3D Secure (3DS) FAQs (Adyen)

3D Secure (3DS) adds an extra layer of protection to online card transactions. The following section answers common questions about how 3DS works, its benefits, and where it is supported.

Q. What is 3D Secure (3DS)?

A. 3D Secure (3DS) is an authentication protocol that adds an extra layer of security—such as an OTP, card PIN, or passphrase—for online card transactions. It verifies the identity of the cardholder and helps protect both your business and your customers from fraud. 3DS requires the cardholder to take action only when the issuing bank detects suspicious activity.

Q. What are the benefits of 3D Secure?

A. 3D Secure offers several advantages that help protect your business and enhance customer trust.

Fraud prevention: 3DS blocks fraudulent transactions by requiring cardholder authentication during checkout, making it harder for stolen or unauthorized card details to be misused.

Customer confidence: Shoppers feel more secure knowing their payments are protected. This builds trust, encourages repeat purchases, and strengthens loyalty.

Chargeback protection: After successful 3DS authentication, liability for fraud-related chargebacks shifts to the card-issuing bank, reducing financial risk for your business.

Q. Does 3DS offer 100% chargeback protection?

A.No. 3DS protects against chargebacks filed under the Fraud category once authentication is successful and liability shifts from the merchant to the issuing bank.

Q. How does 3DS help in fraudulent dispute cases?

A. If a transaction is authenticated through 3DS and later disputed as fraud, liability shifts to the card-issuing bank. Such disputes are automatically marked as Auto Defended, which counts as a win for the merchant.

Q. Which cards support 3D Secure?

A. 3DS is supported by most major card networks (Visa, Mastercard American Express). Availability depends on whether the issuing bank has enabled 3DS for its cards.

Q. Which all regions are supported on 3DS flow?

A. 3DS is currently supported for transactions in the USA, UK, AUS, NZ, South Africa, UAE, and India. Expansion to additional regions is in progress.

Q. Does the 3DS flow reduce or impact authorization success rates?

A. No, the overall authorization rate remains unaffected by 3DS.

Q. What happens if the issuing bank does not support 3DS?

A. If the issuing bank does not support 3DS, the transaction will be processed through a non-3DS flow.

Q. Can customers enable or disable the 3D Secure (3DS) flow on their own?

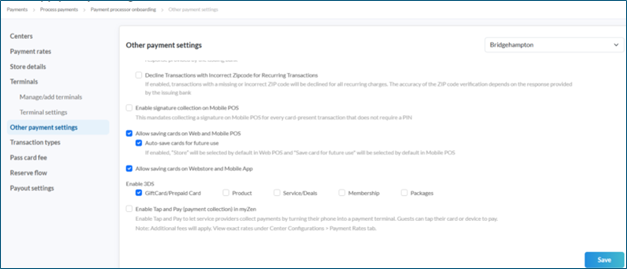

A. Yes, customers can enable or disable the 3D Secure flow from the Other Payment Settings section. Refer to the screenshot below for guidance.