Third Party Administrator Access – Zenoti Integrated Payroll

This article explains how to authorize Zenoti and its tax partner, Check Technologies, as a Third-Party Administrator (TPA) across various U.S. states. You’ll learn how to complete the state-specific steps required to grant access so your payroll taxes can be filed accurately and without delays.

Overview

Some U.S. states require businesses to grant TPA access to authorized providers like Zenoti or Check Technologies before payroll services can be activated. This access allows Check to communicate with state agencies, file taxes, and resolve account issues on your behalf. While most states offer straightforward digital workflows, each state's process, platform, and required credentials vary.

Below are the states that require TPA access, along with specific instructions for granting that access.

State-specific instructions

California: California Employment Development Department (EDD)

To grant TPA access to Check Technologies, provide one of the following:

Total Subject Wages Reported from one of the last three DE 9C filings.

Reserve Account Balance from the latest DE 2088 notice.

Payment Amount from one of the last five EDD payments.

New Employer – If this is a new account, indicate that no historical data is available.

Colorado: Colorado Department of Revenue

In Colorado, employers can assign TPA access to Check through the RevenueOnline portal. This process requires entering Check’s login details and confirming access roles and start dates.

Log in to your account at Colorado.gov/RevenueOnline.

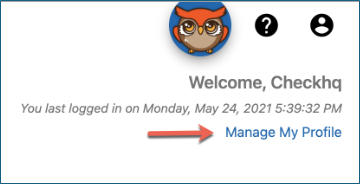

Click Manage My Profile.

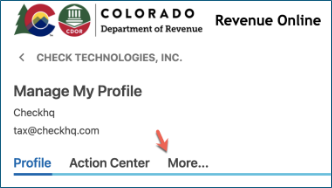

Click More…

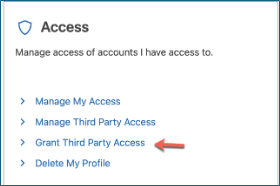

Click Grant Third Party Access.

Click Next.

Enter the requested information on the New Third Party Access screen and click Submit.

Check's login ID = Checkhq

Access level = All Access

Access start date = Beginning of the first payroll quarter (example, Q1 2021 = 1/1/2021)

Verify access was granted via Manage My Profile > More… > Manage Third Party Access.

Hawaii: Department of Labor and Industrial Relations

Hawaii employers can approve Check’s TPA request directly through their UI portal under the User Management section. This enables Check to act as a service company on your account.

From your homepage at Hawaii - Unemployment Insurance, click Employer Services on the right panel.

Log in to your account.

Click on User Management to see options.

A request from Check with a Service Company role appears.

Approve the TPA request from Check (Service Company role).

Iowa: Iowa Workforce Development

Iowa’s myIowaUI system allows employers to designate Check as an agent using a provided Agent ID. Employers must assign specific UI account roles to enable tax and wage management. Log in to myIowaUI.

Click Assign Agent in the left sidebar.

When prompted to enter an Agent ID enter Check Technologies Agent Number: R2579839.

Under the Assign UI account roles, select Manage Payments, Submit/change Wage Detail, and View Transaction History.

Indiana: Uplink Employer Self Services

To assign Check as a TPA in Indiana, employers must log into the Uplink ESS portal and authorize the agent using Check’s Agent ID. This setup grants wage reporting privileges.

Log in to ESS.

Navigate to User Maintenance > User Information.

Expand External Account Authorizations (Agent).

Click Add Agent:

Leave the Agent Business Name blank

Enter the Agent ID: 120389

Click Next on the agent line.

Under the Authorization level, select Wage Records.

Select the important information checkbox and then click Next.

Massachusetts: Massachusetts Department of Unemployment Assistance

Follow the official instructions for authorizing a TPA by visiting the Massachusetts Department of Unemployment Assistance website.

TPA ID: 111213

Assign roles:

Account Maintenance View Only

Payments Update and Submit

Employment Wage Detail Update and Submit

Minnesota: Minnesota Employment and Economic Development (MNDEED)

Follow the instructions provided on this link published and maintained by the Minnesota Unemployment Insurance Program.

TPA ID: AG021422

Assign roles:

Account Maintenance View Only

Tax Payment Update and Submit

Wage Detail Update and Submit

New Mexico: New Mexico Department of Workforce Solutions

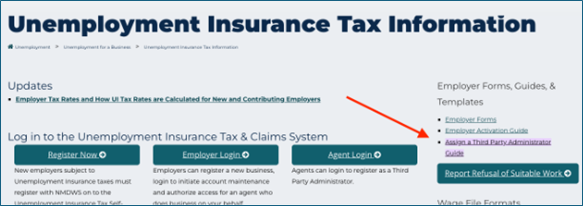

Follow the instructions in the Assign a Third Party Administer Guide published and maintained by the New Mexico Department of Workforce Solutions.

TPA ID: 500002855

Assign roles:

Account Maintenance View Only

Payments Update and Submit

Employment Wage Detail Update and Submit

North Dakota: North Dakota Taxpayer Access Point (TAP)

In order for Check Technologies to achieve TPA Access it is necessary for the client to provide the following item.

Entity Type.

Association

Corporation

Government

Individual

Limited Liability Co.

Partnership

Sole Proprietor

Transmitter

Trust

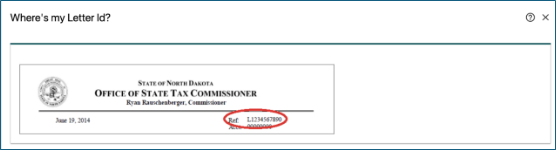

Letter ID (from a recent letter issued on the account).

Approve Check’s access request in TAP.

Oklahoma Taxpayer Access Point (TAP)

In order for Check Technologies to achieve TPA Access it is necessary for the client to provide the following item.

Sign in to your Oklahoma Taxpayer Access Point account.

Click Allow Third Party Access.

Create a passphrase and share it with Check.

After Check requests access, log in again to approve with “All Access” for Check Emp.

Pennsylvania Office of Unemployment Compensation

In order for Check Technologies to achieve TPA, it is necessary for the client to complete the following actions.

Log in to UCMS .

Go to Employer Profile > Manage Representative > Add New Representative.

Enter the following three times with the correct authorization types:

Check’s 10-digit Representative Identifier: 9318336670

Today’s date

Select and submit each of the following:

Contribution Rate Information

Delinquencies and Account Discrepancies

Filing Quarterly Reports and Adjustments

Philadelphia, Pennsylvania: Philadelphia Tax Center

In order for Check Technologies to achieve TPA Access, Check requests access directly via the Philadelphia Tax Center. The client receives a physical letter and shares the Letter ID back with Check to complete access.

Texas: Texas Workforce Commission

In order for Check Technologies to achieve TPA Access, it is necessary for the client to complete the following steps.

Login to your TWC online services account.

Select User Admin, located to the right of the My Home tab.

Under the Quick Links table, choose Applicant List.

You should see Kohl, James; Check Technologies listed.

If this name does not appear, Check Technologies may not have submitted the access request yet. Confirm that your TWC account has an administrator set up.

In the Action column, select Review.

On the Review Applicant page, select Approve.

On the User Permissions page, select the checkboxes for the following permissions:

Manage Wage Reports

Make Payment

View Payment

Select Submit to complete the authorization.