GST - India

Getting ready for GST India with Zenoti

Be GST ready using Zenoti

Starting July 1, 2017, all businesses in India must be Goods and Services Tax (GST) compliant.

To be ready for GST, you must do the following:

Enable GST India

To enable a few settings that will help you be ready for GST using Zenoti, you must enable the GST India option.

Learn how to enable GST India.

Identify and update GST codes for your business

With the introduction of GST, every business in India is required to declare the list of goods and services they offer using specific GST codes.

Learn more about the GST codes that you need to identify and how to update Zenoti with the GST codes.

Make changes to the receipt format

The receipts that you issue to guests must contain mandatory information related to GST.

Learn more about the mandatory information to be included in the receipts and how to enable GST India receipt format and make changes to the receipt header and footer.

Create tax groups and assign to your business offerings

You must either edit existing tax groups or create new tax groups and assign them to your business offerings (services, products, gift cards, packages, and memberships).

Learn how to create a tax group and assign them to your product offerings.

Review your services and products tax group association

After you have created or edited a tax group, review if the services and products are assigned to the appropriate tax groups.

Important

You must make changes to the tax groups only after GST comes into effect. If you make changes before GST, you will be charging your guests GST rates even before it comes into effect.

Learn how to verify the tax group association.

Review your gift cards and tax group association

Decide if you will sell your gift cards with or without tax.

If you decide to sell gift cards with tax, you must review the tax group association of your gift cards.

Important

You must make changes to the tax groups only after GST comes into effect. If you make changes before GST, you will be charging your guests GST rates even before it comes into effect.

Learn how to verify the tax group association.

Review your packages and tax group association

If you sell packages with services or products that fall in different tax rates, speak to your accountant and finalize the tax rate group to apply to the packages.

Important

You must make changes to the tax groups only after GST comes into effect. If you make changes before GST, you will be charging your guests GST rates even before it comes into effect.

Learn how to verify the tax group association.

Review your memberships and tax group association

If you sell memberships with services that fall in different tax rates, speak to your accountant and finalize the tax rate group to apply to the memberships.

Important

You must make changes to the tax groups only after GST comes into effect. If you make changes before GST, you will be charging your guests GST rates even before it comes into effect.

Learn how to verify the tax group association.

Set up invoice sequencing

Under GST, invoice sequencing is as follows:

Tax invoice

Tax Invoice is generated only after a service is provided or a product is sold and the amount is collected.

Tax Receipt Voucher

Sale of pre-paid offerings with tax (gift cards, packages, and memberships) is tracked as a Tax Receipt Voucher.

Advance Receipt

Sale of pre-paid offerings without tax (pre-paid cards, gift cards, packages, and memberships) is tracked as an Advance Receipt.

Credit Note

Refund of service or retail is tracked as a Credit Note.

Tax Refund Voucher

Refund of pre-paid offerings with tax is tracked as a Tax Refund Voucher.

Refund Voucher

Refund of pre-paid offerings without tax is tracked as a Refund Voucher.

Learn more about the types of invoices generated for GST India.

Re-evaluate cross center redemptions

Note

This step is applicable if you run your business in multiple states across India or if you have franchisees across India.

If you sell a pre-paid offering (for example, a gift card) in one state, and the redemption takes place in another state, with GST, the tax impact is as follows: Redemption centerNeeds to pay tax on the service as per the redemption center state SGST.

Original center

Needs to get a refund of the amount collected as tax as per the original center's state SGST. The original center needs to get this refund from the government.

What to re-evaluate?

Decide if you wish to continue with cross center redemptions.

If you wish to discontinue, disable cross center redemptions at the organization level.

If you decide to continue with cross center redemptions, you must talk to your accountant and decide how you will handle the payment of taxes.

Learn how to disable cross center redemptions.

Revisit your inventory management

GST requires you to make the following changes:

Configure center-specific product and vendor assignment

You must configure each center to have its own product-vendor association with pricing, discount, and tax information that is different from other centers.

Learn how to assign products to vendors.

Track PO’s using Goods Received Receipt (GRR) number

You must configure your center to generate and assign a unique GRR number to each purchase order marked as delivered (both partial and full).

Learn how to enable automatic generation of a GRR number.

Update PO’s

You must update purchase orders to include the Invoice#, Date of shipment, Date of delivery, and Address of delivery. Learn how to update the purchase orders.

Generate new invoice numbers

After you have configured Zenoti with GST details, you can start generating new invoice numbers for every sale starting July 1, 2017.

Learn how to generate new invoice numbers.

Important

You must start generating new invoice numbers only from the night of 30th June. Not before.

Handle invoices with care

GST mandates that all sequence numbers issued for documents be reported. Hence ensure that only designated employees have permissions to reopen, backdate, or void invoices.

Pre and post GST transactions

Review the list of GST India FAQ and understand how you must handle transactions pre and post-GST.

Understand GST returns and know when and how to file them

There are various types of tax returns in GST and you must be aware of when and how to file them. We strongly recommend that you speak to your accountant and be ready for filing returns when GST is introduced.

We have added new columns to some of the reports to allow you to extract the required data to file your returns. Learn more about filing GST India returns.

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com.

Additional resources

Important

All the resources here are being provided for informational purposes only.

Zenoti bears no responsibility for the accuracy, legality, or the content of the external site or for that of subsequent links.

Enable Goods and Services Tax (GST) India

Starting July 1, 2017, businesses operating in India need to use Goods and Services Tax (GST) for selling any applicable goods and services.

In Zenoti, you can enable GST - India for your organization using a setting.

Precondition: Your organization or business must be located in India. That is, Configuration icon > Business details > Contact details > Country must show India.

Required roles: Any role with access to the Administrator mode

Required permissions: None

At the organization level, click the Configuration icon.

Search for and select Enable India GST from the Business details section.

After selecting it, the following fields appear:

Start GST Sequences for all centers: Select to start generating new invoice numbers for every sale.

The first invoice number (also called as document number) starts from “1” and the subsequent invoices are then assigned incremental numbers.

Note

You cannot edit an invoice sequence number. You can only add prefixes to the invoice types.

Important

Enable this setting only on the night of 30th June, not before. If you enable this setting you cannot disable it.

Print collected amount in words: Select to print the amount collected in words at the bottom of the receipt.

Click Save.

GST is now enabled for your business.

Identify and update GST codes for your business

With the introduction of GST, every business in India is required to declare the list of goods and services they offer using specific GST codes.

In this article, you will learn about all the GST codes that you need to identify and update Zenoti with to run your business in a GST compliant manner.

Note

You will be able to update Zenoti with all the codes mentioned in this article only one at a time.

Identify the following GST codes:

GSTIN: This is the Goods and Services Taxpayer Identification Number (GSTIN) and is a unique PAN-based 15-digit number. GSTIN is issued to taxpayers who register themselves under the GST law in a particular state of India.

GSTIN varies from state to state. Hence, if you are a business that operates in multiple states, you must register for GST in every state that you operate in and obtain GSTIN for each of the states.

PAN for the Center: The payment receipt you issue to the customer must contain the PAN number of the center.

State Code: This is the state GST code. You must find out the GST code for all the states that you run your business in.Learn how to update the state code of a center

Vendor GSTIN: You must update Zenoti with the GSTIN of every vendor that you are in business with.

PAN of the Vendor: You must update Zenoti with the PAN number of every vendor that you are in business with.

SAC: This is the Services Accounting Code (SAC) and is used to identify, classify, and define services under the GST.

For all the services, add-ons', and packages that you offer, you must obtain the respective SAC. The applicable tax rate depends on the SAC.

HSN: This is the Harmonized System of Nomenclature (HSN) and is used to identify and classify products under the GST.

For all the products you sell, you must obtain the respective HSN code. The applicable tax rate depends on the HSN code.

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com.

Make changes to the receipt format

GST requires you to issue receipts to guests that include the following:

State Code: This is the state GST code.

GSTIN: This is the Goods and Services Taxpayer Identification Number (GSTIN) and is a unique PAN-based 15-digit number.

Guest’s PAN Number: Required if the invoice value is above Rs. 50,000.

Guest’s Address: Required if the invoice value is above Rs. 50,000.

PAN for the Center: The payment receipt you issue to the customer must contain the PAN number of the center.

SAC Code: For each availed service, you must display the SAC with the tax rate and amount.

HSN Code: For each purchased product, you must display the HSN code with the tax rate and amount.

Receipt Header: Under GST, depending on the transaction type, the receipt header should change as follows:

Tax invoice

When you are collecting payments after providing services or selling products, the sale receipt should have Tax Invoice as the receipt header.

Tax Receipt Voucher

Sale of pre-paid offerings with tax (gift cards, packages, and memberships) should have Tax Receipt Voucher as the receipt header.

Advance Receipt

Sale of pre-paid offerings without tax (pre-paid cards, gift cards, packages, and memberships) should have Advance Receipt as the receipt header.

Credit Note

Refund of service or retail should have Credit Note as the receipt header.

Tax Refund Voucher

Refund of pre-paid offerings with tax should have Tax Refund Voucher as the receipt header.

Refund Voucher

Refund of pre-paid offerings without tax should have Refund Voucher as the receipt header.

Advance Receipt

When you sell pre-paid cards, gift cards, memberships, or packages (offerings that you collect payments in advance and are liable for services or goods), the sale receipt should have Advance Receipt as the header.

Duplicate header

If you print a receipt more than once, you must add Duplicate as the header.

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com.

Receipt configuration for GST India

Invoicing under GST

GST prescribes to have a consistent invoice based reporting system that records all the important information related to a sale or purchase.

Invoices have been divided into several categories under the GST regime such as GST tax invoice, vouchers, credit notes, and advance receipts.

Learn more: Types of Invoices Generated for GST India

The GST invoice format, mandatory information that every invoice must include, and the various other components that you can optionally include.

Important

Enable GST – India for your organization

Configure GST invoice format in Zenoti

Configure the header of the receipt to include the center’s GSTIN, state code, and PAN, and automatically insert the correct invoice header, and invoice number. Learn more: Types of Invoices Generated for GST India

Configure the footer of receipts to include the center’s GSTIN, state code, and PAN.

Note

You can choose to add the center GSTIN, state code, and PAN in the header or footer area of the receipt.

Print the guest's address and PAN details if the total invoice amount exceeds ₹50,000. Learn more: Make Guests PAN and Address Mandatory (GST India)

(Optional receipt settings) You can optionally choose to customize and display the following information on receipts:

Customize Invoice Label Names (GST India) (also referred to as header labels)

When the GST amount is zero due to reasons such as redemption or discounts, you can display a sequential receipt number such as R001. This ensures effective tracking and reconciliation of transactions.

After you configure the receipt format, Start New Invoice Sequences for Centers (GST India).

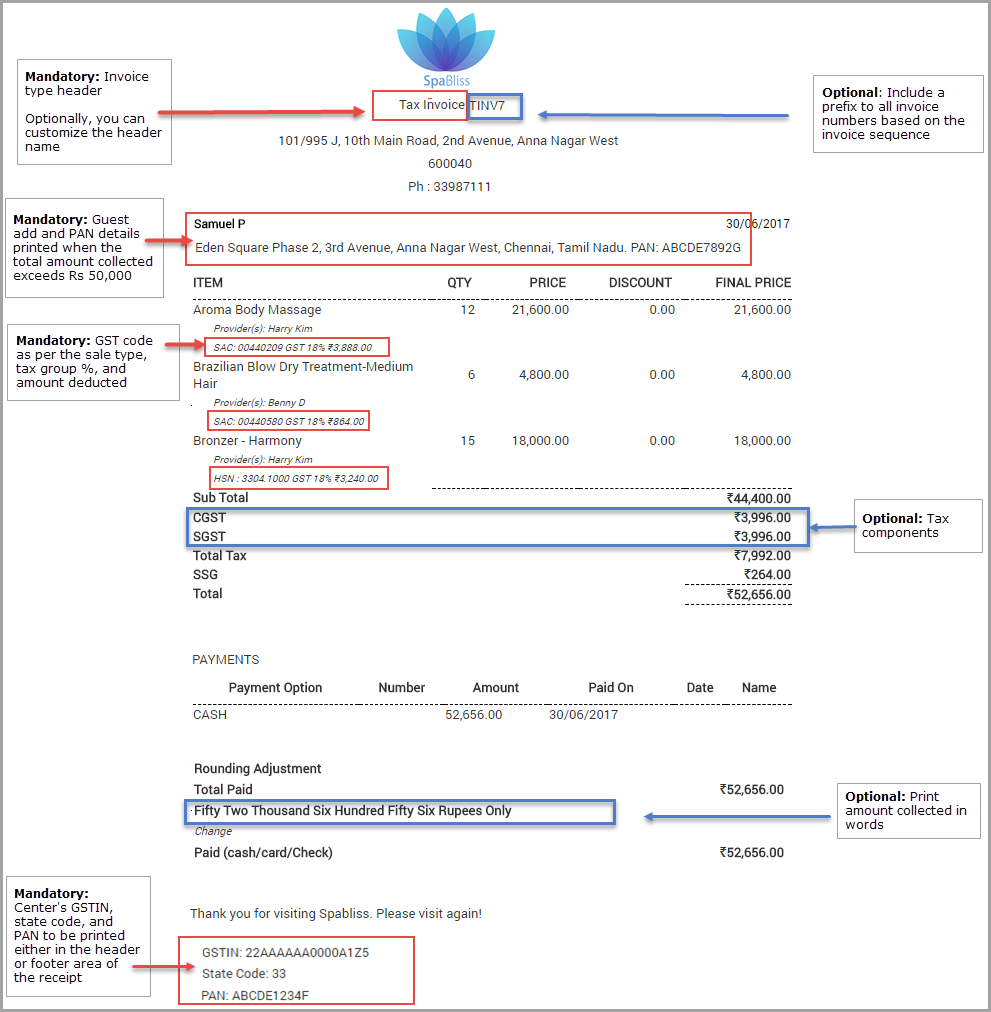

GST invoice format example

The following image is an example of an invoice generated by the sale of a service and a product under GST.

The red highlighted fields are mandatory details that need to be included in the invoice and the blue highlighted fields are optional details that can be included using various settings in Zenoti.

Each setting is explained in detail in the 'Configure GST Invoice Format in Zenoti' section above.

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com.

Enter SAC code for services

With the introduction of GST, every business in India is required to declare the list of goods and services they offer using specific GST codes.

Service Accounting Code (SAC) is used to classify services that fall under Goods and Service Tax (GST) in India. For all the services and add-ons you offer, you must obtain the respective SAC and update Zenoti with the same.

Important

If you have enabled GST India, then updating the SAC code is mandatory for all the services you offer. You cannot update a service’s general details if the SAC field is blank.

To update the SAC for services in Zenoti

At the organization level, click the Master data icon.

Click Services.

Click the name of the service you wish to edit.

In the General tab, scroll down to the SAC field, and then update or enter the SAC number.

Click Save.

Repeat steps 2 to 4 to update the SAC code for all the services that you offer.

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com.

Update the tax group for various business offerings – GST India

To be GST ready, you must ensure that all the services, products, memberships, packages, and gift cards you offer are updated with the new GST tax structure. This ensures that the right tax component is applied to invoices at the time of taking payment.

Important

Ensure that you have created the appropriate tax groups for GST and have enabled them for centers. Read: Create Tax Groups.

Assign the GST tax groups to various items at the center such as services, products, memberships, packages, and gift cards. Read: Associate Tax Groups to Various Items in a Center

To edit the tax group for a service

At the organization level, click the Master data icon.

Click Services.

Click the name of the service you wish to edit.

Click the Centers tab.

Select the Zone.

Verify the Tax Group assigned to the center.

If required, choose the applicable Tax Group from the Select Tax Group drop-down list.

Click Save.

To update the tax group for other services, repeat steps 2 to 6.

To edit the tax group for a product

At the organization level, click the Master data icon.

Click Products .

Click the name of the product you wish to edit.

Click the Price tab.

Verify the Tax Group assigned to the center.

If required, choose the applicable Tax Group from the Select Tax Group drop-down list.

Click Save.

To update the tax group for other products, repeat steps 2 to 6.

To edit the tax group for a package

At the organization level, click the Master data icon.

Click Packages.

Click the name of the package you wish to edit.

Click the Centers tab.

Verify the Tax Group assigned to the center.

If required, choose the applicable Tax Group from the Select Tax Group drop-down list.

Click Save.

To update the tax group for other packages, repeat steps 2 to 6.

To edit the tax group for gift cards and memberships

At the center level, click the Configuration icon.

Search for and select Associate Tax groups from the Business details section.

Ensure the Tax group is available

Click the Tax Groups tab.

Select the applicable tax group for Gift Cards and Memberships.

Note

Only one tax group can be selected for these items.

Click Save.

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com.

Enter HSN code for products

With the introduction of GST, every business in India is required to declare the list of goods and services they offer using specific GST codes.

Harmonized System of Nomenclature (HSN) is used to classify products that fall under Goods and Service Tax (GST) in India. For all the products you offer, you must obtain the respective HSN code and update Zenoti with the same.

Important

If you have enabled GST India, then updating the HSN code is mandatory for all the products you sell. You cannot update a product’s general details if the HSN field is blank.

To update the HSN for products in Zenoti

At the organization level, click the Master data icon.

Click Products.

Click the name of the product you wish to edit.

On the General tab, scroll down to the HSN field, and then update or enter the HSN number.

Click Save.

Repeat steps 2 to 5 to update the HSN code for all the products that you offer.

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com.

Enter SAC Code for Packages

With the introduction of GST, every business in India is required to declare the list of goods and services they offer using specific GST codes.

Service Accounting Code (SAC) is used to classify services that fall under Goods and Service Tax (GST) in India.

For all the packages you offer, you must obtain the respective SAC and update Zenoti with the same. However, this is not a mandatory requirement - you can choose to add this information for better tax association.

Important

Only after you enable GST - India, you can enter the SAC code for packages.

To update the SAC for packages in Zenoti

At the organization level, click the Master data icon.

Click Packages.

Click the name of the package you wish to edit.

In the General tab, scroll down to the SAC field, and then update or enter the SAC number.

Click Save.

Repeat steps 2 to 5 to update the SAC code for all the packages that you offer.

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com.

Enter GSTIN, PAN, and state code for centers

Under GST India, all registered businesses are assigned a unique Goods and Services Tax Identification Number (GSTIN) that varies from state to state. The GSTIN, along with the PAN of the center and State code, is mandatory under GST. This information should be entered for each center individually.

Note

You cannot update a center’s general details if the PAN, GSTIN, and State code fields are blank.

Important

You must Enable India GST from the organization level to view the fields described in the following section.

To enter the PAN, GSTIN, and state code

At the center level, click the Configuration icon.

Search for and select PAN, GSTIN, and State code from the Business details section.

Enter your center's PAN and GSTIN details.

Select the State code.

Click Save.

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com.

Make guests PAN and address mandatory (GST India)

If your organization has enabled GST India, an additional field to capture the guests Permanent Account Number (PAN) appears in the Guests Profile page (General tab). This is not a mandatory field.

However, you have the option to make guest PAN and address mandatory if the invoice amount exceeds a specified limit. If this option is enabled, then the front desk gets prompted to enter the details in the POS window. Without this, Zenoti does not process the payment.

At the center level, click the Configurationicon.

Search for and select the Make it mandatory to enter guest address and PAN card number when invoice amount exceeds a certain amount from the POS section.

Enter the threshold amount in the Specify the invoice amount (in Rupees) field.

Click Save.

If not already captured, the front desk will now be prompted to enter the guest PAN and address if the total invoice exceeds the amount specified in step 3.

To capture the guest’s PAN details in the guest profile page

Navigate to the guest’s profile page.

On the General tab, under the Personal Info section, enter the number in the PAN field.

Click Save.

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com.

Enable GST India receipt format

In Zenoti, you can enable the printing of the new GST India-specific invoice formats at the center level. This includes all the additional information made mandatory for GST India.

Important

Ensure that you have created the appropriate tax groups for GST and have enabled them for centers. Read: Create Tax Groups.

Assign the GST tax groups to various items at the center such as services, products, memberships, packages, and gift cards. Read: Associate Tax Groups to Various Items in a Center

Update the tax group for each service, product, and package at the organization level with the GST tax group. Read: Update the Tax Group for Various Business Offerings – GST India

To enable the GST India receipt format

At the center level, click the Configuration icon.

Search for and select Printer formats from the POS section.

Select the GST receipt – India option as the Printer Format.

Click Save.

After selecting this option, Zenoti by default, prints receipts with GST information.

Tip

If you want the receipts to include your center’s GSTIN, PAN, and state code, then configure these templates to include this information: Customer Email Receipt Header and Customer Email Receipt Footer . After configuration, these details get printed on receipts along with the above mandatory information.

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com.

Add mandatory vendor information for Goods and Services Tax India

Under GST India, each tax paying vendor is allotted a state-wise 15-digit Goods and Services Taxpayer Identification Number (GSTIN) based on the Permanent Account Number (PAN). Learn more about GST India

Zenoti allows you to comply with the norms of GST India by enabling GST for your organization. If you have enabled GST, the vendors defined in your organization or center must include the following mandatory details: GSTIN, PAN, and the state code.

You must individually enter this information for each vendor.

At the organization level, click the Configuration icon.

Search for and select Vendors from the Products section.

Click the name of the vendor whose details you want to add.

If you are adding a new vendor, click Add. Learn how to add a new vendor

On the General tab, enter the vendor's information in the following fields:

PAN: Enter the PAN registered for the vendor

GSTIN: Enter the vendor's complete Goods and Services Taxpayer Identification Number

State Code: Select the state code from the list of codes

Click Save.

Repeat the steps for other vendors.

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com.

Configure prefixes for invoice numbers (GST India)

When taking payments, Zenoti automatically generates a number for the invoice. The numbers are usually in incremental sequence.

To be able to distinguish each invoice type, Zenoti allows you to add prefixes to the invoice numbers. For example, you can add the prefix INV for all Tax Invoice numbers or CN for all Credit Note numbers. You can also use a combination of alphabets and numbers. Adding such prefixes helps easily identify the sale type or items in the invoice.

Note

You cannot edit an invoice sequence number. You can only add prefixes to the invoice types.

Important

Enable the GST India Receipt Format

Ensure you have configured the receipt header template to automatically include the mandatory GST information

To configure prefixes for each invoice type

At the center level, click the Configurationicon.

Search for and update the following settings in the POS section.

Add a prefix for tax invoices

Add a prefix for tax receipt vouchers

Add a prefix for advance receipts

Add a prefix for credit notes

Add a prefix for refund vouchers

Click Save.

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com

Update purchase orders (GST India)

If you have enabled Goods and Service Tax (GST) for your organization, it is imperative that your purchase orders include the address of delivery, date of shipment, and date of delivery.

Your organization can make these fields mandatory from the organization level > Configuration icon > Inventory > Show alert if the following mandatory fields are missing when receiving the order (options: Date of shipment, Date of delivery, Address of delivery).

At the center level, click the Inventory icon and navigate to Procurement > Orders.

To open a specific purchase order, enter its number in the Order No field, and click Search. Else, proceed to Step 4.

In the Select a Report drop-down list, select List of Orders.

In the Order Type list, select Purchase Orders.

In the Status list, select either Delivered or Raised.

Select the duration, and then click Refresh.

Click the reference number of the order that you want to update.

The Purchase Order opens with details such as product code, product name, the quantity of the product ordered, and unit price.

Enter the following information: - Address of delivery: Address of the center where the shipment was delivered - Date of shipment: Date when the order was shipped - Date of delivery: Date when the order was delivered.

Click Save.

Note

If you are raising a purchase order from another center (acting as a vendor), and if the GSTIN of the center is different from that of your center, a Tax Invoice number is generated automatically and appears on the purchase order.

For every part delivery, a new Tax Invoice number is generated. For Transfer Orders, a tax invoice number is generated at the time of creating the order.

The Tax Invoice number is not different from the regular Tax Invoice numbers generated in the POS window during the sale of certain items. Tax invoice numbers are generated in sequence numbers for invoices (including purchase orders and transfer orders).

In case you need help configuring GST, contact us at GstHelp@zenoti.com.

Update credit note for return orders

When you return the excess, damaged, or expired products to your vendors using the Return Order form, vendor issues a Credit Note number.

If you raise a return order to a center that is acting as vendor, a Credit Note number is automatically generated and updated for you on the return order.

If you have raised a return order to an external vendor, your vendor issues a Credit Note number which you must manually update in the return order.

After you have submitted the return order, get a confirmation from your vendor that they have received the products, and perform one of the following:

If your vendor is another center that is acting as a vendor, click Returned.

A Credit Note number is automatically generated and updated for you in the Credit Note # field.

If your vendor is external, when the vendor issues a Credit Note number:

In the Credit Note # field, enter the Credit Note number

Click Returned.

When you click Returned, the current stock is updated.

Example: Let’s say you have ordered 10 Green Tea Shampoo bottles from your vendor for retail use. You received the shampoo bottles and the current stock count is updated to 10.

You realized that 4 of the bottles were damaged. Therefore, you submitted a return order to the vendor with -4 in the Retail Quantity field. After your vendor receives the shampoo bottles, you clicked Returned. This updates the current stock to 6.

Note

When you print the Return Order, you can see the Credit Note number on it.

Customize invoice label names (GST India)

You can customize the label names for each of the invoice types. The appropriate label name then appears as a header on receipts.

At the organization level, click the Configuration icon.

Search for and configure the settings from the POS section.

Setting

Description

Enter a label for Invoice number

Enter a label for invoice number such as Invoice.

Enter a label for Receipt number

Enter a label for Receipt number such as Receipt.

Enter a label for Payment number

Enter a label for Payment number such as Payment.

Enter a label for Invoice amount due

Enter a label for Invoice amount due such as Invoice due.

Enter a label for Invoice sale price

Enter a label for Invoice sale price such as Invoice sale price.

Enter a label for Invoice final sale price

Enter a label for Invoice final sale price such as Invoice final sale.

Enter a label for Tax receipt

Enter a label for Tax receipt such as Tax receipt.

Click Save.

Subsequent receipts will display the new name in the header.

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com

Types of invoices generated for GST India

With GST enabled for your organization and your invoices configured with the

GST-specific formats, the POS window generates different types of invoices based on the sale items included.

For example, it generates a Refund Voucher upon processing the refund of a prepaid card (without taxes), but upon processing the refund of a service or a product, it generates a Credit Note.

As per GST India, it is mandatory to display the invoice type (in the header) along with its associated sequence on all the invoices/receipts generated at a center.

Learn how to automatically include this information in all invoices/receipts

Important

Zenoti will not generate GST sequences for:

Invoices generated prior to July 1, 2017

Redemption of prepaid payment instruments (such as packages) sold before July 1, 2017

The following are the different invoice types that the POS generates based on sale items:

You can configure your invoices to display customized invoice headers and prefixes. Learn how

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com

Tax invoices (GST India)

A Tax Invoice is a statement of the sale of products and services (which include service fees such as no-show, cancellation, or freeze fee).

The POS window generates a Tax Invoice when you collect payment and close invoices that include the following

Only products

Only services (for the current day or past appointments)

Services (for the current day or past appointments) and products

Membership with no credit amount and no service credit revenue (SCR) defined

Only services redeemed from a package

Note

In this case, the receipt displays the service price based on the apportioned package price and the tax against the service based on the apportioned price.

Only services redeemed using loyalty points accrued on the pre-tax amount

Note

In this case, the receipt displays the loyalty points redemption as a discount.

Only services redeemed using loyalty points accrued on the post-tax amount

Note

In this case, the receipt displays the loyalty points redemption as payment. Tax is collected on the full amount and not on the net loyalty points payment.

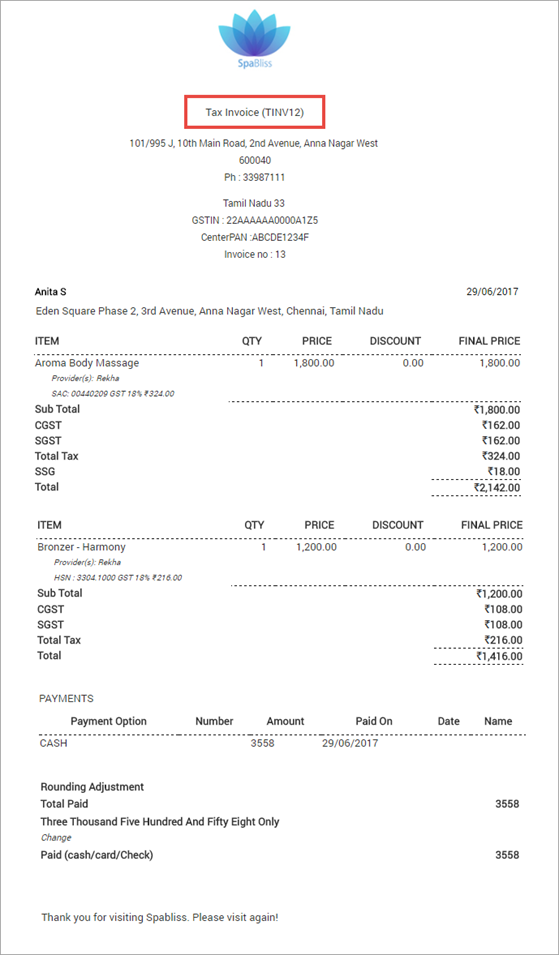

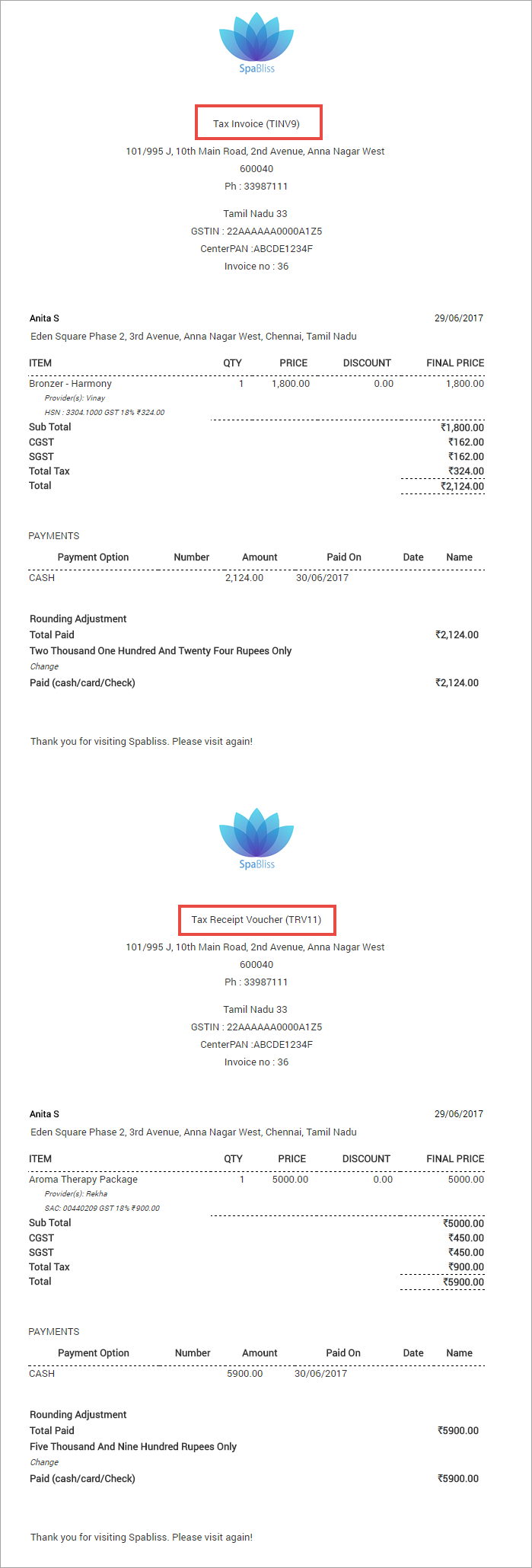

The following is an example of a Tax Invoice generated for the sale of a service and a product.

Tax receipt vouchers (GST India)

A Tax Receipt Voucher is a statement of the sale of taxed prepaid items such as packages (series and custom), memberships, and gift cards.

Note

While a Tax Receipt Voucher is generated upon the sale of the above mentioned prepaid items, a Tax Invoice is generated when a guest uses any of the prepaid items to redeem a service.

The POS window generates a Tax Receipt Voucher in the following scenarios:

While collecting payment for an invoice with a service booked for a future appointment

While collecting payment for an invoice that includes a package of products

While collecting payment for the sale of a gift card

While collecting a partial payment for the sale of a package (series, custom, or offer)

While collecting a partial payment for the sale of a recurring or non-recurring membership

Note

For a membership that has no credit amount and no service credit revenue (SCR) defined, the POS generates a Tax Invoice instead of a Tax Receipt Voucher.

While collecting a partial payment for the sale of a package that includes products (where the package price is inclusive of services and products)

Note

When the guest later redeems the package, each redemption of the product and service generates a Tax Invoice number.

Upon collecting a payment, Zenoti locks the invoice so that taxable value cannot be changed. It does not allow the addition of new sale items, application of discounts, or redemption of loyalty points. It only allows collection of new payments.

The following is an example of a Tax Receipt Voucher generated while collecting a partial payment for a membership sale.

Advance receipts (GST India)

The POS window generates an Advance Receipt upon collecting a payment for the sale of a gift card or prepaid card without taxes.

Note

After collecting a payment and generating an Advance Receipt, Zenoti locks the invoice. You can only add new payments to the locked invoice.

The following is an example of an Advance Receipt generated upon the sale of a prepaid card.

Tax refund vouchers (GST India)

The POS window generates a Tax Refund Voucher upon the refund of taxed prepaid cards, memberships, or packages (series, custom, or day).

The following is an example of a Tax Refund Voucher generated upon refunding a taxed package.

Refund vouchers (GST India)

The POS window generates a Refund Voucher upon the refund of a gift card or prepaid card without taxes.

See the following image for reference.

Credit notes (GST India)

The POS window generates a Credit Note upon the refund of a Tax Invoice item such as a service or a product. It also generates a Credit Note for a no-show fee refund and cancellation fee refund.

The following is an example of a Credit Note generated for the refund of a service.

Combined invoices (GST India)

Combination of tax invoice and tax receipt voucher

The POS window generates a combination of a Tax Invoice and a Tax Receipt Voucher while collecting a partial payment for invoices that include the following:

A package (with service benefits) and products In this case, Zenoti first assigns a payment to the product and generates a Tax Invoice number. It then assigns the remaining amount to the package and generates a Tax Receipt Voucher number. Finally, it prints two separate receipts for the Tax Invoice and the Tax Receipt Voucher.

A service, product, and package (with service benefits)In this case, Zenoti first assigns a payment to the product, and then to the service. Even if the amount of the service and product is not fully paid, it generates a Tax Invoice number. Zenoti then assigns the remaining amount to the package and generates a Tax Receipt Voucher number. Finally, it prints separate receipts for the Tax Invoice and Tax Receipt Voucher.

Combination of tax invoice, tax receipt voucher, and advanced receipt

The POS window generates a combination of a Tax Invoice, Tax Receipt Voucher, and Advance Receipt while collecting a partial payment for an invoice that includes a combination of the following:

Service, product, package (with service benefits), and gift card (without taxes)

In this case, Zenoti first assigns a payment to the product, and then to the service. Even if the amount of the service and product is not fully paid, it generates a Tax Invoice number. Zenoti then assigns the payment to the package and generates a Tax Receipt Voucher number. It then assigns any remaining amount to the gift card and generates an Advance Receipt number. Finally, it prints three separate receipts for Tax Invoice, Tax Receipt Voucher, and Advance Receipt.

The following is an example of a combined invoice generated upon the sale of a package (with service benefits) and a product.

Include GST information in receipt header

You can configure your receipts to automatically include all the mandatory GST information in the header area while printing or emailing the receipt from the Point of Sale (POS) window.

Important

Ensure to enable the GST India Receipt Format

If you want to include a breakdown of the tax components in the receipts, enable the show tax components setting

At the organization level, click the Configurations icon.

Search for and select the Templates for email and text setting from the Notifications section.

Locate the Customer Email Receipt Header in the Configuration template section and click Edit.

In the Available Macros list, locate the following macros, and then paste them into the HTML edit window:

[GSTIN]: Prints the center's GSTN on the receipt

[StateCode]: Prints the center's state code on the receipt

[CenterPAN]: Prints the center's PAN on the receipt

[TaxHeader]: Automatically inserts the header according to the sale items. For example, the sale of a service/product would display the Tax Invoice header or sale of prepaid cards/gift cards without tax would display the Advance Receipt header.

[InvoiceSequence]: Displays the appropriate invoice number (also called as document number) along with the above tax header.

Click Save.

Note

When you click Save, Zenoti validates the macros used in the template. If the template contains unsupported macros, you will see a warning listing the invalid macros. Remove or replace those macros using the Available Macros list, then save again to ensure the receipt renders correctly.

All subsequent receipts printed will include these details in the header area.

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com.

Show tax components in receipts (GST India)

All receipts, by default, show the tax group that is applied to the item along with the tax percentage such as GST 5%. You can, however, choose to also include a breakdown of the tax components applied on each item in the invoice.

To include the tax components in receipts

At the center level, click the Configurations icon.

Search for and enable Show tax components from the POS section.

Click Save.

Subsequent receipts will display the tax components for each item.

For example, if CGST and SGST are two tax components applied to a GST tax group, the receipt will display the amount deducted towards each of these components for the service and the product.

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com

Start new invoice sequences for centers (GST India)

Important

You must enable this setting on the night of 30th June, 2017. Not before. Also, once enabled, this setting cannot be disabled.

Ensure that you have updated Zenoti with all the GST related details. Read: Update Zenoti with GST India Details

After you have entered all the relevant GST information in Zenoti, you can start generating new invoice numbers for every sale.

The first invoice number (also called as document number) starts from “1” and the subsequent invoices are then assigned incremental numbers.

Note

You cannot edit an invoice sequence number. You can only add prefixes to the invoice types.

At the organization level, click the Configurations icon.

Search for and select Start GST sequences for all centers from the Business details section.

If you enable this setting you cannot disable it. Also, you must enable this setting only on the night of 30th June, not before.

Click Save.

Any invoices generated from the POS window will display the new invoice number.

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com

FAQ on transitioning to GST

Do I need to collect additional tax for gift cards, packages, and memberships sold before GST was implemented?

If you have collected full payment for gift cards, packages, and memberships before GST was implemented, you do not need to collect additional tax from the guest.

If you have collected partial payments, redemptions against already paid amounts do not attract GST, but new payments do.

Will the GST tax rate be applicable on partially paid invoices (partial payments collected before GST was implemented)?

Redemptions against already paid amount do not attract GST, but new payments do.

Zenoti Recommendation:

Services:

If a guest paid a partial amount for a service that is scheduled to be done after GST implementation, we recommend that you convert the payment to a prepaid card and ask the guest to redeem it when availing the service.

Packages:

Because redemptions against already paid amount do not attract GST but new payments do, to avoid taxation issues, after GST implementation, we recommend that you close the current packages and create custom packages to collect the remaining amount.

Memberships:

The following are our recommendations for memberships:

Discount only memberships: The sale of memberships before GST that offer only discounts, there is no impact of GST.

Service memberships with partial payments: Service redemptions against already paid amount do not attract GST but new payments do.

Service memberships with full payments: If you have collected full payment for a membership before GST was implemented, there is no impact of GST.

What about my open purchase orders?

If your purchase orders are not delivered before GST comes into effect, we recommend that you delete the purchase orders and create them afresh.

What happens if I delete any invoices after GST?

You must report the deleted invoice details in your returns. Talk to your accountant to know how to do this.

Can we provide HSN and SAC codes to Zenoti to upload for us?

Yes, we can update the HSN and SAC codes for you. For more information, reach out to GstHelp@zenoti.com.

If I have not collected payments for appointments made just prior to GST implementation, will GST be applied or the current service tax?

GST tax rate is applicable for any payments made after GST takes effect. It does not matter what tax rate was applicable when the appointment was made.

For appointments made after GST implementation, Zenoti prompts you to apply GST tax rate in POS when collecting payments.

If a guest redeems a package at a different center in the same state, what is the impact of GST?

If your guest redeems the package in a center that has the same GSTIN, the redemption center does not have to pay tax.

Note

In case you need help configuring GST, contact us at GstHelp@zenoti.com.

Filing GST India returns

There are various types of tax returns in GST that you must file online.

Here are some resources that can help you understand how to file GST Returns.

Important

All the resources here are being provided for informational purposes only. Zenoti bears no responsibility for the accuracy, legality, or the content of the external site or for that of subsequent links.

Furthermore, we strongly recommend that you consult your accountant before filing returns and ensure you are compliant with all the government requirements.

Important

GST mandates that all sequence numbers issued for documents to be reported. To ensure compliance with this requirement, Zenoti generates a Tax Invoice number only when you close an invoice.

If you reopen or backdate an invoice, you will not be able to accurately report the sequence numbers issued for documents. Hence Zenoti strongly recommends that you do not reopen or backdate invoices.

List of Enhanced Reports

The following is the list of enhanced reports that will help you file your GST Returns:

Collections By Item Report

You can use the Collections By Item report to gather the following information for filing GST Returns:

Service or Product sales made by collecting payments via cash, card, check, or custom payments

Services or Product sales made by redeeming non taxed gift cards, prepaid cards, memberships, and loyalty points

Package sales (with tax)

Membership sales (with tax)

Gift Card sales (with tax)

Sale of Memberships that do not awards service credit or service value, but only allows discounts.

Collections By Item Report

To help you with your GST Returns, the Collections By Item report has the following new columns:

Invoice Status

Tax Component Name and Percentage

Item Code

Invoice Sequence

Loyalty Points Redemptions

Membership Redemptions

Gift Card Redemptions

Prepaid Card Redemptions

Package - Redemptions Report

You can use the Package - Redemptions report to gather the following information for filing GST Returns:

To help you with your GST Returns, the Package - Redemptions report has the following new columns:

Package Sale Date

Package Tax Group

Package Tax Rate

Tax Component

Membership - Redemptions Report

You can use the Membership - Redemptions report to gather the following information for filing GST Returns:

Services or Product sales made by redemption of memberships that have been purchased in the same month

To help you with your GST Returns, the Membership - Redemptions report has the following new columns:

Membership Sale Date

Membership Tax Group

Membership Tax Rate

Tax Component

Gift Card - Redemptions Report

You can use the GiftCard- Redemptions report to gather the following information for filing GST Returns:

Services or Product sales made by redemption of packages that have been purchased in the same month

To help you with your GST Returns, the Gift Card - Redemptions report has the following new columns:

Gift Card Sale Date

Gift Card Tax Group

Gift Card Tax Rate

Tax Component

Invoice Refunds Report

You can use the Invoice Refunds report to gather the following information for filing GST Returns:

Refund of Services or Products (credit note)

Refund of packages or memberships (tax refund voucher)

To help you with your GST Returns, the Invoice Refunds report has the following new columns:

Base Invoice Date

Tax Group Name

Tax Group Percentage

Tax Component Name

Purchase Tax Details Report

You can use the Purchase Tax Details report to gather product procurement (inward supplies from vendors) details for filing GST Returns.

The Purchase Tax Details report has the following new columns:

GSTIN of Vendor

Tax Invoice Number

HSN of Product

Quantity Delivered

Tax Group Name

Tax Group Percentage

Tax Component

FAQ around Tax Invoice Numbers

While filing returns, you might encounter the following scenarios involving Tax Invoice numbers:

Tax Invoice numbers missing in the Collections By Item reportIf you have Tax Invoice numbers missing in the Collections By Item report, it means that you have reopened one or more invoices. Example: If Tax Invoice numbers 1, 2, 3, 4, 5, 6, 7, and 8 are generated, and you reopen Tax Invoice #4, the next Tax Invoice number that is generated is 10 and not 9. What should you do?You must treat the missing invoices as voids and consult your accountant to understand how you should file returns with the missing Tax Invoice numbers.

A finished appointment has no tax invoice number.A Tax Invoice number is generated only after a service is provided, amount is collected, and the invoice is closed. Check if the finished appointment has the invoice closed.

Tax Invoice number is not generated when a purchase is made by means of a redemption.

Tax invoice number is not generated if the redemption instrument (membership, package, gift card, or a prepaid card) is purchased before July 1st, 2017.

Consider the following:

If a guest purchases a service by redeeming a package (that was purchased before July 1st, 2017), Tax invoice number is not generated.

If a guest purchases a service by redeeming credit value from a membership (that was purchased before July 1st, 2017), Tax invoice number is not generated.

If a guest purchases a service by redeeming a gift card (that was purchased before July 1st, 2017), Tax invoice number is not generated.

If a guest makes a partial payment for a service by redeeming a gift card (that was purchased before July 1st, 2017) and completes the payment using cash or card, Tax invoice number is not generated.

If a guest purchases a service by redeeming a gift card (that was purchased before July 1st, 2017) and also purchases a product using cash or card, two receipts are generated. receipts are generated.

The receipt for the service redeemed using the gift card will not contain the Tax invoice number, and the receipt for the product purchased using cash or card contains the Tax invoice number.

Print a guest's GSTIN on a receipt

At times you might have to issue a receipt to a guest that includes the guest's GSTIN (in addition to your center GSTIN).

To print a guest's GSTIN on a receipt

Create a guest custom field for guest GSTIN (this is a one-time activity)

Important

You can create a custom field only if you have an Enterprise license.

Save the guest's GSTIN in the guest's profile before printing the receipt.

To create a guest custom field for GSTIN

At the organization level, click the Configurations icon.

Search for and select the Guest profile tabs setting from the Guests section.

Locate and enable Custom Fields Label.

Click Add Field.

Complete the fields and ensure that you have selected the Field Type as Textbox and also have selected the option Print data on invoice.

Click Add Field.

The guest custom field for guest's GSTIN is added. You can now use this field to enter a guest's GSTIN number.

To include a guest's GSTIN on a receipt

Access the guest's profile.

Click the Custom Fields tab.

You will see the custom field you created for GSTIN.

Enter the guest's GSTIN in the guest custom field and click Save.

When you close an invoice of the guest and print the receipt, the receipt includes the GSTIN of the guest.

Do I need to change the invoice sequence number every year?

When taking payments, Zenoti automatically generates a number for the invoice. The numbers are unique and in incremental sequence.

Note

You cannot edit an invoice sequence number.

Do I need to change the invoice sequence number?

No, you do not necessarily need to change the invoice sequence number. This is because Zenoti generates only unique and incremental sequenced numbers that help you be compliant with the GST law.

When do I need to change the invoice sequence number?

You might want to consider changing the invoice sequence number every year if while setting up Zenoti, you have added a prefix to the invoice numbers to help you distinguish the year of transaction. Learn more about Prefixes for Invoice Numbers and how to change the prefix of invoices.

Note

If you do not change the prefix at the beginning of the financial year, the invoices that are generated are still compliant with the GST law, because the new invoices numbers continue to be consecutive unique serial numbers. Example: If you had set up a prefix of RCITY17 when you configured Zenoti for GST in 2017, the first invoice generated can be RCITY17000001.

If the last invoice generated during the 2017 is RCITY17009008, then:

If prefix is changed: If you change the prefix to RCITY18, the next invoice generated in the new financial year will be RCITY18009009.

If the prefix is not changed: If you have not changed the prefix, the next invoice generated is RCITY17009009.

In both these cases the invoice numbers continue to be unique.