Pass Credit Card Fees to Guests with Zenoti Surcharges

This article explains how to enable and configure Zenoti’s surcharging feature—one of our most impactful cost-saving tools—to offset credit card processing fees in a fully compliant, transparent, and customizable way. You’ll learn how to set rates, ensure regulatory compliance, view charges across guest touchpoints, issue refunds, and track surcharges in reports.

Overview

Zenoti’s surcharging feature allows businesses like yours to pass credit card processing costs to your clients for qualifying transactions. This feature supports surcharging on both card-present and card-not-present flows, and is available under the blended pricing model.

Surcharging is available for both Adyen and Stripe customers. Stripe surcharge availability:

Stripe-based surcharging is supported only for:

Market: United States only

Stripe account type: Stripe Express

Payment terminals: BBPOS WisePOS E Cloud

The following terminals are not supported for Stripe surcharging:

Chipper

M2

If your business uses unsupported terminals or a different Stripe account type, surcharging will not apply to terminal transactions.

By adopting surcharging, businesses can reduce payment processing costs by up to +95%. This gives businesses the power to offset rising payment costs without raising prices across the board—leading to increased profitability and improved cost control.

Zenoti’s surcharging feature enforces US state regulations and card network limits. The feature is completely self-serviceable, allowing businesses to decide which surcharge rates to apply at a brand level.

Note

Before enabling this feature, Zenoti strongly recommends verifying compliance with all applicable state or regional laws. Consult a tax professional, legal advisor, or local government authority to confirm whether surcharges are allowed in your area.

How does surcharging work in Zenoti?

Surcharging is available for centers using Adyen (blended pricing model) and Stripe Express (U.S. only), subject to terminal compatibility. It supports both card-present and card-not-present payments across all payment channels such as Web POS, Webstore, CMA, and Mirror Mode.

When the feature is enabled, Zenoti standardizes your credit card processing fee. The new fee covers the cost of the feature and also helps you to gain maximum saving on your credit card processing fee. The exact fee will be displayed during the enablement process. You may reach out to Zenoti support for more details.

Zenoti enforces compliance both during setup and at the time of transactions. You can configure surcharge percentages by:

Card brand (Visa, Mastercard, Amex, Discover)

Card type (Credit, Debit. Note- US allows surcharge only on credit. Laws across other countries may vary)

Mode (card-present or card-not-present)

The surcharge rate must not exceed your actual processing cost or the card network’s maximum threshold—whichever is lower.

Get started

To enable this feature for your center, follow the steps below.

Go to Configuration > Payments > Payment processor onboarding (under Process payments.

Click the caret icon next to the payment processor > click 3-dots > select View Center configurations (under Actions) for the desired business.

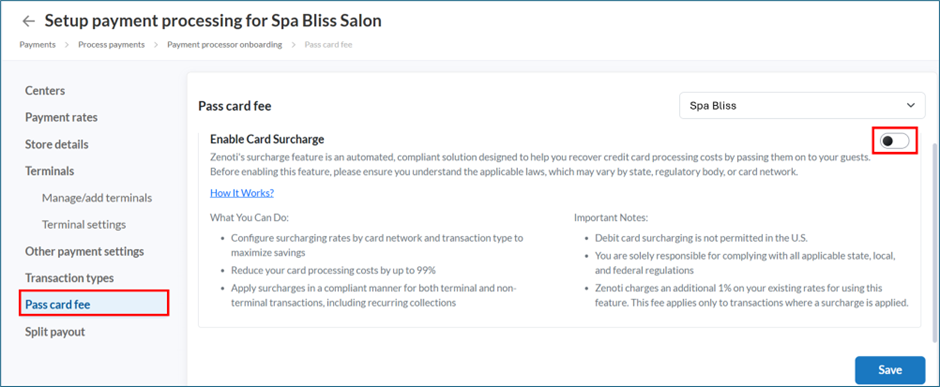

Select Pass card fee in the left navigation and enable the feature.

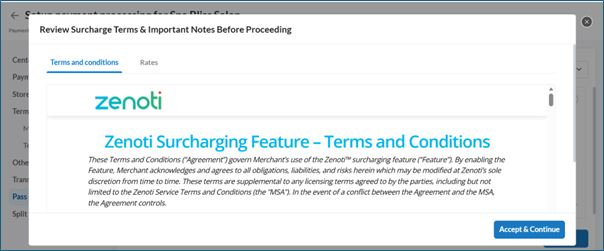

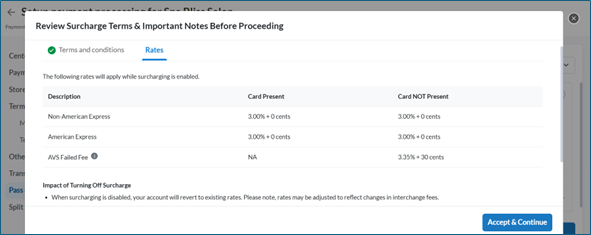

Review your new Rates and acknowledge Terms and conditions.

Note

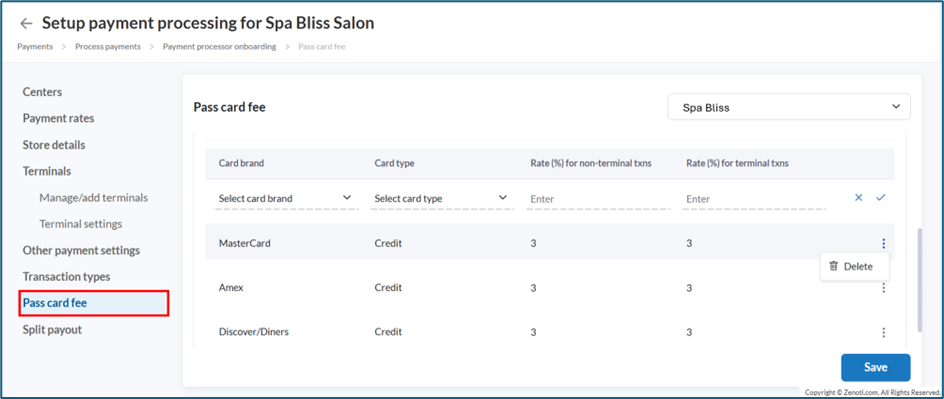

Zenoti sets the maximum surcharge allowed for each card brand based on compliance rules. You can adjust these rates within the permitted limits to match your business requirements. To update a rate, delete the existing entry and add a new one.

Currently, you cannot enable it directly. Please reach out to your Zenoti representative or email at Zenotisurchargehelp@zenoti.com to receive next steps and confirm eligibility.

Note

If your center uses payment terminals, restart the terminal once after saving the configuration. This ensures the updated surcharge settings are applied. You can also update the configuration in the terminal Settings and click Update.

What Guests See (and when)?

Zenoti ensures that guests are fully informed of any surcharge before they complete payment—across all channels.

Channel | Before Payment | At Checkout Screen |

|---|---|---|

POS | "A surcharge will apply" alert prior to swipe | Terminal shows exact surcharge after swipe |

Webstore/CMA | Banner after selecting card payment | Guests enter card → surcharge shown as separate line item |

Mirror Mode | Guest-facing message shown | Final checkout shows surcharge + total |

How is surcharge calculated?

Zenoti makes surcharging seamless for your front desk and clients. The system automatically detects the card brand (Visa, Mastercard, Amex, etc.) and type (credit or debit) to calculate the applicable surcharge amount.

Surcharges are calculated on the total transaction amount, including tips and taxes.

Surcharge in terminal transactions

Surcharges are also applied to payments made through card readers (payment terminals) based on your configured rules in Zenoti. When a customer taps, swipes or inserts their card, the terminal automatically detects the card brand and whether it is a credit or debit card. The applicable surcharge is then calculated and displayed to the customer before the transaction is completed.

Note

After completing the surcharge-related configuration in Zenoti, you must restart the payment terminal once for the changes to take effect.

What happens on refunds?

When you issue a refund, Zenoti automatically handles surcharge returns based on the type and method of refund—so nothing falls through the cracks.

Full Refund: Entire surcharge refunded.

Partial Refund: Pro-rated refund of surcharge per item.

Non-card Refund: Surcharge is refunded only if the original payment is refunded to the same card. Refunds via cash, gift card, or wallet do not include the surcharge.

Where to find Surcharges in Reports?

Zenoti includes surcharge data in Digital Payments Report. You will see the surcharge amount and other related information for each transaction in this report.

What are the compliance aspects to keep in mind?

Each region and card network has its own surcharge rules—this section summarizes what you need to know to stay compliant.

You must notify Mastercard using this form well in advance.

Surcharging is permitted only on credit card transactions. It is not allowed on other card types such as debit or prepaid cards.

Surcharge amount can never exceed your cost of payment.

Zenoti will take care of notifying the acquiring bank (payment processor).

Max surcharge limits:

Visa: 3% or cost of payment, whichever is lower.

Mastercard: 4% or cost of payment, whichever is lower.

Amex/Discover: Cost of payment only.

Surcharging is banned in the following states - Connecticut, Maine, and Massachusetts.

Colorado imposes a 2% cap on surcharge.

Card networks require clear signage at the point of entry and point of sale disclosing surcharge rates. Refer to Visa sample signage.

Note

Surcharging rules vary by country. The policies listed below apply only to the specific regions mentioned and may differ from U.S. regulations. Always ensure you follow the local rules applicable to your business.

Cannot exceed the actual cost of payment.

Applies to all card types.

Surcharge amount can’t exceed actual processing cost.

Applies to all card types

Frequently asked questions (FAQs)

Q. What is a credit card surcharge?

A. A fee added to recover credit card processing costs.

Q. Why add a surcharge?

A. To reduce your processing costs without raising overall service prices.

Q. How does it lower fees?

A. Guests cover entire or part of the processing cost, reducing business expenses.

Q. Can I surcharge debit cards?

A. Not in the U.S. Zenoti blocks debit surcharges where prohibited. System will automatically detect eligible cards and apply surcharge based on the % you configured.

Q. What’s the max surcharge I can charge?

A. This depends on card network and local government rules. Zenoti enforces caps based on your cost and card network rules. See details provided in the earlier section.

Q. What are AU/NZ rules on surcharges?

A. The surcharge must not exceed your actual processing cost.

Q. Will guests see the surcharge?

A. Yes, it’s shown before payment and on the receipt.

Q. Can I absorb the fees instead of surcharging?

A. Yes. The feature is optional and can be enabled per center.

Q. Will surcharging affect sales?

A. We do not have data to confirm. We recommend informing clients beforehand.

Q. What about recurring collections?

A. Yes, if you’ve configured surcharging, it applies to all recurring credit card transactions - regardless of whether they are card-present or card-not-present.

Q. What about payments made through payment terminals/card readers?

A. Yes, surcharges are applied to transactions made via card readers as per the configured rules. Once a card is tapped, swiped, or inserted the system automatically identifies the card brand (Visa, Amex etc.) and whether it’s a credit or debit card. The applicable surcharge is then calculated and displayed to the customer before completing the transaction.'

Q. Will my processing fee become zero for credit card transactions after enabling surcharging?

A. That depends on your effective processing fee after enabling surcharging and the surcharge rate you’ve configured to pass on to guests. If both values are equal, your effective fee for credit card transactions becomes zero. Otherwise, you’ll bear the difference.

Q. If surcharging is not allowed on debit cards, why do I still incur a fee?

A. While surcharging on debit cards is restricted by compliance regulations, there is still a cost associated with processing debit card payments. Zenoti’s blended pricing model calculates rates based on your overall card mix, which applies to both credit and debit transactions.

Q. How do I enable or disable the feature?

A. Contact Zenoti. You can disable it per center.

Q. Can I edit an existing surcharge rate?

A. No. To update a surcharge rate, delete the existing entry and add a new one with the revised percentage. You can adjust rates only within the permitted limits set for each card brand.

Q. Can I apply it only to specific locations or methods?

A. Yes, but only in accordance with card network rules.

Surcharges can be configured by center and card mode (card-present or card-not-present), but within each center, they must apply uniformly to all eligible card brands and types as per your configuration. Selective or partial application may violate compliance guidelines.

Q. Does this apply to online deposits?

A. Yes, if card-not-present mode is active.

Q. Can I waive the surcharge for specific guests?

A. No. It applies to all guests when enabled.

Q. Even after enabling surcharging, I don’t see it applied on terminal transactions. Why?

A. You must reboot the payment terminal to apply the latest surcharge configuration. Alternatively, you can try updating the configuration under the admin menu.

Q. Is surcharging supported for Stripe payments?

A. Yes, but with limitations. Stripe surcharging is supported only in the U.S., only for Stripe Express accounts, and only on BBPOS WisePOS E Cloud terminals. Other terminals such as Chipper and M2 are not supported.

Q. Is surcharging allowed on all device types for Stripe?

A. No. For Stripe, surcharging is supported only on the BBPOS WisePOS E Cloud terminal. If your center uses any other terminal model, such as Chipper or M2, surcharging will not apply to terminal transactions. To use surcharging with Stripe, you must switch to a supported device.

Q. What disclosures are required?

A. Signage and in-app messaging per card network guidelines.

Q. Are surcharges allowed in all U.S. states?

A. No. They’re banned in some states ; Colorado limits to 2%. Please note that these rules keep changing.

Q. Do I need to notify card networks before enabling surcharging?

A. Yes. You must notify Mastercard before enabling surcharges.

Q. How are surcharges displayed in reports?

A. Shown in Digital Payments Report in a column named “Card Surcharge”

Q. Where does the surcharge go?

A. The surcharge is added to your guest’s total and collected along with the payment. It helps offset your business’s credit card processing costs.

Q. Is the surcharge taxable?

A. Consult your tax advisor—it depends on local laws.

Q. How are refunds handled?

A. If refunded to the same card, surcharge is returned. Not applicable for non-card methods.

Q. What will guests see?

A. Banner or terminal message before payment, line item in receipt.

Q. Can I change the message shown to guests?

A. No. Messaging is standardized to ensure compliance.

Q. How are chargebacks handled?

A. Zenoti follows regular dispute logic. If the guest disputes the surcharge, your account is debited as per normal rules.

Term | Description |

|---|---|

Surcharge | A fee passed to the guest to cover the cost of credit card processing. |

Cost of payments | The total expense of accepting a card payment, including Zenoti’s processing rate and surcharge add-on. |

Card-present | A transaction where the card is physically swiped, dipped, or tapped, swiped, or inserted in person. |

Card-not-present | A transaction completed online or remotely, such as through the Webstore or CMA. |

Blended Pricing Model | A pricing structure where Zenoti bundles all varying transaction fees, like interchange fees and processor markups and charge you a fixed flat rate per transaction by card categories (e.g. Amex vs non-Amex). Required to enable surcharging. |