

For Locations, click Get.

Map Tax Rate to Chart of Accounts.

Expand the Tax Rate Mapping section.

For each tax group in Zenoti, map it to the respective tax rate in QBO.

Expand the Payments Mapping section.

For each payment type in Zenoti, map it to an account name in QBO. Refer to the table in Step 2 of this procedure.

Test whether the sync is set up properly.

Expand the Manual Sync section.

For Sales and Refunds, select a date, then click Post.

Now go to QBO and verify that the sync was completed correctly.

Accrual accounting - Journal entries

In QBO, create the following chart of accounts for revenues and tax liabilities.

Account name to create in QBO

Account type in QBO

Item type in Zenoti

Zenoti Service Revenue

Revenue

Service

Zenoti Product Revenue

Revenue

Product

Zenoti Class Revenue

Revenue

Classes

Zenoti Gift Cards Liability

Other Current Liabilities

Gift Cards

Zenoti Prepaid Cards Liability

Other Current Liabilities

Prepaid Cards

Zenoti Membership Liability

Other Current Liabilities

Membership

Zenoti Package Liability

Other Current Liabilities

Package

Zenoti Sales Tax Liability

Other Current Liabilities

Taxes

In QBO, create the following chart of accounts for redemptions and collections.

Account name to create in QBO

Account type in QBO

Payment type in Zenoti

Zenoti Undeposited Funds - Cash

Bank or Other Current Asset

Cash

Zenoti Undeposited - Card

Bank or Other Current Asset

Card

Zenoti Undeposited - Check

Bank or Other Current Asset

Check

Zenoti Undeposited - Custom

Bank or Other Current Asset

Custom

Zenoti Gift Cards Liability

Other Current Liabilities

Gift Card Redemption

Zenoti Prepaid Cards Liability

Other Current Liabilities

PPC Redemption

Zenoti Membership Liability

Other Current Liabilities

Membership Redemption

Zenoti Package Liability

Other Current Liabilities

Package Redemption

Navigate to the Integrations tab as follows,

At the organization level, click the Configuration icon.

Search for and select Accounting from the Integrations section.

Expand the Accounting tab.

Under the Configuration tab, expand the Provider section.

Select QuickBooks Online as the accounting platform, then click Continue.

On the Financials dialog box, click Advanced Configuration.

Set the Use Live Key toggle to Yes.

Important

This tab is visible only after you configure the invoice and sync settings in the Configuration tab.

Important

If you have multiple locations, you must configure locations in QBO and switch on the Multi-Location switch in Zenoti.

Expand the Authorize tab.

Click Authorize. A new tab opens in the browser asking for access to your QBO account.

Note

If you have a single organization created for your business on QBO, you will see the following window:

To allow Zenoti to access your QBO account, click Connect.

Sync the Chart of Accounts and Locations.

Expand the Manual Sync section.

For Accounts, click Get.

If you have multiple locations, for Locations, click Get.

Map the configured Chart of Accounts.

Expand the Items Mapping section.

For each item type in Zenoti, map it to an account name in QBO. Refer to the table in Step 1 of the Prepare QBO procedure.

Expand the Payments Mapping section.

For each payment type in Zenoti, map it to the respective Chart of Accounts in QBO. Refer to the table in Step 2 of the Prepare QBO procedure.

Test whether the sync is set up properly.

Expand the Manual Sync section.

For Sales and Refunds, select a date, then click Post.

Now go to QBO and verify that the sync was completed correctly.

Accrual accounting - Invoices

To enable posting Invoices created in Zenoti in to QBO, you must set up the following:

In QBO, create the following chart of accounts and items for Revenue.

Item type

(in Zenoti)

Item name

(create in QBO)

Item code

Item type

Account name

(create in QBO)

Account type

Service

Service

Service

Service

Zenoti Service Revenue

Revenue

Product

Product

Product

Inventory/Service

Zenoti Product Revenue

Revenue

Classes

Class

Class

Service

Zenoti Class Revenue

Revenue

Gift cards

Gift cards

Gift cards

Service

Zenoti Gift Cards Liability

Other Current Liabilities

Prepaid cards

Prepaid cards

Prepaid cards

Service

Zenoti Prepaid Cards Liability

Other Current Liabilities

Memberships

Membership

Membership

Service

Zenoti Membership Liability

Other Current Liabilities

Package

Package

Package

Service

Zenoti Sales Tax Liability

Other Current Liabilities

In QBO, create the following chart of accounts for Redemption and Collections.

Payment type

Account name

(create in QBO)

Account type

Cash

Zenoti Undeposited Funds - Cash

Bank or Other Current Asset

Card

Zenoti Undeposited - Card

Bank or Other Current Asset

Check

Zenoti Undeposited - Check

Bank or Other Current Asset

Custom

Zenoti Undeposited - Custom

Bank or Other Current Asset

Gift card redemption

Zenoti Gift Cards Liability

Revenue

Prepaid card redemption

Zenoti Prepaid Cards Liability

Revenue

Membership redemption

Zenoti Membership Liability

Revenue

Package redemption

Zenoti Package Liability

Revenue

For the US region: In QBO, enable Automated Sales Tax. More information

For other regions: In QBO, configure tax rates as per local requirements. More information

Navigate to the Integrations tab as follows,

At the organization level, click the Configuration icon.

Search for and select Accounting from the Integrations section.

Expand the Accounting tab.

Under the Configuration tab, expand the Provider section.

Select QuickBooks Online as the accounting platform, then click Continue.

On the Financials dialog box, click Advanced Configuration.

Set the Use Live Key toggle to Yes.

Important

This tab is visible only after you configure the invoice and sync settings in the Configuration tab.

Important

If you have multiple locations, you must configure locations in QBO and switch on the Multi-Location switch in Zenoti.

Clear the Post Journal Entries checkbox.

Expand the Authorize tab.

Click Authorize . A new tab opens in the browser asking for access to your QBO account.

Note

If you have a single organization created for your business on QBO, you will see the following window:

Sync Guest, Items, Chart of Accounts, and Locations.

Expand the Manual Sync section.

For Accounts, click Get.

For All Items, click Get.

For Guests, click Post.

For Locations, click Get.

Map Tax Rate to Chart of Accounts.

Expand the Tax Rate Mapping section.

For each tax group in Zenoti, map it to the respective tax rate in QBO.

Expand the Payments Mapping section.

For each payment type in Zenoti, map it to an account name in QBO. Refer to the table in Step 2 of the Prepare QBO procedure.

Test whether the sync is set up properly.

Expand the Manual Sync section.

For Sales and Refunds, select a date, then click Post.

Now go to QBO and verify that the sync was completed correctly.

Onboarding: Set up and authorize Xero

Depending on whether you use the cash or accrual accounting method, the procedure to set up and authorize Xero will differ slightly. For each method, you also have to set up how Zenoti posts journal entries and invoices to Xero.

Important

Ensure that you have an account created on Xero.

Based on the accounting method and the data type of posting, you can configure Xero in one of the following ways:

In Xero, create the following chart of accounts for revenues and tax liabilities.

Account name to create in Xero

Account type in Xero

Item type in Zenoti

Zenoti Service Revenue

Revenue

Service

Zenoti Product Revenue

Revenue

Product

Zenoti Class Revenue

Revenue

Classes

Zenoti Gift Cards Revenue

Revenue

Gift Cards

Zenoti Prepaid Cards Revenue

Revenue

Prepaid Cards

Zenoti Membership Revenue

Revenue

Membership

Zenoti Package Revenue

Revenue

Package

Zenoti Sales Tax Payable

Other Current Liabilities

Taxes

In Xero, create the following chart of accounts for redemptions and collections.

Account name to create in Xero

Account type in Xero

Payment type in Zenoti

Zenoti Undeposited Funds - Cash

Bank or Other Current Asset

Cash

Zenoti Undeposited - Card

Bank or Other Current Asset

Card

Zenoti Undeposited - Check

Bank or Other Current Asset

Check

Zenoti Undeposited - Custom

Bank or Other Current Asset

Custom

Zenoti Gift Cards Revenue

Revenue

Gift Card Redemption

Zenoti Prepaid Cards Revenue

Revenue

PPC Redemption

Zenoti Membership Revenue

Revenue

Membership Redemption

Zenoti Package Revenue

Revenue

Package Redemption

Important

If you have multiple locations, you must configure locations in Xero and switch on the Multi-Location switch in Zenoti.

Navigate to the Integrations tab as follows,

At the organization level, click the Configuration icon.

Search for and select Accounting from the Integrations section.

Expand the Accounting tab.

Under the Configuration tab, expand the Provider section.

Select Xero as the accounting platform, then click Continue.

On the Financials dialog box, click Advanced Configuration.

Set the Use Live Key toggle to Yes.

Important

This tab is visible only after you configure the invoice and sync settings in the Configuration tab.

Important

If you have multiple locations, you must configure locations in Xero and switch on the Multi-Location switch in Zenoti.

Expand the Authorize tab.

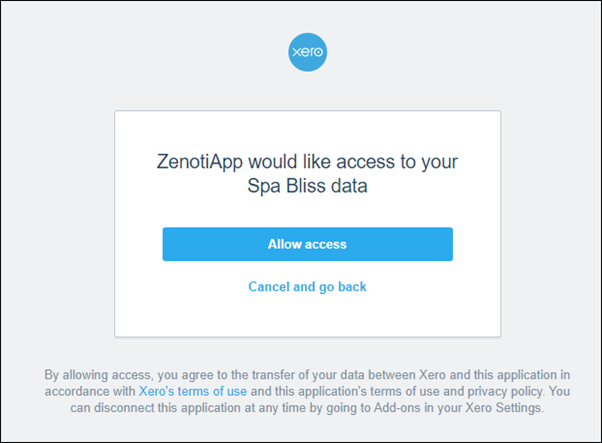

Click Authorize. A new tab opens in the browser asking for access to your Xero account.

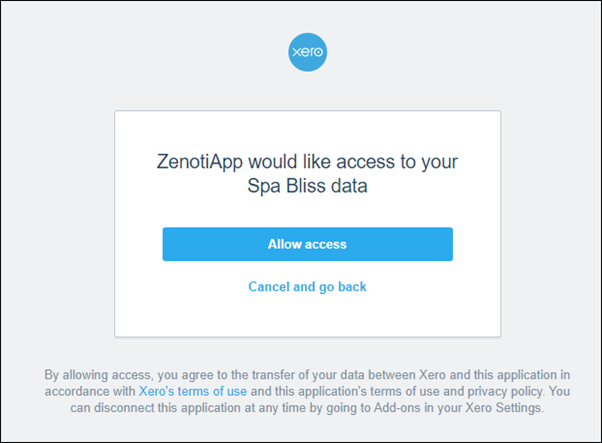

Note

If you have a single organization created for your business on Xero, you will see the following window:

Sync Chart of Accounts and Locations.

Expand the Manual Sync section.

For Accounts, click Get.

For Locations, click Get.

Map Item Type to Chart of Accounts.

Expand the Items Mapping section.

For each item type in Zenoti, map it to the respective chart of accounts in Xero.

Item type in Zenoti

Chart of accounts created in Xero

Service

Zenoti Service Revenue

Product

Zenoti Product Revenue

Classes

Zenoti Class Revenue

Gift Cards

Zenoti Gift Cards Revenue

Prepaid Cards

Zenoti Prepaid Cards Revenue

Membership

Zenoti Membership Revenue

Packages

Zenoti Package Revenue

Taxes

Zenoti Sales Tax Payable

Expand the Payments Mapping section.

For each payment type in Zenoti, map it to an account name in Xero. Refer to the table in Step 2 of the Prepare Xero procedure.

Test whether the sync is set up properly.

Expand the Manual Sync section.

For Sales and Refunds, select a date, then click Post.

To enable posting Invoices created in Zenoti in Xero, you must set up the following:

In Xero, create the following chart of accounts for revenues and tax liabilities.

Item type

(in Zenoti)

Item name

(create in Xero)

Item code

Item type

Account name

(create in Xero)

Account type

Service

Service

Service

Service

Zenoti Service Revenue

Revenue

Product

Product

Product

Inventory/Service

Zenoti Product Revenue

Revenue

Classes

Class

Class

Service

Zenoti Class Revenue

Revenue

Gift cards

Gift cards

Gift cards

Service

Zenoti Gift Cards Revenue

Revenue

Prepaid cards

Prepaid cards

Prepaid cards

Service

Zenoti Prepaid Cards Revenue

Revenue

Memberships

Membership

Membership

Service

Zenoti Membership Revenue

Revenue

Package

Package

Package

Service

Zenoti Package Revenue

Revenue

In Xero, create the following chart of accounts for Redemption and Collections and select the Enable payments to this account checkbox.

Payment type

Account name

(create in Xero)

Account type

Cash

Zenoti Undeposited Funds - Cash

Bank or Other Current Asset

Card

Zenoti Undeposited - Card

Bank or Other Current Asset

Check

Zenoti Undeposited - Check

Bank or Other Current Asset

Custom

Zenoti Undeposited - Custom

Bank or Other Current Asset

Gift card redemption

Zenoti Gift Cards Revenue

Revenue

Prepaid card redemption

Zenoti Prepaid Cards Revenue

Revenue

Membership redemption

Zenoti Membership Revenue

Revenue

Package redemption

Zenoti Package Revenue

Revenue

In Xero, configure tax rates as per local requirements. More information

Select the Enable payments to this account checkbox.

Navigate to the Integrations tab as follows,

At the organization level, click the Configuration icon.

Search for and select Accounting from the Integrations section.

Expand the Accounting tab.

Under the Configuration tab, expand the Provider section.

Select Xero as the accounting platform, then click Continue.

On the Financials dialog box, click Advanced Configuration.

Set the Use Live Key toggle to Yes.

Important

This tab is visible only after you configure the invoice and sync settings in the Configuration tab.

Important

If you have multiple locations, you must configure locations in Xero and switch on the Multi-Location switch in Zenoti.

Clear the Post Journal Entries checkbox.

Expand the Authorize tab.

Click Authorize. A new tab opens in the browser asking for access to your Xero account.

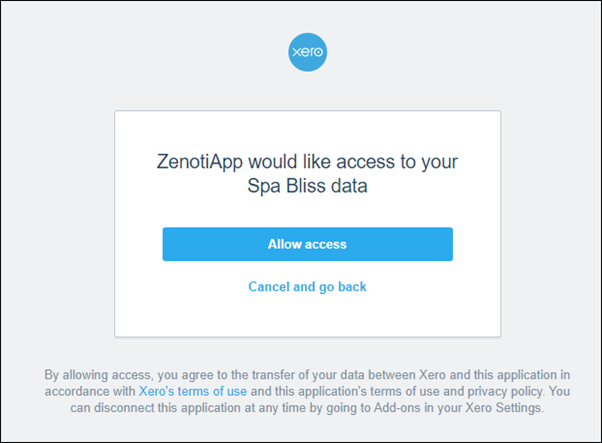

Note

If you have a single organization created for your business on Xero, you will see the following window:

Sync Guest, Items, Chart of Accounts, and Locations.

Expand the Manual Sync section.

For Accounts, click Get.

For All Items, click Get.

For Guests, click Post.

For Locations, click Get.

Map Tax Rate to Chart of Accounts.

Expand the Tax Rate Mapping section.

For each tax group in Zenoti, map it to the respective tax rate in Xero.

Expand the Payments Mapping section.

For each payment type in Zenoti, map it to an account name in Xero. Refer to the table in Step 2 of the Prepare Xero procedure.

Test whether the sync is set up properly.

Expand the Manual Sync section.

For Sales and Refunds, select a date, then click Post.

To enable posting Invoices created in Zenoti in Xero, you must set up the following:

In Xero, create the following chart of accounts for revenues and tax liabilities.

Account name to create in Xero

Account type in Xero

Item type in Zenoti

Zenoti Service Revenue

Revenue

Service

Zenoti Product Revenue

Revenue

Product

Zenoti Class Revenue

Revenue

Classes

Zenoti Gift Cards Liability

Other Current Liabilities

Gift Cards

Zenoti Prepaid Cards Liability

Other Current Liabilities

Prepaid Cards

Zenoti Membership Liability

Other Current Liabilities

Membership

Zenoti Package Liability

Other Current Liabilities

Package

Zenoti Sales Tax Liability

Other Current Liabilities

Taxes

In Xero, create the following chart of accounts for redemptions and collections.

Account name to create in Xero

Account type in Xero

Payment type in Zenoti

Zenoti Undeposited Funds - Cash

Bank or Other Current Asset

Cash

Zenoti Undeposited - Card

Bank or Other Current Asset

Card

Zenoti Undeposited - Check

Bank or Other Current Asset

Check

Zenoti Undeposited - Custom

Bank or Other Current Asset

Custom

Zenoti Gift Cards Liability

Other Current Liabilities

Gift Card Redemption

Zenoti Prepaid Cards Liability

Other Current Liabilities

PPC Redemption

Zenoti Membership Liability

Other Current Liabilities

Membership Redemption

Zenoti Package Liability

Other Current Liabilities

Package Redemption

Important

If you have multiple locations, you must configure locations in Xero and switch on the Multi-Location switch in Zenoti.

Navigate to the Integrations tab as follows,

At the organization level, click the Configuration icon.

Search for and select Accounting from the Integrations section.

Expand the Accounting tab.

Under the Configuration tab, expand the Provider section.

Select Xero as the accounting platform, then click Continue.

On the Financials dialog box, click Advanced Configuration.

Set the Use Live Key toggle to Yes.

Important

This tab is visible only after you configure the invoice and sync settings in the Configuration tab.

Important

If you have multiple locations, you must configure locations in Xero and switch on the Multi-Location switch in Zenoti.

Expand the Authorize tab.

Click Authorize. A new tab opens in the browser asking for access to your Xero account.

Note

If you have a single organization created for your business on Xero, you will see the following window:

Sync Chart of Accounts and Locations.

Expand the Manual Sync section.

For Accounts, click Get.

For Locations, click Get.

Map Item Type to Chart of Accounts.

Expand the Items Mapping section.

For each item type in Zenoti, map it to the respective chart of accounts in Xero.

Item type in Zenoti

Chart of accounts created in Xero

Service

Zenoti Service Revenue

Product

Zenoti Product Revenue

Classes

Zenoti Class Revenue

Gift Cards

Zenoti Gift Cards Liability

Prepaid Cards

Zenoti Prepaid Cards Liability

Membership

Zenoti Membership Liability

Packages

Zenoti Package Liability

Taxes

Zenoti Sales Tax Liability

Expand the Payments Mapping section.

For each payment type in Zenoti, map it to an account name in Xero. Refer to the table in step 2 of the Prepare Xero procedure.

Test whether the sync is set up properly.

Expand the Manual Sync section.

For Sales and Refunds, select a date, then click Post.

To enable posting Invoices created in Zenoti in Xero, you must set up the following:

In Xero, create the following chart of accounts for revenues and tax liabilities.

Item type

(in Zenoti)

Item name

(create in Xero)

Item code

Item type

Account name

(create in QBO)

Account type

Service

Service

Service

Service

Zenoti Service Revenue

Revenue

Product

Product

Product

Inventory/Service

Zenoti Product Revenue

Revenue

Classes

Class

Class

Service

Zenoti Class Revenue

Revenue

Gift cards

Gift cards

Gift cards

Service

Zenoti Gift Cards Liability

Other Current Liabilities

Prepaid cards

Prepaid cards

Prepaid cards

Service

Zenoti Prepaid Cards Liability

Other Current Liabilities

Memberships

Membership

Membership

Service

Zenoti Membership Liability

Other Current Liabilities

Package

Package

Package

Service

Zenoti Package Liability

Other Current Liabilities

In Xero, create the following chart of accounts for Redemption and Collections and select the Enable payments to this account checkbox.

Payment type

Account name

(create in Xero)

Account type

Cash

Zenoti Undeposited Funds - Cash

Bank or Other Current Asset

Card

Zenoti Undeposited - Card

Bank or Other Current Asset

Check

Zenoti Undeposited - Check

Bank or Other Current Asset

Custom

Zenoti Undeposited - Custom

Bank or Other Current Asset

Gift card redemption

Zenoti Gift Cards Liability

Other Current Liabilities

Prepaid card redemption

Zenoti Prepaid Cards Liability

Other Current Liabilities

Membership redemption

Zenoti Membership Liability

Other Current Liabilities

Package redemption

Zenoti Package Liability

Other Current Liabilities

In Xero, configure tax rates as per local requirements. More information

Select the Enable payments to this account checkbox.

Navigate to the Integrations tab as follows,

At the organization level, click the Configuration icon.

Search for and select Accounting from the Integrations section.

Expand the Accounting tab.

Under the Configuration tab, expand the Provider section.

Select Xero as the accounting platform, then click Continue.

On the Financials dialog box, click Advanced Configuration.

Set the Use Live Key toggle to Yes.

Important

This tab is visible only after you configure the invoice and sync settings in the Configuration tab.

Important

If you have multiple locations, you must configure locations in Xero and switch on the Multi-Location switch in Zenoti.

Clear the Post Journal Entries checkbox.

Expand the Authorize tab.

Click Authorize. A new tab opens in the browser asking for access to your Xero account.

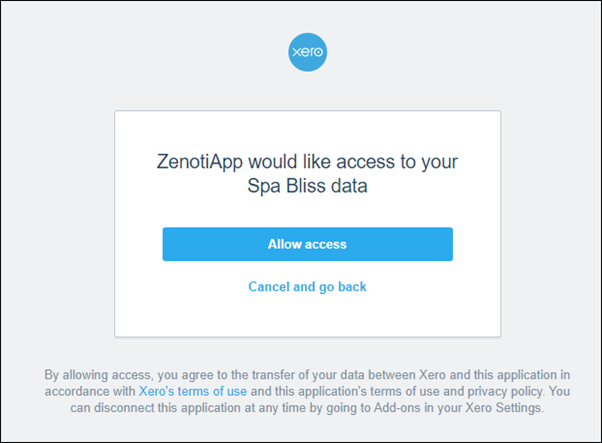

Note

If you have a single organization created for your business on Xero, you will see the following window:

Sync Guest, Items, Chart of Accounts, and Locations.

Expand the Manual Sync section.

For Accounts, click Get.

For All Items, click Get.

For Guests, click Post.

For Locations, click Get.

Map Tax Rate to Chart of Accounts.

Expand the Tax Rate Mapping section.

For each tax group in Zenoti, map it to the respective tax rate in Xero.

Expand the Payments Mapping section.

For each payment type in Zenoti, map it to an account name in Xero. Refer to the table in Step 2 of the Prepare Xero procedure.

Test whether the sync is set up properly.

Expand the Manual Sync section.

For Sales and Refunds, select a date, then click Post.