Redeem a taxed gift card in the POS window

Launch the POS from the appointment book.

In the guest details section at the top of the POS, enter either the mobile number, email address, first name, or last name of the guest, and select a matching record from the list of suggestions.

If the guest record does not exist in the system, then create a new guest record.

In the lower-left pane of the POS screen, select the service or package and add it to the invoice.

Note

If the service and package include a tax component, then the item invoice shows the sum total (net price + tax) of the service or package selected.

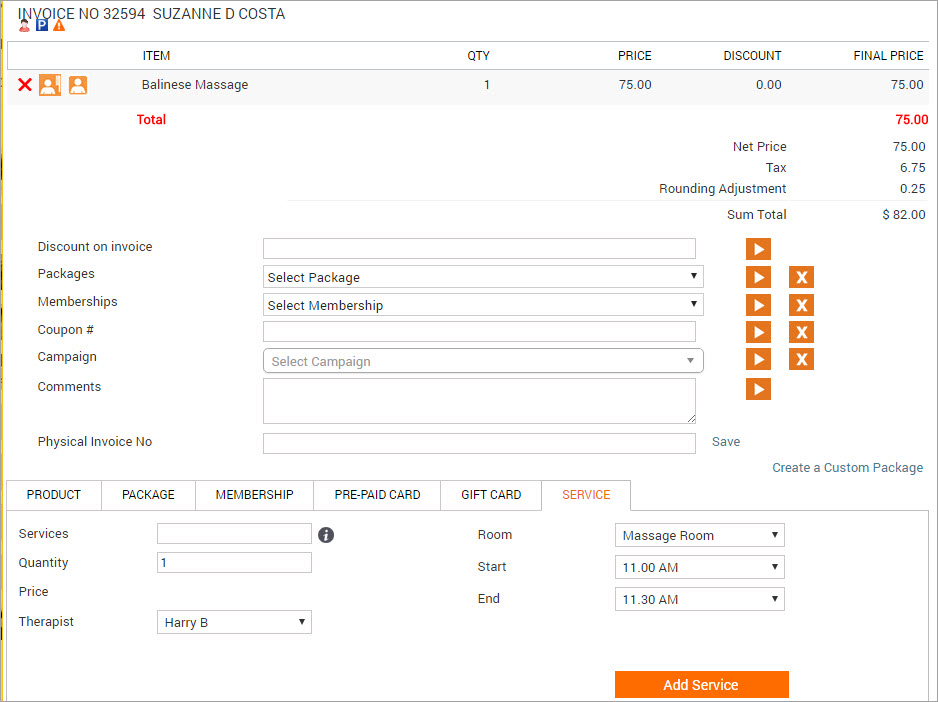

Example: The following image is an example of a taxed service.

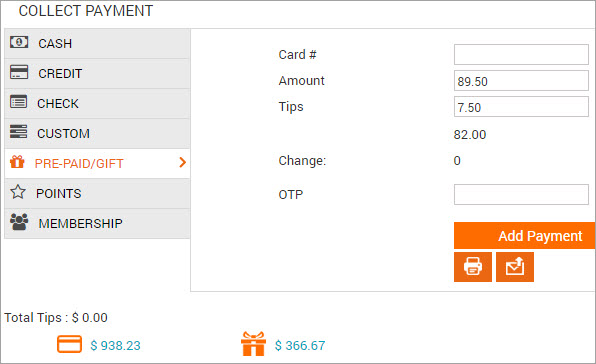

Select PRE-PAID/GIFT as the payment option in the Collect Payment section.

The sum total and any applicable tips (or gratuity) automatically populate in the Amount and Tips fields respectively.

Note

A gift card sold with tax cannot be used to pay for the tax component of the purchased service or package, tips, or gratuity.

Example: Below is an example image of a taxed service.

If no tax or tips (or gratuity) is applicable to the invoice, then proceed to step 8 below.

Edit the Amount field and replace the sum total with the net price amount (net price is the service/ or the package amount before tax.

Obtain this information from the invoice section in the POS window.

Delete the amount from the Tips (or Gratuity) field (if applicable).

Delete the amount from the Service Charge field (if applicable).

Authentication may be required to edit this field.

Do one of the following:

In the Card # field, enter the gift card number manually

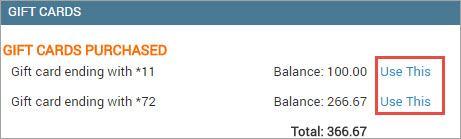

Click the gift card balance link beside the gift icon to select a gift card from the list of gift cards that the guest owns.

Click the Use This link beside a gift card number and the card information automatically populates in the Card # field. Note: If the gift card numbers are masked, refer to section below on: How to apply a masked gift card number to an invoice?.

Click Add Payment.

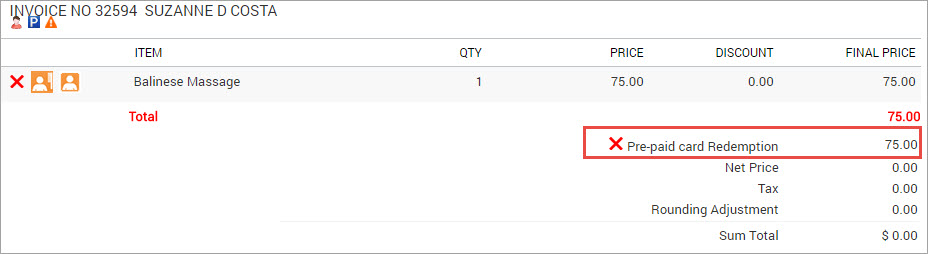

The payment is shown on the left side as pre-paid Card Redemption.

The guest needs to pay any remaining service tax amount, tips and gratuity using another mode of payment. Choose the payment method to take any remaining payment.

Note

The Collect Payment section reflects the pending amount.

Close the invoice.

How to apply a masked gift card number to an invoice?

Based on your organization settings and role permissions, only the last two digits of the gift card number or redemption code is visible and the remainder of the gift card number is masked with an '*' .

If the number is masked, clicking the Use this link does not populate the card number, but opens a field for you enter the gift card number. In such cases, either the guest must provide the number, or you must contact a staff member who has permission to view the complete number (by default, the owner role has the permission enabled).

Note

If the guest or owner cannot provide the number, the gift card cannot be redeemed.

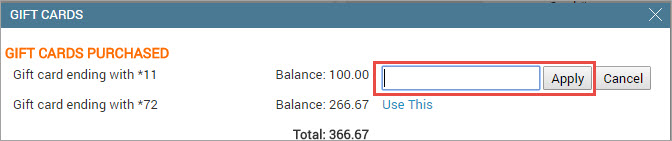

Example:

The following image is an example of masked gift cards. Click the Use This link beside a gift card number.

A field to enter the card number appears.

Enter the complete card number in the field and click Apply.

The card information automatically appears in the Card # fields.