Configure Commission Slabs

Businesses can calculate commissions based on total service sales rather than just post-deduction revenue. This enhancement is particularly beneficial for industries with fixed costs, such as laser services, ensuring fair and accurate payouts while incentivizing providers effectively.

Scenario: A spa uses a slab-based commission structure for their laser technicians, with the following slabs:

$12,000 - $14,999.99: 3% commission

$15,000+: 6% commission

Technicians should qualify for commissions when their service sales reach these thresholds. However, the commission payout is typically based on service sales minus deductions.

A technician's service sales total $13,000, with $2,000 in deductions.

Post-deduction model (Existing): The technician qualifies for a 3% commission on $11,000 (payout: $330).

Pre-deduction model (New): The technician qualifies for a 3% commission on $13,000 (payout: $390).

Steps to configure commission slabs:

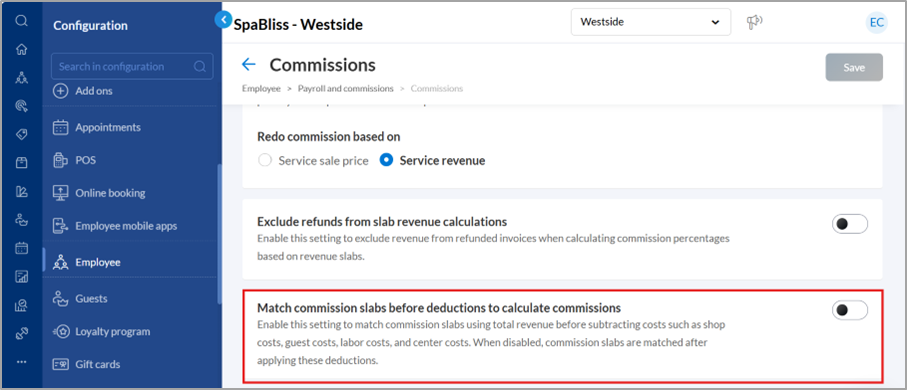

Navigate to Employee > Payroll and Commissions > Commissions at the center level.

To configure how commission slabs are matched, use the Match commission slabs after deductions to calculate commissions toggle:

Off (Default Setting) – Commission slabs are matched after deductions.

On – Commission slabs are matched before deductions.

Save your changes.

To disable the setting, switch off the Match commissions slabs before deductions to calculate commissions toggle.

Impacts and considerations

Once enabled, the Payroll Summary Report will reflect commissions calculated before deductions, ensuring greater transparency in compensation.