Configure overtimes

Guide to set up overtime eligibility and multipliers.

Configure employee overtime

You can give overtime pay to those employees who work beyond their scheduled work timings. You can define when employees become eligible for overtime pay (for example, if they work above 40 hours in a week). Note that you can pay employees overtime only when their hourly rate is not zero.

Important

Overtime pay applies only to those employees who receive their pay on their actual check-in and check-out time. You can configure this setting from Center level (Calculate Payroll Hours Based on > Actual check-in/checkout time).

To configure overtime pay for an employee:

At the center level, click the Employee icon and navigate to Employees > Employees.

Click the name of the employee.

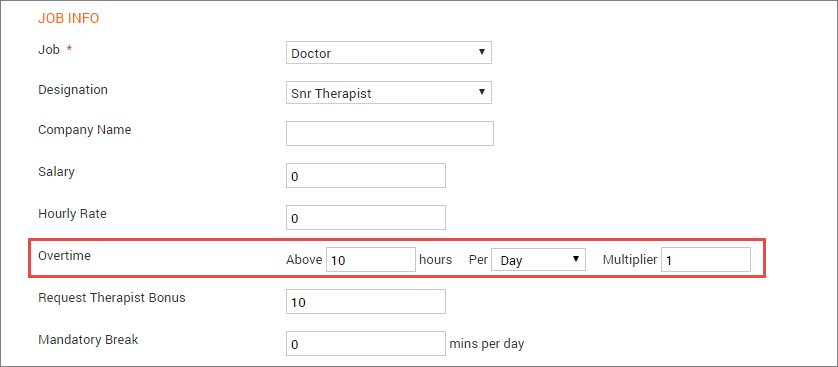

In the General tab, against Overtime, you will see the following options:

a) Above __ hours: Enter the number of hours per day, week, or pay period above which the employee becomes eligible for overtime pay.

b) Per (Day/Week/Pay Period): Specify whether you want to pay overtime based on hours the employees work in a day, week, or pay period.

c) Multiplier: The number of times the regular hourly pay should be multiplied with.

Example: Consider the following:

You want to give overtime to your employees if they work Above 10 hours in a Day.

The Hourly pay for a particular employee is $50

The multiplier is set to 1.

On a given day, the employee works for 12 hours.

Zenoti calculates overtime pay as follows: 2x$50 = $100 (where 2 is the number of overtime hours and $50 is the hourly pay).

Note

If the multiplier is set to 2, Zenoti calculates the overtime pay as 2x$100 =$200.

Click Save.

Set up payroll based on payout model and 7i Overtime calculation

Zenoti considers the following settings when calculating payroll for an employee in this model:

Payout Model – When setting up payroll configurations for an employee, you can choose from:

Hourly Pay Only: This model uses the hourly pay rate but not the commission rate.

Commission + Base Rate: This model uses both the commission rate and base pay rate.

Max of Commission or Base Rate: This model uses either the commission rate or base pay rate (whichever is higher).

The calculation also includes the hourly pay rate for secondary work tasks and overtime as applicable in all three models.

7i Overtime Calculation – You can choose whether you want to include 7(i) Overtime calculation.

Tip

7(i) overtime refers to a provision in the Fair Labor Standards Act (FLSA) in the United States that exempts certain commission-based employees from receiving overtime pay.

Applies to: Commissioned employees of "retail or service establishments"

Conditions:

The establishment's main business must involve retail sales or services (not resale).

The employee's regular rate of pay must be higher than one and a half times the minimum wage for every overtime hour worked.

More than half of the employee's total earnings in a designated period (at least a month but not more than a year) must be from commissions.

If all these conditions are met, the employer doesn't have to pay overtime for hours worked over 40 in a workweek. It's important to note that some states might have their own additional regulations on overtime exemptions.

Note

If you want to use the new payroll model, reach out to Zenoti Support.

You must select Enable Work Tasks > Manager and employees can select work tasks at the time of check-ins, and manager can assign payrate by work task setting to run this payroll model.

Set up the Payout Model with 7i Overtime Calculation for an employee:

At the center level, click the Employee icon and navigate to Employees > Employees.

Click the first name of the employee.

Click the General tab.

In the Compensation Info section, select Payout Model fromthe list.

Select 7i Overtime Calculation.

Click Define hourly rate by work tasks.

Set the hourly rate for each work task and click Save.

Click Save.

The following flow charts show how Zenoti calculates payroll for different payout models while considering the 7i Overtime Calculation setting.

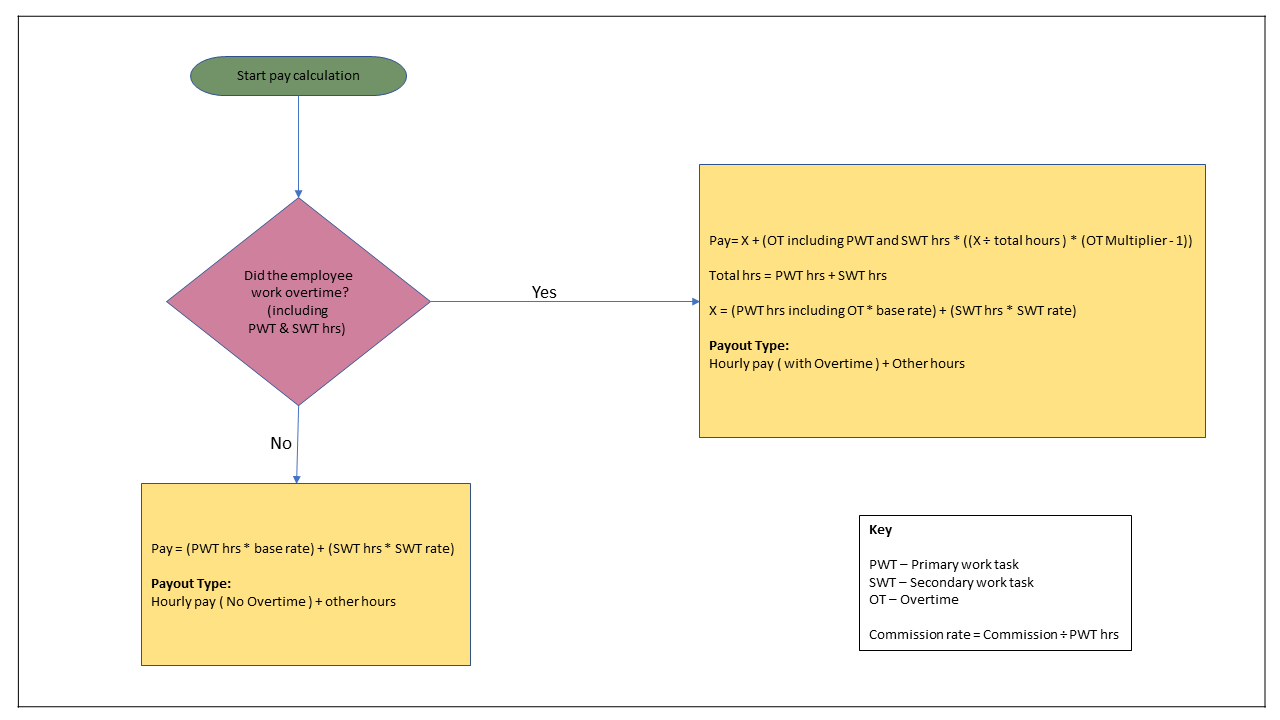

Payout Model: Hourly Pay Only

7i Overtime Calculation: Include or Exclude

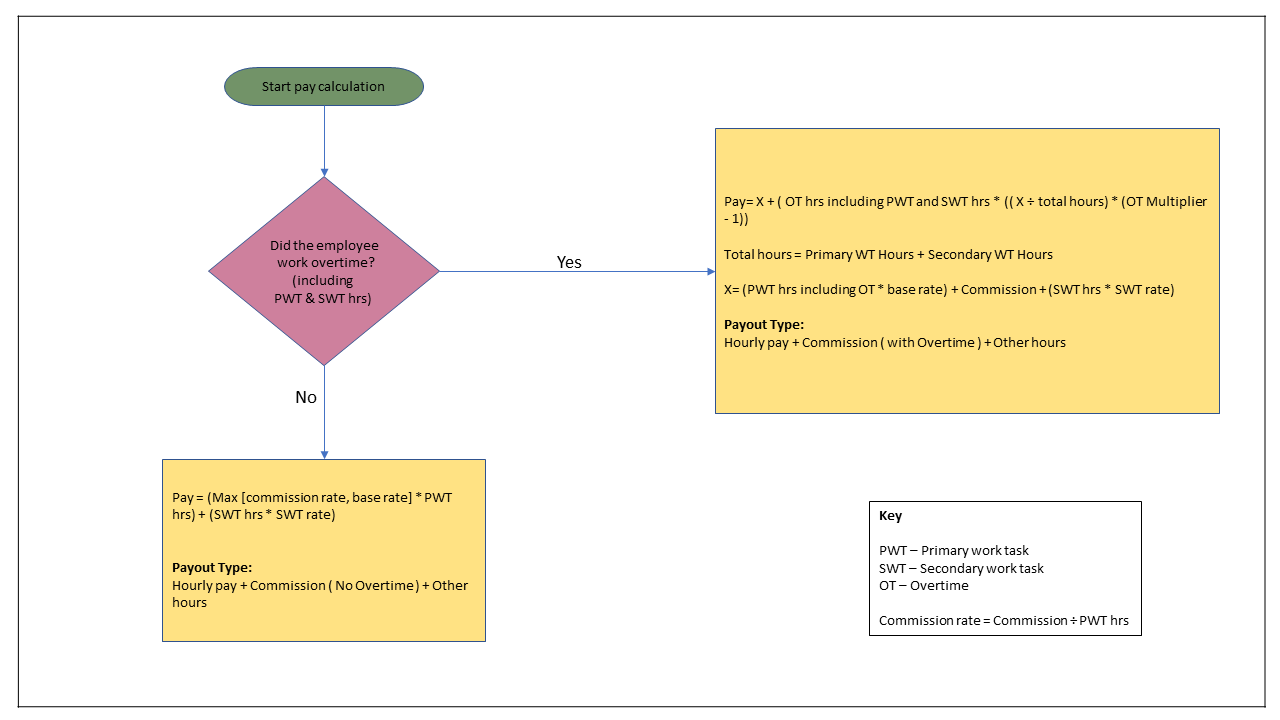

Payout Model: Commission + Base Rate

7i Overtime Calculation:Include or Exclude

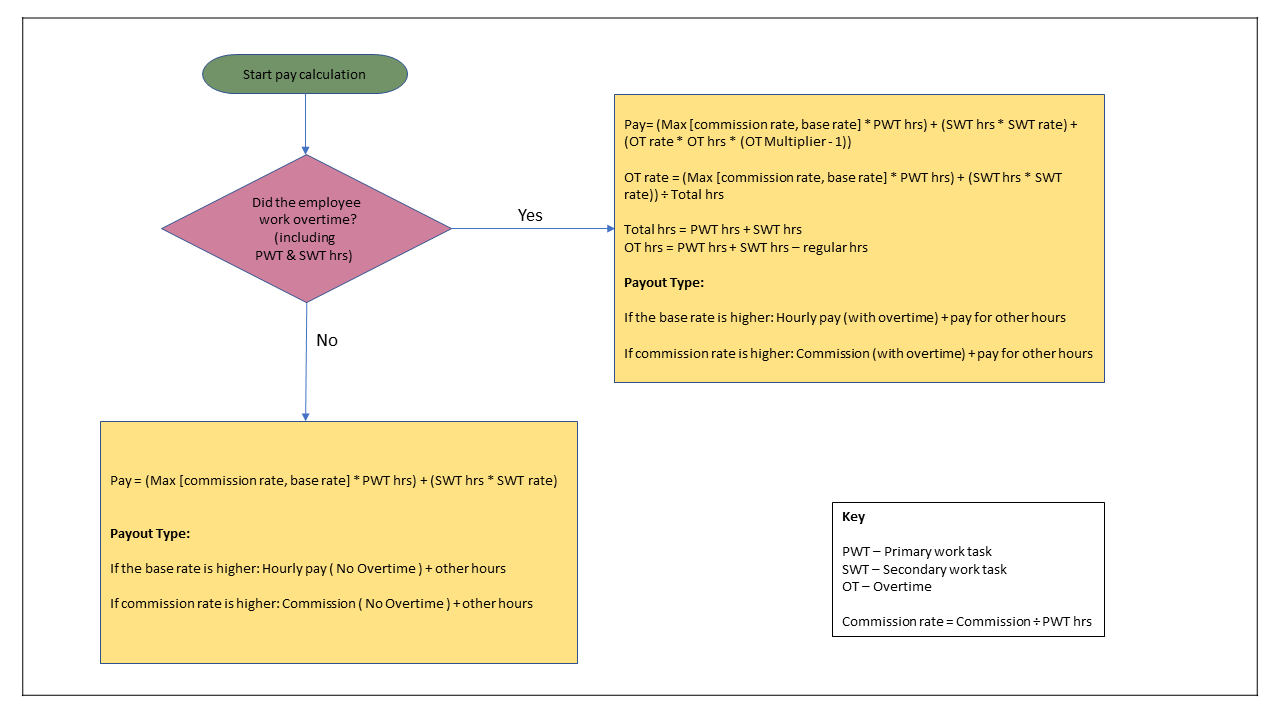

Payout Model: Max of Commission or Base Rate

7i Overtime Calculation: Exclude

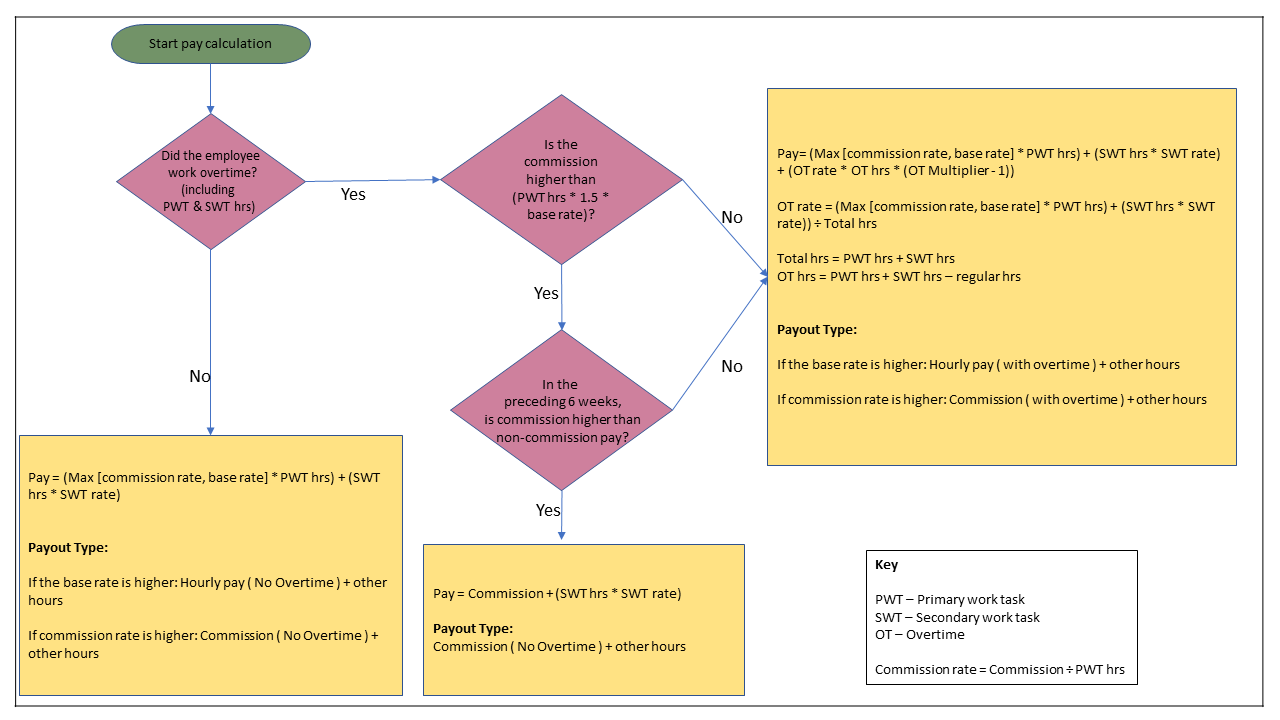

Payout Model: Max of Commission or Base Rate

7i Overtime Calculation: Include

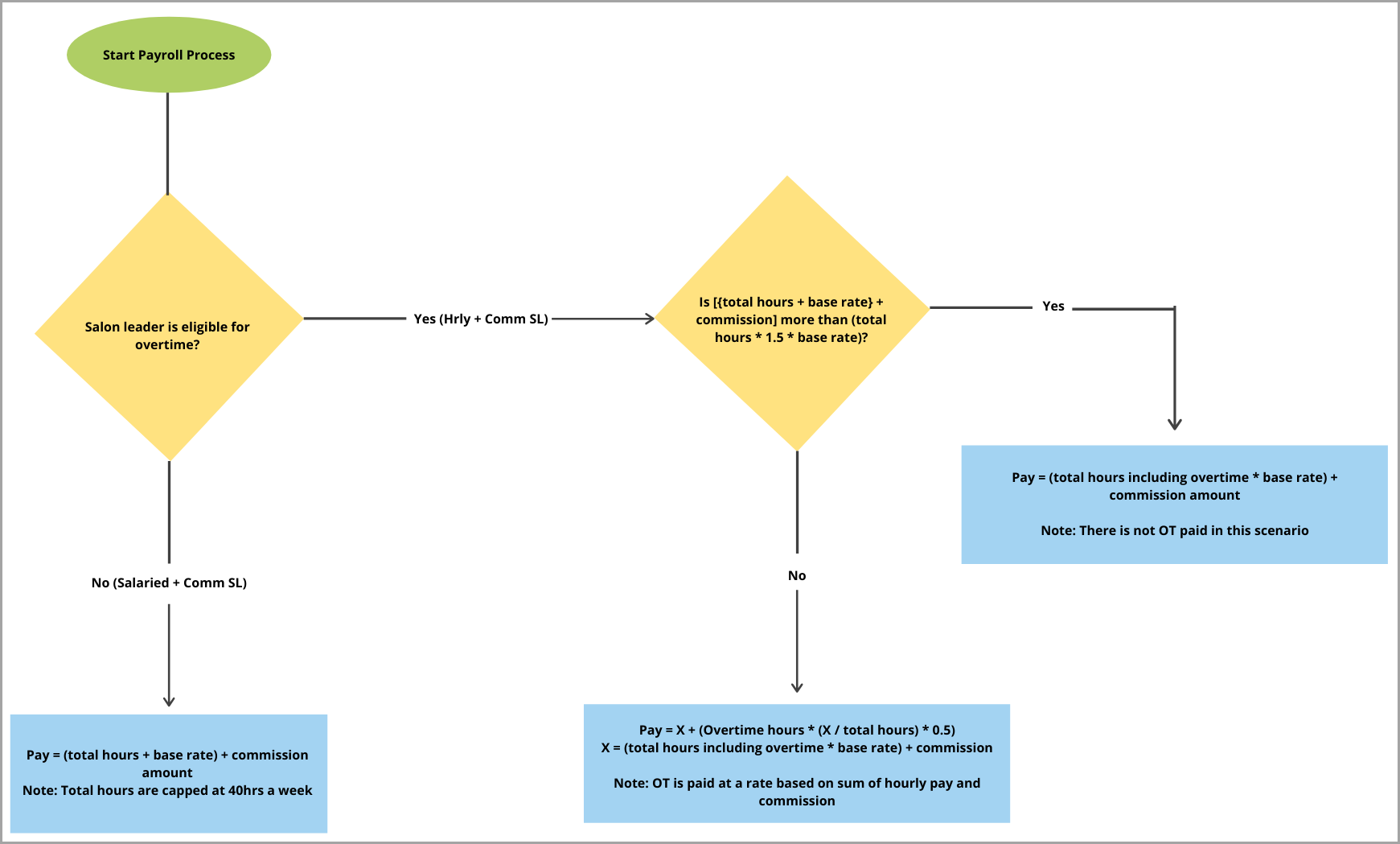

Set up overtime pay for nonexempt commission employees

Some commissioned employees such as salon managers may or may not be exempt from overtime.

For employees with hourly pay + commission exceeding (typically) 1.5 times hourly pay, OT is exempt.

Else, OT is paid at the rate of hourly pay + commission amount.

Exempt employees are paid the sum of hourly pay and commission but hourly pay should be for no more than 40 hrs. For example, if the employee worked for 50 hours, they would still get hourly pay for 40 hours.

Non-exempt employees are paid using the following formula.

If

Commission + (Total Hours*Hourly Rate) > (Total Hours*Horly Rate * 1.5)

Then

Total pay = Commission + (Total Hours*Hourly Rate)

Else

(Total hours*Hourly rate)+Commission+(Total hours*Hourly rate+Commission/Total Hours)*0.5*OT hours

Consider this example.

A center manager with an hourly rate of $10, with 25% commission, worked for 45 hours in a week and earned $800 in service sales.

To calculate her payout:

Step 1: Eligible for OT ? - Yes

Step 2: Is [Hourly pay + Commission ($650.00) > Total hours * Base rate * 1.5 ($675)? ] - No

Step 3: Pay = X + (overtime hours * (X/total hours) * 0.5)

Pay = 650 + (5 * (650/45) * 0.5) = $686.10

Consider the following flowchart to understand how overtime pay for non-exempt employees is calculated; this is typically for salon managers.

To define whether a commissioned employee is exempt or not exempt from overtime, use the employee profile page.

Ensure you are at the center level.

Open an employee profile (Employee > Employees > Employees > Name of the employee > General tab).

In the Job info section, for the setting Employee pay using hourly pay and service commission comparison, select Override at employee level.

Note

You can see this option only when center-level configuration is set to Based on employee overtime exemption.

Select either one of the following options:

Click Save.

This particular employee is paid based on the settings you chose in her profile.

Note

New federal law — Tips and OT pay deduction (2025–2028)

Under the One Big Beautiful Bill Act (OBBBA), employees who earn $150,000 or less annually can claim federal tax deductions on certain income when filing their 2025 tax return. They can deduct:

Up to $12,500 in overtime wages, and

Up to $25,000 in tip income

These deductions apply to tax years 2025 through 2028.

This update does not change overtime calculations, payroll withholding, or payroll reporting in Zenoti. Employees will claim these deductions when filing their taxes.

Conditions apply

For OT exempt employees:

You can configure Overtime using the Weekly option (you cannot use the Multiplier option).

Pay-out type must be set to Hourly pay + Service commission (OT not eligible) in Hourly pay/Service commission report.

For OT eligible employees

You can configure Overtime using the Weekly option (you cannot use the Multiplier option).

Pay-out type must be set to either Hourly pay + Service commission (with Overtime) or Hourly pay + Service commission (No Overtime) in Hourly pay/Service commission report.