Onboard Employee for Zenoti Integrated Payroll

This article provides step-by-step instructions for both regular employees and contractors to self-onboard to Zenoti Payroll.

Overview

When businesses switch to Zenoti Integrated Payroll, employee data is often migrated automatically. In such cases, employees can bypass the onboarding process and directly review or update their data.

For new hires or employees whose data could not be migrated, completing the onboarding flow outlined is mandatory to receive payroll through Zenoti. Tax setup forms, such as W-4 for regular employees or W-9 for contractors, vary by employment type. The remaining onboarding process is the same for all employees.

The onboarding process for Zenoti Integrated Payroll ensures:

Efficient payroll setup.

Compliance with tax and legal requirements.

Accurate configuration of payment settings.

For more information on reviewing payroll settings through the web app or the myZen mobile app, refer to the Manage Payroll settings for employee article.

Key terms

Direct deposit bank account: The bank account where payroll funds are deposited directly.

W-4 form: A tax form that regular employees complete to determine their federal tax withholding.

W-9 form: An IRS form contractors complete to confirm their taxpayer identification.

W-2/1099 delivery preference: Option to receive tax documents electronically or by mail.

Prerequisites

Before beginning the onboarding process, employees must ensure that:

Their employer is enrolled with Zenoti Integrated Payroll.

They are correctly mapped to workplaces or centers.

Their employment type (Regular or Contractor) is accurately categorized.

Steps to self-onboard

Perform the following steps to complete the onboarding process:

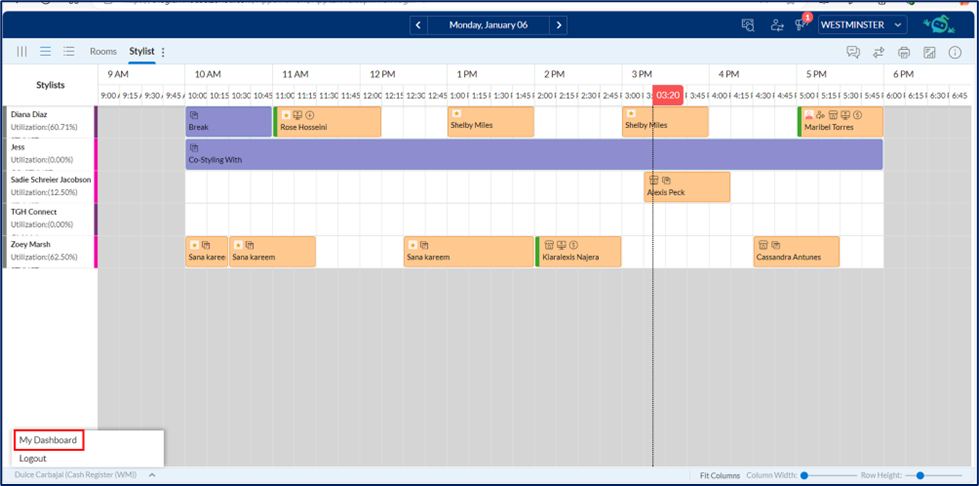

Log in and navigate to My Dashboard.

Depending on your role, you will either see the appointment book or the Admin Dashboard page.

Navigate to your profile.

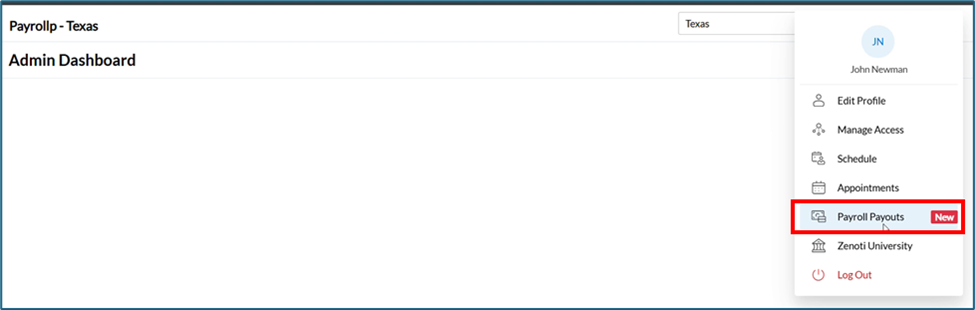

Click Zenoti Integrated Payroll.

Note: The Zenoti Integrated Payroll option is available under the profile menu when your employer switches to Zenoti Integrated Payroll.

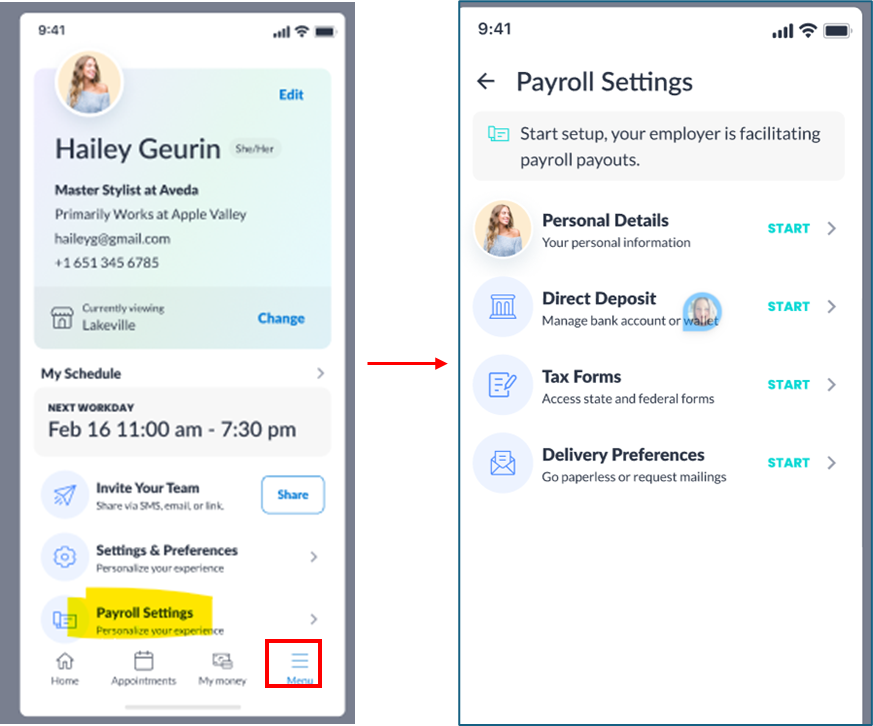

You can also complete the onboarding process from myZen app.

Login to myZen app.

Tap Menu at the bottom right.

Click Payroll Settings.

Note: If your data is already migrated, you can directly access Payroll Settings or Paystubs. Otherwise, tap START and add details.

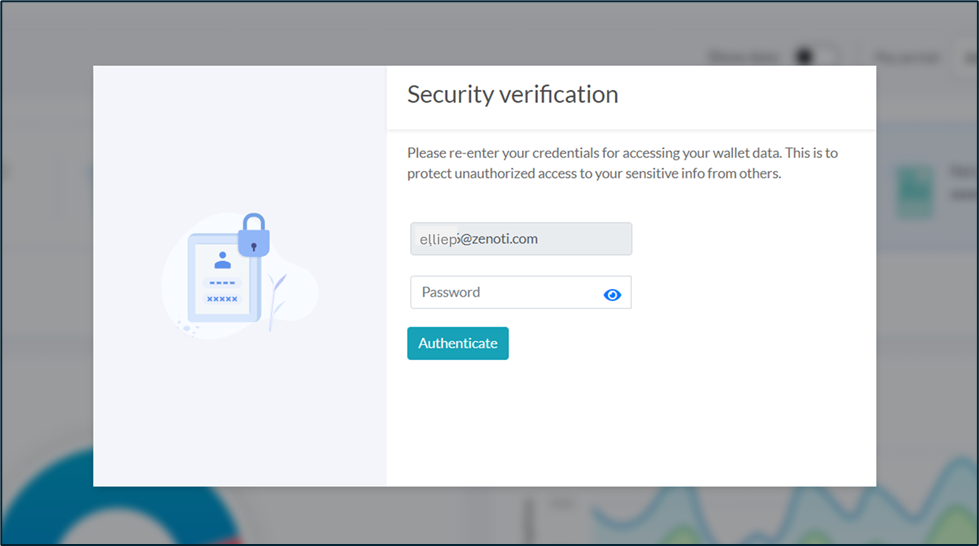

IMPORTANT: To protect your personal and financial information, additional authentication is required to access the Payroll dashboard.

Enter your credentials and click Authenticate.

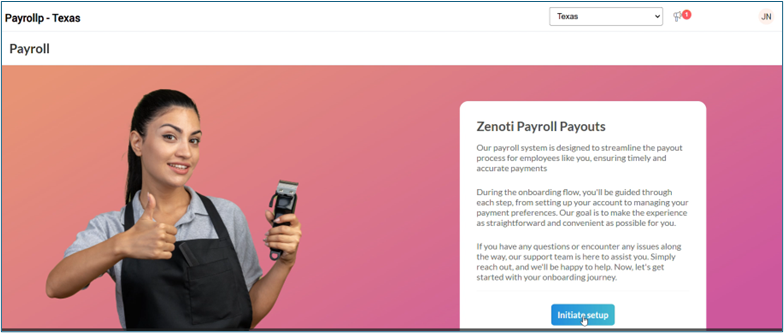

Click Initiate setup and complete the following steps:

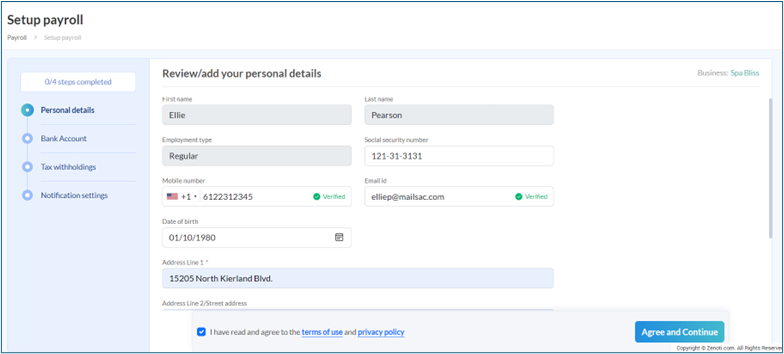

Enter your Personal details.

Note: If Zenoti already has your details, it automatically populates them. You should verify pre-populated information or manually enter any missing details.

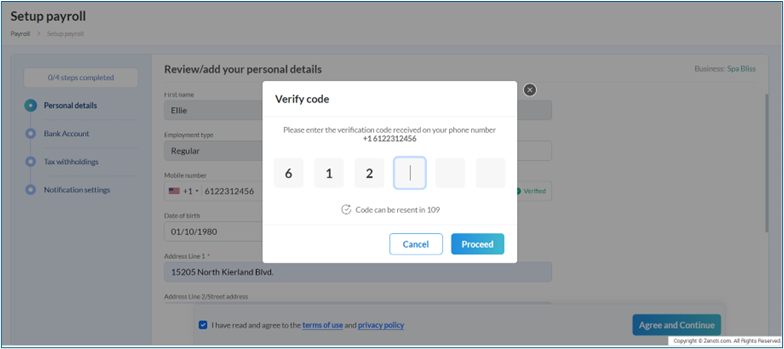

Verify both mobile number and email address.

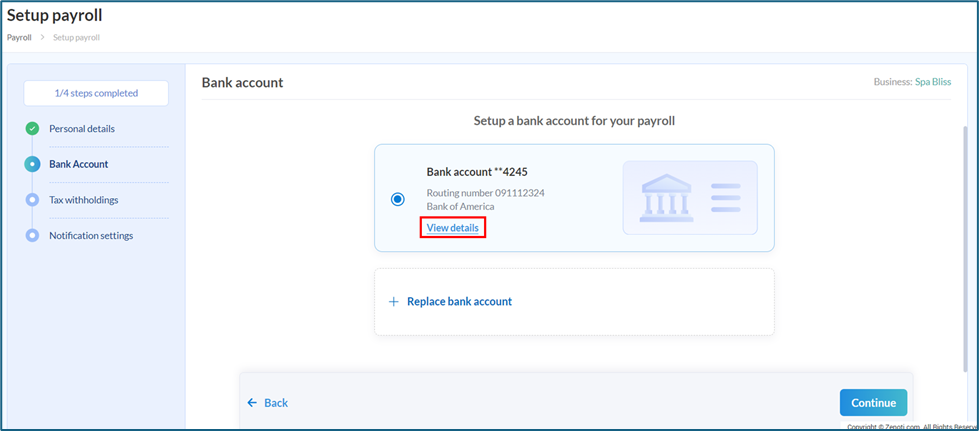

Set up Bank Account. Choose the bank account for receiving payroll deposits:

Use Zenoti Wallet if already set up.

Alternatively, log in to a bank account for instant linking or manually enter the account and routing numbers.

Note: Manual verification may require 1–2 business days. If verification fails, you will receive a notification at your verified email address with steps to resolve the issue.

Payroll deposits can only be made into verified accounts; transactions will be impacted for accounts that fail verification.

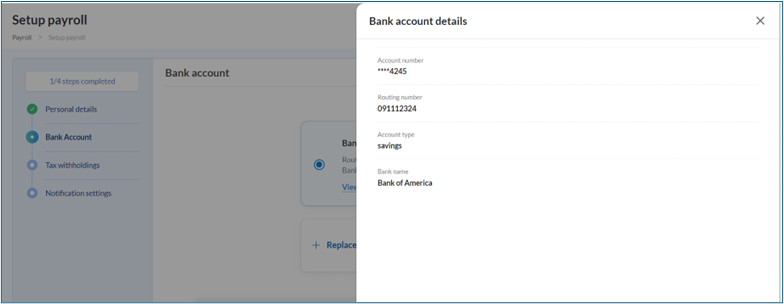

Click View details to verify your bank account details.

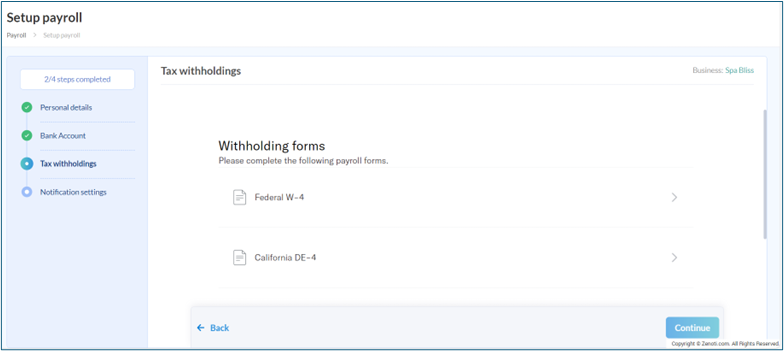

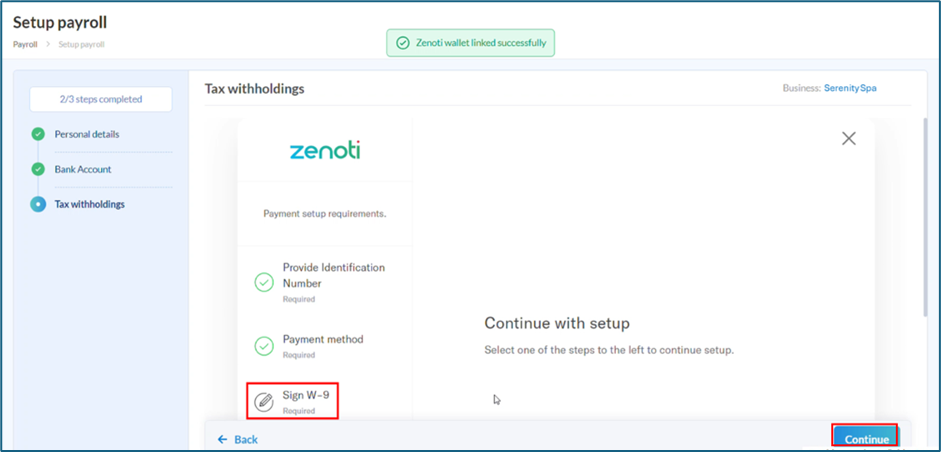

Click Continue to proceed with Tax withholdings section.

Regular employees will receive a prompt to update tax forms and complete the digital signature process.

Contractors can review and sign the W-9 form.

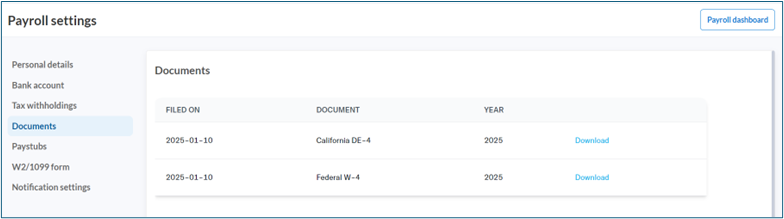

Once completed, signed tax documents will be available in Payroll Settings > Documents.

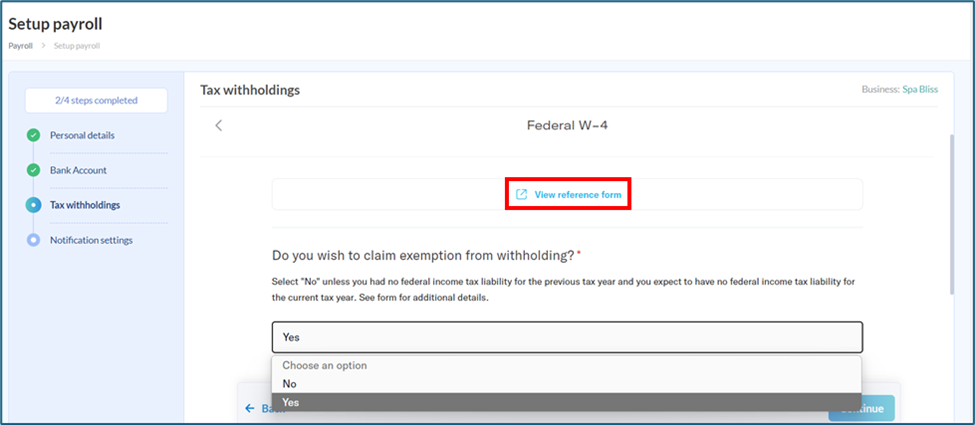

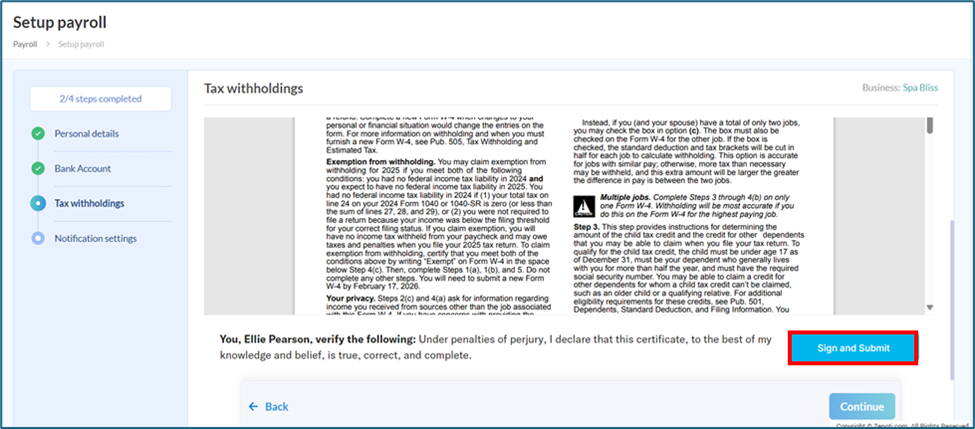

Note: Use the View reference form option for additional context while answering questions on the W-4 or W-9 form or state-specific forms.

Review each form and click Sign and Submit.

Click Continue to proceed to the delivery preference setup.

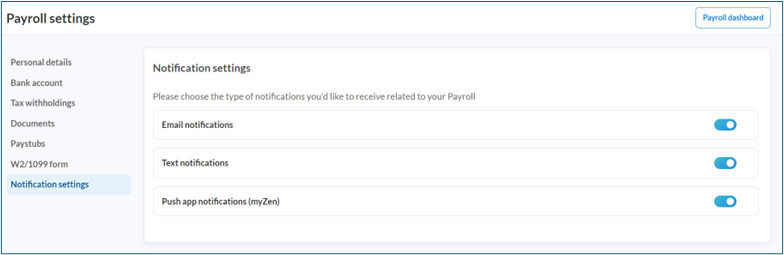

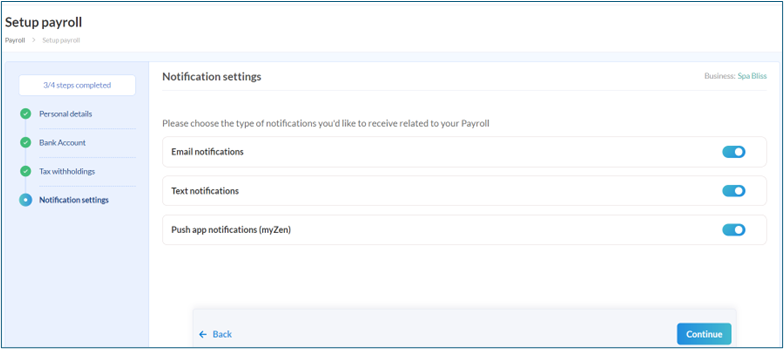

Review and update Notification settings as needed.

Click Continue.

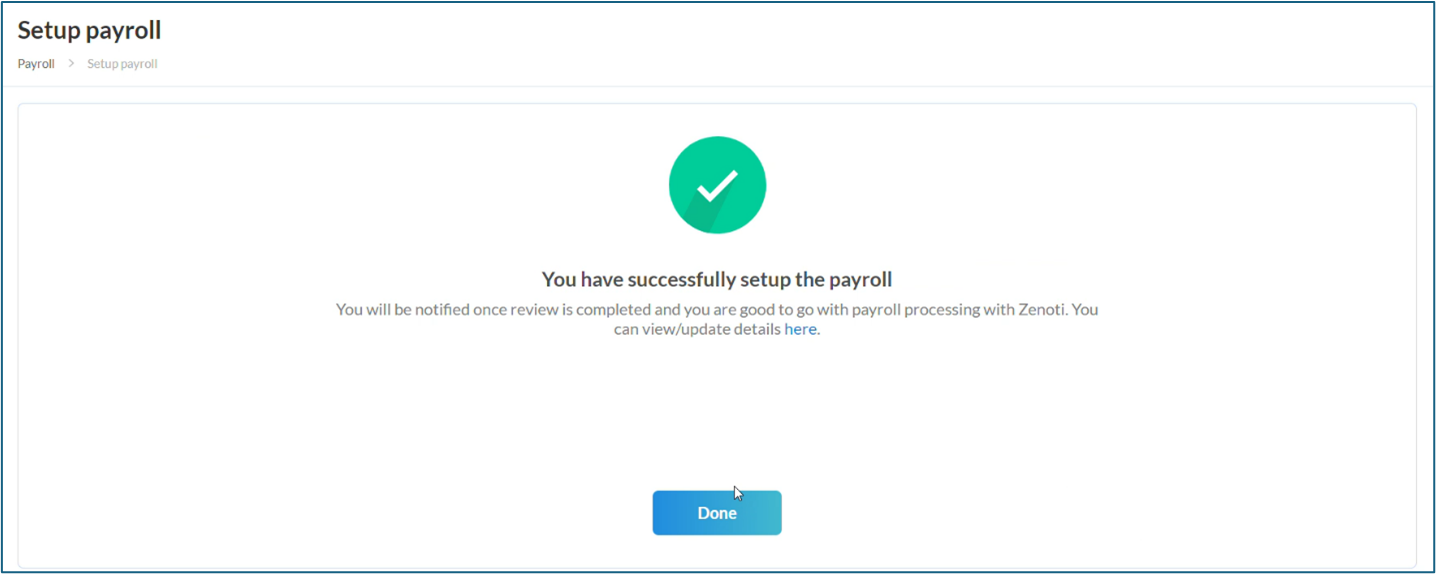

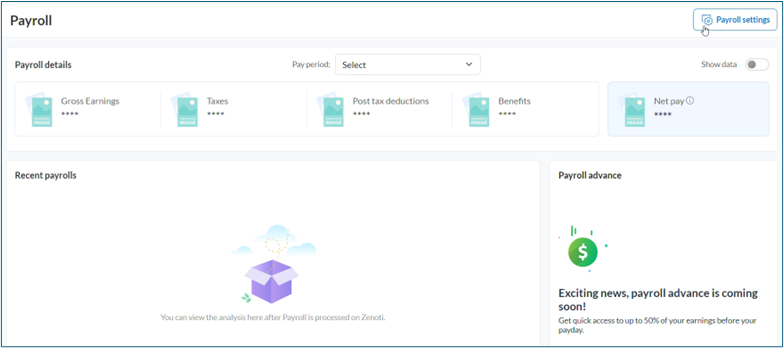

Click Done to go to Payroll dashboard page.

A snapshot of the payroll details is displayed.

Click Payroll settings (on the top right corner).

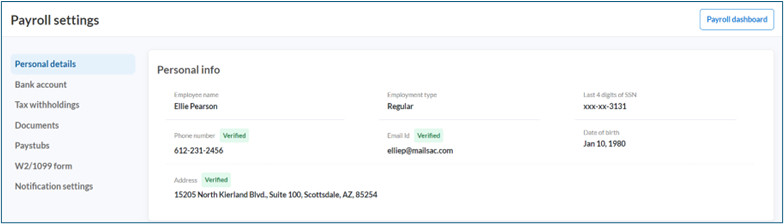

Displays Personal details. Here, you can view or edit some of your details.

On the left navigation, click on the tabs to view or edit information.

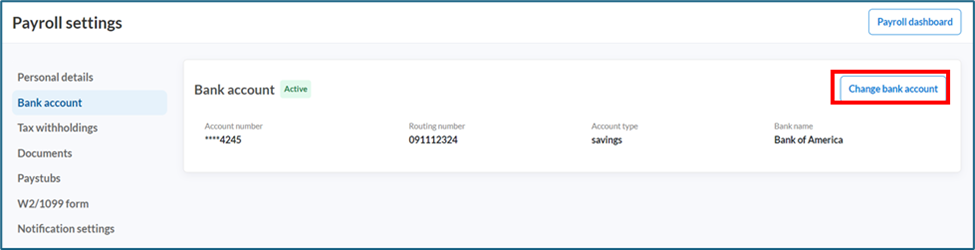

Click Bank account to view bank account details.

The linked bank account details are displayed with an option to change bank account if needed.

Click Change bank account to change or add a new bank account.

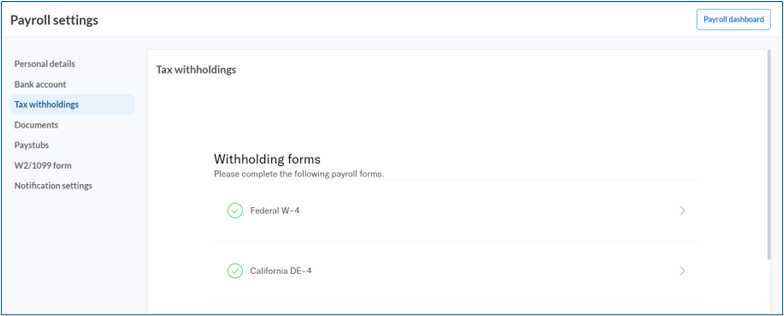

Click Tax withholdings to view completed forms.

View all the signed and submitted documents in the Documents section, with an option to download them for reference.

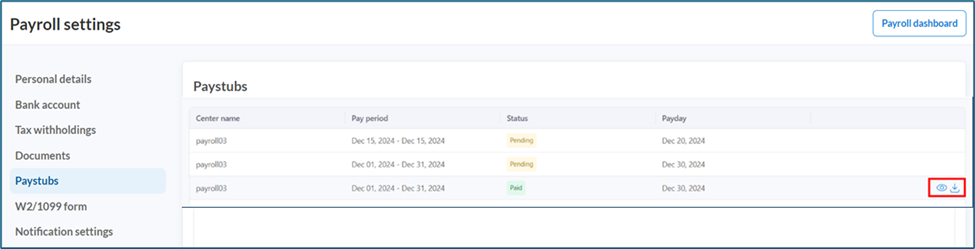

View and download Paystubs.

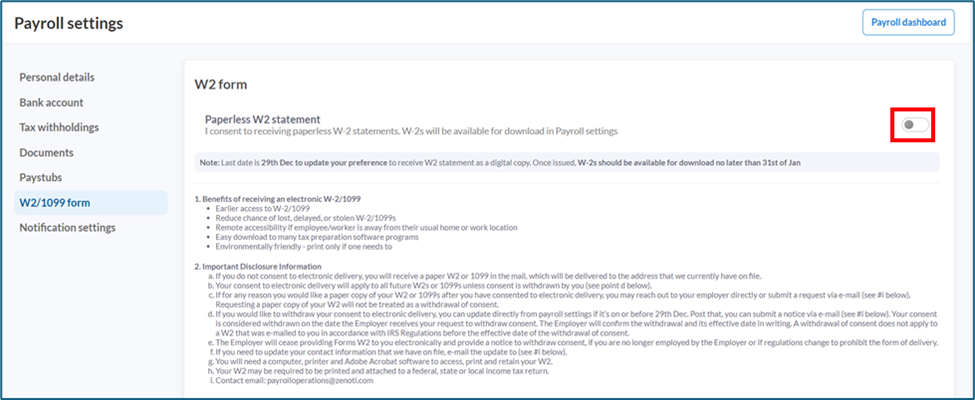

Set W-2/1099 form delivery preference.

If enabled, it means the user accepts online or paperless statement delivery. By default, it is set to off.

Review Notification settings and make changes as needed.