Accounting integrations

Accounting integration syncs Zenoti sales transactions with an accounting application, automating the creation of financial statements and payment reconciliation. The real-time sales data in the accounting application provides accurate insights into revenue, liabilities, cash flow, and business performance from any location. The benefits of accounting integration are:

Optimizes your financial management with a diverse array of customizable options. You can post sales to the accounting application either as invoices or as journal entries. Tailor your preferences by opting to post based on individual invoice details or by providing a daily summary of total sales.

Syncs Zenoti sales data daily, facilitating seamless financial statement generation, including comprehensive profit and loss and cash flow statements.

Minimizes manual data entry and gain visibility over Zenoti sales and payments. Syncs data, saving numerous professional hours and associated costs.

Matches bank statements with synced payments for easy reconciliation.

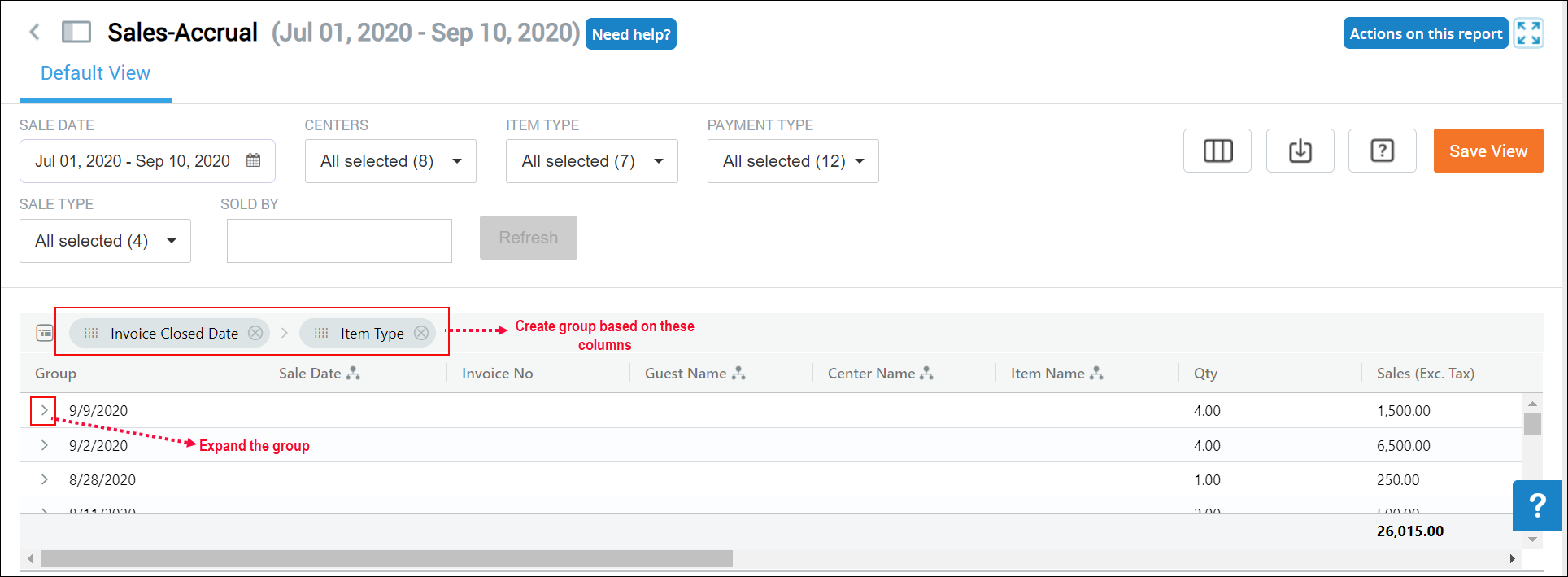

Accrual Accounting

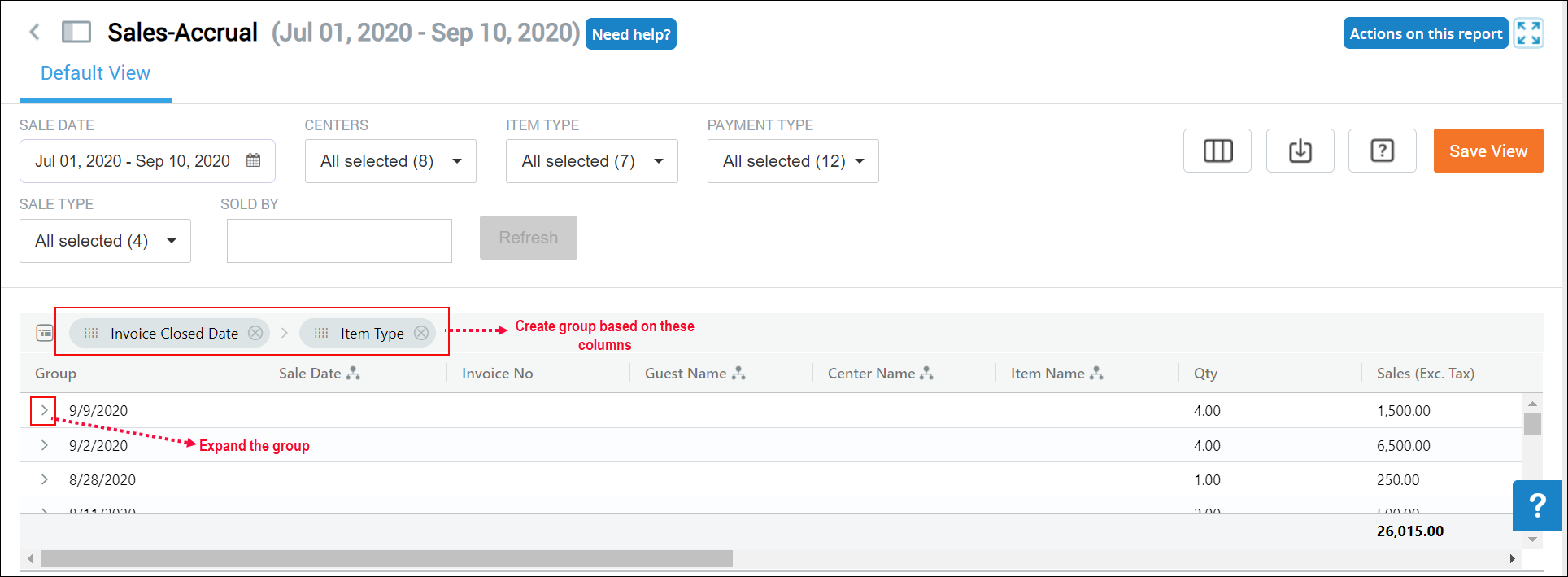

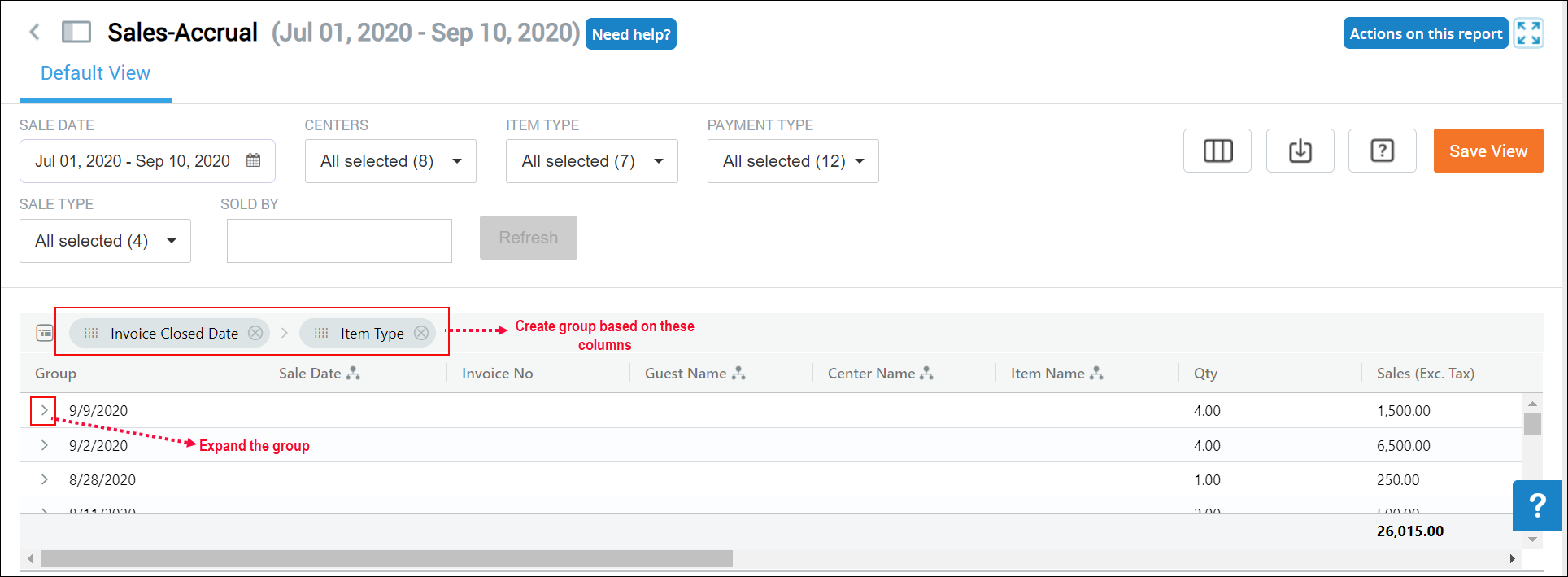

In accrual accounting, transactions are recorded based on the day they occur. For example, sales and collections indicate the day on which the business earned revenue by selling products or providing services, or the day on which the business received payment to reconcile the amount received with the money in the bank. This approach simplifies the process of reconciling accounts with sales and facilitates bank reconciliation with collections.

Cash Accounting

In cash accounting, transactions are posted based on the day the payments are received, denoting the day the business has earned revenue based on the received payment. This is commonly used by small businesses to simplify their accounting processes and manage financial liabilities.

Cash basis accounting is primarily used by small businesses that need to constantly monitor their cash flow. It is generally easier to manage as there is less to track. Many small businesses use this method due to its simplicity. Cash basis accounting recognizes all revenue as it is received and all expenses when the money is spent. Hence, whenever you check your bank balance, you know precisely what resources are available to you. Additionally, this method implies that your revenue will generally not be subject to tax until the cash is in the bank.

Switch to a new accounting platform in one click

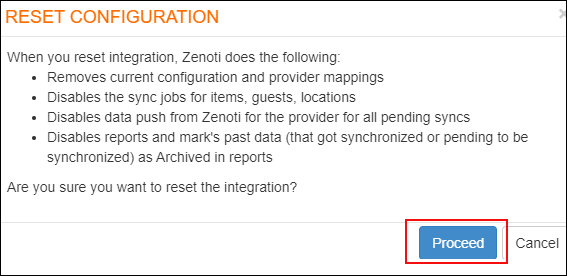

Zenoti can enable the Reset Configuration button on the configuration page, where the integration is configured (at center level or at the organization level).

|

When a business resets the integration, Zenoti does the following:

Removes current configuration and provider mappings.

Disables the sync jobs for items, guests, and locations

Disables data sync to the accounting platform of all pending syncs

Disables reports and marks past data (synced or pending) as Archived in reports

Click Reset Configuration.

|

Click Proceed to continue to reset the configuration.

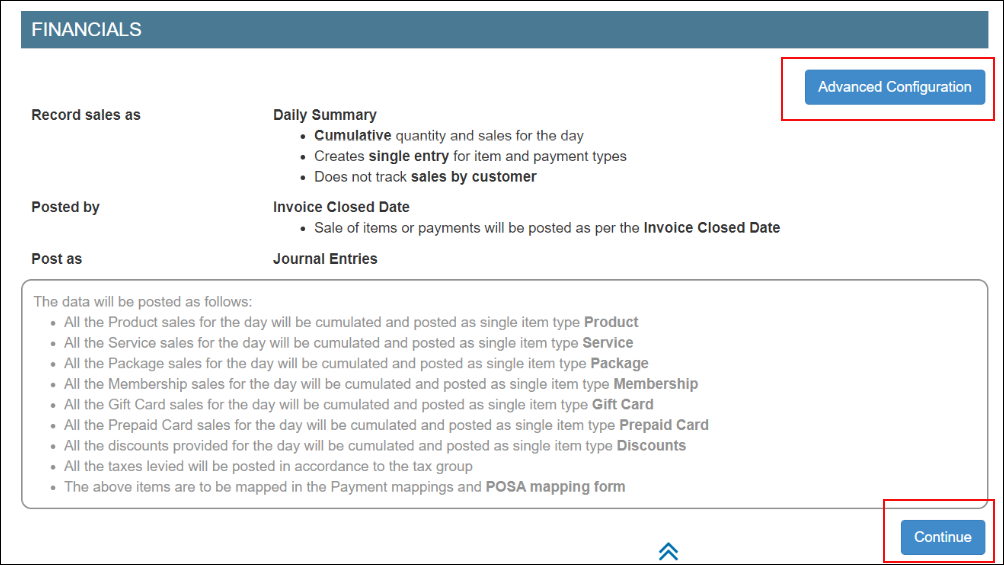

Simplified configuration for accounting integration

Generally, not all businesses need a multiple set of configurations to set up accounting integration in Zenoti.

To help such businesses easily set up the integration, we've simplified the configuration page.

|

By default, Zenoti considers the following configurations:

Record sales as Daily Summary:

Cumulative quantity and sales for the day are considered

Single entry is created for items and payment types

Note

This configuration does not track sales by customers.

Post sale of items (for services the date when the services are performed) or payments based on Invoice Closed Date.

Post items as journal entries.

Default Value for Customer - Guest

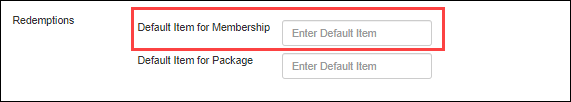

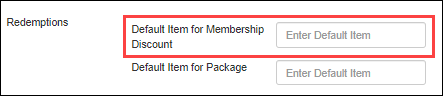

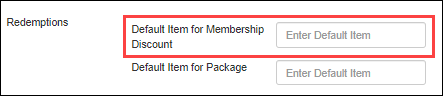

Default Item for Membership Discount - Membership Discounts

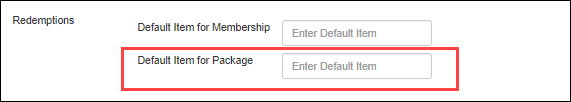

Default Item for Package Discount - Package Discounts

Click Continue to accept the default configurations. To edit these configurations, click Advanced Configuration.

Accounting integration in Zenoti

Running a smooth and profitable business is always challenging. Accounting activities such as tracking sales, managing expenses, filing taxes, measuring liabilities, and reconciling cash-flows, are the most crucial and complex activity for any business.

With Zenoti, you can integrate with a third-party accounting platform that can help you track these complex activities and in turn, helps you to prepare the following book of accounts for your business:

Profit and loss accounts

Cash-flow statements

Balance sheets

Expenses

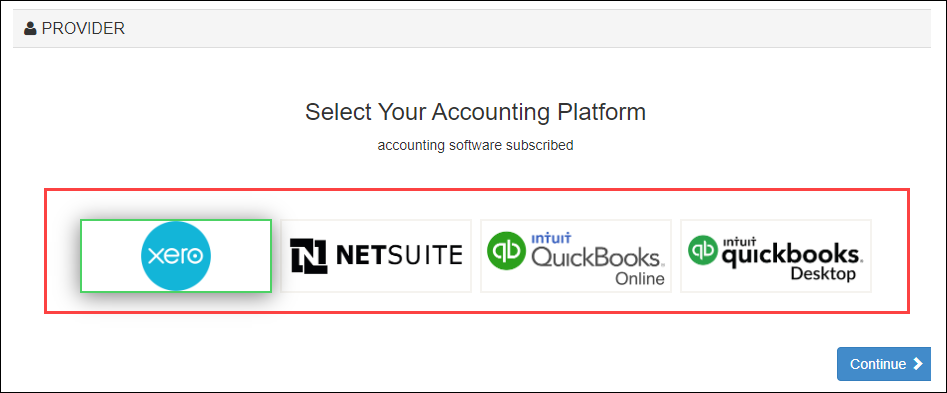

Zenoti partners with POSAccounting and supports integration with the following accounting platforms:

Xero

QuickBooks Desktop

QuickBooks Online

NetSuite

Businesses can choose to set up the integration at the organization level or at each center.

Based on where you want to set up the integration,

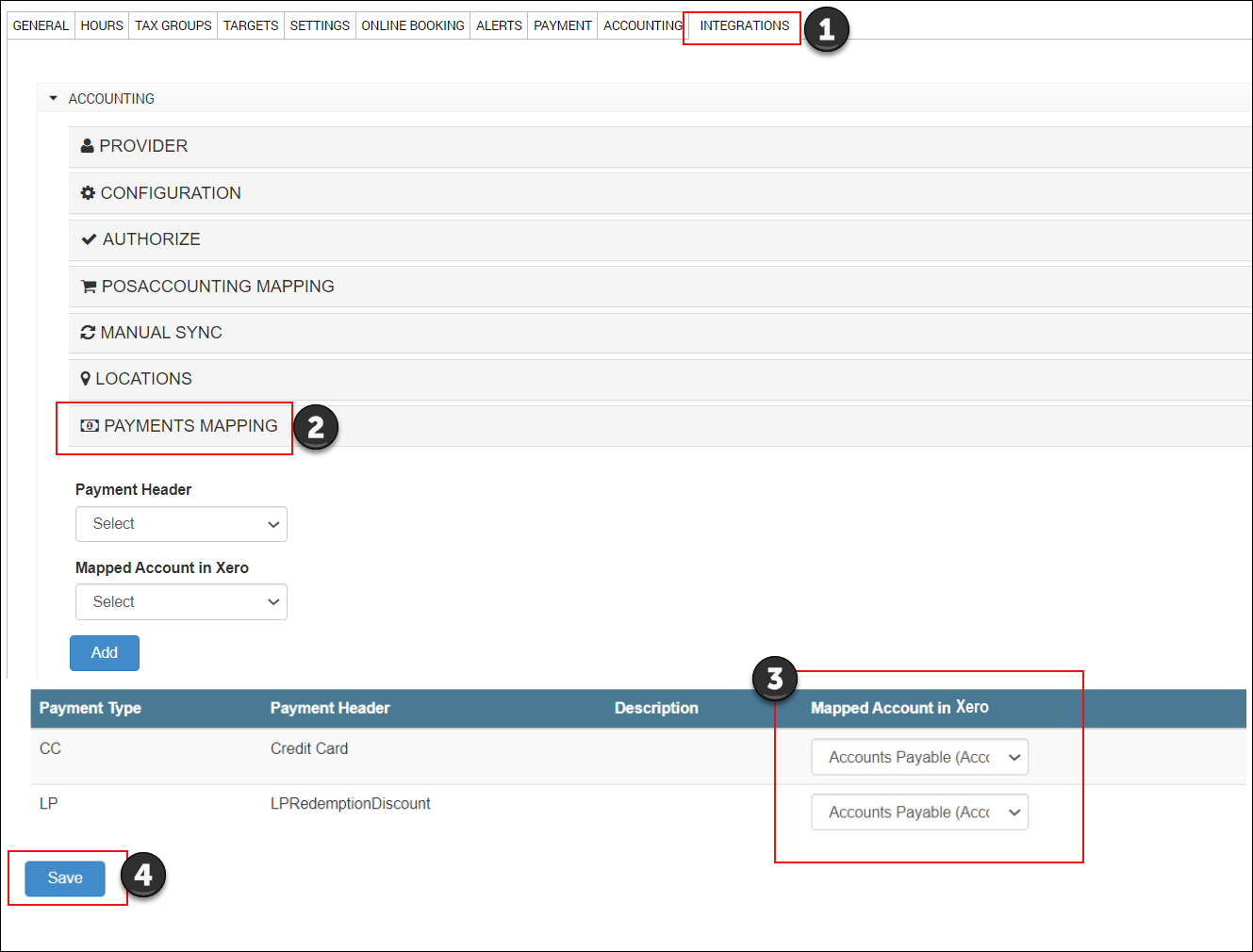

Navigate to organization or center, click Configuration icon > Integrations tab.

Set up and authorize the accounting platform.

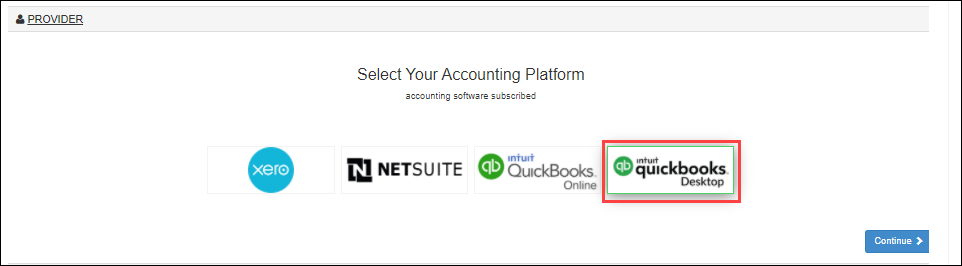

Expand the Provider section and select the accounting platform.

Click Continue to move to the next step.

The Configuration section appears. The fields in this section vary based on the accounting platform that you’ve selected.

Enter the details of the account that you have on the accounting platform.

Note

When a user authorizes or re-authorizes a third-party provider, whether a POSA or Codat integration, including middleware, the user account performing the action must have Administrator permissions. If the account lacks these permissions, the authorization may appear successful, but the data flow will fail to function correctly.

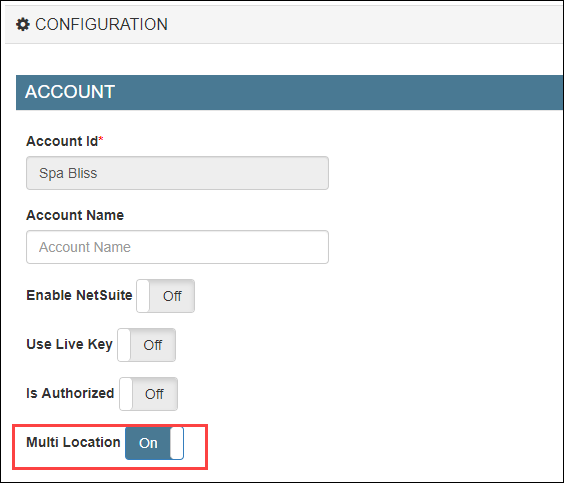

Locations

In this step, you can choose to send data with or without locations.

If you want to enable the integration with locations, select the Multi-Location switch.

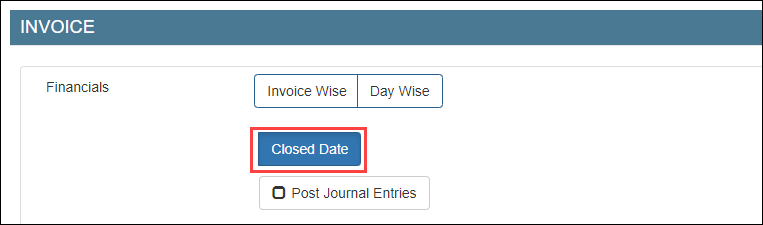

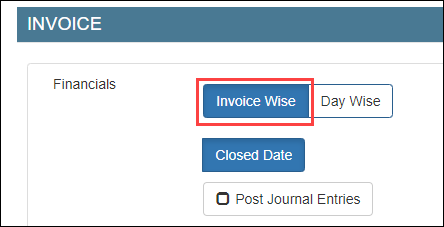

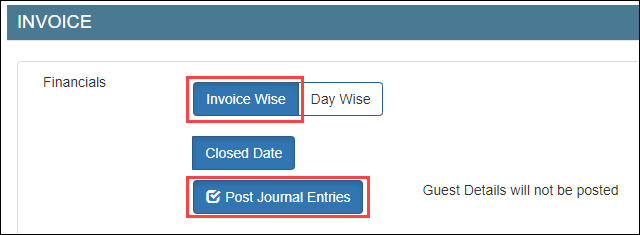

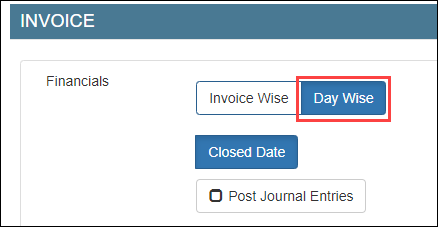

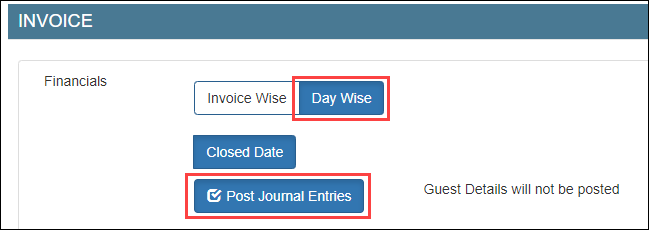

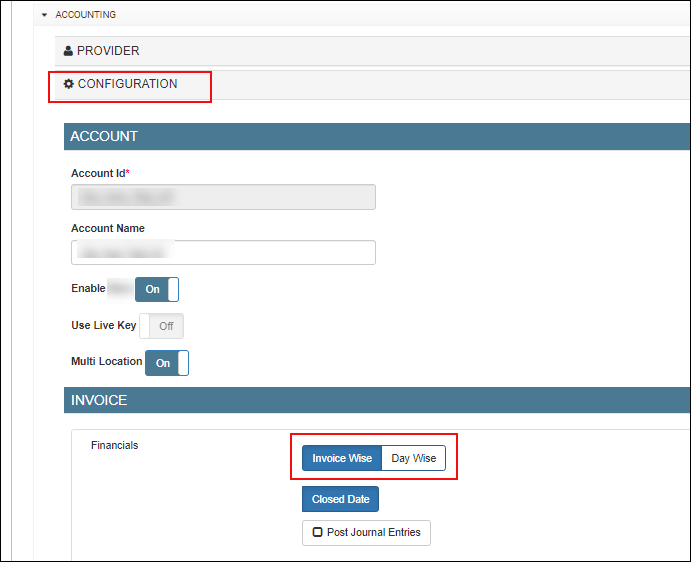

Sync Type

Select the way you want to sync the data.

Important

Ensure that you’ve enabled Closed Date. This is important as Zenoti syncs data based on the day when the invoice is closed.

You can choose to sync data in one of the following ways:

Invoice-wise

For each invoice in Zenoti, a corresponding invoice is created in the accounting platform.

Invoice-wise as Journal entries

For each invoice in Zenoti, a corresponding invoice is posted as a journal entry in the accounting platform.

Day-wise

For all the invoices in Zenoti on a day, a corresponding summarized invoice is created in the accounting platform.

Day-wise as Journal entries

For all the invoices in Zenoti on a day, a corresponding summarized invoice is posted as a journal entry in the accounting platform.

Configure

Based on the sync type that you’ve selected in step-3, you can choose how to post your data from Zenoti to the accounting platform.

You can do the configuration either by:

Map

After you’ve completed configuring how data in Zenoti can be pushed to the accounting platform, you are ready to map data in Zenoti to data in the accounting platform.

If you’ve configured data by invoice, you have to map the following:

If you’ve configured data by journal entries, you have to map the following:

Sync

After you’ve mapped the data, you can sync data using one of the following ways:

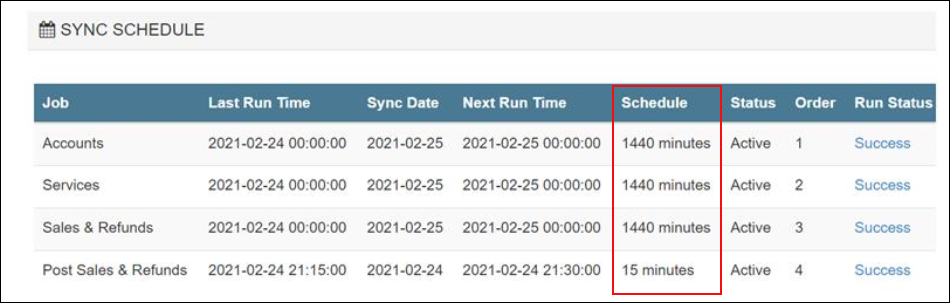

Scheduled sync

To auto-sync data on a timely basis, reach out to Zenoti Support to set up scheduled sync for your business.

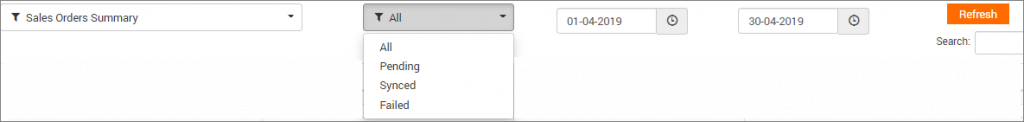

Reconcile

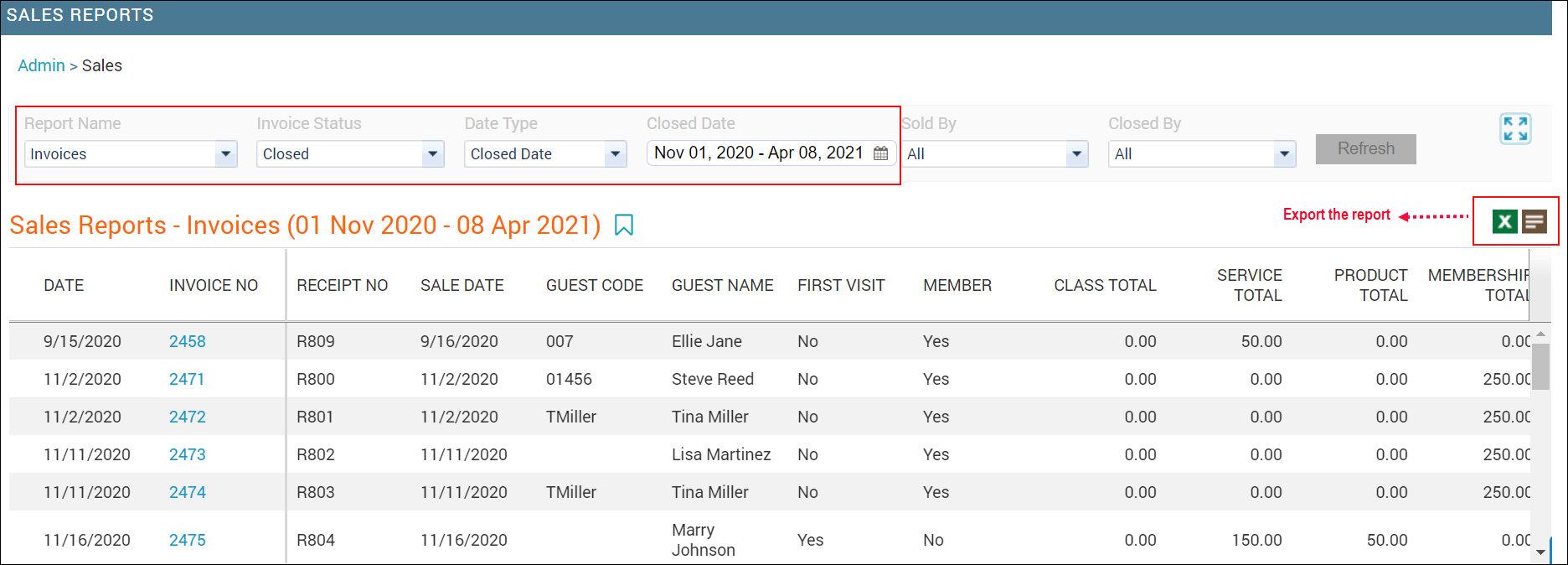

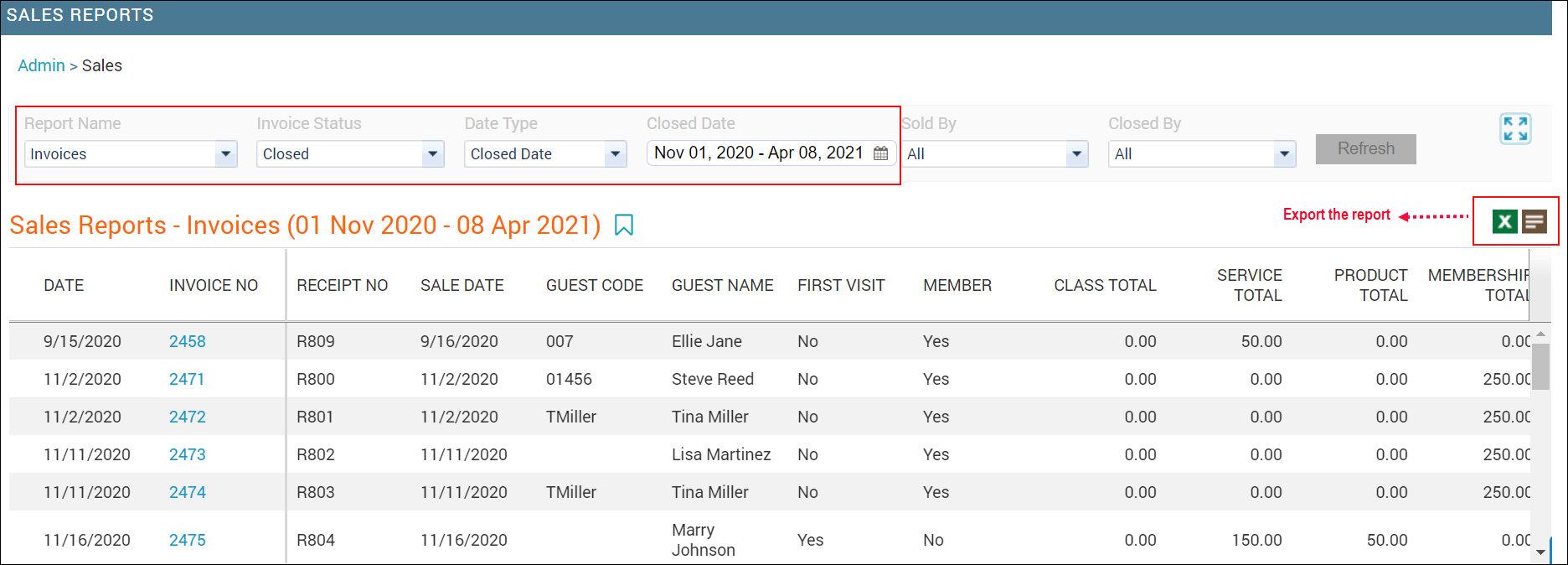

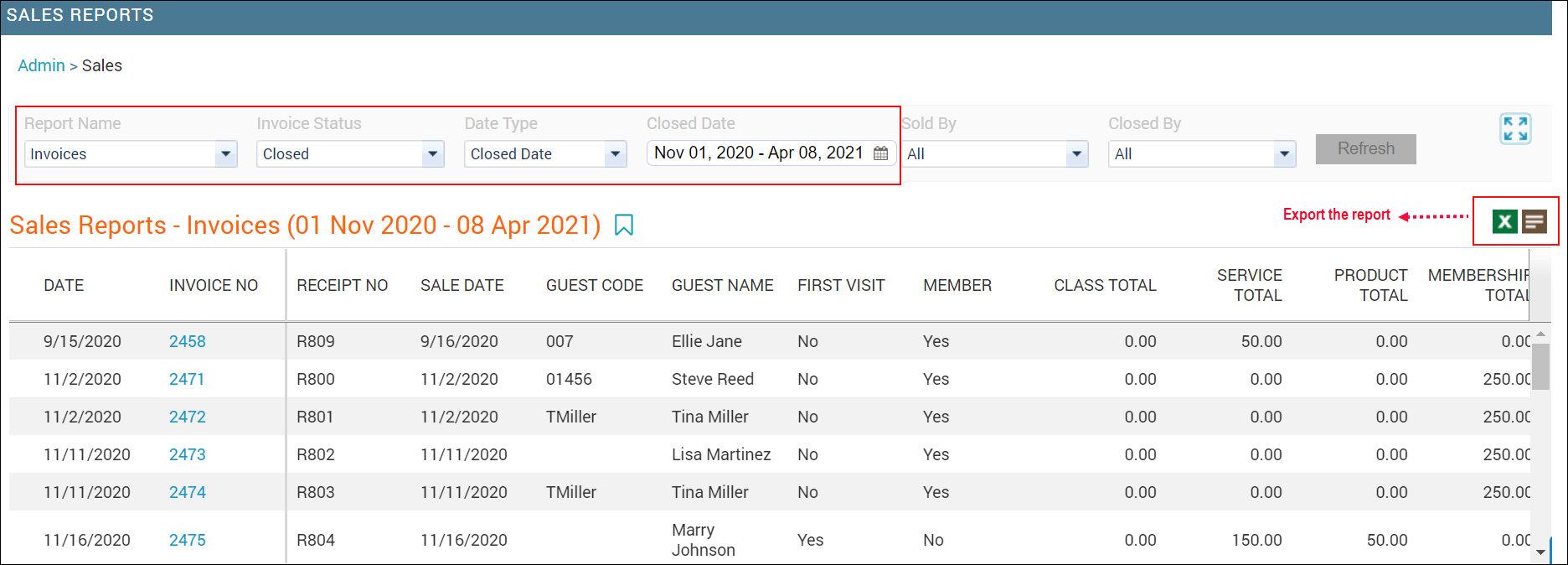

The last step is to reconcile data that you’ve synced from Zenoti to the accounting platform using the following Zenoti Reports:

Items

Customers

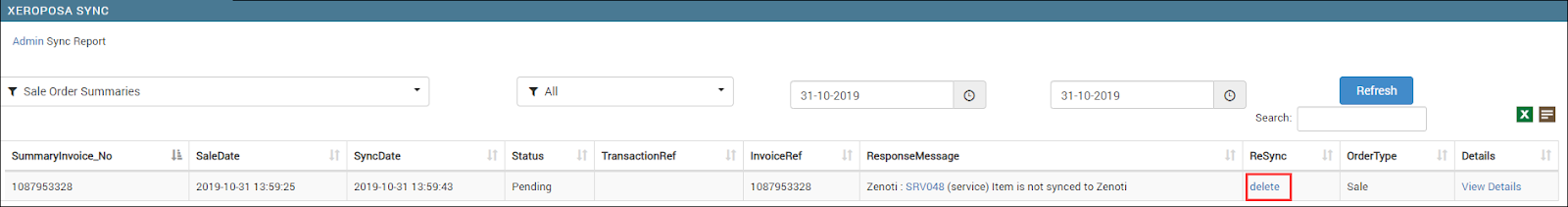

Sales Orders Summary

Inventory Orders

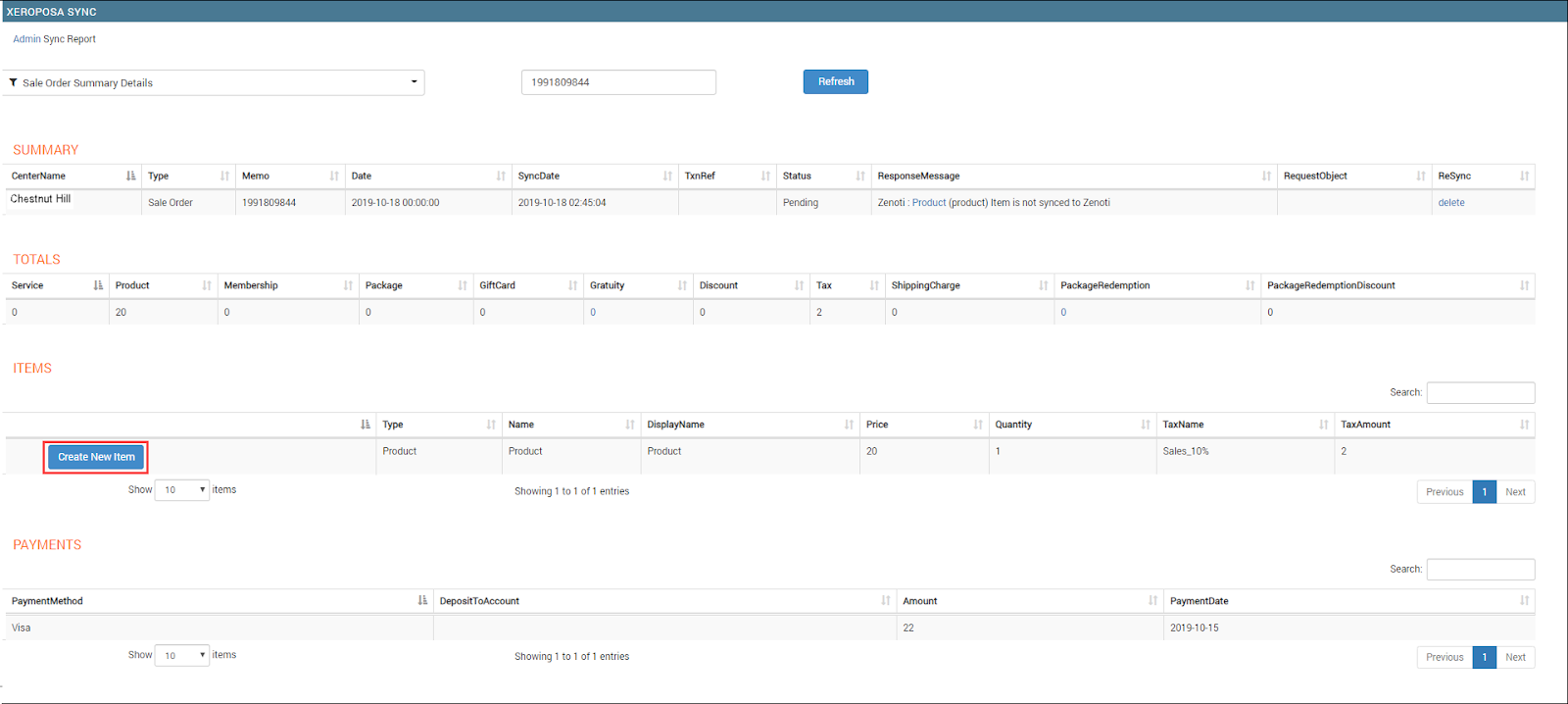

Sale Order Summary Details

Note

Zenoti has separate reports for each accounting platform: Xero Reports and QuickBooks Reports.

Reauthorizing Integrations

This article explains how reauthorization works for integrations when the connection is broken, and what users can expect during the reauthorization process.

Overview

Zenoti accounting integrations rely on an active authorization link to securely sync data. If this link is broken, for example, due to expired credentials or revoked permissions, the integration must be reauthorized to resume data sync.

When the authorization link is broken:

The Status of the integration is displayed as Deauthorized.

The Reauthorize button is shown for the affected integration.

The standard Authorize option is replaced with Reauthorize to indicate an existing but inactive connection.

To reauthorize integration, follow these steps:

Navigate to the organization or center level based on where the integration is set up.

Click Configurations > Integrations > Integration Settings.

Expand the Accounting section.

Locate the integration showing Status as Deauthorized.

Click Reauthorize. A new browser tab opens with the provider’s authorization page.

Sign in and grant the required permissions. Once completed successfully, return to Zenoti.

The integration status updates to Authorized, and data sync resumes.

Note

Users can complete reauthorization on their own, without contacting Zenoti Support.

Reauthorization does not require reconfiguration of previously saved settings.

Existing integration mappings remain unchanged unless modified during the provider’s flow.

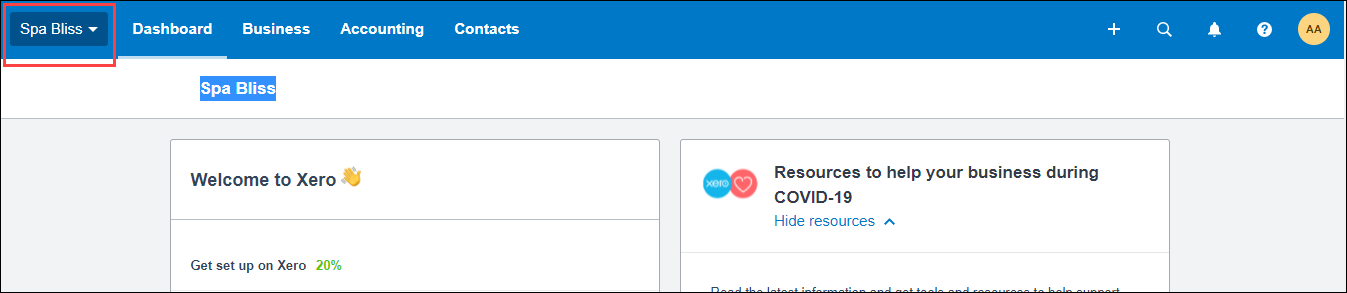

Set up and authorize Xero accounting integration

Xero is an online accounting software that allows you to track financials.

Zenoti's integration with Xero enables you to sync the financial data from Zenoti to your Xero account.

Important

Before you begin to set up and authorize Xero, ensure that you already have an account created on Xero.

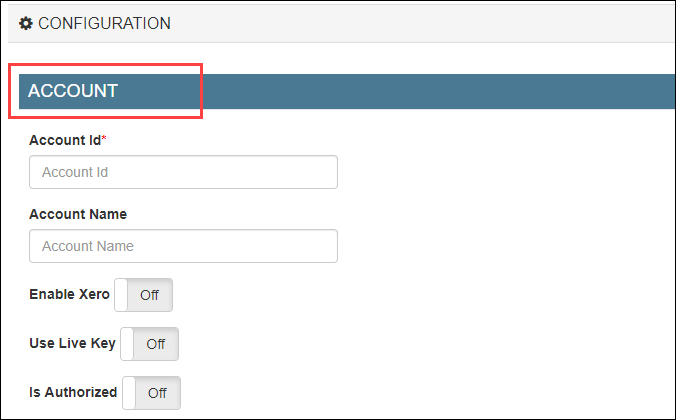

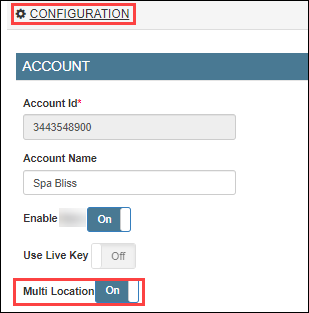

To set up your Xero account details in Zenoti

If you are not on the integration page, based on where you want to set up the integration, click on the Configurations icon.

Click the Integrations tab.

Select Accounting.

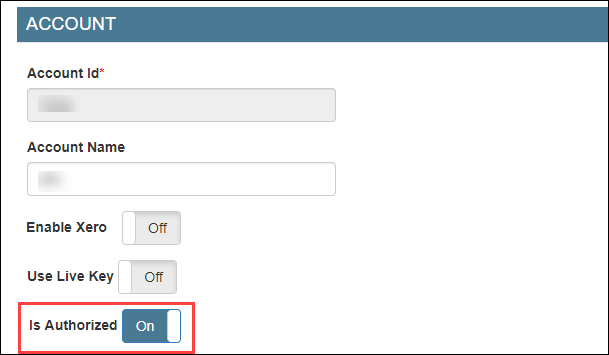

Under the Configuration tab, expand the Account section.

You can see the fields relevant to Xero integration.

Enter the following details:

Account Id: Enter an identifier for your business. This can be any random combination of numbers. Zenoti will use this id while creating a company for your business in POSAccounting (a third-party connector for accounting integrations in Zenoti).

For example, 34567821.

Account Name: Enter the company name of your business. You may use the same name that you’ve provided in Xero.

For example, Spa Bliss.

Enable Xero: Select this switch to enable integration.

If you want to pause the sync, you can turn off this switch.

Use Live Key: If you want to test the integration, turn off this switch. After you are ready to integrate data, you must turn on this switch.

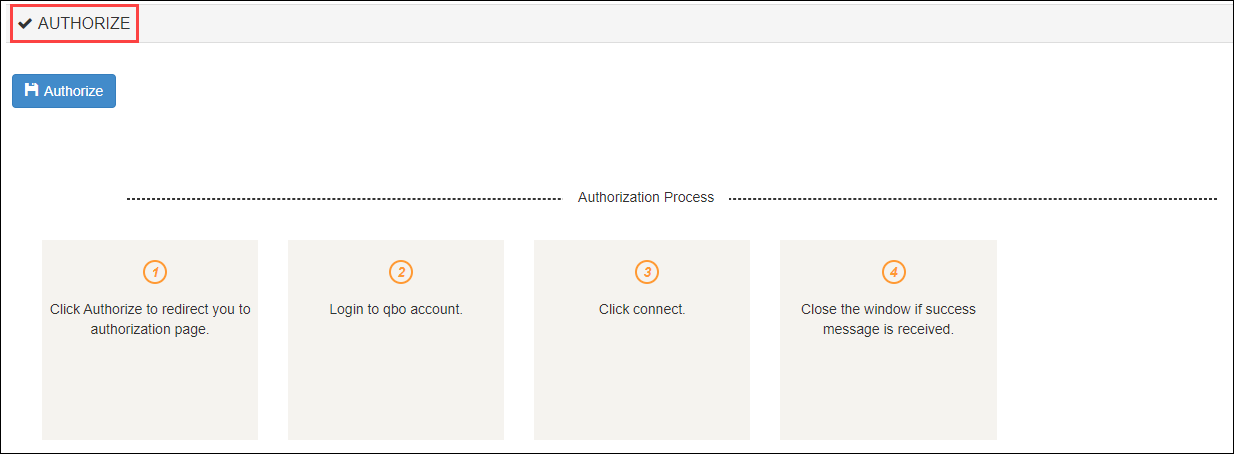

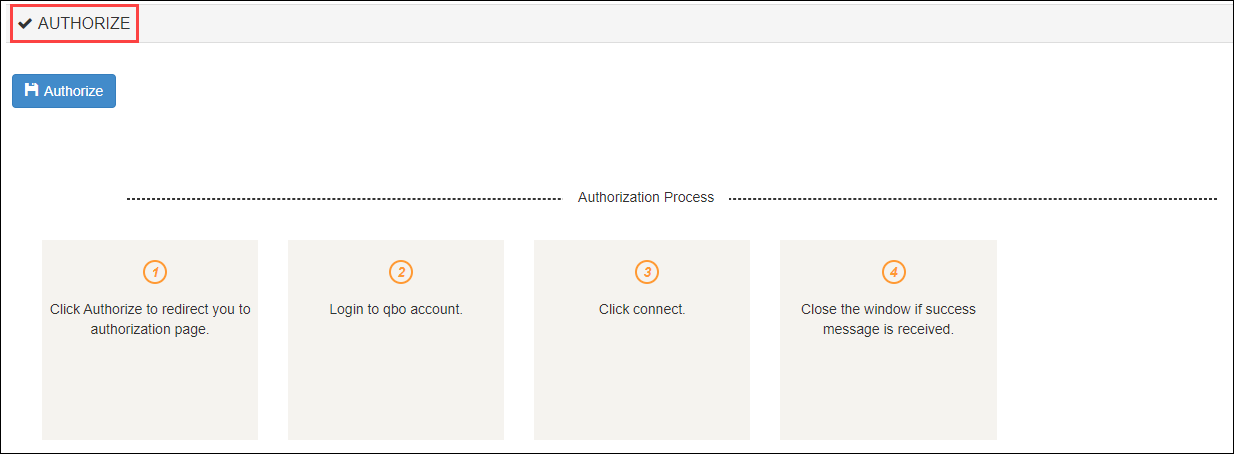

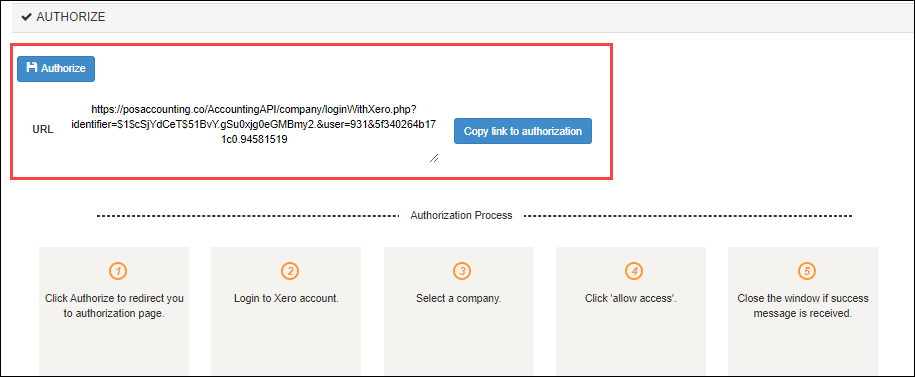

To authorize Zenoti to access your Xero account

Caution

This tab will be visible only after you configure the invoice and sync settings in the Configuration tab.

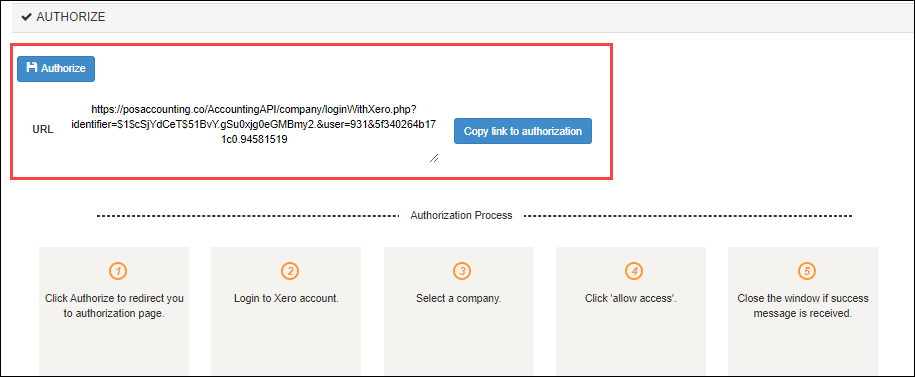

Expand the Authorize tab.

Click the Authorize button.

A new tab opens that will ask you for access to your Xero account to Zenoti.

Important

For some technical reasons, if the new tab does not open, you can see the authorization link in the Authorize section.

Copy and paste the authorization link in a new tab and press Enter.

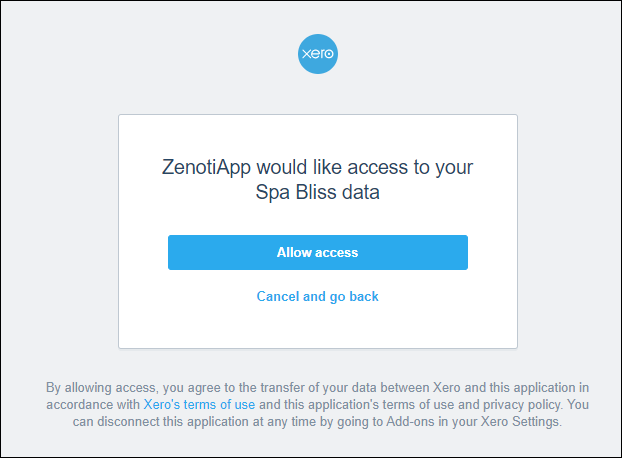

If you have a single organization created for your business on Xero, you will see the following window:

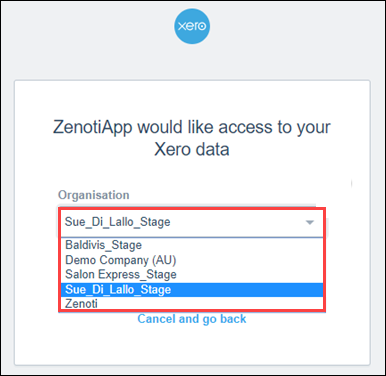

However, if you have multiple organizations created for your business on Xero, you will see the following window:

Select the organization to which you want to give access to Zenoti.

Click Allow access.

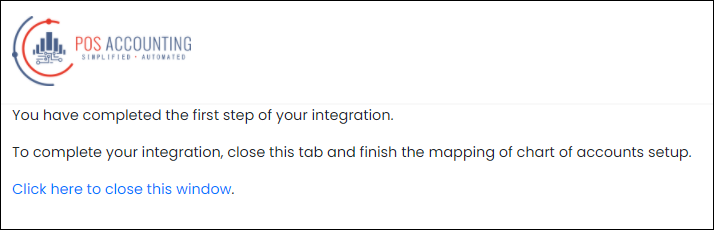

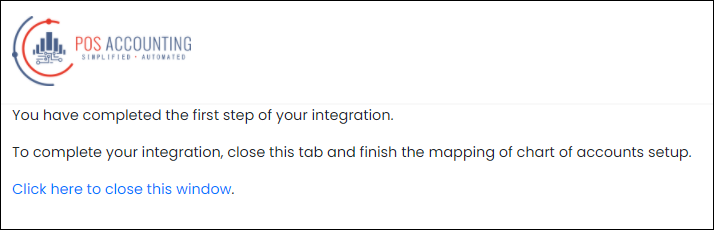

Zenoti now has access to your Xero account and you will see the following message.

To close the window, click Click here to close this window.

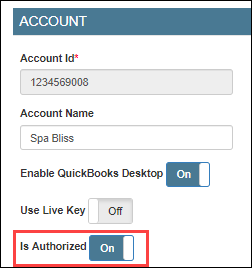

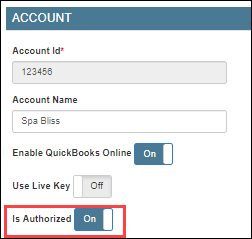

Turn on the Is Authorized switch.

Click Save.

You’ve completed the authorization process for Xero.

Next step

If you've created locations in Xero, you must configure the location details. However, if you have not created locations in Xero, you must follow these steps (configure without location details).

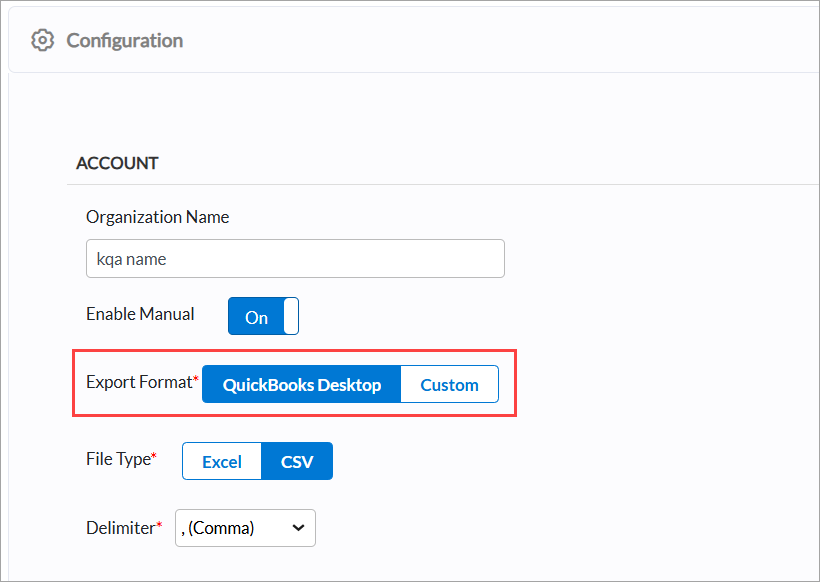

Set up and authorize QuickBooks Desktop accounting

QuickBooks Desktop (QBDT) is an on-premise accounting software that allows you to track financials.

Zenoti's integration with QBDT enables you to sync the financial data from Zenoti to your QBDT account.

Before you begin to set up and authorize QBDT, ensure that you have an account already created on QBDT and you’ve installed the QuickBooks Web Connector for Zenoti.

To set up your QuickBooks Desktop account details in Zenoti

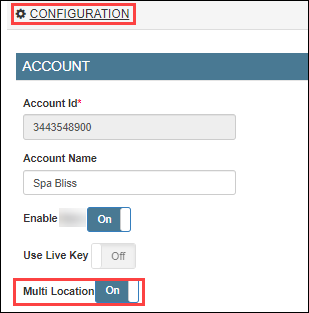

At the organization level, click the Configurations icon.

Click the Integrations tab and expand Accounting.

Under the Configuration tab, expand the Provider section.

Select quickbooks Desktop as the accounting platform.

Click Continue.

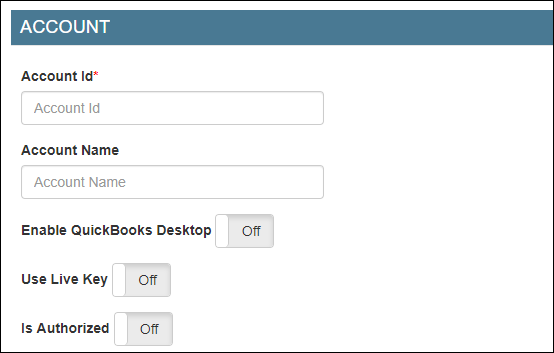

The Configurations tab expands and you can see the fields relevant to QuickBooks Desktop integration.

Enter the following details:

Account Id: Enter an identifier for your business. This can be any random combination of numbers. Zenoti will use this id while creating a company for your business in POSAccounting (a third-party connector for accounting integrations in Zenoti).

For example, 34567821.

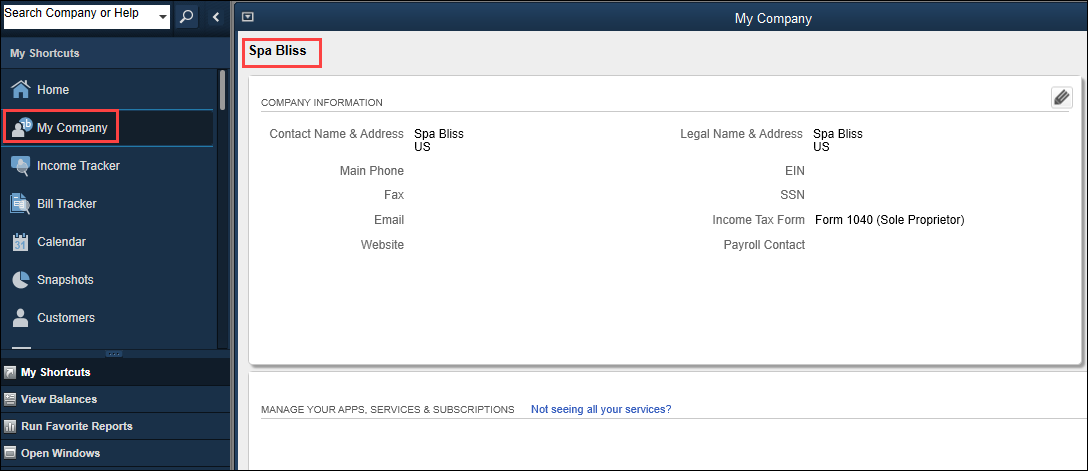

Account Name: Enter the company name of your business. You may use the same name that you’ve provided in QuickBooks.

For example, Spa Bliss.

Enable QuickBooks Desktop: Select this switch to enable the integration for the desktop version of the accounting platform.

If you want to pause the sync, you can turn off this switch.

Use Live Key: If you want to test the integration, turn off this switch. After you are ready to integrate data, you must turn on this switch.

To authorize Zenoti to access your QuickBooks Desktop account

Disclaimer

This tab will be visible only after you configure the invoice and sync settings in the Configuration tab.

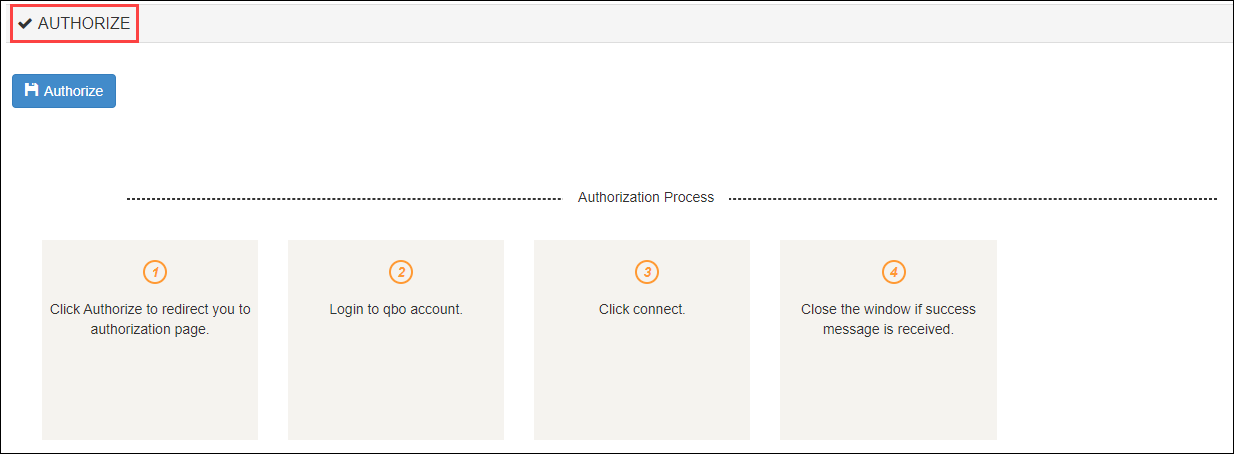

Expand the Authorize tab.

Click the Authorize button.

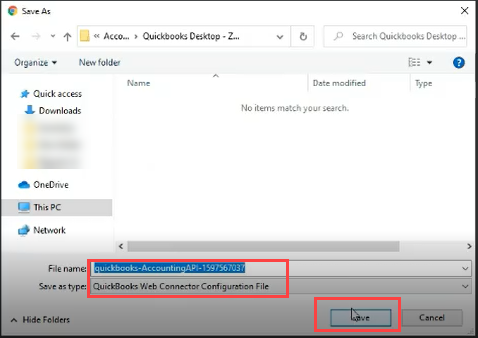

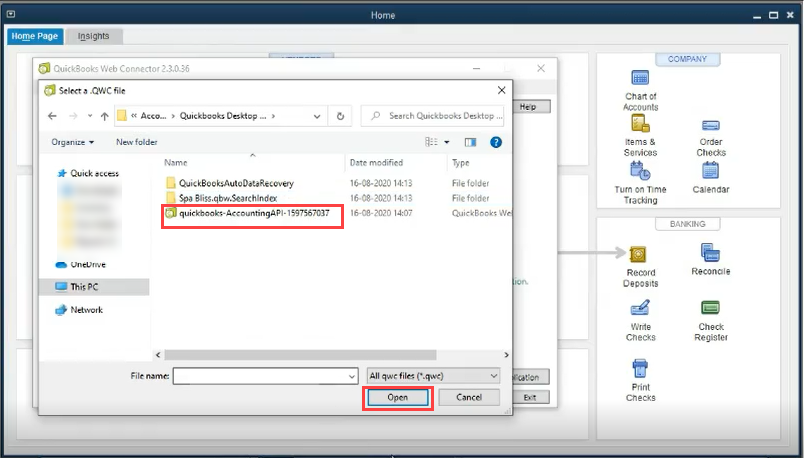

The quickbooks-AccountingAPI file downloads on your local machine.

Select the location where you want to download the file and click Save.

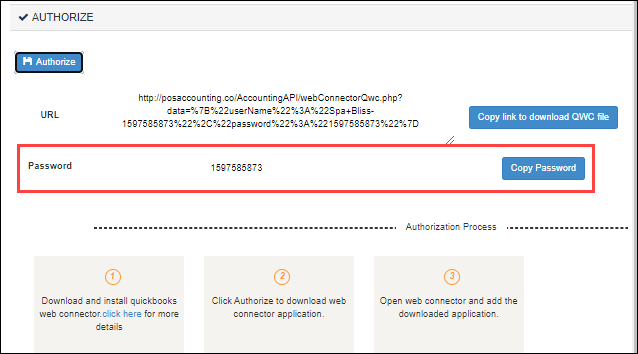

Navigate back to the Zenoti integrations page and you can see the API password.

This is an auto-generated password. Keep this password handy as you will need in (Step: 13) while authorizing the API in Quickbooks web services.

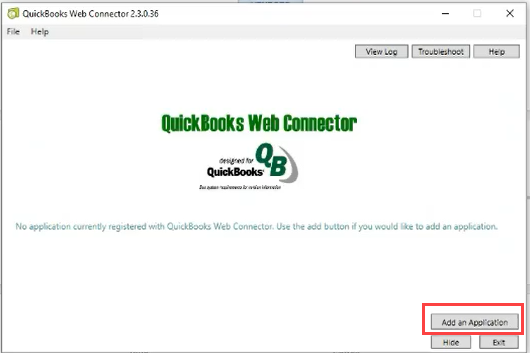

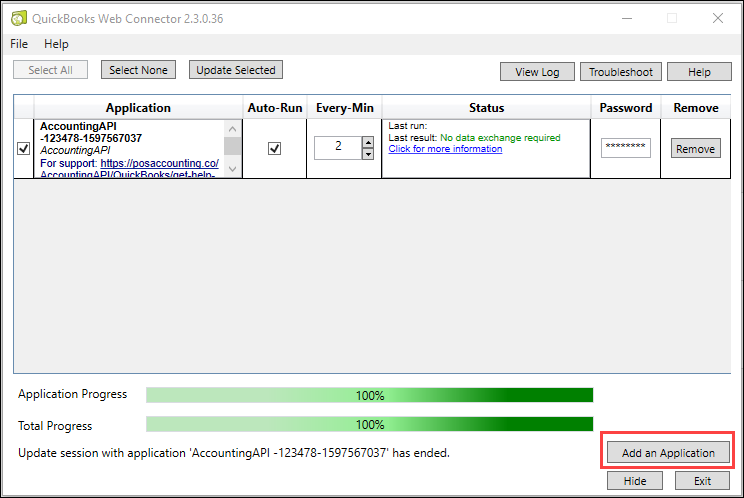

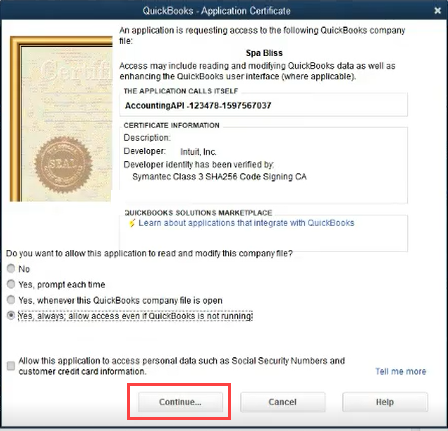

Open the QuickBooks Web Connector application from your local machine.

If you are a new user, you will see the following screen:

If you are an existing user, you will see the following screen:

Click Add an Application.

Open the quickbooks-AccountingAPI file that you’ve saved in step 3.

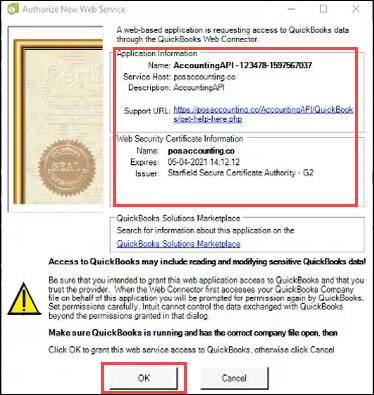

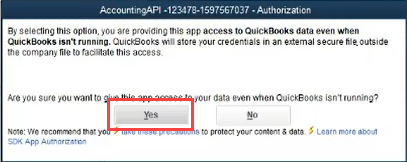

Click Ok to authorize the QuickBooks web service.

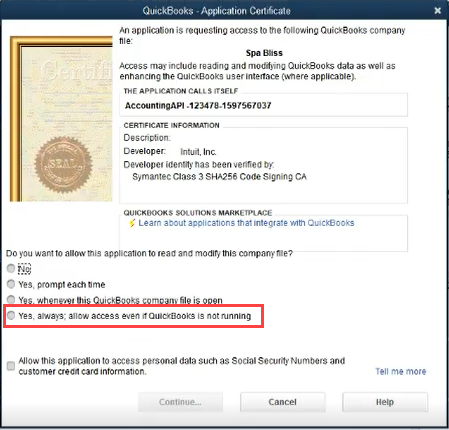

The QuickBooks - Application Certificate dialog box appears.

Select the Yes, always; allow access even if QuickBooks is not running option.

A confirmation dialog box appears.

Click Yes.

Click Continue.

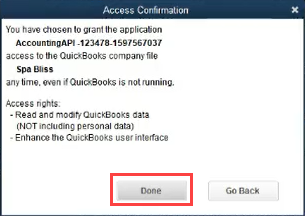

Click Done.

You’ve allowed access to the QuickBooks web service.

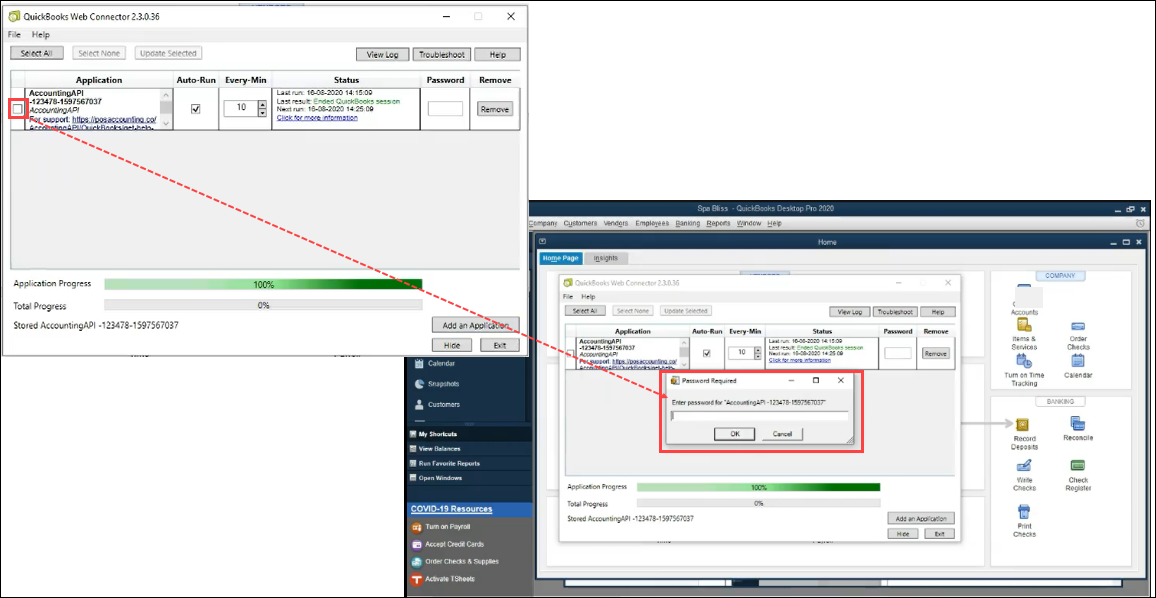

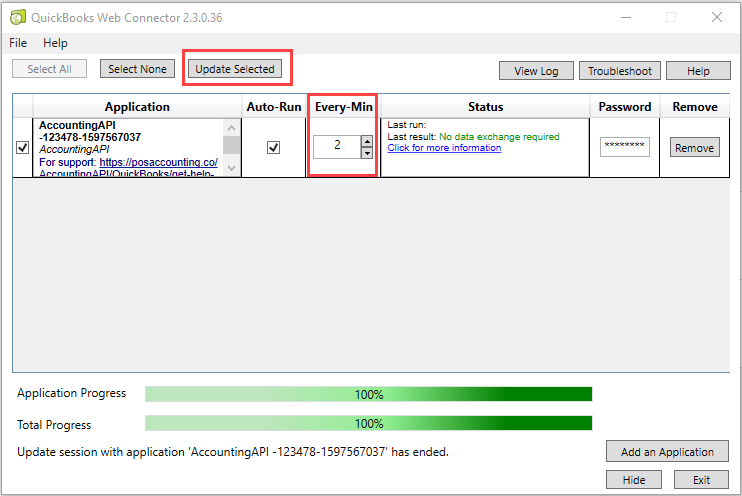

On the QuickBooks: Web Connector window, click the Application checkbox and enter the password that you copied from the Zenoti integration page (Step: 4).

Click Ok.

Click Update Selected to test the connection between QuickBooks web-services and POSAccointing API (Zenoti).

(Optional) By default the auto-sync is set to 10 minutes. You can update this duration in the Every-Min box.

Navigate back to the Zenoti integration page and turn on the Is Authorized switch.

Click Save.

You’ve completed the authorization process for QuickBooks Desktop.

Next step

If you've created locations in QuickBooks Desktop, you must configure the location details. However, if you have not created locations in QuickBooks Desktop, you must follow these steps (configure without location details).

Configure QuickBooks Desktop accounting with location details

Important

Ensure that you’ve created locations (classes) in QuickBooks Desktop.

To create tracking categories in QuickBooks Desktop

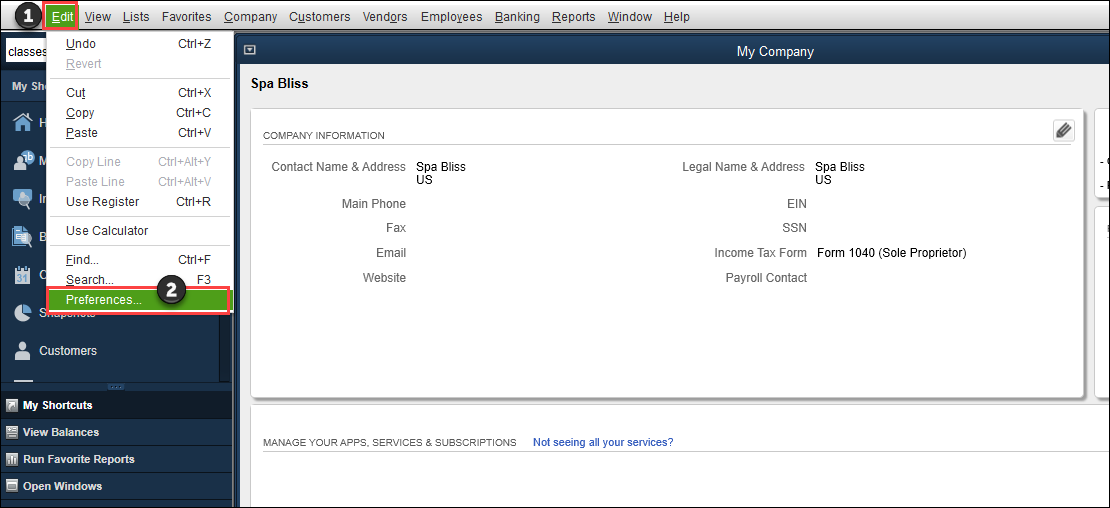

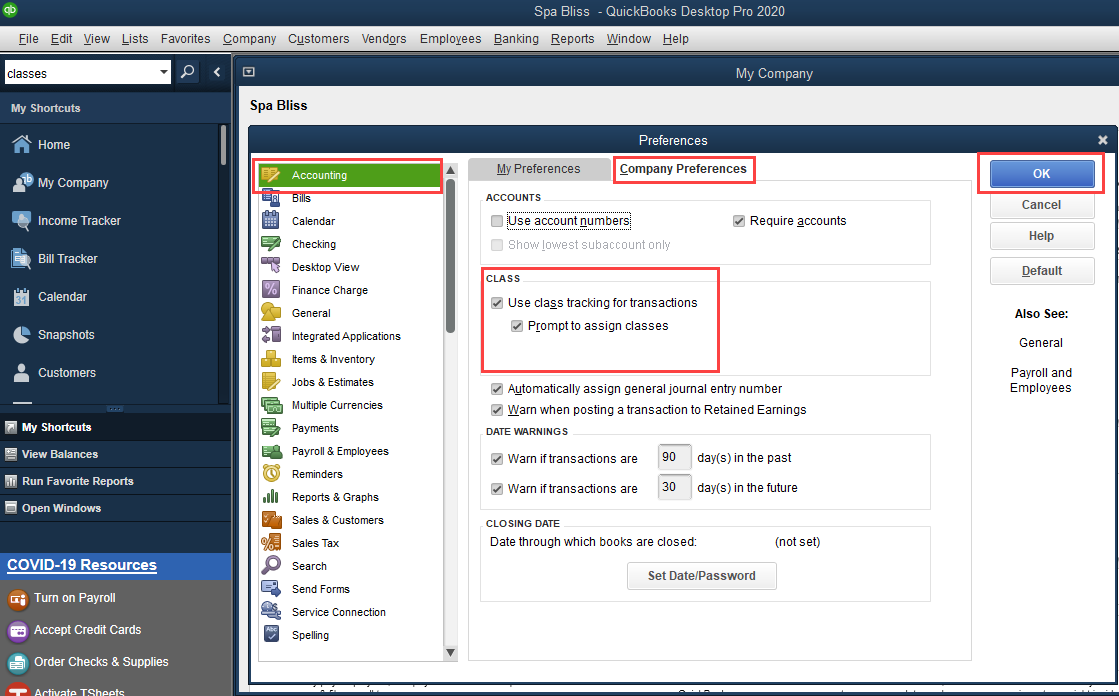

Login to your QuickBooks Desktop account.

Click Edit.

Click Preferences.

Click Accounting > Company Preferences.

Under the Class section, select the Use class tracking for transactions and Prompt to assign classes.

Click Ok.

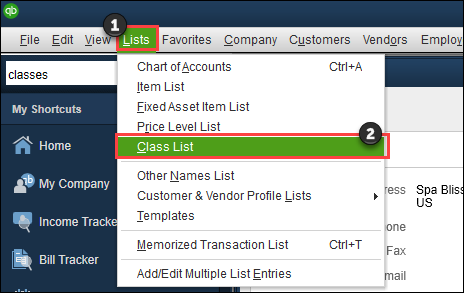

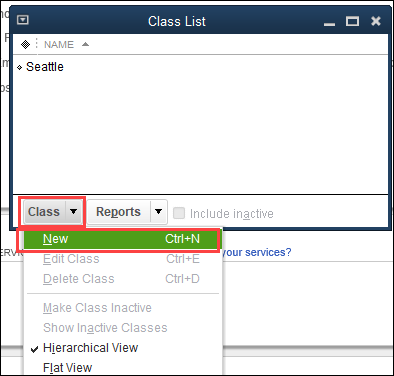

Navigate to Lists and click Class List.

To add a new class, from the Class menu, select New.

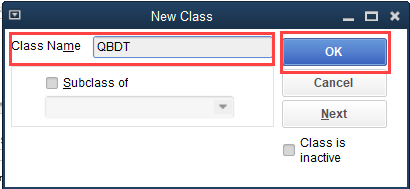

In the Class Name box, enter the name of the class. Keep this information handy to map the category options as location names in Zenoti.

Click Ok.

The class is created.

To configure location details in Zenoti

Navigate to the Integrations page.

Organization level:

Click the Configurations icon.

Click Integrations.

Center level:

Click the Configurations icon.

Click Integrations.

Select Accounting.

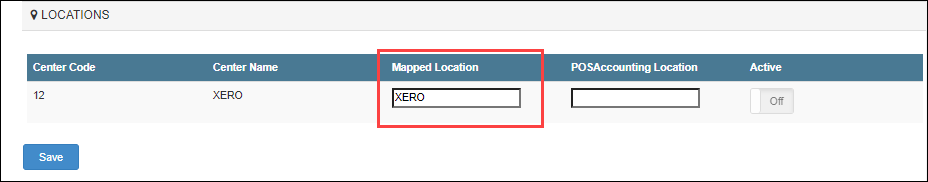

Expand the Configuration tab and navigate to the Account section.

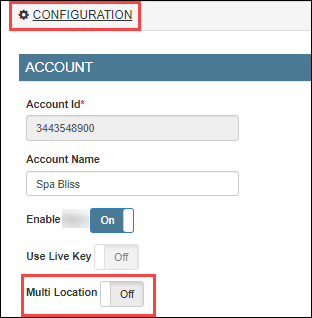

Turn on the Multi-Location switch.

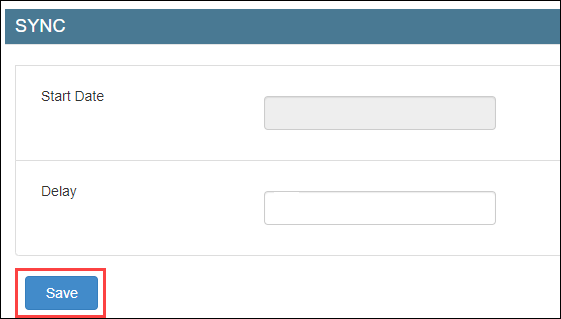

Navigate to the Sync section and click Save.

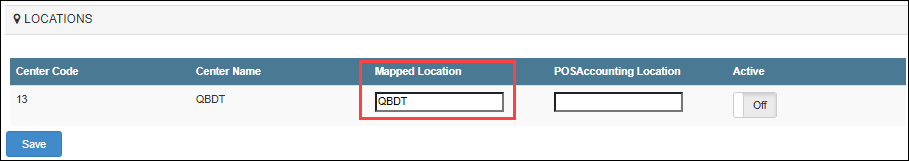

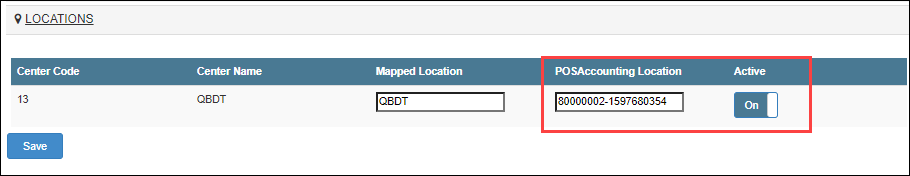

Expand the Locations tab.

In the Mapped Location box, enter the category option that you’ve entered in QuickBooks Desktop (Step 9 of location creation in QuickBooks Desktop).

Click Save.

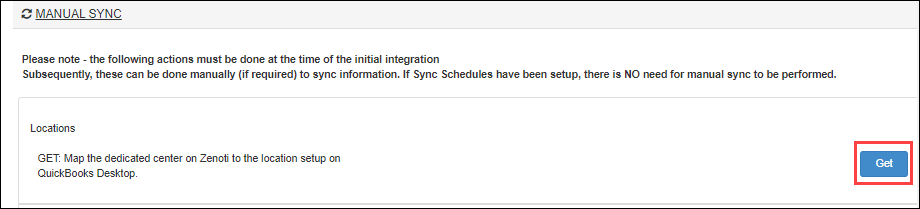

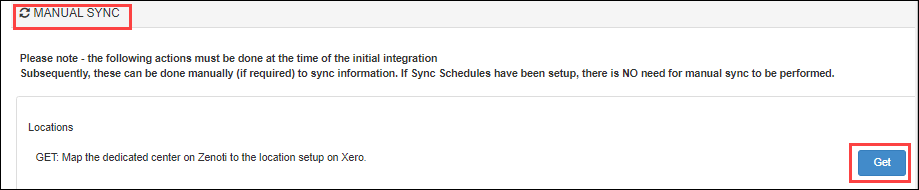

Expand the Manual Sync tab.

Click Get to sync the locations.

Expand the Locations tab.

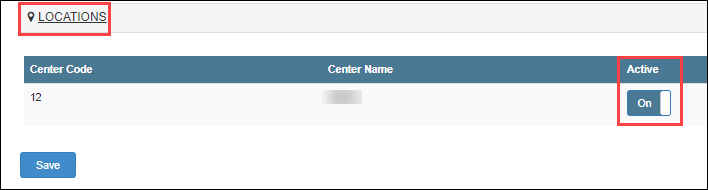

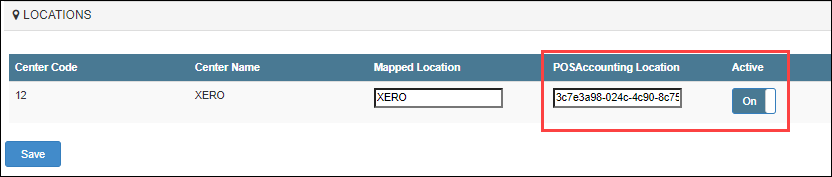

Verify that the POSAccounting Location is updated and the Active switch is enabled.

You’ve completed locations mapping for QuickBooks Desktop.

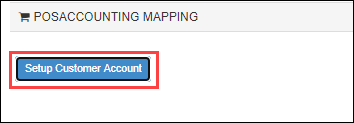

To add locations in POSAccounting

Note

Ensure that you’ve completed mapping in the POSAccounting application.

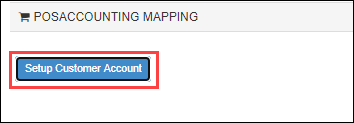

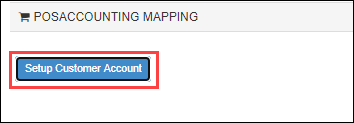

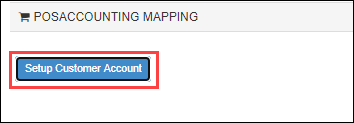

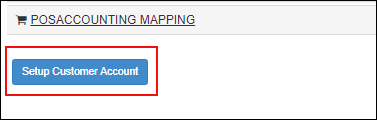

Navigate and expand the POSAccounting Mapping tab.

Click Setup Customer Account.

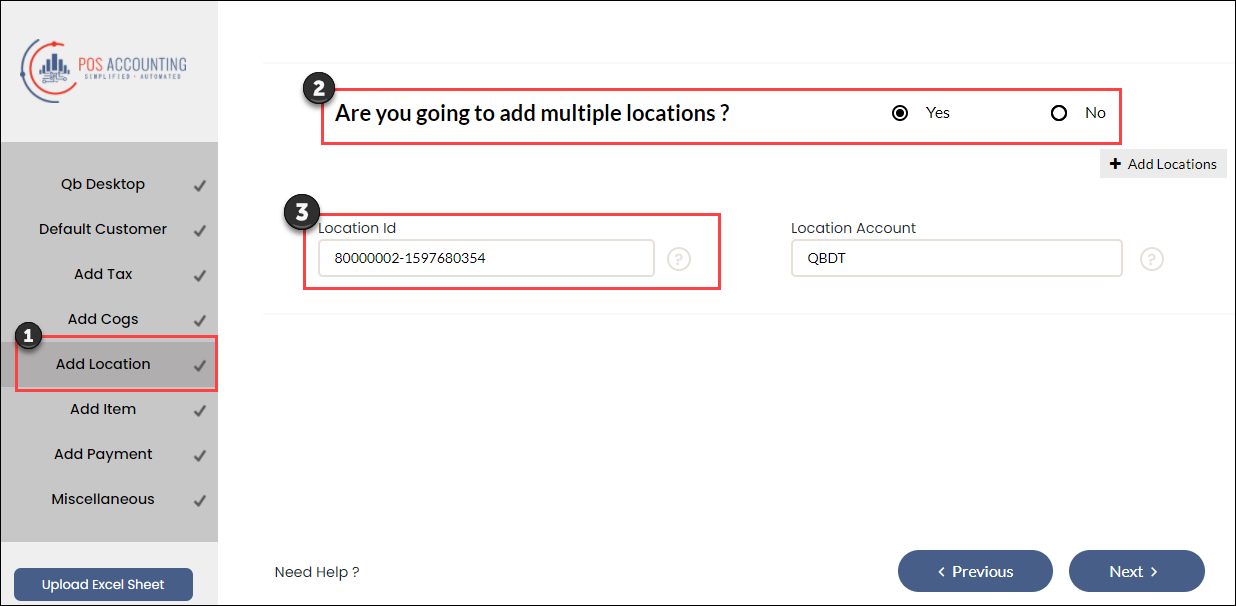

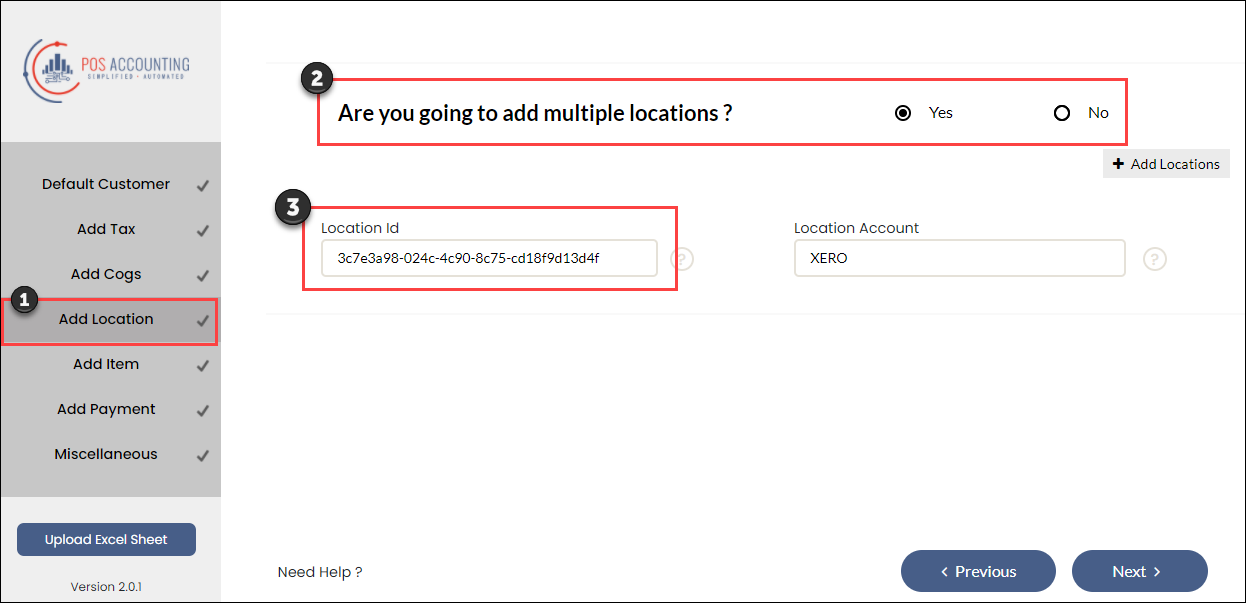

The POSAccounting page opens.

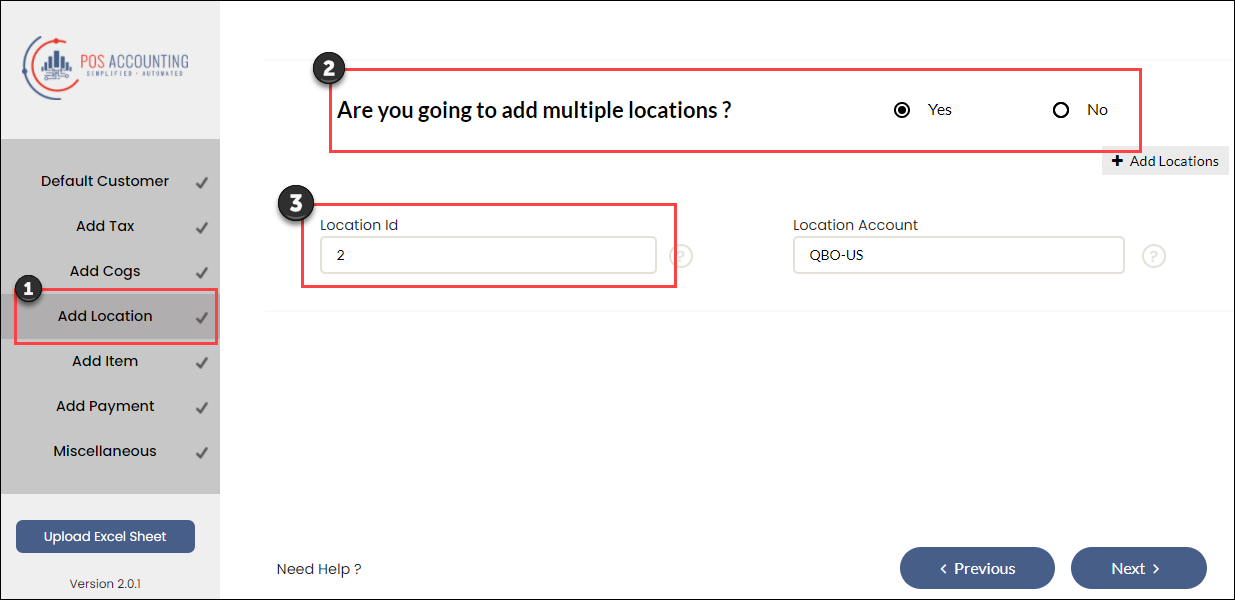

Navigate to Add Location.

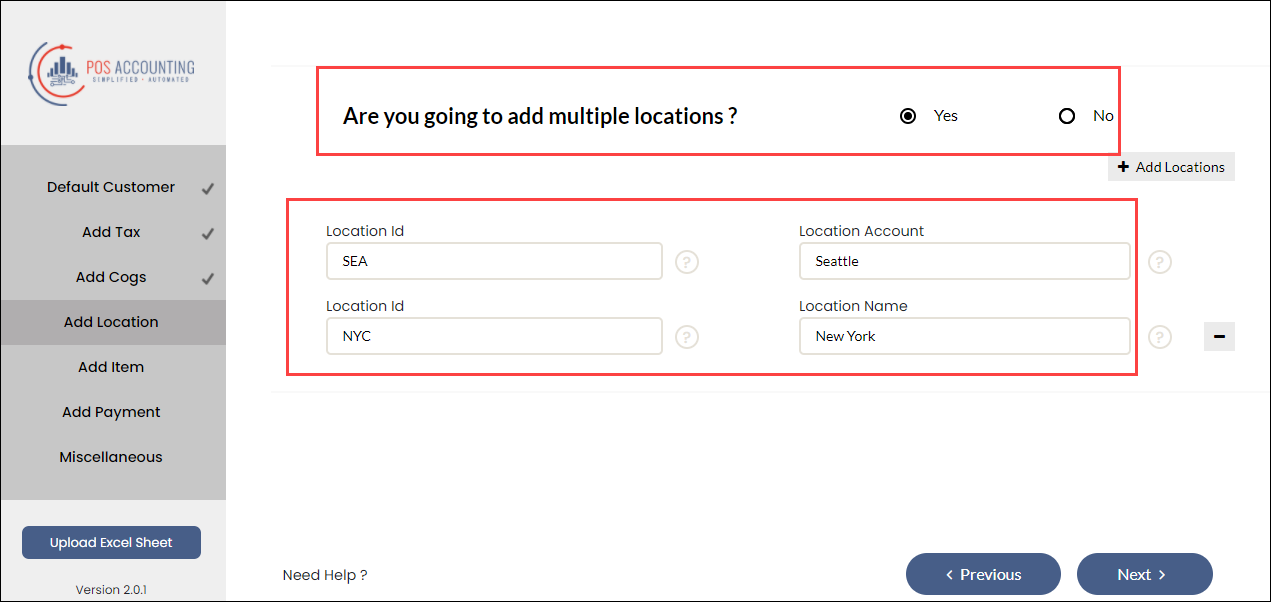

Select Yes for multiple locations.

Enter the POSAccounting Location (Step 11 while configuring locations in Zenoti) as the Location id in POSAccounting.

Enter the class (in QuickBooks Desktop) as Location Account in POSAccounting.

Next step

Set up and authorize QuickBooks Online accounting

QuickBooks Online (QBO) is an online accounting software that allows you to track financials.

Zenoti's integration with QBO enables you to sync the financial data from Zenoti to your QBO account.

Before you begin to set up and authorize QBO, ensure that you have an account already created on QBO.

To set up your QuickBooks Online account details in Zenoti

At the organization level:

Click the Configurations icon.

Expand the Integrations tab.

At the center level:

Click the Configurations icon.

Expand the Integrations tab.

Select Accounting.

Under the Configuration tab, expand the Provider section.

Select QuickBooks Online as the accounting platform.

Click Continue.

The Configurations tab expands and you can see the fields relevant to QuickBooks Online.

Enter the following details:

Account Id: Enter an identifier for your business. This can be any random combination of numbers. Zenoti will use this id while creating a company for your business in POSAccounting (a third-party connector for accounting integrations in Zenoti).

For example, 1234.

Account Name: Enter the company name of your business. You may use the same name that you’ve provided in QuickBooks.

For example, Spa Bliss.

Enable QuickBooks Online: Select this switch to enable the integration for the online version of the accounting platform.

If you want to pause the sync, you can turn off this switch.

Use Live Key: If you want to test the integration, turn off this switch. After you are ready to integrate data, you must turn on this switch.

Note

Zenoti calculates tax amounts accurately and consistently. These values match exactly with QuickBooks Online, eliminating discrepancies during reconciliation. For example, if an invoice shows $1,190.65 in tax in Zenoti, the same amount will appear in QBO.

Zenoti records delayed refunds as separate transactions to ensure accurate syncing with accounting systems. This avoids data mismatches, reduces manual adjustments, and maintains clear audit trails.

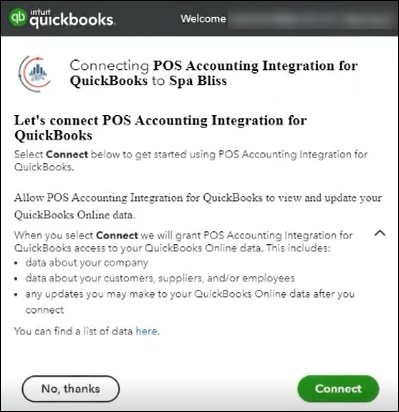

To authorize Zenoti to access your QuickBooks Online account

Disclaimer

This tab will be visible only after you configure the invoice and sync settings in the Configuration tab.

Expand the Authorize tab.

Click the Authorize button.

A new tab opens that will ask you to give access to your QuickBooks account to Zenoti.

Important

For some technical reasons, if the new tab does not open, you can see the authorization link in the Authorize section.

Copy and paste the authorization link in a new tab and press Enter.

If you have a single organization created for your business on QuickBooks, you will see the following window:

Click Connect.

Zenoti now has access to your QuickBooks account and you will see the following message.

To close the window, click Click here to close this window.

Turn on the Is Authorized switch.

Click Save.

Next step

If you've created locations in QuickBooks Online, you must configure the location details. However, if you have not created locations in QuickBooks Online, you must follow these steps (configure without location details).

Configure QuickBooks Online accounting with location details

Before you begin, ensure that you’ve created locations (tracking categories) in QuickBooks Online.

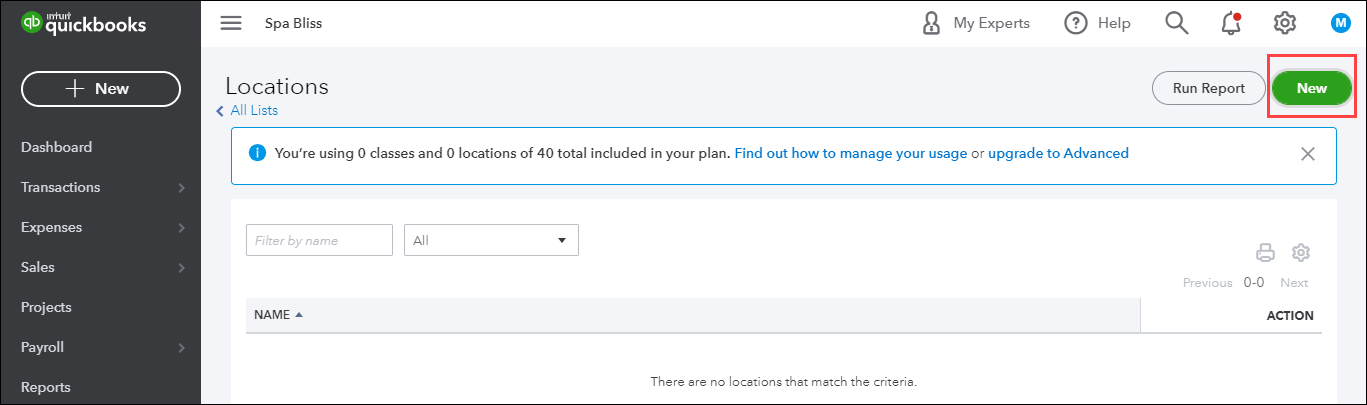

To create tracking categories in QuickBooks Online

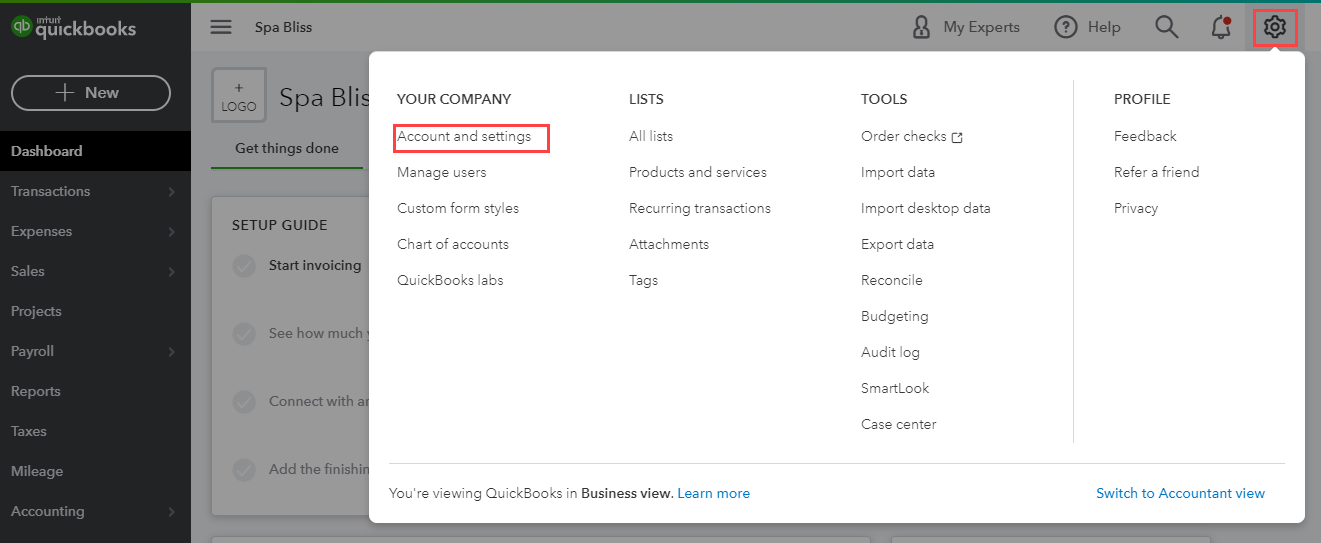

Login to your QuickBooks Online account.

Click the settings icon.

Click Account and settings.

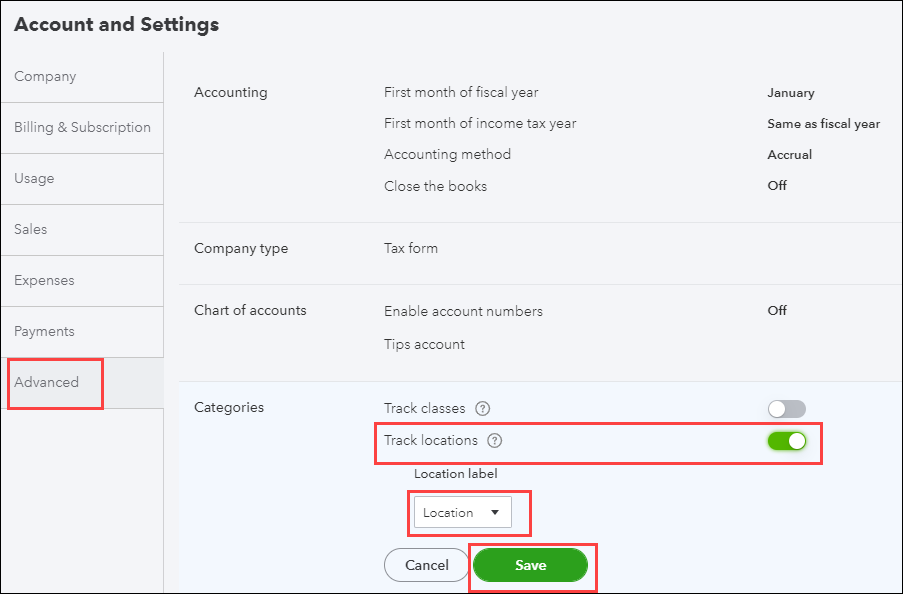

Click Advanced.

Turn on the Track locations switch.

From the Location label drop-down list, select Location as only this location label is supported by Zenoti.

Click Save.

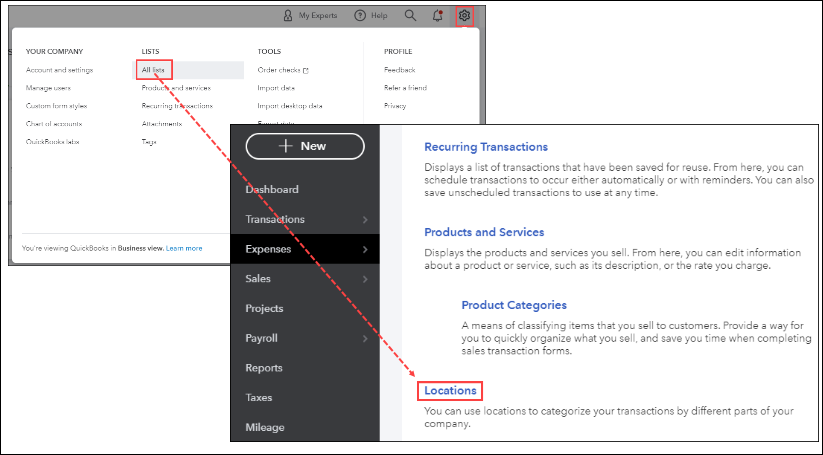

Click the settings button on the upper-right corner of the screen.

Click All Lists.

You can see that the Locations section is enabled.

Click Locations.

The list of locations page appears where you can see existing locations, if any.

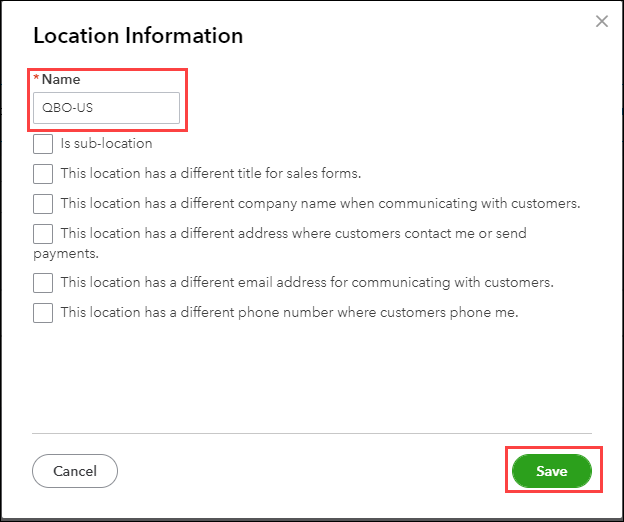

To add a new location, click New.

Enter the location name.

Click Save.

The location is created in your QuickBooks Online account.

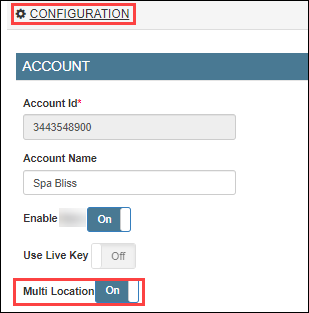

To configure location details in Zenoti

At the organization level, click the Configuration icon.

At the center level, click the Configuration icon.

Navigate to Integrations tab.

Select Accounting.

Expand the Configuration tab and navigate to the Account section.

Turn on the Multi-Location switch.

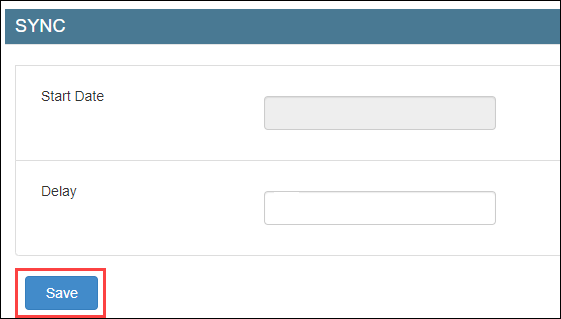

Navigate to the Sync section and click Save.

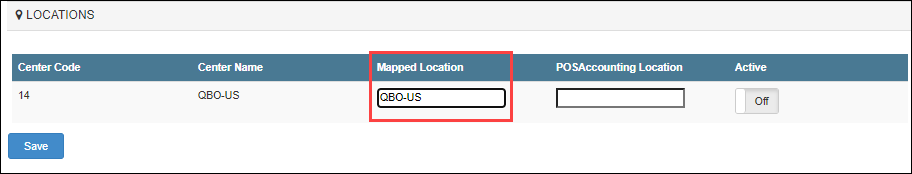

Expand the Locations tab.

In the Mapped Location box, enter the category option that you’ve entered in QuickBooks Online (Step 12 of location creation in QuickBooks Online).

Click Save.

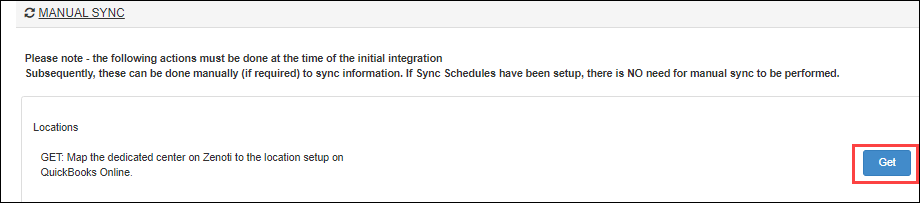

Expand the Manual Sync tab.

Click Get to sync the locations.

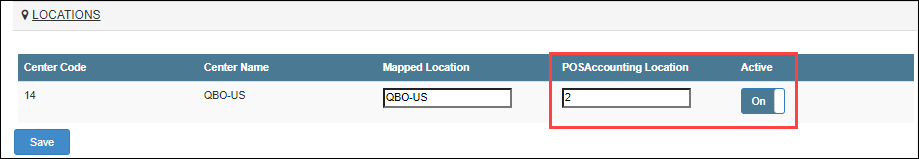

Expand the Locations tab.

Verify that the POSAccounting Location is updated and the Active switch is enabled.

You’ve completed mapping locations for QuickBooks Online.

To add locations in POSAccounting

Note

Before you add locations in POSAccountnig, ensure that you’ve completed mappings in the POSAccounting application.

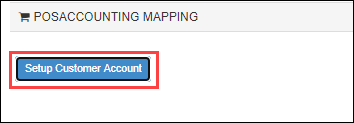

Navigate and expand the POSAccounting Mapping tab.

Click Setup Customer Account.

The POSAccounting page opens.

Navigate to Add Location.

Select Yes for multiple locations.

Enter the center code (in Zenoti) as the Location id in POSAccounting.

Enter the category option (in QuickBooks Online) as Location Account in POSAccounting.

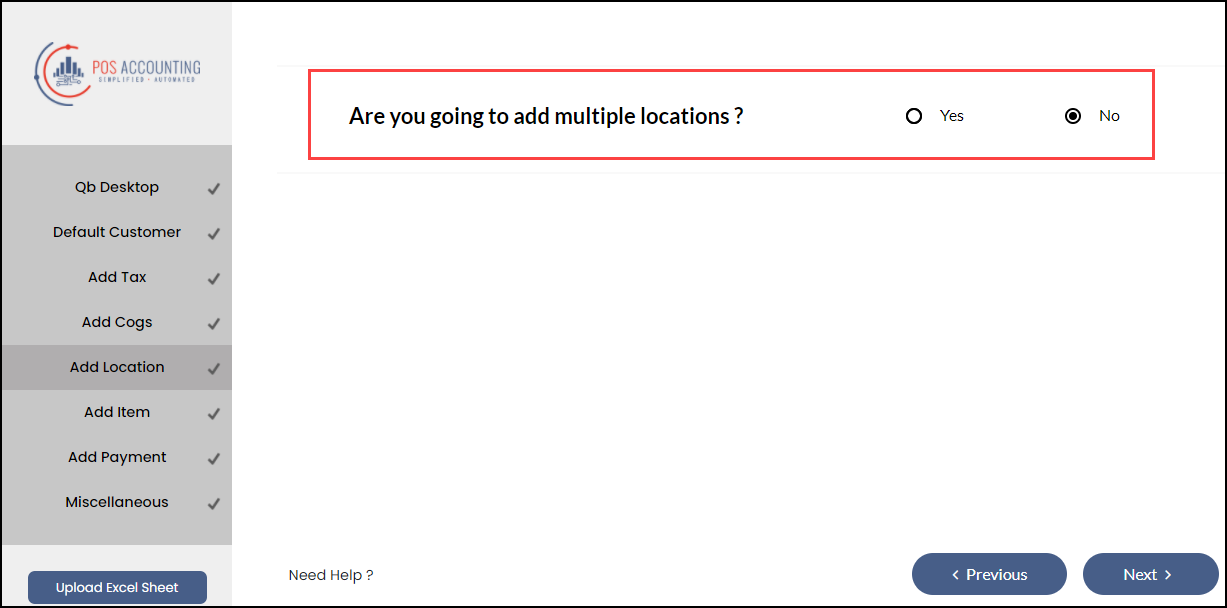

Configure accounting integration without location details

Note

Follow these steps if you’ve not created locations in your accounting platform.

Navigate to the Integrations tab.

Organization level:

Click the Configuration icon.

Click the Integrations tab.

Center level:

Click the Configuration icon.

Click the Integrations tab.

Select Accounting.

Expand the Configuration tab and navigate to the Account section.

Turn off the Multi-Location switch.

5. Navigate to the Sync section Click Save.

6. While setting up the POSAccounting mapping, you must select No for multi- locations.

Important

Under the Locations tab, ensure that the Active switch is turned on for the required center (for center level) or centers (if you are at the organization level).

This is to let Zenoti know that data has to be synced for the selected centers.

You’ve completed the configuration.

Next step

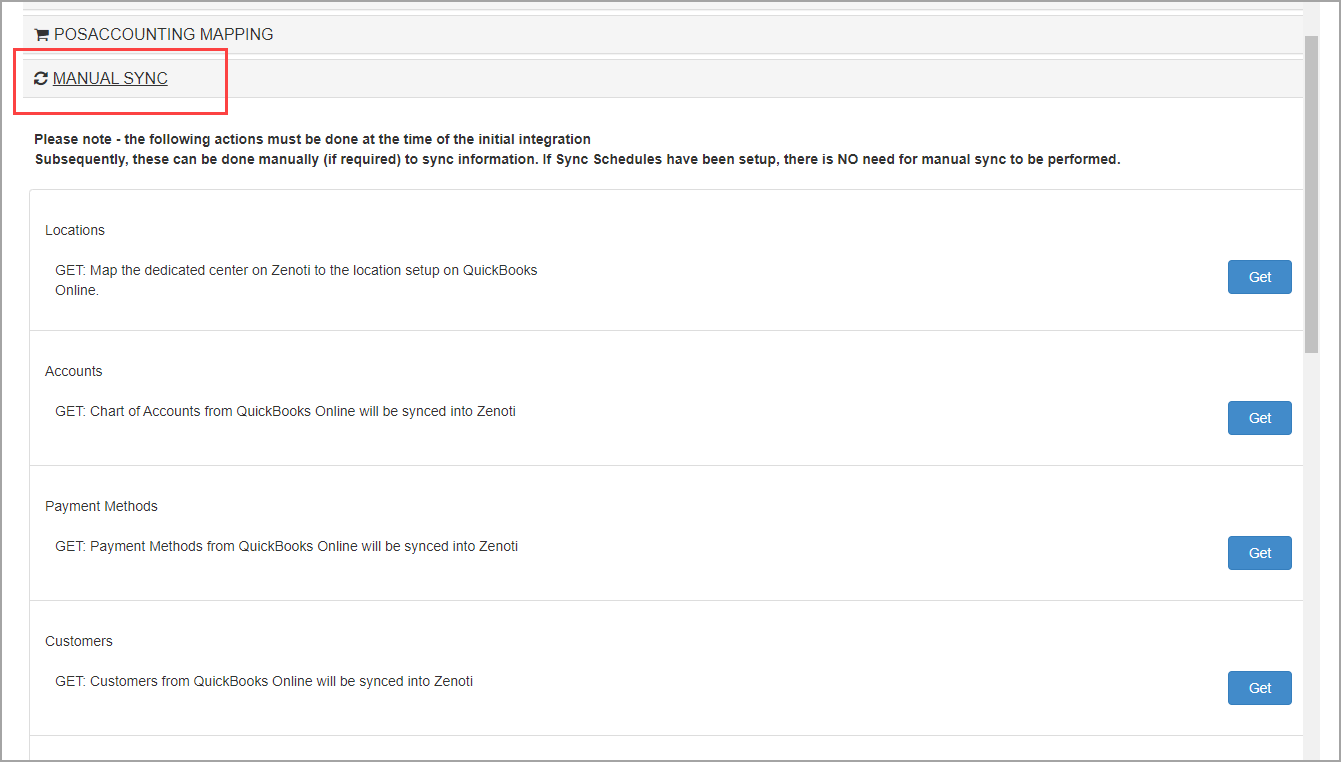

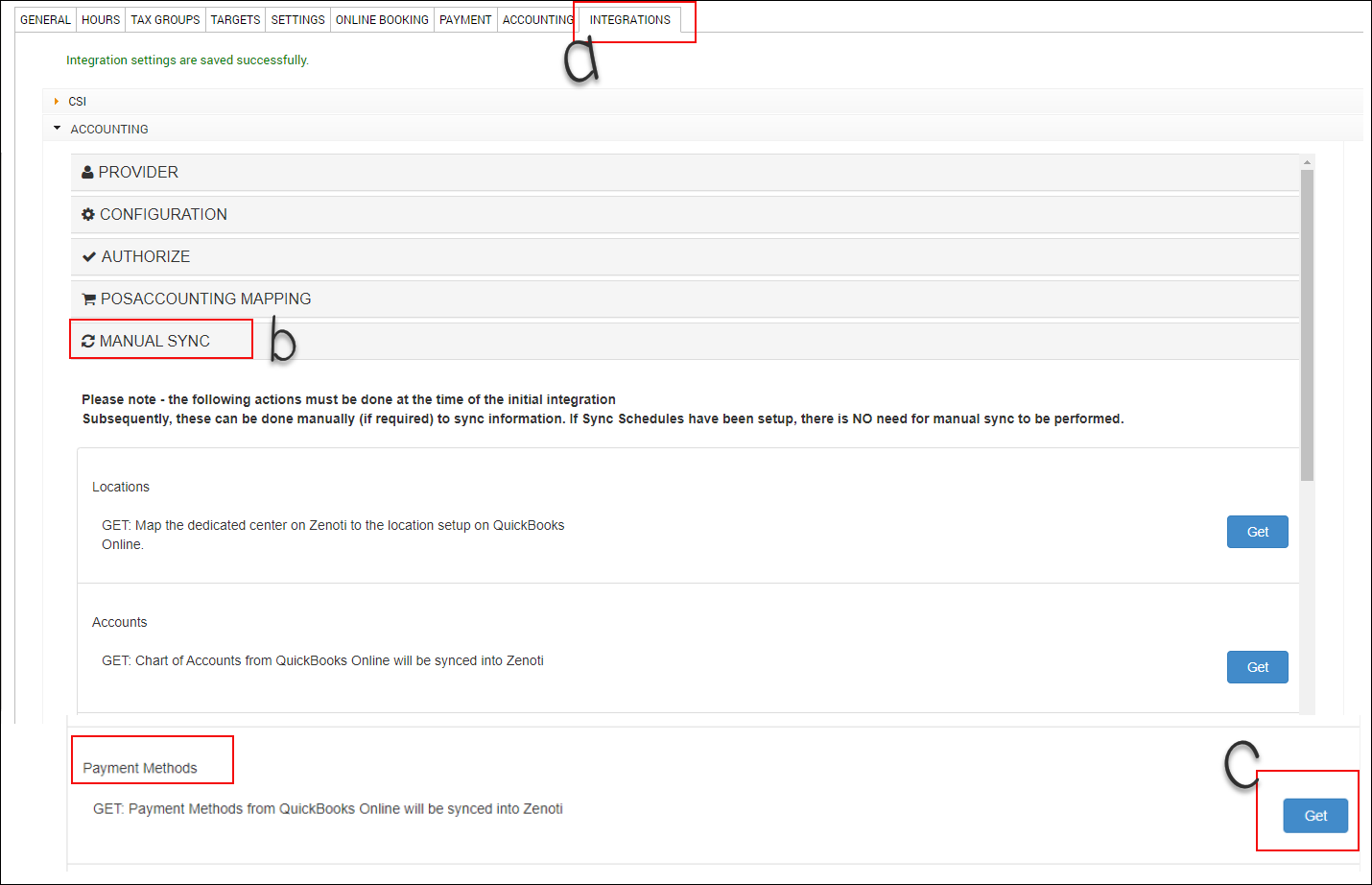

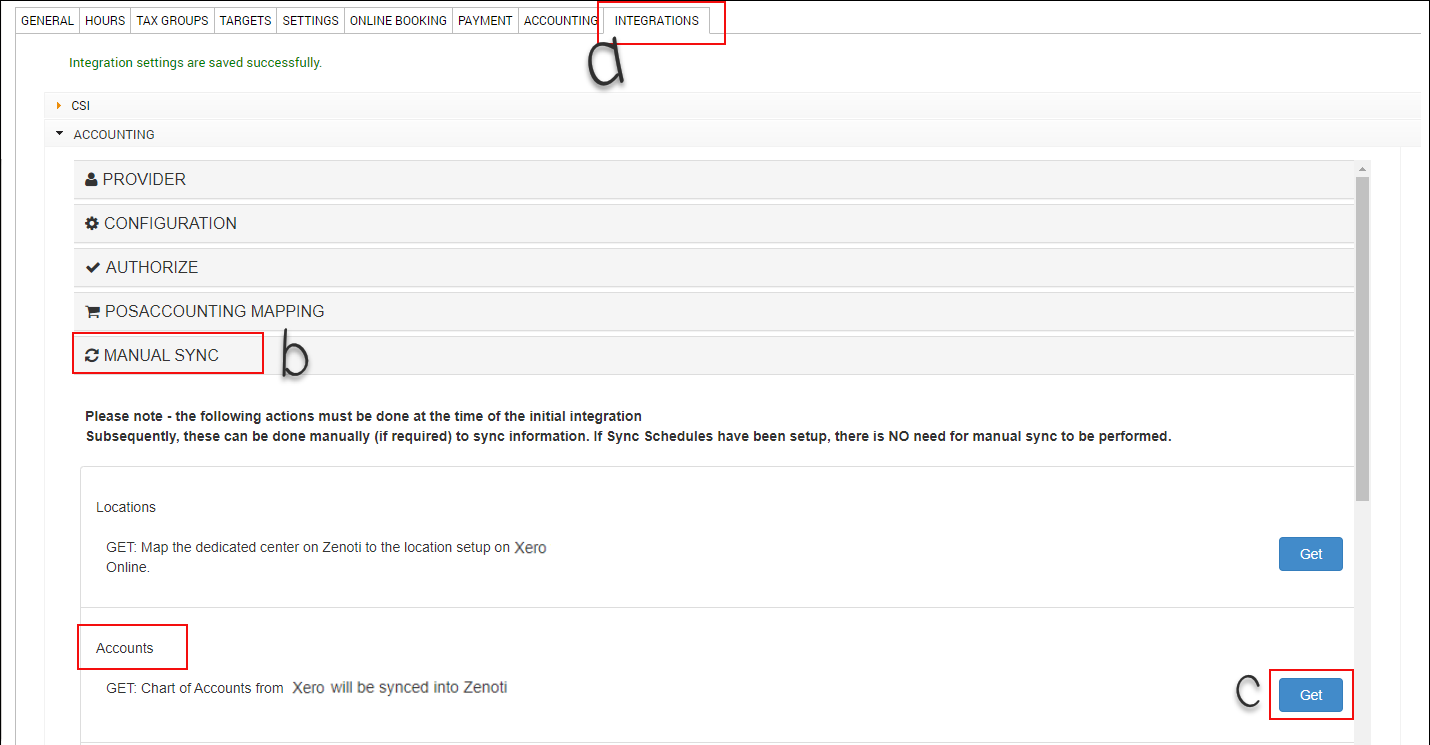

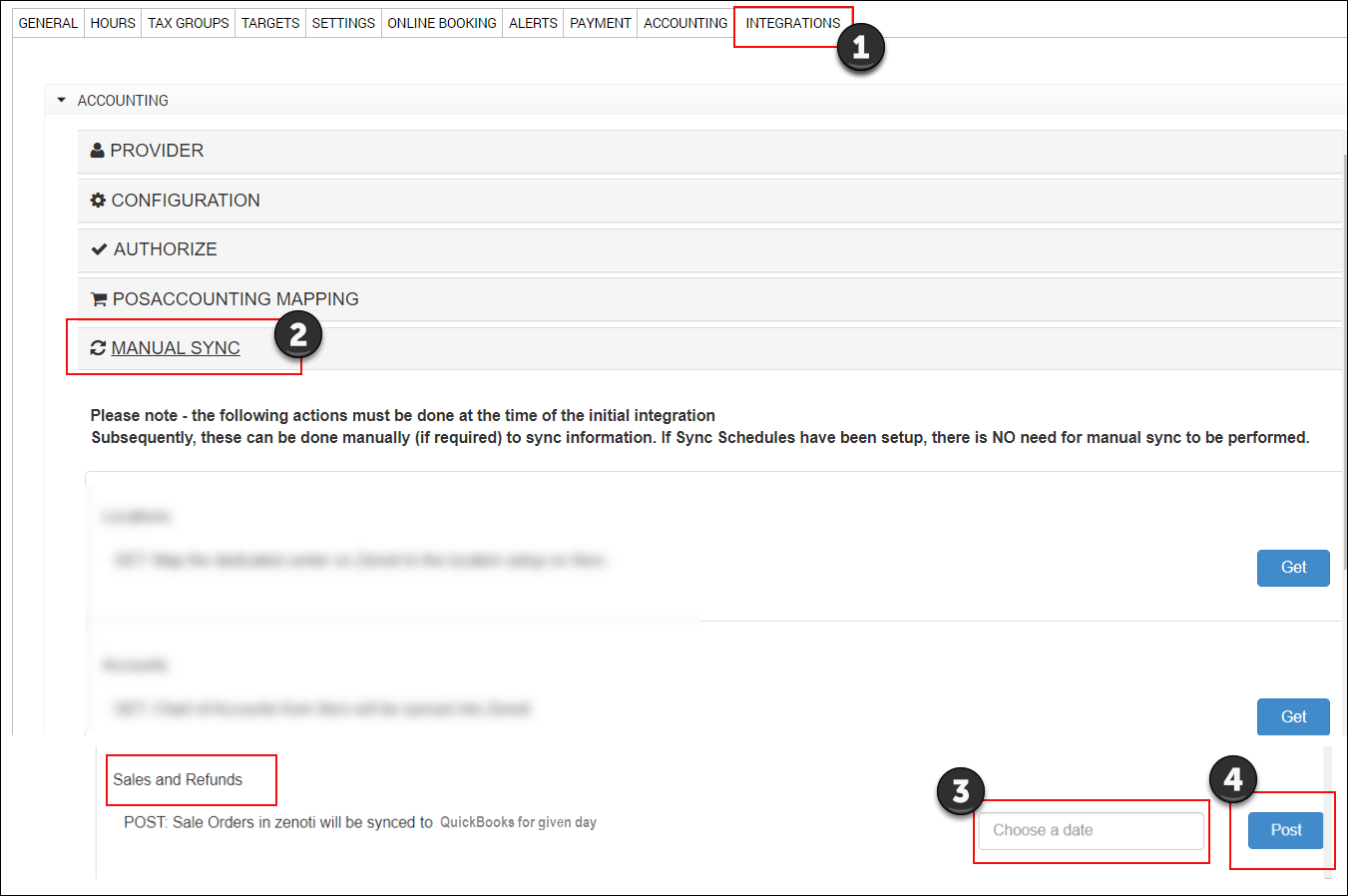

Manual sync for accounting integration

After you’ve completed mapping, you can start syncing the data from Zenoti to the accounting platform.

Navigate to the Integrations page.

At the organization level:

Click the Configuration icon.

Go to the Integrations tab.

At the center level:

Click the Configuration icon.

Go to the Integrations tab.

Select Accounting.

Expand the Manul Sync tab.

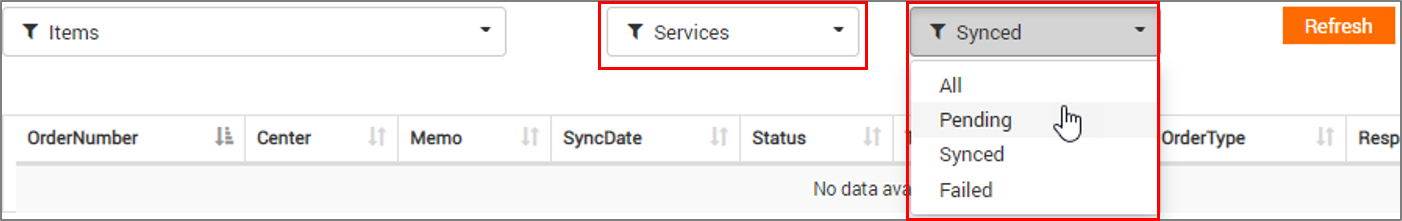

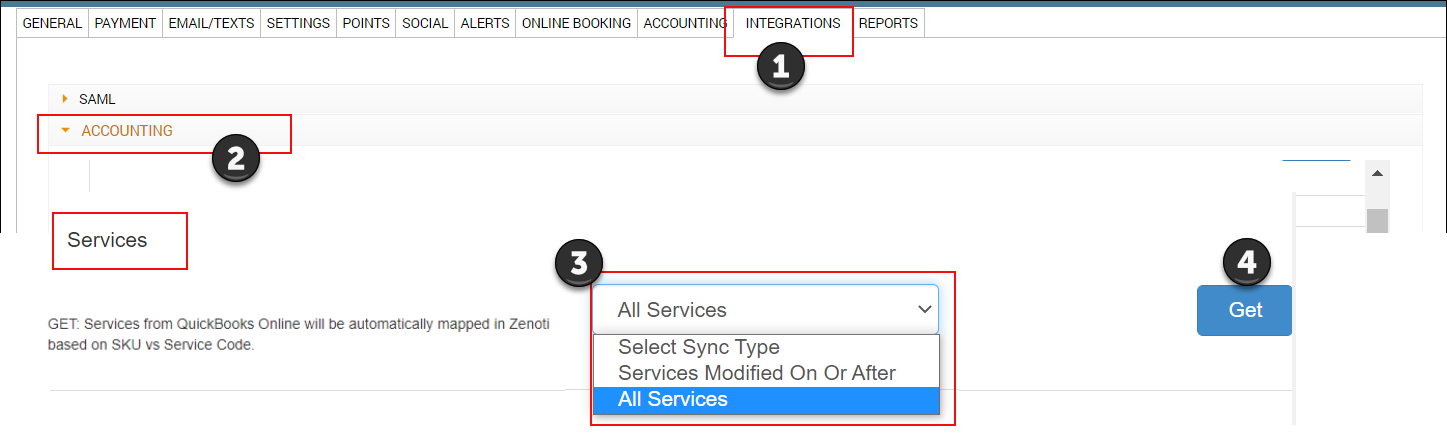

Sync items

Click the respective Get button to sync the following items from the accounting platform to Zenoti:

Locations: Locations in the accounting platform is synced with locations in Zenoti.

Note

If you’ve not enabled the Multi-Location switch, you can skip this step.

Accounts: Chart of accounts in the accounting platform is synced for the -------- mapping in Zenoti.

Payment Methods: Payment methods in the accounting platform is synced with payment types in Zenoti.

Note

This is required only for QuickBooks(Online and Desktop).

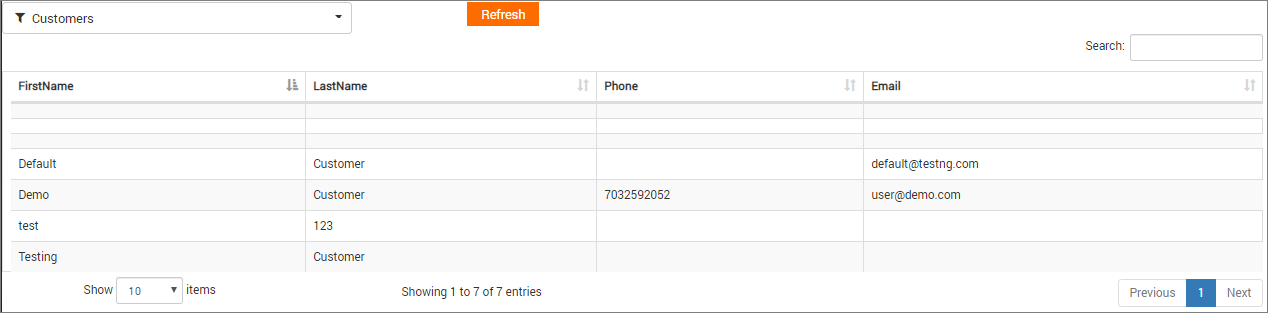

Customers: Customer details in the accounting platform is synced with configured customer details in Zenoti.

Taxes: Tax codes in the accounting platform is synced with tax groups in Zenoti.

Note

If you are posting tax as a separate item, you can skip this step.

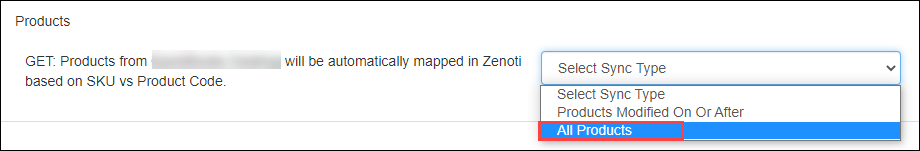

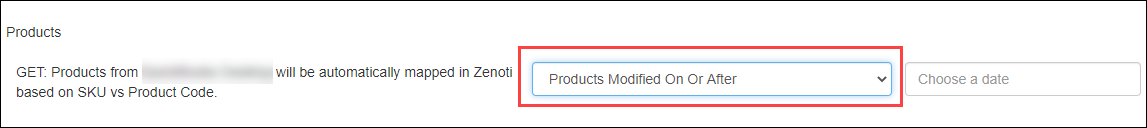

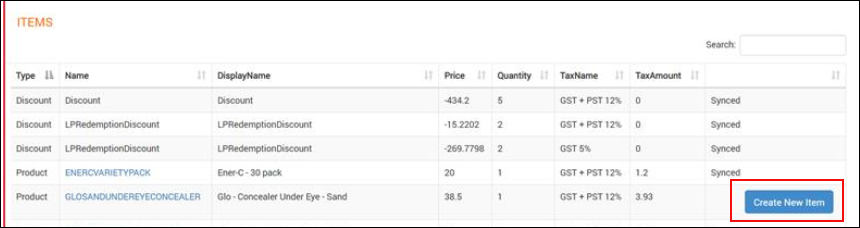

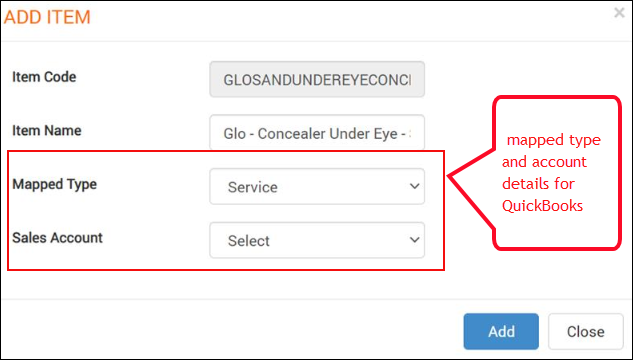

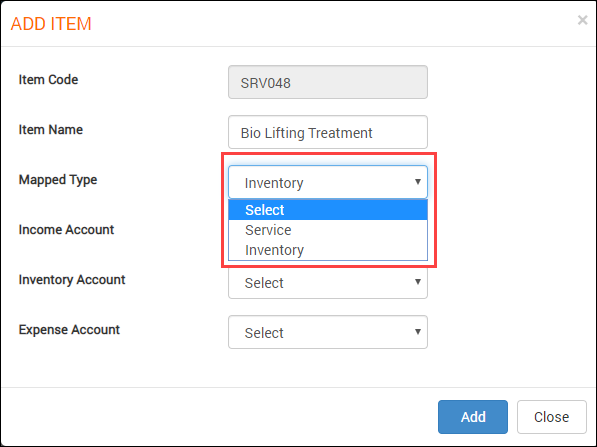

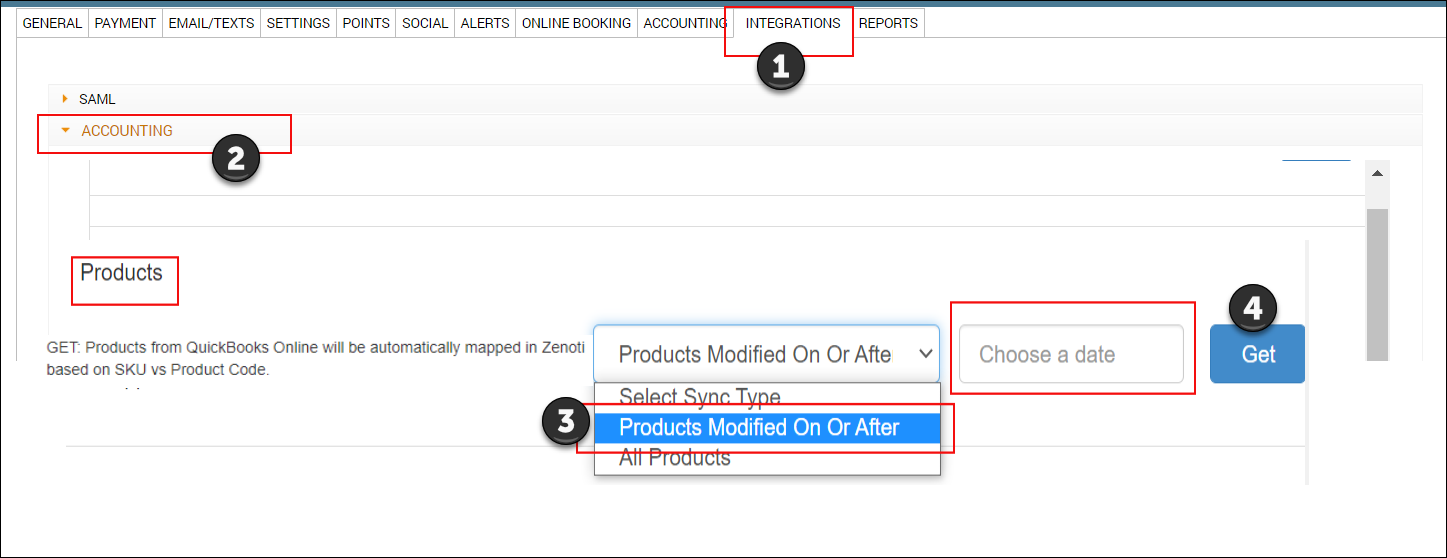

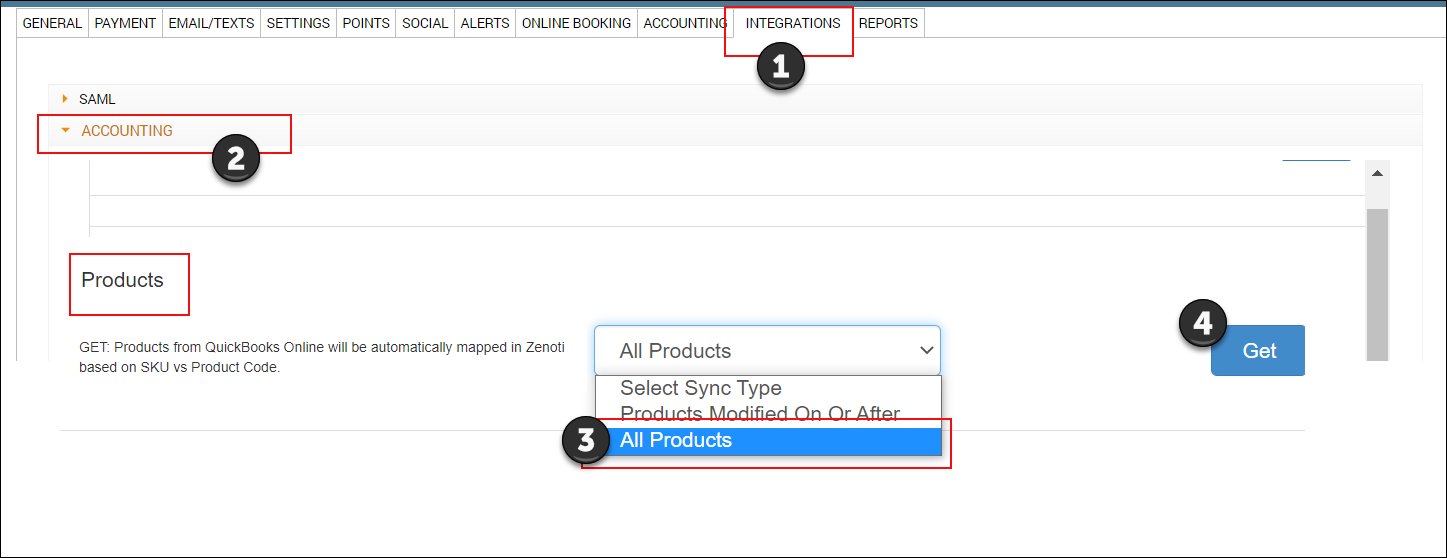

Products: Inventory item codes in the accounting platform are synced with items mapped as Inventory item type in Zenoti.

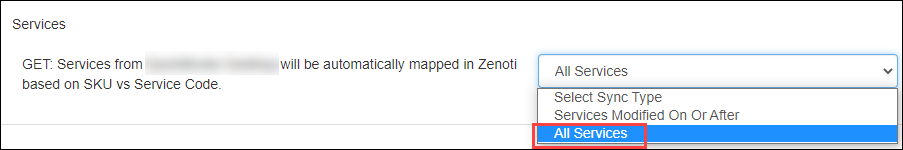

When you are syncing products for the first time, select the Sync Type as All Products.

After the first sync, if you update any products in the accounting platform, select the Products Modified On or After option and the select date to sync the changes.

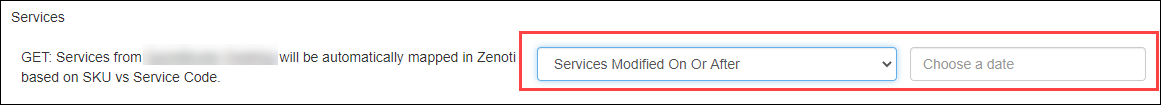

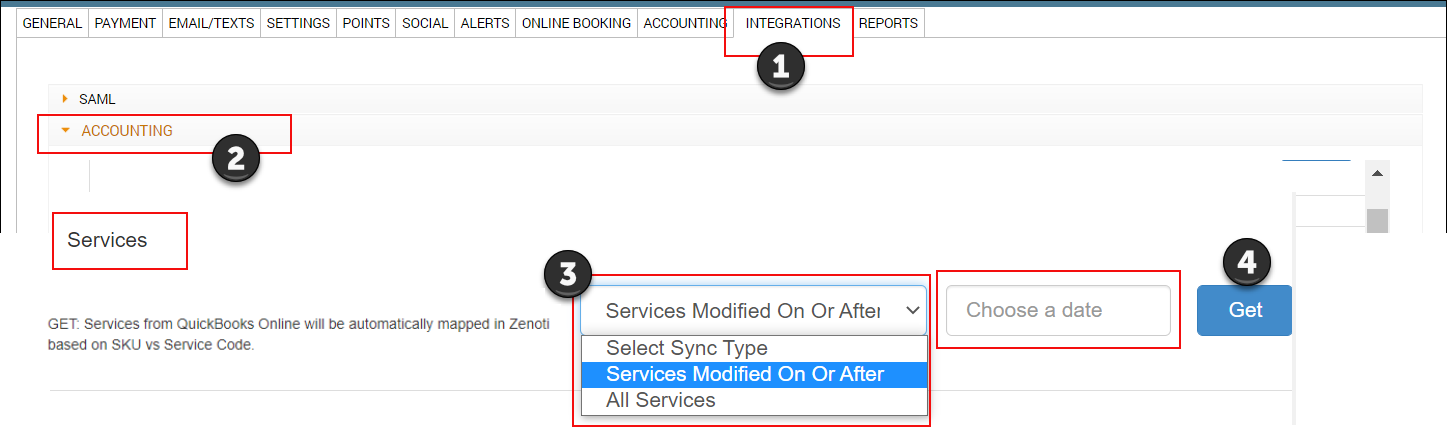

Services: Service codes in the accounting platform is synced with items mapped as Service item type in Zenoti.

When you are syncing services for the first time, select the Sync Type as All Services.

After the first sync, if you update any services in the accounting platform, select the Services Modified On or After option and the select date to sync the changes.

Non-Inventory Items: Non-Inventory item codes in the accounting platform is synced with items mapped as Non-Inventory Item type in Zenoti.

Other charge Items: Other charges in the accounting platform is synced with items mapped as Other Charge item type in Zenoti.

Bundle Items: Bundle items in the accounting platform is synced with items mapped as Bundle Items in Zenoti.

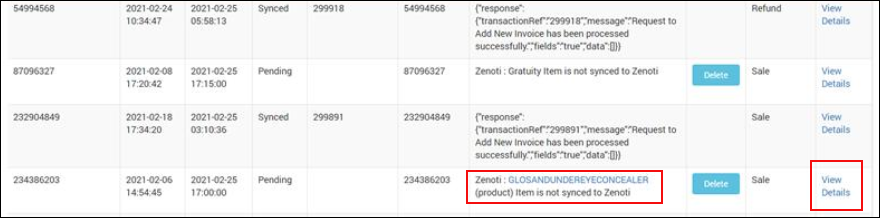

You can verify the sync, by using the Items report for the respective accounting platform. You can navigate to this report from Reports > Accounting Platform.

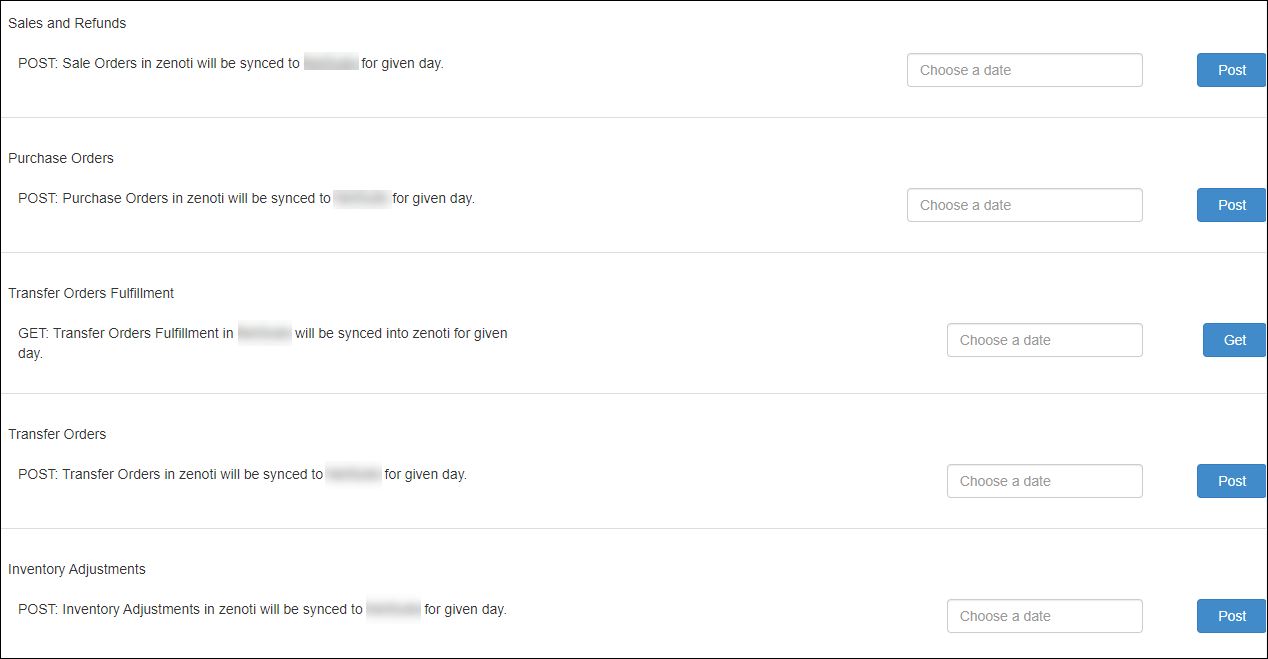

Sync transactions

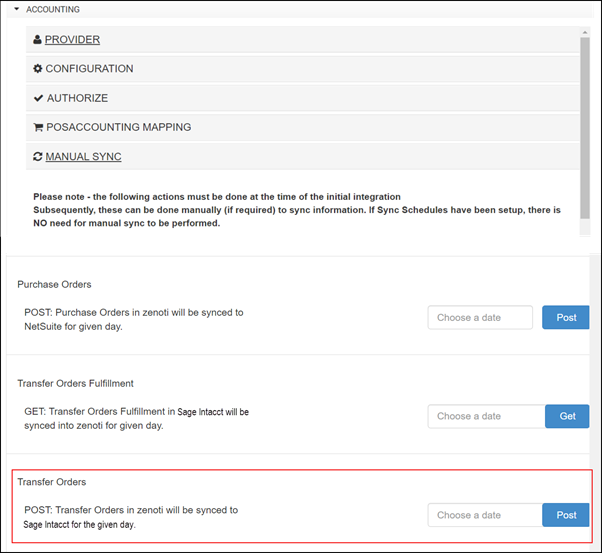

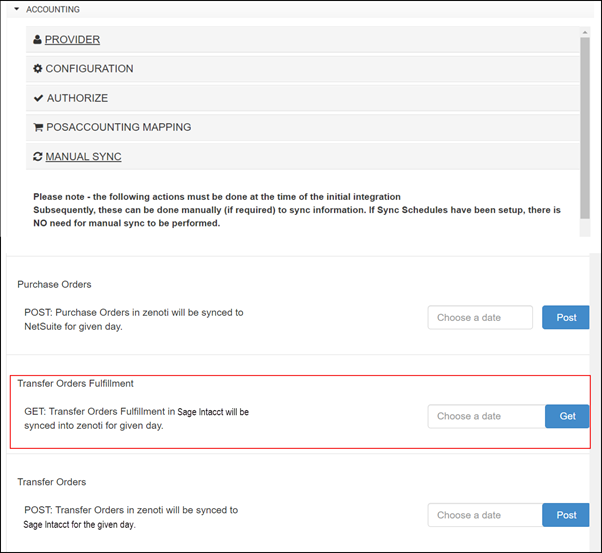

Click the respective Get or Post buttons for the following transactions, to sync data from the accounting platform to Zenoti or vice-versa:

Sales and Refunds: Post the sales invoices generated in Zenoti to the accounting platform.

Purchase Orders: Post the purchase orders created in Zenoti to the accounting platform.

Note

You must specify the date for which you want to post the sale invoices or purchase orders to the accounting platform.

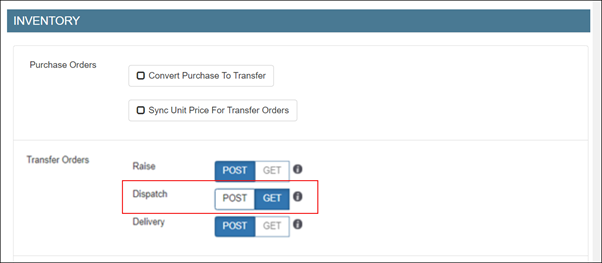

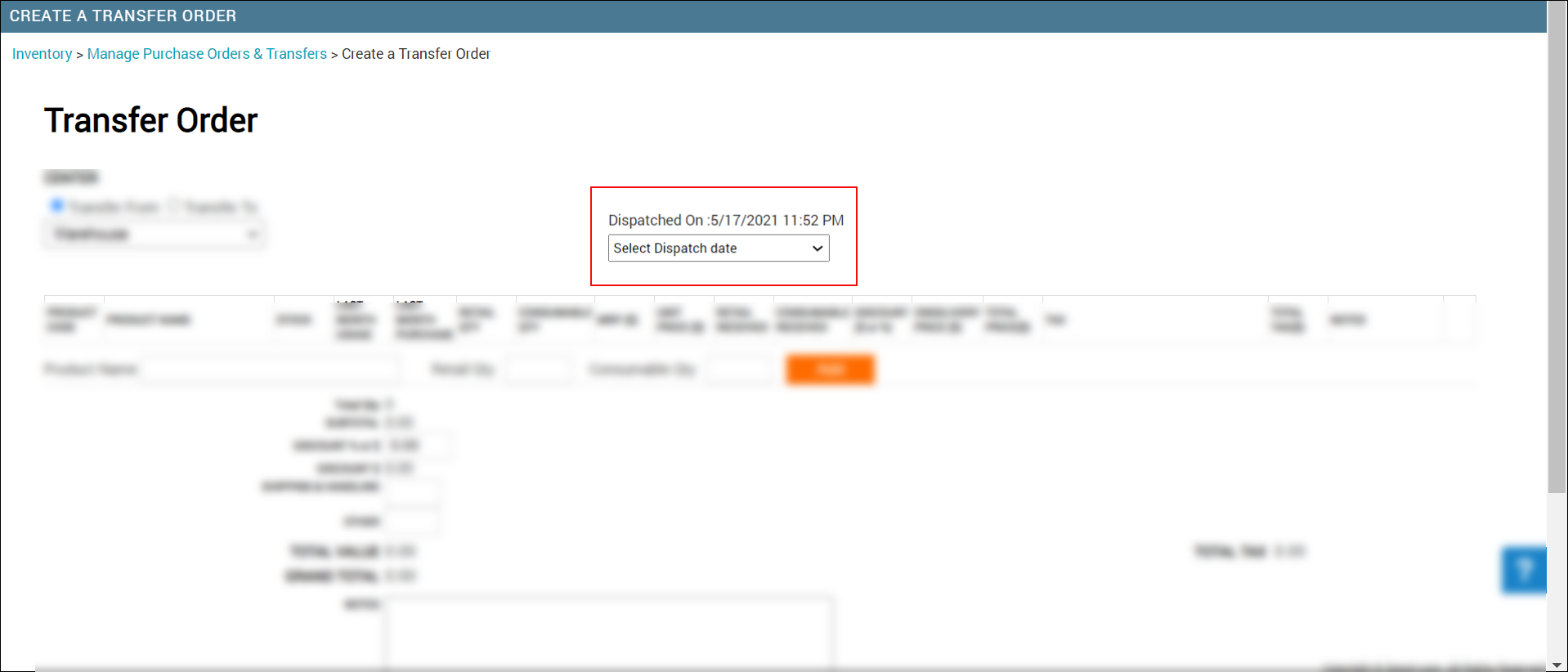

For NetSuite, you can see three more transactions that you can sync:

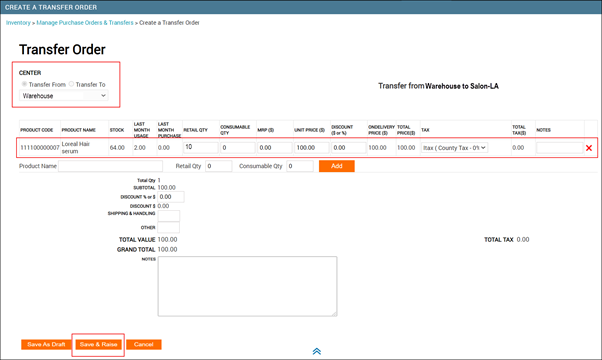

Transfer Orders: Post the transfer orders created in Zenoti to the accounting platform.

Inventory Adjustments: Post the inventory adjustments made in Zenoti to the accounting platform.

Transfer Orders Fulfillment: Get the delivered transfer orders in the accounting platform to Zenoti.

Note

You must specify the date for which you want to post the transfer orders and inventory adjustments to the accounting platform. For transfer orders fulfillment, specify the date for which you want to get the transfer orders fulfillment from the accounting platform.

Next step

The last step is to reconcile data that you’ve synced from Zenoti to the accounting platform using the following Zenoti Reports:

Items

Customers

Sales Orders Summary

Inventory Orders

Sale Order Summary Details

Note

Zenoti has separate reports for each accounting platform: Xero Reports, QuickBooks Reports, and NetSuite Reports.

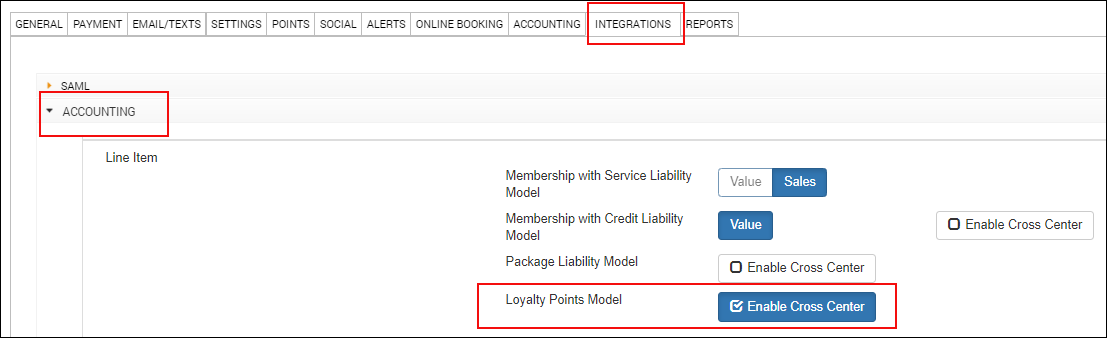

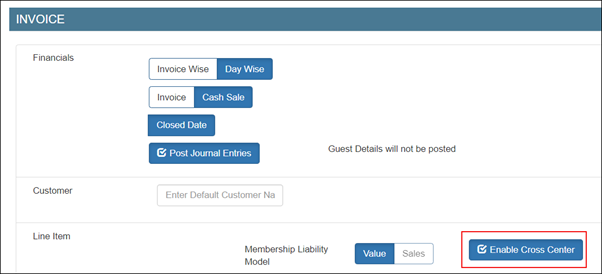

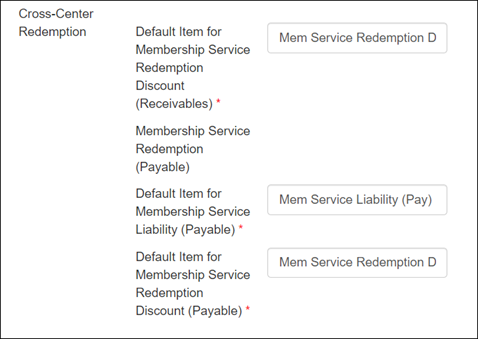

Post cross-center redemptions of loyalty points as journal entries

Disclaimer

This enhancement is done only for businesses where the value-based model is enabled.

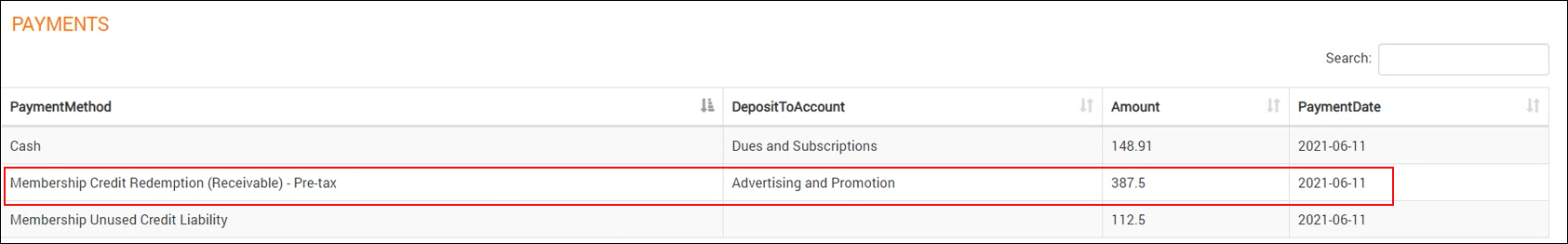

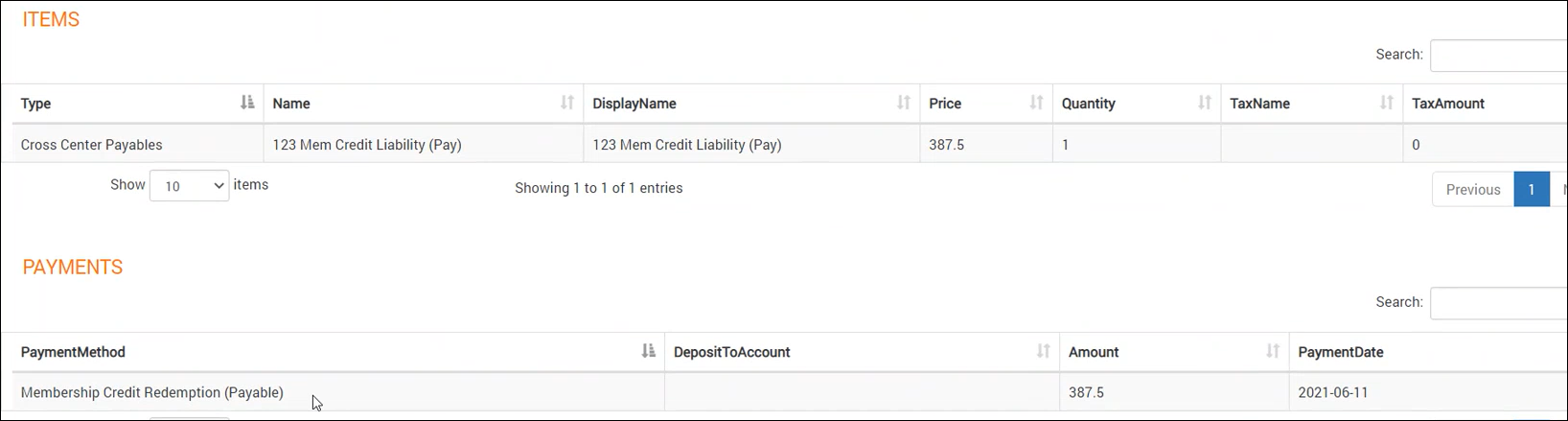

Generally, businesses with multiple centers allow guests to redeem loyalty points across centers. For cross-center settlement, they need the amount to appear as payable for the center where the points are accrued, and as receivable for the center where the points are redeemed.

Moreover, a business can choose to post the value of the points for cross-center redemption.

Example

A guest buys a package from the Los Angeles center for $500 and earns loyalty points worth $100. The guest took a service worth $100 in the California center and paid using loyalty points.

Based on the value model, when Zenoti syncs this redemption to the accounting platform, the value of the service $100 is posted as payable to the Los Angeles center and as receivable to the California center.

To configure posting of loyalty points redemption based on value

At the organization level, click the Configurations icon.

Click the Integrations tab and expand Accounting.

Expand the Configuration tab and navigate to the Invoice section.

For Loyalty Points Model, select the Enable Cross Center check box.

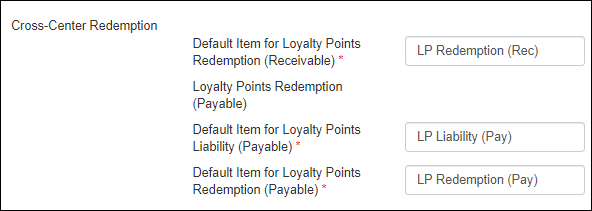

The following fields appear.

Default Item for Loyalty Points Redemption (Receivable): Enter the item to be used to post the redemption as receivable for the center where the points are accrued (where there’s no redemption invoice – the redemption invoice is only in the center where the redemption is made).

Note

You can post this as an item or as a payment type.

Default Item for Loyalty Points (Payable)

Default Item for Loyalty Points Redemption (Payable): Enter the item to be used to post the redemption as payable for the center where the points are redeemed (where there’s no redemption invoice – the redemption invoice is only in the center where the redemption is made).

Note

You can post this as only an item.

Under the Sync section, click Save.

You can post the receivable amount as either an item or as payment. However, you can post the payable amount as only journal entries.

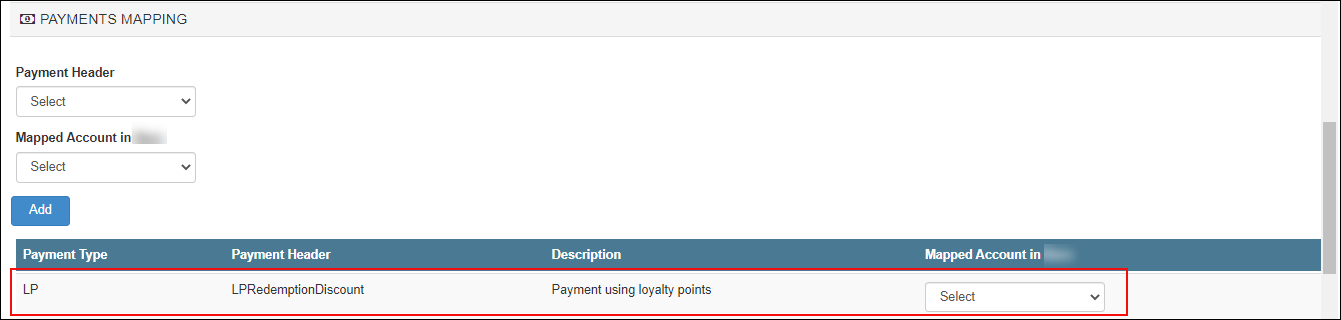

To post redemption amount as journal entries, expand the Payments Mapping tab and add and map the chart of accounts for receivable and payable.

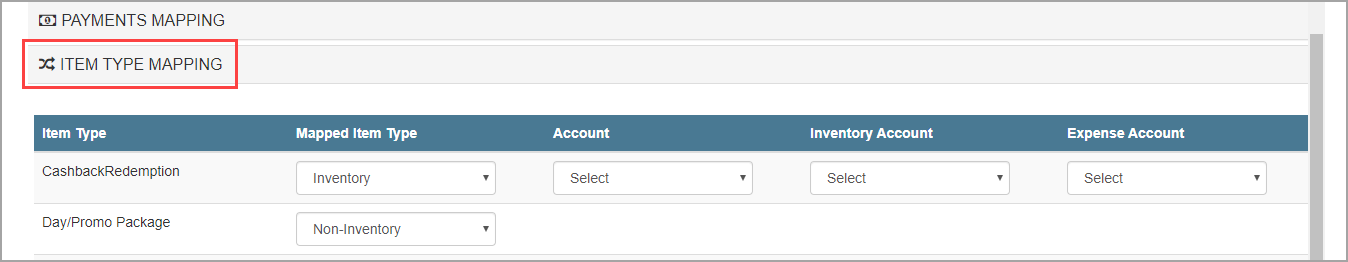

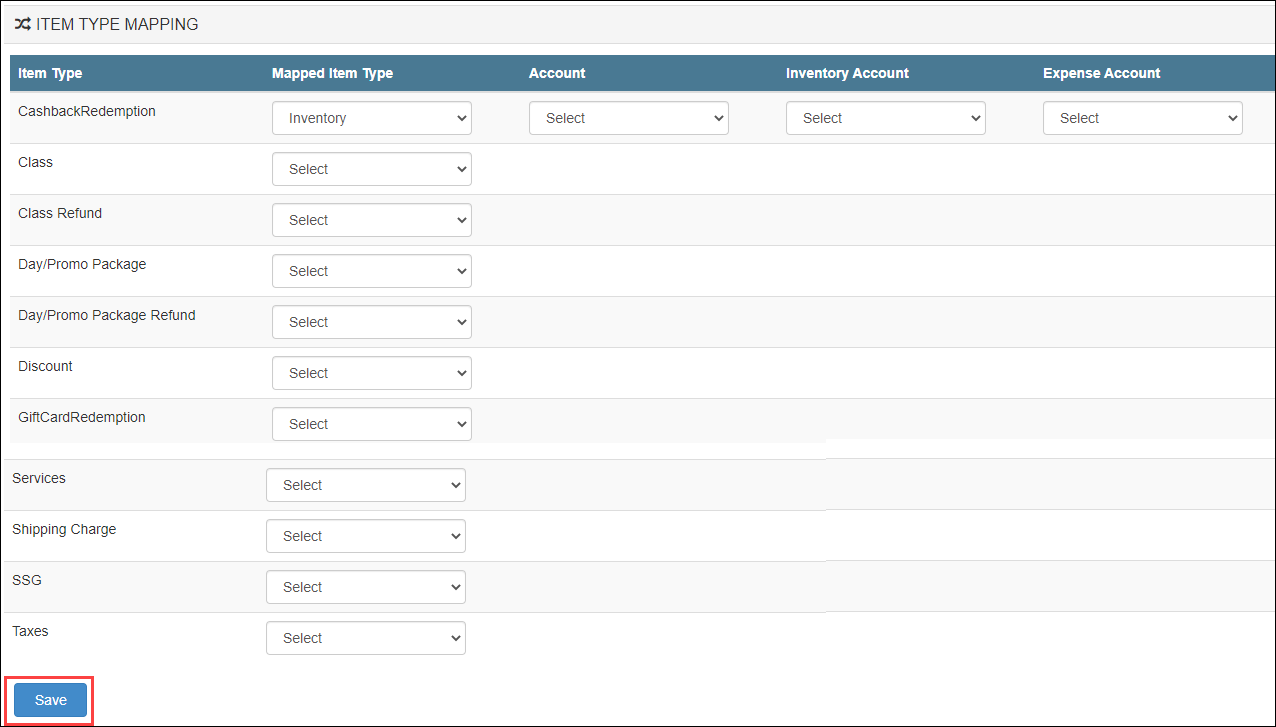

To post redemptions as invoices, expand the Item Type Mapping tab and add and map the chart of accounts for receivable.

Click Save.

The integration is configured to post cross-center redemptions for loyalty points based on value.

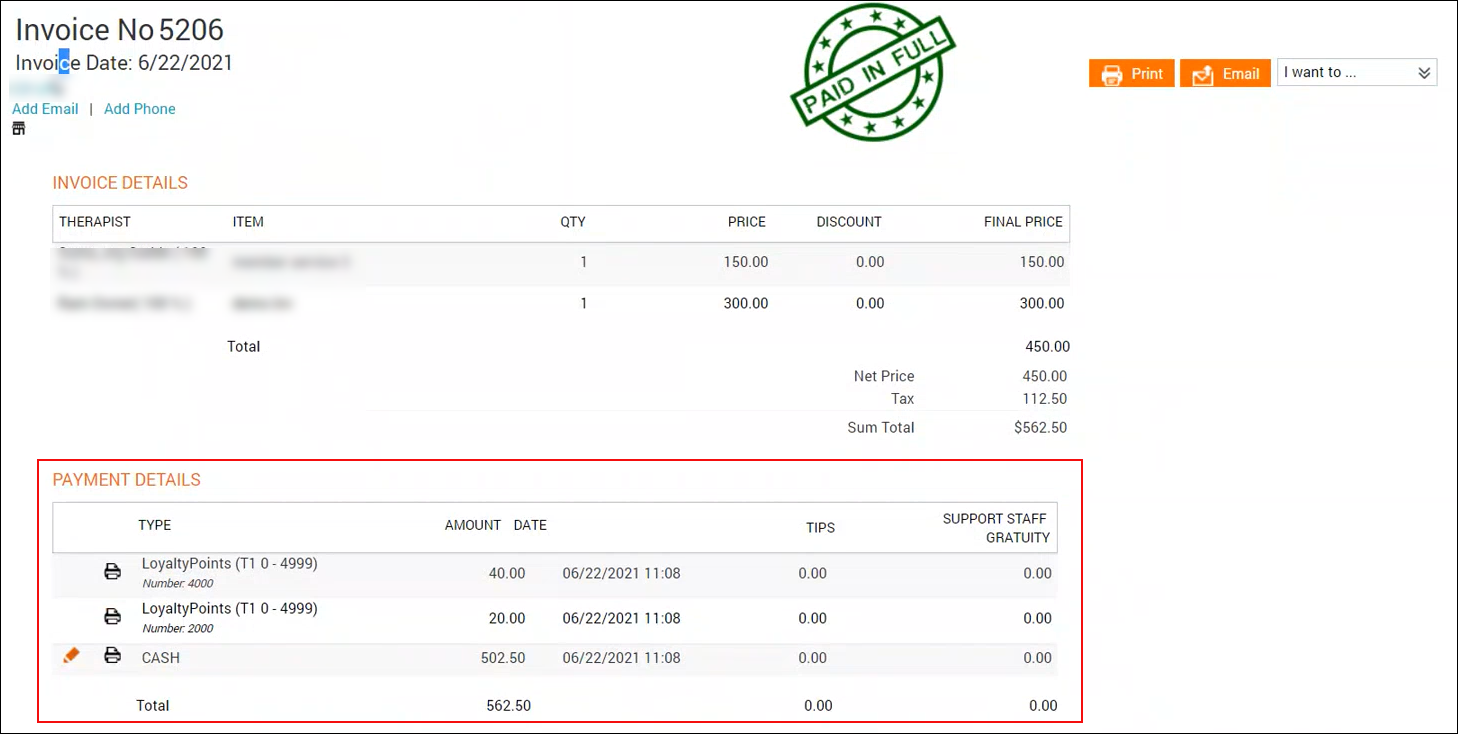

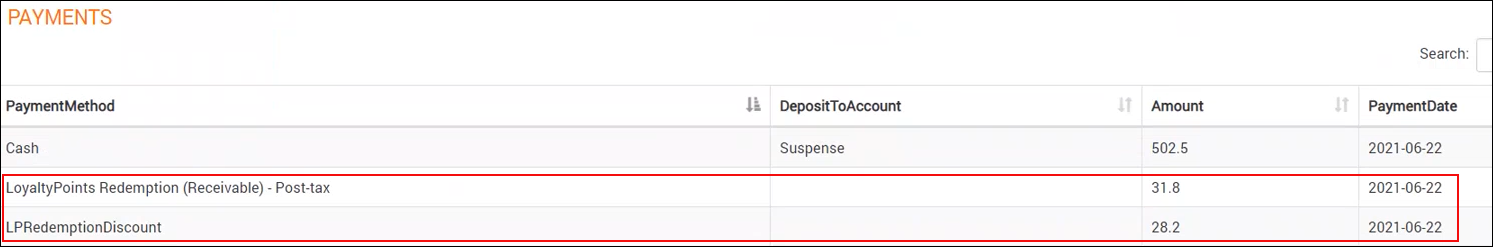

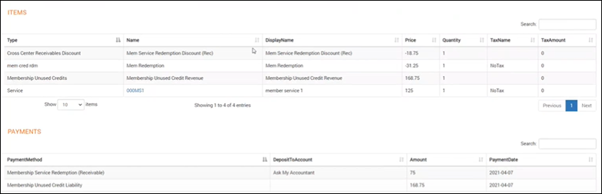

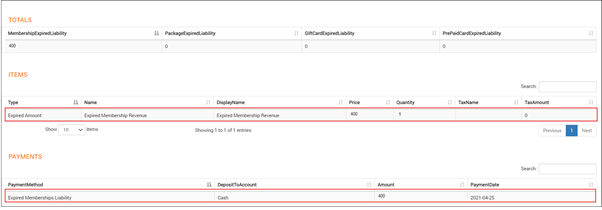

Sample transaction

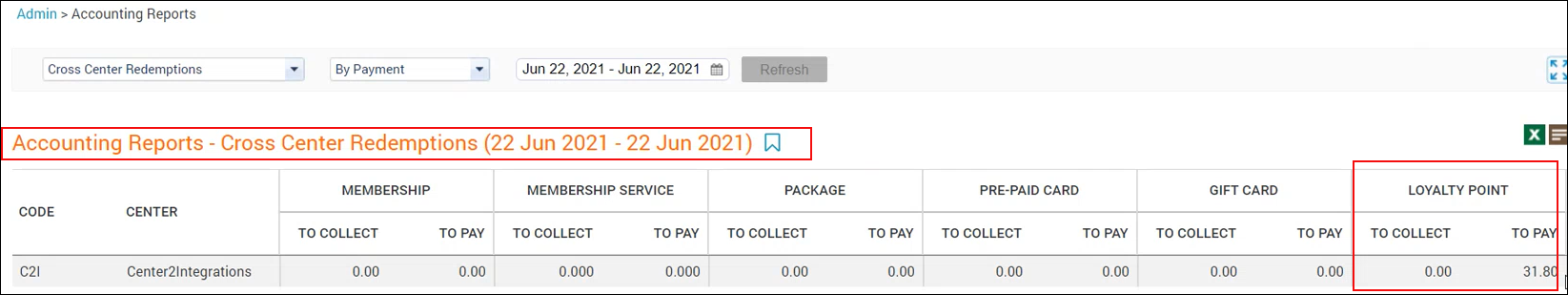

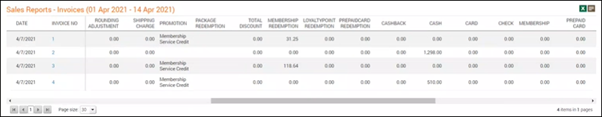

Reports

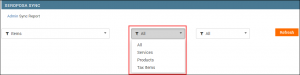

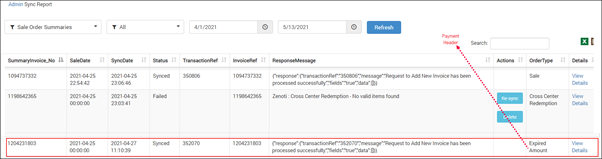

Admin Sync – Sale Order Summaries report

You can verify the posting of cross-center redemptions for loyalty points in this report.

Cross Center Redemptions report

Configure Xero accounting with location details

Important

Ensure that you’ve created locations (tracking categories) in Xero.

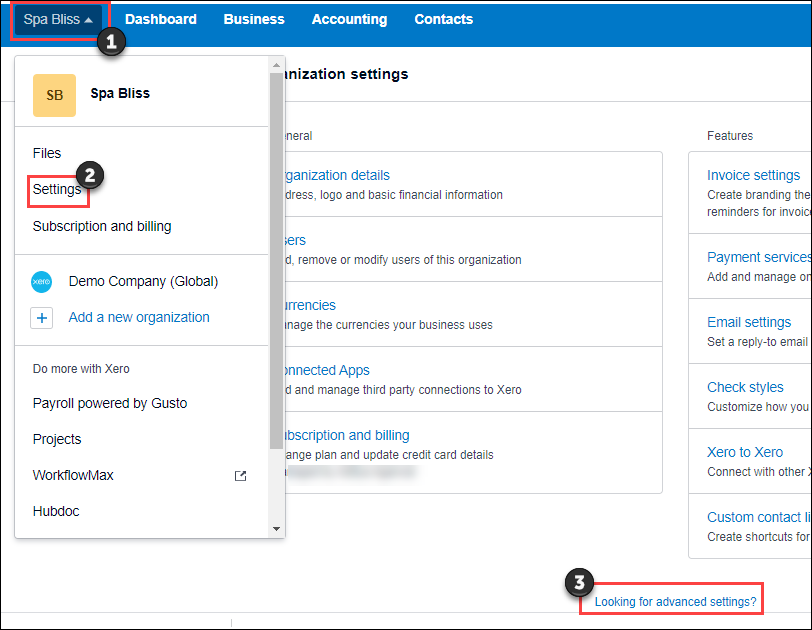

To create tracking categories in Xero

Login to your Xero account.

Click your company name.

For example, Spa Bliss.

Click Settings and then click Looking for advanced settings?

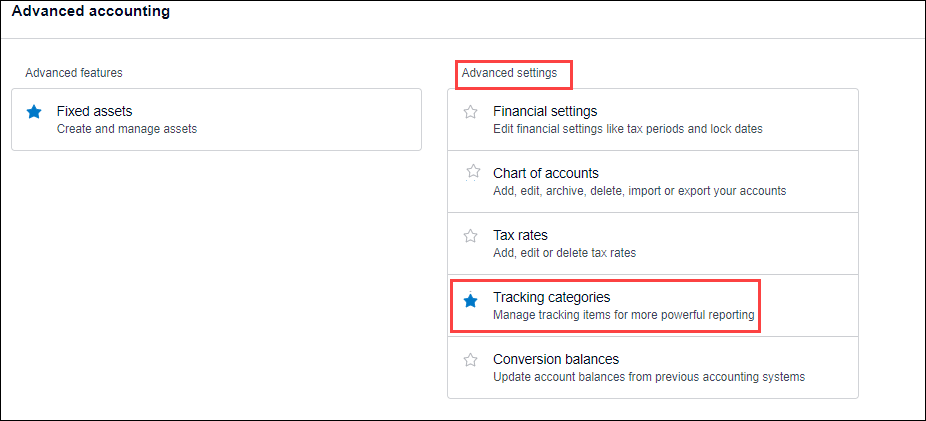

Click Tracking categories.

Click Add Tracking Category.

In the Tracking category name box, enter Locations.

In the Category options box, enter the center names.

Keep this information handy to map the category options as location names in Zenoti.

Click Save.

The tracking category is created.

To configure Xero with location details in Zenoti

Navigate to the Integrations page.

Organization level:

Click the Configurations icon.

Click Integrations.

Center level:

Click the Configurations icon.

Click Integrations.

Select Accounting.

Expand the Configuration tab and navigate to the Account section.

Turn on the Multi-Location switch.

Navigate to the Sync section and click Save.

Expand the Locations tab.

In the Mapped Location box, enter the category option that you’ve entered in Xero (step 8 of location creation in Xero).

Click Save.

Expand the Manual Sync tab.

Click Get to sync the locations.

Expand the Locations tab.

Verify that the POSAccounting Location is updated and the Active switch is enabled.

You’ve completed locations mapping for Xero.

Keep POSAccounting Location handy as you will need this while adding locations in POSAccounting.

To add locations in POSAccounting

Note

Ensure that you’ve completed mapping in the ----POSAccounting---- application.

Expand the POSAccounting Mapping tab.

Click Setup Customer Account.

The POSAccounting page opens.

Navigate to Add Location.

Select Yes for multiple locations.

Enter the POSAccounting Location (Step 11 while configuring locations in Zenoti) as the Location id in POSAccounting.

Enter the category option (in Xero) as Location Account in POSAccounting.

Next step

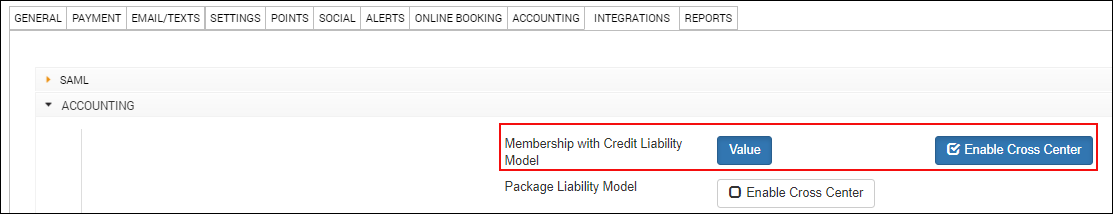

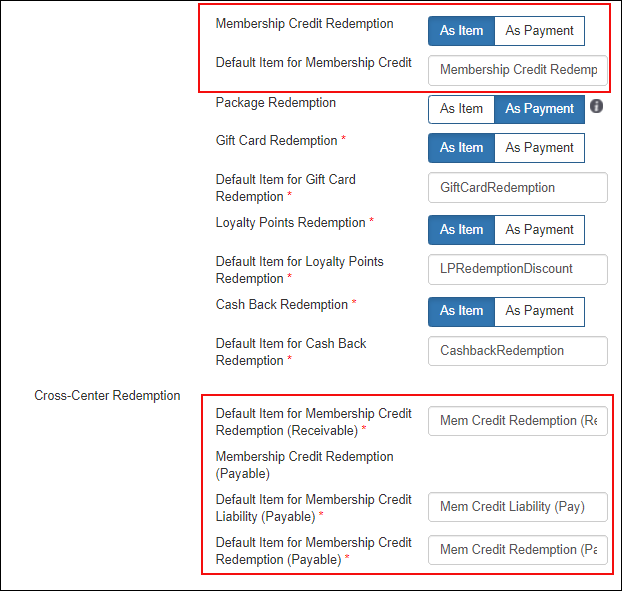

Configure cross-center redemptions for accounting integration

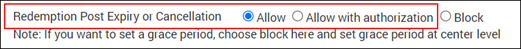

In Zenoti businesses are allowed to redeem liabilities at any center - irrespective of where the liabilities are purchased.

Using cross-center redemptions, businesses can reconcile the amount that a center should collect or pay to other centers as a result of the redemption of liabilities: packages, prepaid cards, and gift cards.

Example: A guest purchased a $200 gift card from the Los Angeles center and redeems it on a service worth $100 at the San Antonio center, then the Los Angeles center needs to pay $100 to the San Antonio center.

Receivables (Amount to collect): The total amount a center should collect from other centers.

Example: A guest purchased a $500 gift card from the San Antonio center and redeemed it on a service worth $200 at the Los Angeles center, then the Los Angeles center needs to collect $200 from the San Antonio center.

Payables (Amount to pay): The total amount a center should pay to other centers.

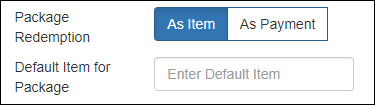

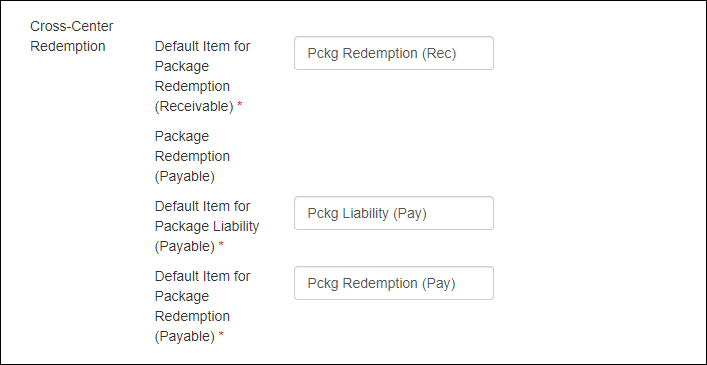

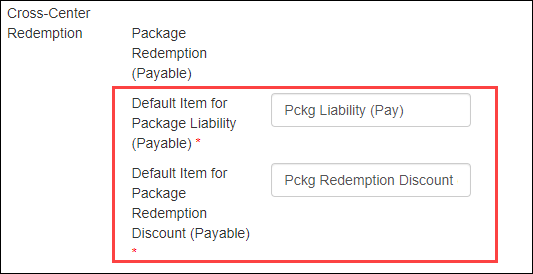

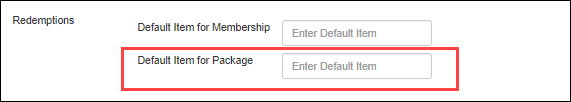

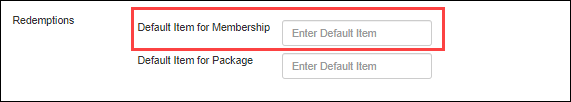

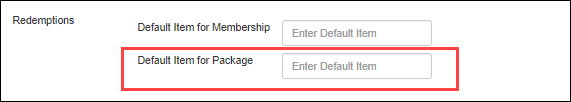

Configure Cross-Center Redemption for Packages

You can configure to post redemptions as an item or as a payment.

As Item

Select this option to post redemption based on the benefit actual price.

Example: If a liability (package or membership) was sold at $100 (with one benefit of $150), the redemption value that gets posted is $150.

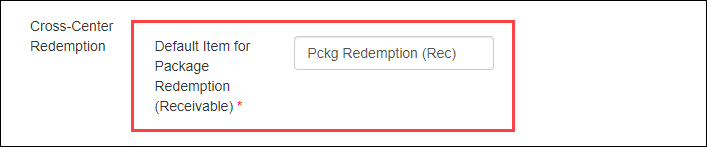

Configuration for Receivables

Enter the default item name for redemptions through packages that are sold at other centers and redeemed at this center.

Configuration for Payables

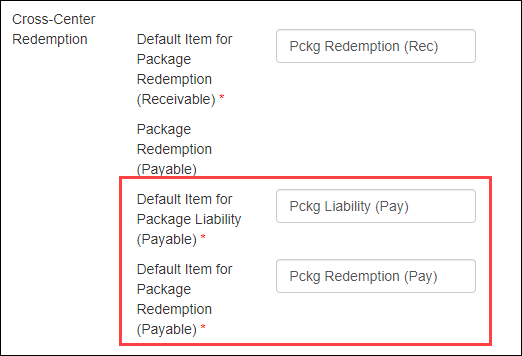

Enter the default item names for redemptions through packages that are sold at this center and redeemed at other centers.

Default item for Package Liability (Payable): Configure this to post a debit entry to the package liability account.

Default item for Package Redemption (Payable): Configure this to post a credit entry to the payables account.

As Payment

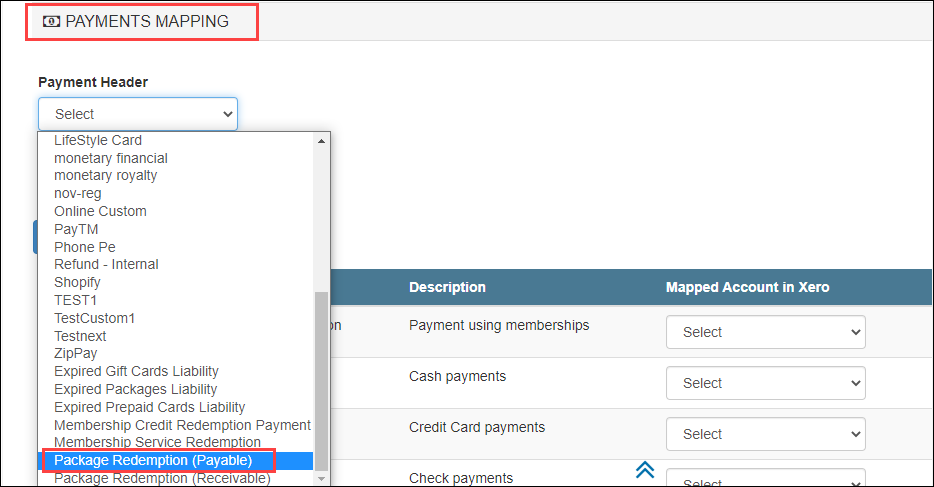

Select this option to post redemption based on the liability price.

Example: If a liability (package or membership) was sold at $100 (with one benefit of $150), the redemption value that gets posted is $100 and the redemption discount that gets posted is $50.

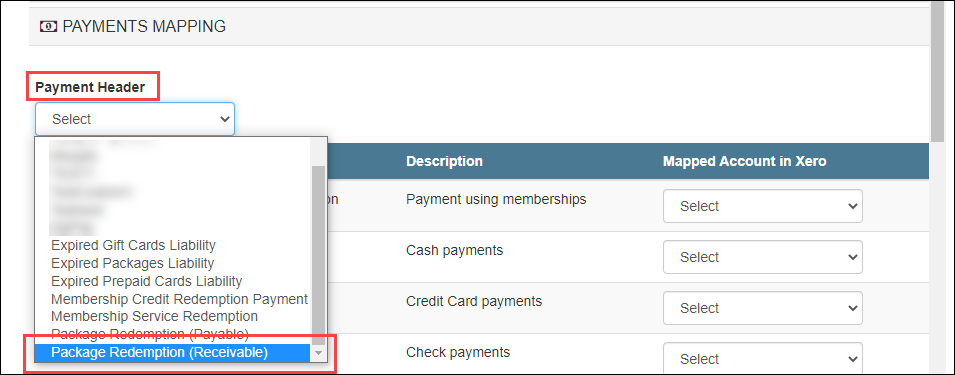

Configuration for Receivables

Map the payment type to the payment account or payment method for redemptions through packages that are sold at other centers and redeemed at this center.

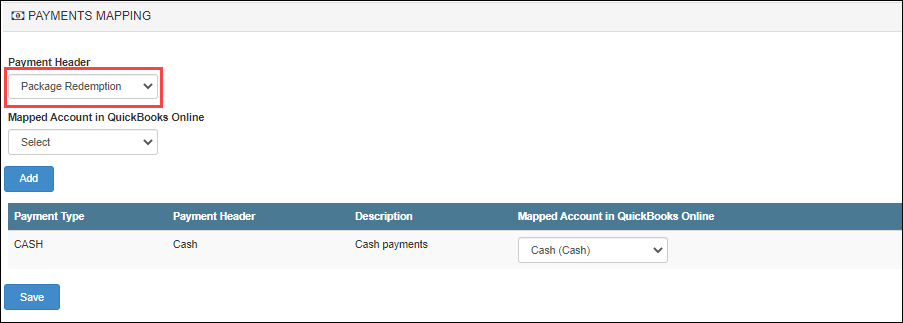

To configure this, expand the Payments Mapping tab.

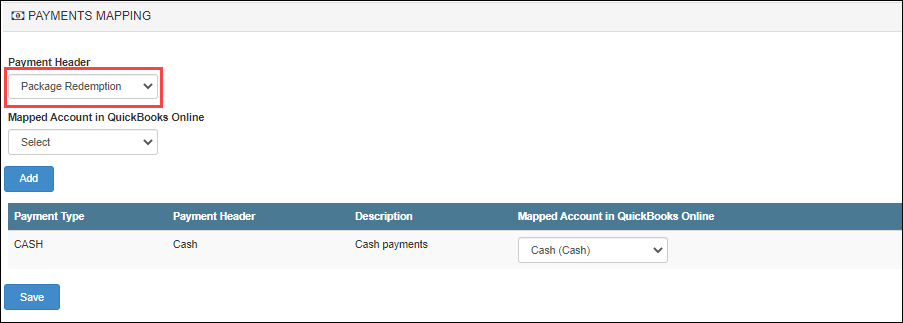

From the Payment Header drop-down, select Package Redemption (Receivable).

From the Mapped Account drop-down, select the corresponding payment account or payment method.

Click Add.

Configuration for Payables

Enter the default item names for redemptions through packages that are sold at this center and redeemed at other centers.

Default item for Package Liability (Payable): Configure this to post the redemption as a debit entry to the package liability account.

Default item for Package Redemption Discount (Payable): Configure this to post the redemption discount as a credit entry to the liability account.

Default item for Package Redemption (Payable): Configure this to post the redemption as a credit entry to the payable account.

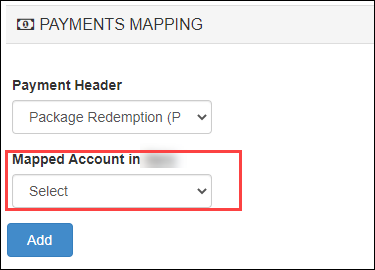

To configure this, expand the Payments Mapping tab.

From the Payment Header drop-down, select Package Redemption (Payable).

From the Mapped Account drop-down, select the corresponding payment account or payment method.

Click Add.

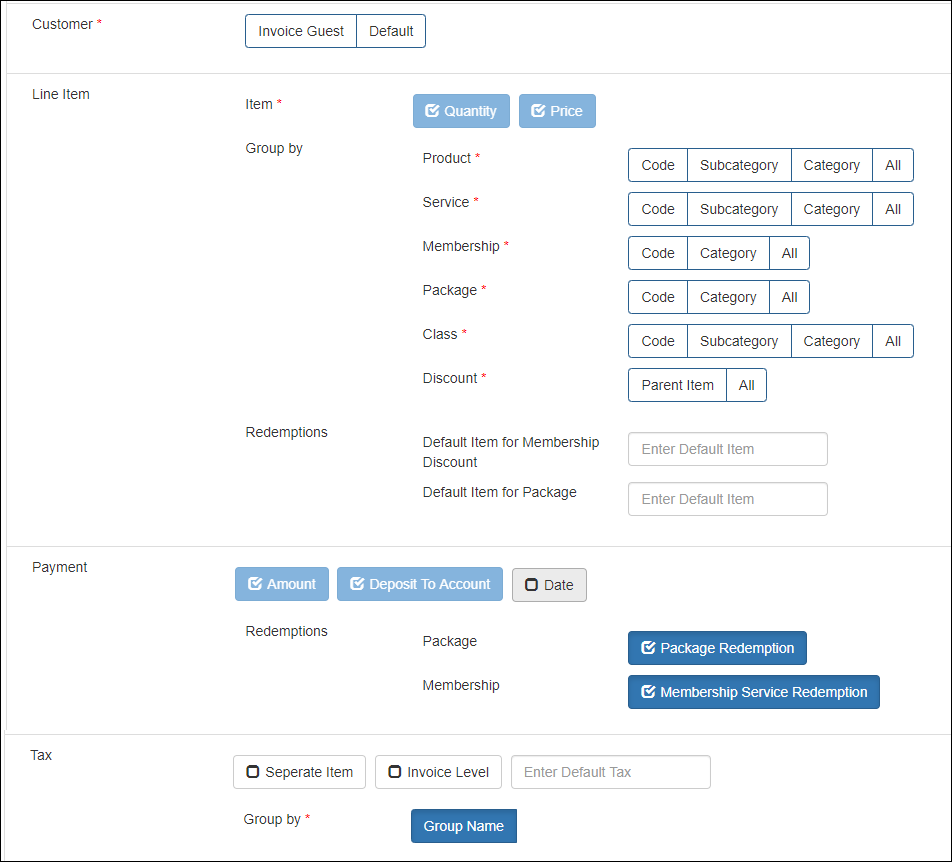

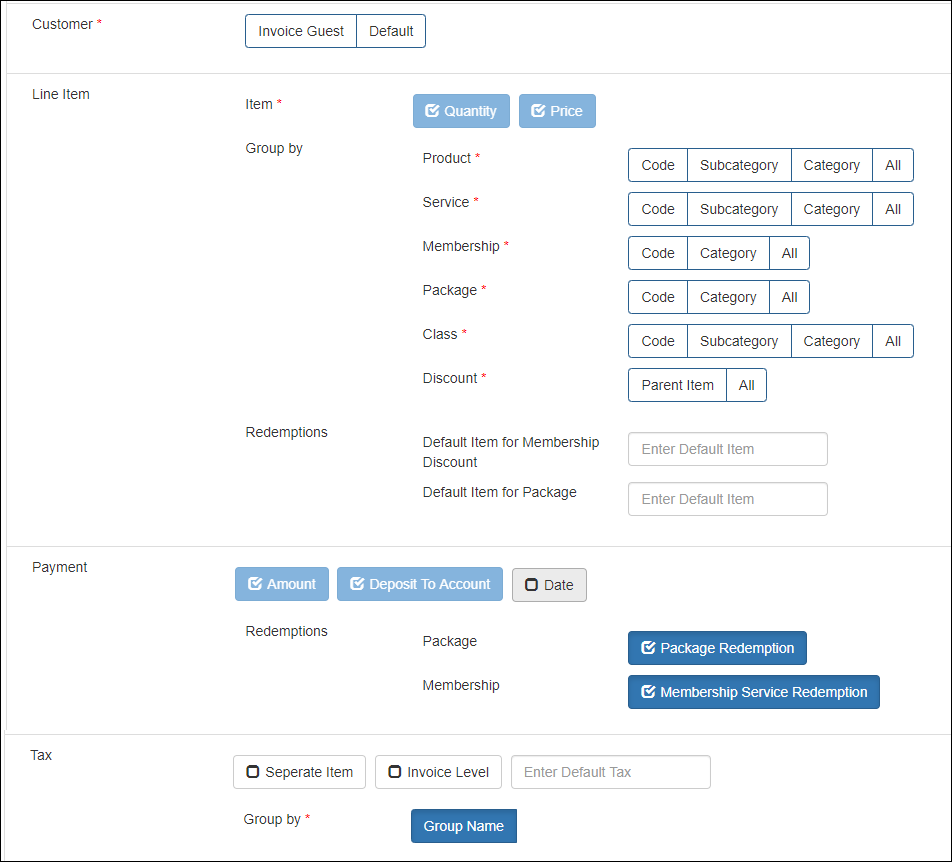

Configure accounting integration by invoice

Based on the sync type you’ve selected; you can choose how to present your data from Zenoti to the accounting platform.

If you are not on the integration page, based on where you want to set up the integration, click the Configuration icon > Integrations tab.

Select Accounting.

Expand the Configuration tab and navigate to the Invoice section.

Customer: The name of the guest that you want to post for each invoice.

Select any one of the following options:

Invoice Guest: Select this option if you want to sync the guest name on the Zenoti invoice to the accounting platform.

Note

This is applicable only for the Invoice-Wise sync type.

Default: Select this option to post a default guest name for all invoices. Then, enter the default guest name in the box.

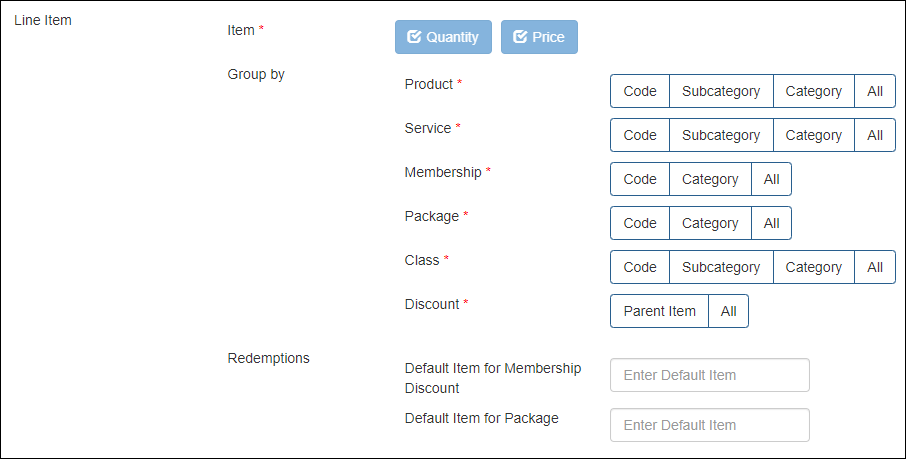

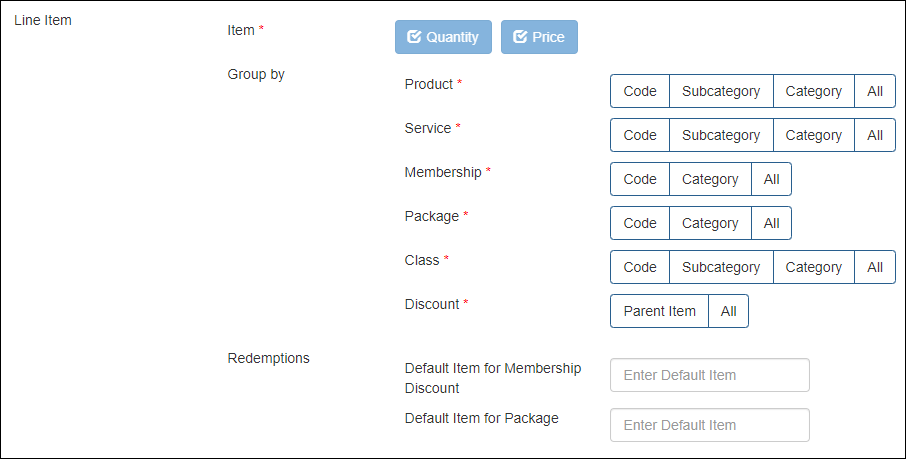

Line Item: In this section, you can configure how you want to post items to your accounting platform.

Item: Zenoti posts each item with Quantity and Price. These options are selected by default.

You can Group each item as follows:

Product

Code

Select this option to map each product in Zenoti to the respective item in the accounting platform

Important

Before you select this option, you must ensure that each product in Zenoti has a corresponding item with the same code in the accounting platform.

Subcategory

Select this option to map each product subcategory in Zenoti to the respective item in the accounting platform.

Important

Before you select this option, you must ensure that each product subcategory and subcategory code in Zenoti has a corresponding item with the same code in the accounting platform.

Category

Select this option to map each product category in Zenoti to the respective item in the accounting platform.

Important

Before you select this option, you must ensure that each product category and category code in Zenoti has a corresponding item with the same code in the accounting platform.

Default Item

Select this option to map all the products to the single item with item code as Product in the accounting platform.

Service

Code

Select this option to map each service in Zenoti to the respective item in the accounting platform.

Important

Before you select this option, you must ensure that each service in Zenoti has a corresponding item with the same code in the accounting platform.

Subcategory

Select this option to map each service subcategory in Zenoti to the respective item in the accounting platform.

Important

Before you select this option, you must ensure that each service subcategory and subcategory code in Zenoti has a corresponding item with the same code in the accounting platform.

Category

Select this option to map each service category in Zenoti to the respective item in the accounting platform.

Important

Before you select this option, you must ensure that each service category and category code in Zenoti has a corresponding item with the same code in the accounting platform.

Default Item

Select this option to sync all the services to the single item with item code as Service in the accounting platform.

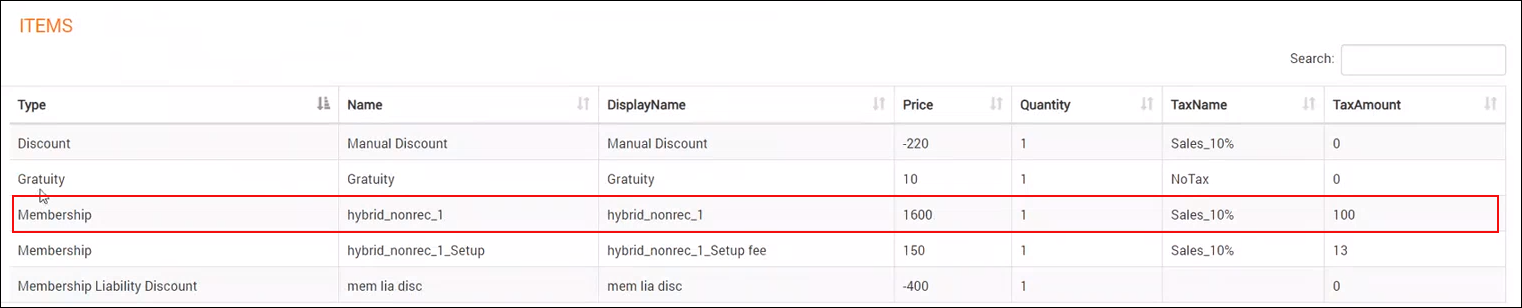

Membership

Code

Select this option to map each membership in Zenoti to the respective item in the accounting platform.

Important

Before you select this option, you must ensure that each membership in Zenoti has a corresponding item with the same code in the accounting platform.

Category

Select this option to map each membership category in Zenoti to the respective item in the accounting platform.

Important

Before you select this option, you must ensure the following:

The Membership Category is Mandatory setting is enabled at the organization level.

Each membership has a category assigned in Zenoti.

Each membership category and category code in Zenoti has a corresponding item with the same code in the accounting platform.

Default Item

Select this option to map all memberships to the single item with item code as Membership in the accounting platform.

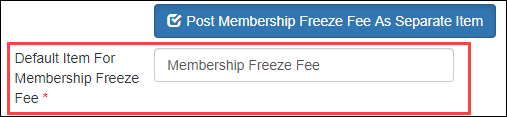

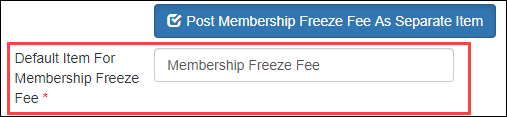

Post Membership Freeze Fee As Separate Item

Select this option to map membership freeze fee to a single item in the accounting platform. You can enter this item code (that you’ve in the accounting platform) in the Default Item For Membership Freeze Fee box.

Package

Code

Select this option to map each package in Zenoti to the respective item in the accounting platform.

Important

Before you select this option, you must ensure that each package in Zenoti has a corresponding item with the same code in the accounting platform.

Category

Select this option to map each package category in Zenoti to the respective item in the accounting platform.

Important

Before you select this option, you must ensure the following:

The Package Category is Mandatory setting is enabled at the organization level.

Each package has a category assigned in Zenoti.

Each package category and category code in Zenoti has a corresponding item with the same code in the accounting platform.

Default Item

Select this option to map all packages to the single item with item code as Package in the accounting platform.

Gift Cards

Zenoti maps all the gift cards to a single item GiftCard with the item code as in the accounting platform.

Prepaid Cards

Zenoti maps all the prepaid cards to a single item PrepaidCard with the item code as in the accounting platform.

Class

Note

You will see this section only if Classes/Fitness is enabled for your business.

Code

Select this option to map each class in Zenoti to the respective item in the accounting platform.

Important

: Before you select this option, you must ensure that each class in Zenoti has a corresponding item with the same code in the accounting platform.

Subcategory

Select this option to map each class subcategory in Zenoti to the respective item in the accounting platform.

Important

: Before you select this option, you must ensure that each class subcategory and subcategory code in Zenoti has a corresponding item with the same code in the accounting platform.

Category

Select this option to map each class category in Zenoti to the respective item in the accounting platform.

Important

: Before you select this option, you must ensure that each class category and category code in Zenoti has a corresponding item with the same code in the accounting platform.

Default Item

Select this option to map all the classes to the single item with item code as Class in the accounting platform.

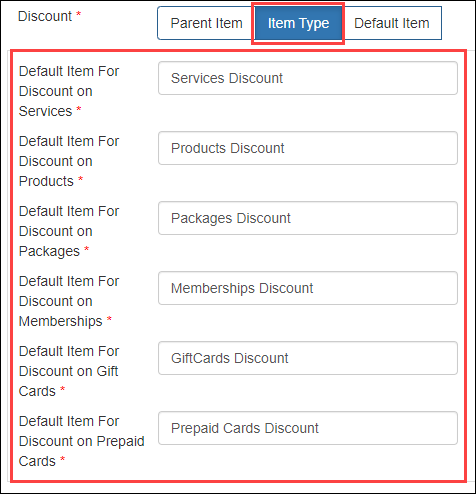

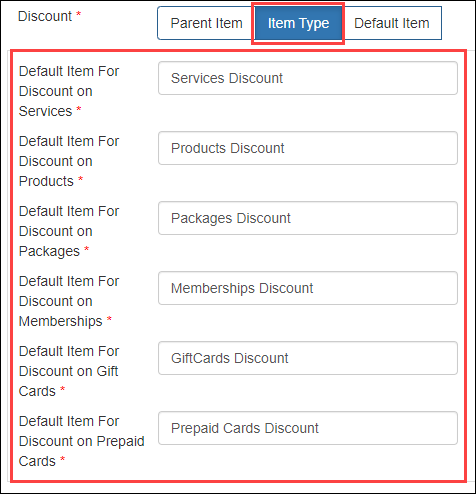

Discount

Discounts in Zenoti are of three types:

Campaign-based discounts

Membership discounts

Package discounts

Parent Item

Select this option to map each discount type in Zenoti to the respective item in the accounting platform.

In Zenoti, a discount can be one of the following types:

Campaign-based discounts - Map each campaign code to an item in the accounting platform.

Membership discounts - These discounts get posted against the membership item that you’ve configured in the Line Item section for memberships.

Package discounts - These discounts get posted against the membership item that you’ve configured in the Line Item section for packages.

Manual discounts - Map all manual discounts to a single item Manual Discount in the accounting platform.

Price adjustments - Map all price adjusted amounts to a single item Price Adjustment in the accounting platform.

Important

Before you select this option, you must ensure that each discount type and its code in Zenoti has a corresponding item with the same code in the accounting platform.

For example, if there’s a campaign-based discount in Zenoti Thanksgiving Offer 10% with campaign code as TH10OFF, the item in the accounting platform must have the code as TH10OFF.

Item Type: Select this option to map discounts applied to an item type in Zenoti to the respective discount item in the accounting platform. You can enter the code of this discount item in the respective default item discount box for each item type.

For example, if you want to account all the service discounts under one item, let’s say Service Discount in the accounting platform with code as SD, enter SD in the Default Item for Discount on Services box.

Note

This configuration INCLUDES package redemption discounts and membership redemption discounts under the respective item type on which these redemptions are applied. For example, if a package is redeemed on a service, the redemption discount will be accounted under services discount.

- Default Item: Select this option to map all the discount types to a single item in the accounting platform. You can enter this item code (that you’ve in the accounting platform) in the Discount box.

Note

This configuration DOES NOT include package redemption discounts and membership redemption discounts - you need to configure these discounts separately.

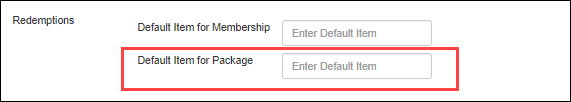

Redemption

You can post the value of a redemption in any one of the following ways:

Based on the benefit actual price

If a liability (package or membership) was sold at $100 (with one benefit of $150), the redemption value that gets posted is $150.

To configure this for packagesDo not select the Package Redemption checkbox.

Enter the default item name for the package redemption.

To configure this for memberships (with service benefits)Do not select the Membership Service Redemption checkbox.

Enter the default item name for the membership redemption.

Based on the liability price

If a liability (package or membership) was sold at $100 (with one benefit of $150), the redemption value that gets posted is $100 and the redemption discount that gets posted is $50.

To configure this for packagesSelect the Package Redemption checkbox.

Enter the default item name for the package redemption discount.

Configure the package redemption as a payment in the Payment Mapping tab.

To configure this for memberships (with service benefits)Select the Membership Service Redemption checkbox.

Enter the default item name for the membership redemption.

Configure the membership service redemption as a payment in the Payment Mapping tab.

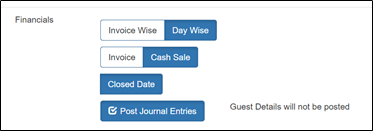

Financials

Accrual Accounting: Sales are posted based on the invoice sale date.

Cash Accounting: Sales are posted on the date payment is collected.

Departments: Post departments to track revenues, expenses, and operational performance at a departmental level. This is only applicable for NetSuite and Sage Intacct.

Classes: Post classes to analyze profitability and performance across product lines, services, or customer segments. This is only applicable for NetSuite and Sage Intacct.

Payment

To configure payments, ensure that each payment type in Zenoti has a corresponding payment type in the accounting platform.

Amount: The payment transaction amount. This option is selected by default.

Deposit to Account: The chart of account to which the payment is mapped in the accounting platform. This option is selected by default.

Date: By default the payments are posted based on the closed date. However, to post payments based on the payment date, select the Date checkbox.

Note

If you’ve selected QuickBooks Desktop as the accounting platform, you will not see the Date checkbox.

Credit Card

Card Logo: Post payments individually for each card logo.

Default Card Type: Post a single entry for the total credit card payment.

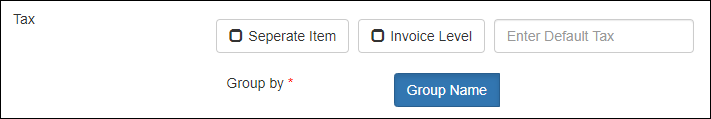

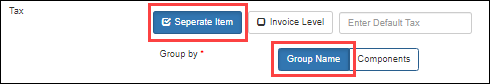

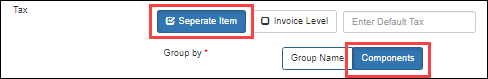

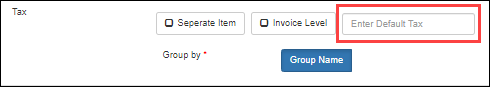

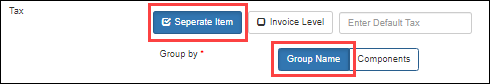

Tax

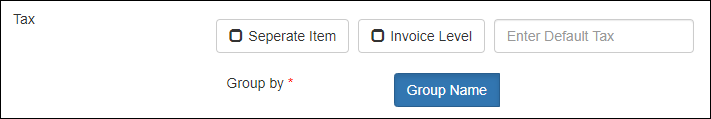

You can post taxes in four different ways:

Item-level: By default, the tax amount is posted for each item in the accounting platform.

Important

Ensure that each tax group in Zenoti has a corresponding tax with the same code in the accounting platform.

Tax as a separate item (as tax group): The total tax amount is posted by the tax group name.

Important

Ensure that each tax group in Zenoti has a corresponding item with the same code in the accounting platform.

Tax as a separate item (as tax component): The tax amount is posted by the individual tax components (by names).

Important

Ensure that each tax group component in Zenoti has a corresponding item with the same name in the accounting platform.

Invoice Level: The total tax amount for an invoice is posted in the accounting platform.

Important

Ensure that each tax group in Zenoti has a corresponding tax with the same code in the accounting platform.

Irrespective of whether you post taxes based on item-level, as a separate item, or based on invoice level, you must enter the default tax group name in the Enter Default Tax box.

Automated Sales Tax: For Quickbooks US, select Tax from the drop-down list and then select Automated Sales Tax. Enter None in Automated sales tax ID. For other QBO versions, do not select anything.

Expenses: Select this option to post retail cost of goods to the accounting platform.

Important

You can use this option only if your business tracks inventory in Zenoti.

By default, Cost of Goods Sold is the name of the default item for cost of goods of retail products sold in Zenoti, which you must map to the corresponding chart of accounts in the POSAccounting Mapping form.

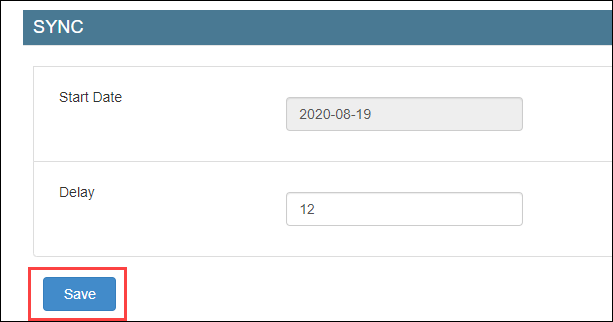

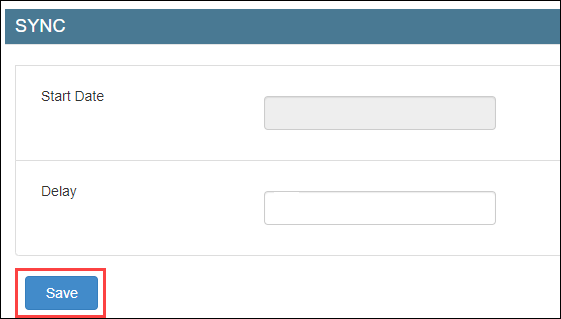

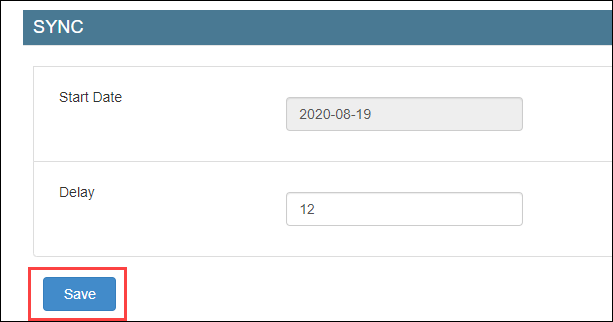

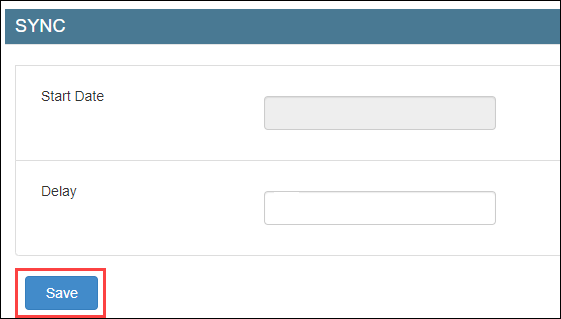

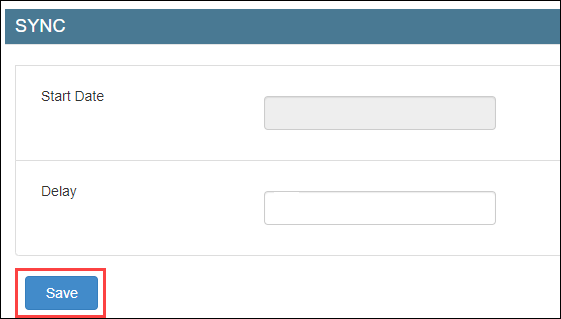

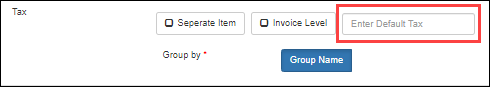

Navigate to the Sync section under the Configuration tab.

Start Date: Select the date from when you want to start posting your data to the accounting platform.

Delay: Specify the gap between each data posting.

Important

After you’ve set these two fields, reach out to Zenoti Support to enable auto-sync.

Click Save.

Impacts and considerations

You must enable multi-location functionality to post invoices in NetSuite. When setting up location mapping, select only locations. Do not include departments or classes in the mapping.

Next step

Configure accounting integration by journal entries

Based on the sync type you’ve selected, you must do two things:

Configure how you want to present data from Zenoti.

Map the data in Zenoti to the respective chart of accounts in POSAccounting mapping.

Access Integrations tab.

Organization level:

Click the Configurations icon.

Go to the Integrations tab.

Center level:

Click the Configurations icon.

Go to the Integrations tab.

Select Accounting.

Expand the Configuration tab and navigate to the Invoice section.

Customer: The name of the guest. This is not required for journal entries.

Line Item: In this section, you can configure how you want to post items to your accounting platform.

Item: Zenoti posts each item with Price. This option is selected by default.

You can Group each item as follows:

Product

Code

Select this option to map each product in Zenoti to the respective chart of accounts in the accounting platform.

Important

You must map each product code to the corresponding chart of accounts in the POSAccounting Mapping form.

Subcategory

Select this option to map each product subcategory in Zenoti to the respective chart of accounts in the accounting platform.

Important

You must map each product subcategory code to the corresponding chart of accounts in the POSAccounting Mapping form.

Category

Select this option to map each product category in Zenoti to the respective chart of accounts in the accounting platform.

Important

You must map each product category code to the corresponding chart of accounts in the POSAccounting Mapping form.

Default Item

Select this option to map all products to a single item Product, which you can use to map to the corresponding chart of account in the accounting platform.

Service

Code

Select this option to map each service in Zenoti to the respective chart of accounts in the accounting platform.

Important

You must map each service code to the corresponding chart of accounts in the POSAccounting Mapping form.

Subcategory

Select this option to map each service subcategory in Zenoti to the respective chart of accounts in the accounting platform.

Important

You must map each service subcategory code to the corresponding chart of accounts in the POSAccounting Mapping form.

Category

Select this option to map each service category in Zenoti to the respective chart of accounts in the accounting platform.

Important

You must map each service category code to the corresponding chart of accounts in the POSAccounting Mapping form.

Default Item

Select this option to map all services to a single item Service, which you can use to map to the corresponding chart of account in the accounting platform.

Membership

Code

Select this option to map each membership in Zenoti to the respective chart of accounts in the accounting platform.

Important

You must map each membership code to the corresponding chart of accounts in the POSAccounting Mapping form.

Category

Select this option to map each membership category in Zenoti to the respective chart of accounts in the accounting platform.

Important

Before you select this option, you must ensure the following:

The Membership Category is Mandatory setting is enabled at the organization level.

Each membership has a category assigned in Zenoti.

Map each membership category code to the corresponding chart of accounts in the POSAccounting Mapping form.

Default Item

Select this option to map all memberships to a single item Membership, which you can use to map to the corresponding chart of account in the accounting platform.

Post Membership Freeze Fee As Separate Item

Select this option to map membership freeze fee to the chart of accounts for freeze fee in the accounting platform. By default, Membership Freeze Fee is the name of the default item for membership freeze fee in Zenoti, which you must map to the corresponding chart of accounts in the POSAccounting Mapping form.

Package

Code

Select this option to map each package in Zenoti to the respective chart of accounts in the accounting platform.

Important

You must map each package code to the corresponding chart of accounts in the POSAccounting Mapping form.

Category

Select this option to map each package category in Zenoti to the respective chart of accounts in the accounting platform.

Important

Before you select this option, you must ensure the following:

The Package Category is Mandatory setting is enabled at the organization level.

Each package has a category assigned in Zenoti.

Map each package category code to the corresponding chart of accounts in the POSAccounting Mapping form.

Default Item

Select this option to map all packages to a single item Package, which you can use to map to the corresponding chart of account in the accounting platform. You can also configure and post day packages as a separate item. If the posting is for JE-wise entries or for the Xero provider, it will automatically default to day packages.

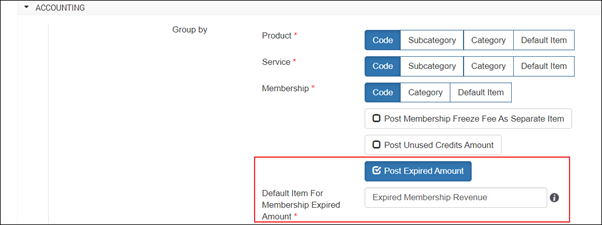

Post Expired Amount

Select this option to map the expired amount from packages in Zenoti to the chart of accounts for package liabilities in the accounting platform. By default, Expired Packages Revenue is the name of the default item for expired amount from packages in Zenoti, which you must map to the corresponding chart of accounts in the POSAccounting Mapping form.

Gift Cards

Zenoti maps all the gift cards to a single item GiftCard, which you can use to map to the corresponding chart of account in the accounting platform.

Post Expired Amount: Select this option to map the expired amount from gift cards in Zenoti to the chart of accounts for gift card liabilities in the accounting platform. By default, Expired Gift Cards Revenue is the name of the default item for expired amount from gift cards in Zenoti, which you must map to the corresponding chart of accounts in the POSAccounting Mapping form.

Prepaid Cards

Zenoti maps all the gift cards to a single item PrepaidCard, which you can use to map to the corresponding chart of account in the accounting platform.

Post Expired Amount: Select this option to map the expired amount from prepaid cards in Zenoti to the chart of accounts for prepaid card liabilities in the accounting platform. By default, Expired Prepaid Cards Revenue is the name of the default item for expired amount from prepaid cards in Zenoti, which you must map to the corresponding chart of accounts in the POSAccounting Mapping form.

Class

Note

You will see this section only if Classes/Fitness is enabled for your business.

Code

Select this option to map each class in Zenoti to the respective chart of accounts in the accounting platform.

Important

You must map each class code to the corresponding chart of accounts in the POSAccounting Mapping form.

Subcategory

Select this option to map each class subcategory in Zenoti to the respective chart of accounts in the accounting platform.

Important

You must map each class subcategory code to the corresponding chart of accounts in the POSAccounting Mapping form.

Category

Select this option to map each class category in Zenoti to the respective chart of accounts in the accounting platform.

Important

You must map each class category code to the corresponding chart of accounts in the POSAccounting Mapping form.

Default Item

Select this option to map all classes to a single item Class, which you can use to map to the corresponding chart of account in the accounting platform.

Discount

Parent Item: Select this option to map each discount type in Zenoti to the respective chart of accounts in the accounting platform.

In Zenoti, a discount can be one of the following types:

Campaign-based discounts - Map each campaign code to the corresponding chart of accounts in the accounting platform.

Membership discounts - These discounts get posted against the membership chart of account that you’ve configured in the Line Item section for memberships.

Package discounts - These discounts get posted against the package chart of account that you’ve configured in the Line Item section for packages.

Manual discounts - Map all manual discounts to the corresponding chart of accounts in the accounting platform.

Price adjustments - Map all price adjusted amounts to the corresponding chart of accounts in the accounting platform.

Important

You must map each discount type to the corresponding chart of accounts in the POSAccounting Mapping form.

For example, if there’s a campaign-based discount in Zenoti Thanksgiving Offer 10% with campaign code as TH10OFF, use TH10OFF in the accounting platform to map the discount to the corresponding chart of account.

Item Type: Select this option to map discounts applied to an item type in Zenoti to the respective chart of accounts in the accounting platform. By default, for each item type in Zenoti a corresponding default item name is created.

Important

You must map the item type discount to the corresponding chart of accounts in the POSAccounting Mapping form.

For example, all discounts applied on services will be accounted under Service Discounts.

Note

This configuration INCLUDES package redemption discounts and membership redemption discounts under the respective item type on which these redemptions are applied. For example, if a package is redeemed on a service, the redemption discount will be accounted under services discount.

Default Item: Select this option to map all the discount types to a single chart of accounts for discounts in the accounting platform. By default, Discount is the name of the default item for discounts in Zenoti, which you must map to the corresponding chart of accounts in the POSAccounting Mapping form.

Note

This configuration DOES NOT include package redemption discounts and membership redemption discounts - you need to configure these discounts separately.

Redemption

You can post the value of a redemption in any one of the following ways:

Based on the benefit actual price

If a liability (package or membership) was sold at $100 (with one benefit of $150), the redemption value that gets posted is $150.

To configure this for packagesDo not select the Package Redemption checkbox.

Enter the default item name for the package redemption.

Use the default name in the accounting platform to map to the corresponding chart of accounts.

To configure this for memberships (with service benefits)Do not select the Membership Service Redemption checkbox.

Enter the default item name for the membership redemption.

Use the default name in the accounting platform to map to the corresponding chart of accounts.

Based on the liability price

If a liability (package or membership) was sold at $100 (with one benefit of $150), the redemption value that gets posted is $100 and the redemption discount that gets posted is $50.

To configure this for packagesSelect the Package Redemption checkbox.

Enter the default item name for the package redemption discount.

Use the default name in the accounting platform to map to the corresponding chart of accounts.

Configure the package redemption as a payment in the Payment Mapping tab.

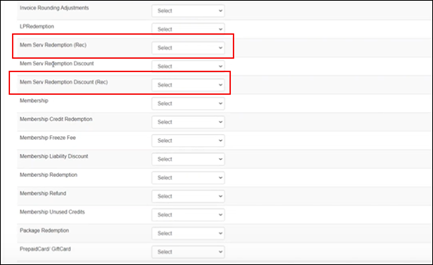

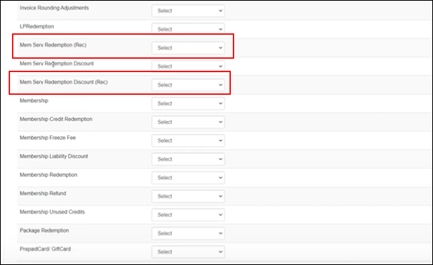

To configure this for memberships (with service benefits)Select the Membership Service Redemption checkbox.

- Enter the default item name for the membership redemption.

Use the default name in the accounting platform to map to the corresponding chart of accounts.

Configure the membership service redemption as a payment in the Payment Mapping tab.

Payment

To configure payments, ensure that each payment type in Zenoti has a corresponding chart of accounts in the accounting platform.

Amount: The payment transaction amount. This option is selected by default.

Deposit to Account: The chart of account to which the payment is mapped in the accounting platform. This option is selected by default.

Date: By default the payments are posted based on the closed date. However, to post payments based on the payment date, select the Date checkbox.

Note

If you’ve selected QuickBooks Desktop as the accounting platform, you will not see the Date checkbox.

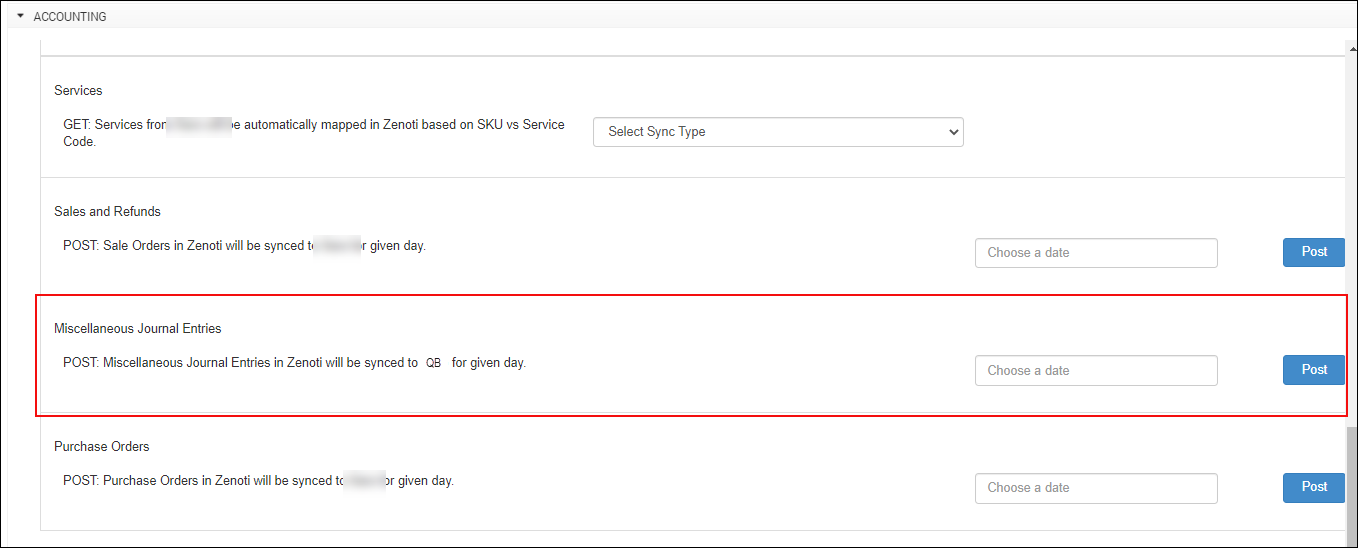

Tax

You can post taxes in four different ways:

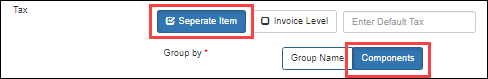

Item-level: Not supported for journal entries - you must select either the Separate Item option of the Invoice Level option.

Tax as a separate item (as tax component): The tax amount is posted by the individual tax components (by names).

Important

Ensure that each tax group in Zenoti is mapped to the corresponding chart of accounts in the POSAccounting Mapping form.

Tax as a separate item (as tax group): The total tax amount is posted by the tax group name.

Important

Ensure that each tax group in Zenoti is mapped to the corresponding chart of accounts in the POSAccounting Mapping form.

Invoice Level: The total tax amount for an invoice is posted in the accounting platform.

Important

Ensure that each tax group in Zenoti is mapped to the corresponding chart of accounts in the POSAccounting Mapping form.

Irrespective of whether you post taxes based on item-level, as a separate item, or based on invoice level, you must enter the default tax group name in the Enter Default Tax box.

Expenses: Select this option to post retail cost of goods to the accounting platform.

Important

You can use this option only if your business tracks inventory in Zenoti.

By default, Cost of Goods Sold is the name of the default item for cost of goods of retail products sold in Zenoti, which you must map to the corresponding chart of accounts in the POSAccounting Mapping form.

Navigate to the Sync section under the Configuration tab.

Start Date: Select the date from when you want to start posting your data to the accounting platform.

Delay: Specify the gap between each data posting.

Important

After you’ve set these two fields, reach out to Zenoti Support to enable auto-sync.

Click Save.

Next step

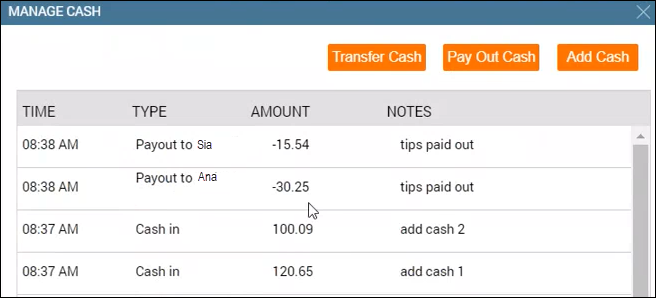

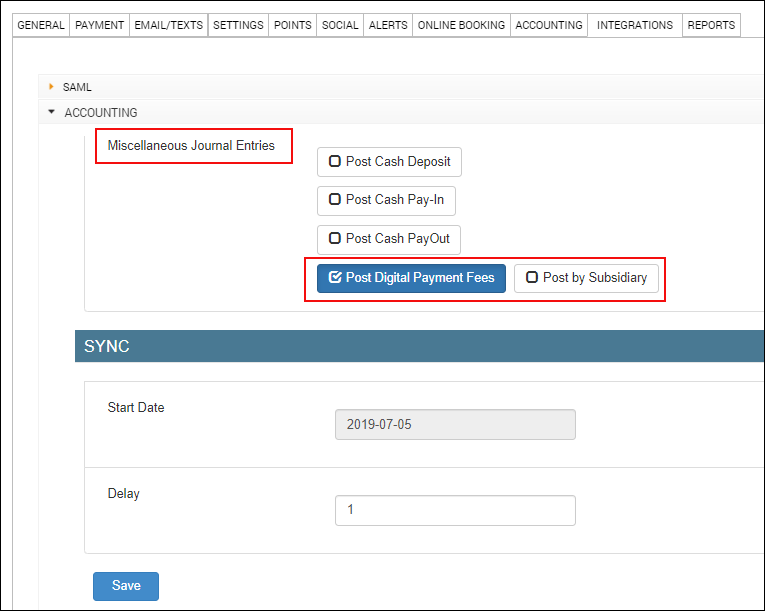

Post bank deposits and cash pay-ins to the accounting platform as journal entries

Generally, businesses use some amount of cash for pay-outs and petty expenses. As these transactions are not tracked, businesses cannot reconcile the cash deposits, cash added to the register, cash pay-outs and petty expenses with their bank statement.

For example, if the center manager of the LA center collected $500 on a day as cash, but deposited only $450 to the bank, the difference of $50 was not tracked anywhere.

Important

For cash-related transactions, a subsidiary is a cash register for a location or center.

Before you begin

On the Configurations page, ensure that the following organization-level settings are enabled for Invoice & Receipt:

Enable multiple cash registers: To post cash deposits, cash pay-outs, cash added, and petty expenses done from each register (subsidiary) as a separate entry. If you enable this setting, you will see the Post by Subsidiary options. However, if you do not enable this setting, all these transactions will be posted from the default register.

Maintain separate product sales: To view the product sales register as a subsidiary in mapping.

To configure posting of cash deposits, cash added, cash pay-outs, petty cash expenses, transfer cash, check deposits as journal entries

At the organization level, click the Configurations icon.

Navigate to Integrations tab.

At the center level, click the Configurations icon.

Navigate to Integrations tab.

Select Accounting.

Expand the Configuration tab.

Navigate to the Invoice section and locate Miscellaneous Journal Entries.

Select the following checkboxes based on requirement:

Post Cash Deposit

You will see the Post by Subsidiary option if you've enabled the Enable multiple cash registers setting at the organization level.

Post Cash Pay-In

You will see the Post by Subsidiary option if you've enabled the Enable multiple cash registers setting at the organization level.

Post Cash Payout

You will see the Post by Subsidiary option if you've enabled the Enable multiple cash registers setting at the organization level.

Post Petty Cash

You can post petty cash as either Petty Cash Expenses based on petty cash categories, or Petty Cash Receipts that is business cash and other receipts.

Post Transfer Cash

You can post transfer cash if you have enabled multiple cash registers at the organization level.

Post Check Deposit

You will see the Post by Subsidiary option if you've enabled the Enable multiple cash registers setting at the organization level.

Note

The payment type as check must be enabled from Organization > Configuration > Payments > Payments setting > Payment Type.

Post Custom Payment Deposit

You will see the Post by Subsidiary option if you've enabled the Enable multiple cash registers setting at the organization level.

Post Card Deposit

You can post cash deposits for both online and offline card payments. Additionally, you have the option to assign card logos to different accounts.

Click Save.

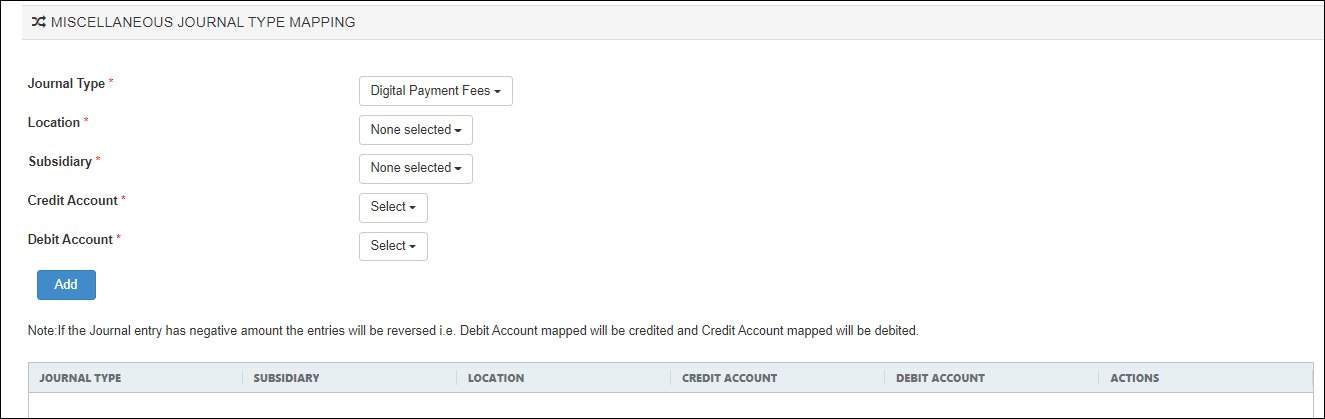

Expand the Miscellaneous Journal Type Mapping section.

For each cash journal entry type, map the following details and click Add:

Journal Type: Select the entry - Cash Deposit, Cash Pay-In, or Cash Payout.

Location: Center for which you want to post the entry.

Subisdiary: Register for each location.

If you've selected the Post by Subsidiary option for the journal entry in the Configuration tab, you can see all the registers that are available for the selected locations.

If you've not selected the Post by Subsidiary option for the journal entry in the Configuration tab, you can see only the default register.

Important

If you've enabled the Maintain separate product sales organization-level setting, you will also see the product sales register as another default register.

Credit Account: Chart of accounts in the accounting platform for credit entry.

Debit Account: Chart of accounts in the accounting platform for debit entry.

Note

If the journal entry has a negative amount, the entries are reversed - the mapped Debit Account is credited and the mapped Credit Account is debited.

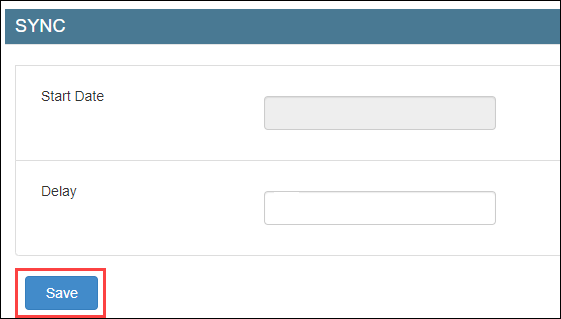

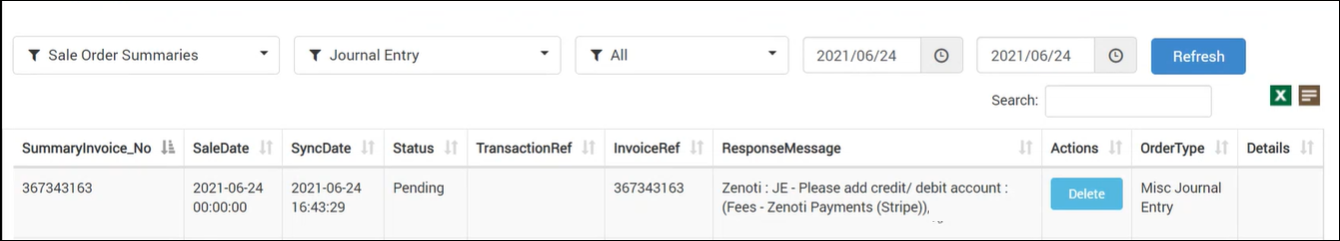

To manually sync data, expand the Manual Sync section and locate Miscellaneous Journal Entries.

Select the date for which you want to post data.

Click Post.

Note

To add auto-sync schedules, reach out to Zenoti.

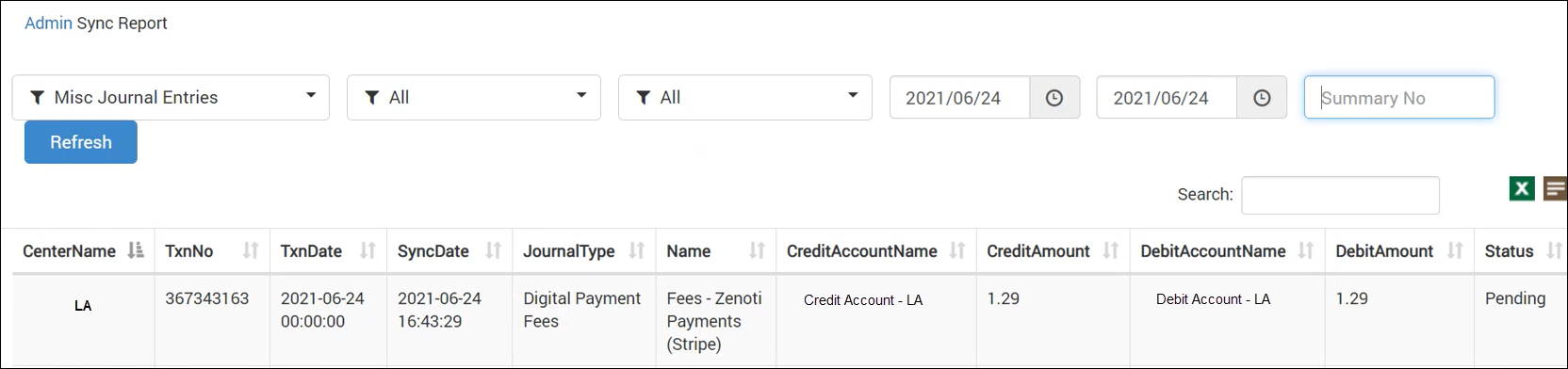

Sample transactions

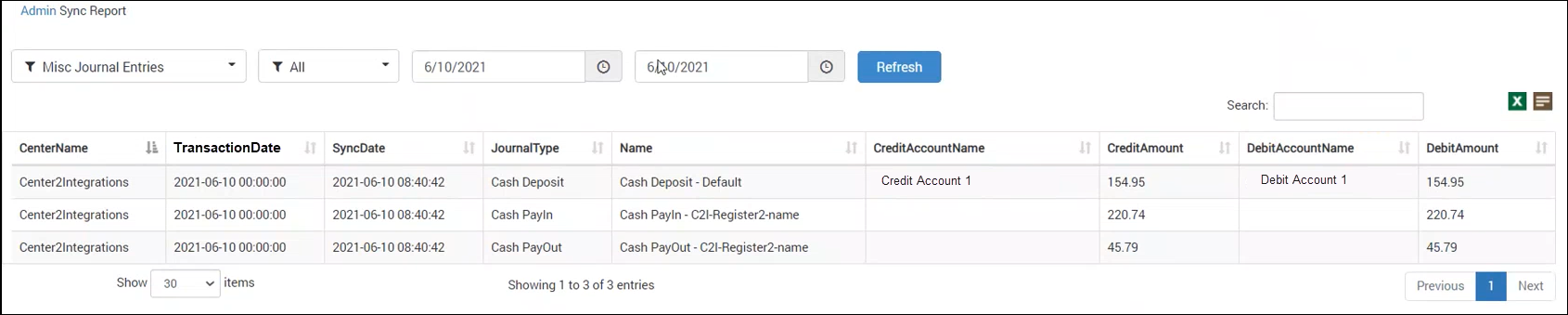

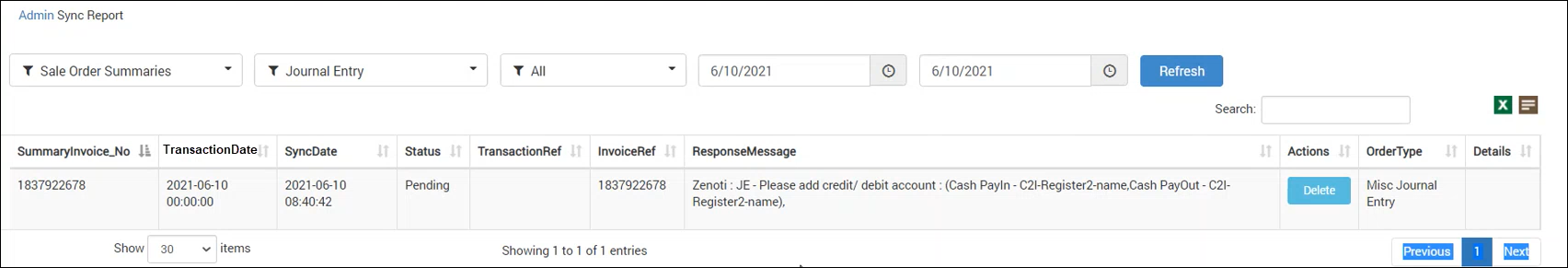

Admin Sync report - Misc Journal Entries

Admin Sync report - Sale Order Summaries

POSAccounting mapping by invoices for accounting integration

After you’ve completed configuring how data in Zenoti can be pushed to the accounting platform, you are ready to map data in Zenoti to data in the accounting platform.

Zenoti partners with POSAccounting to push data from Zenoti to the accounting platform.

Based on where you want to set up the integration, Click the Configurations icon.

Click Integrations.

Select Accounting.

Expand the POSAccounting Mapping tab.

Click Setup Customer Account.

The POSAccounting window opens.

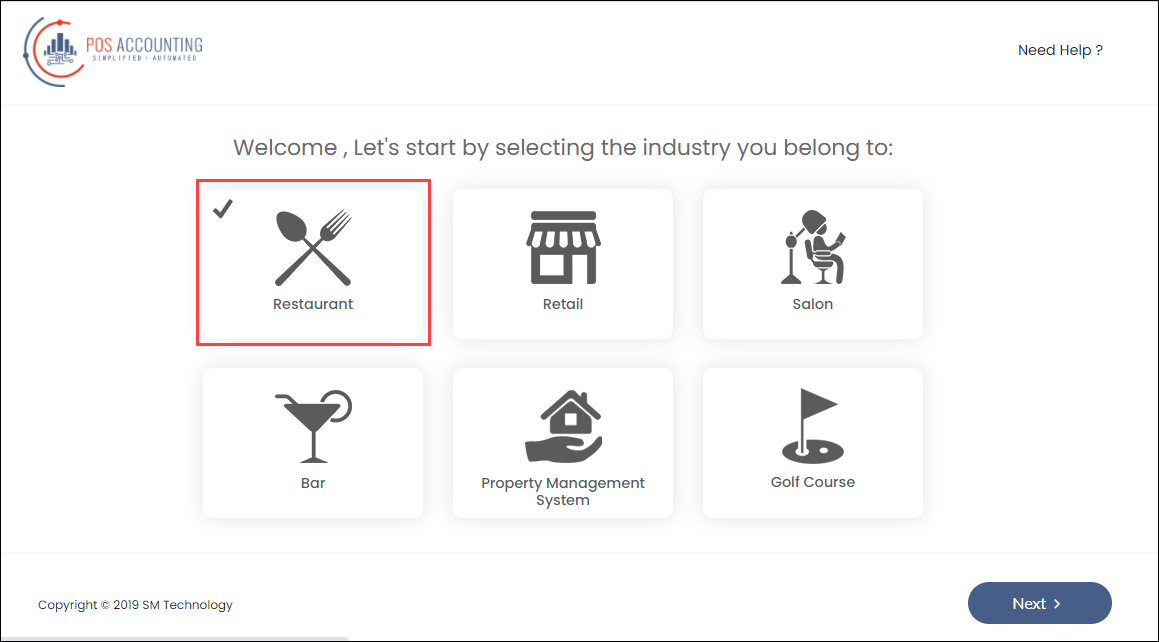

Select the business type as Salon.

Enter the default customer name and click Next.

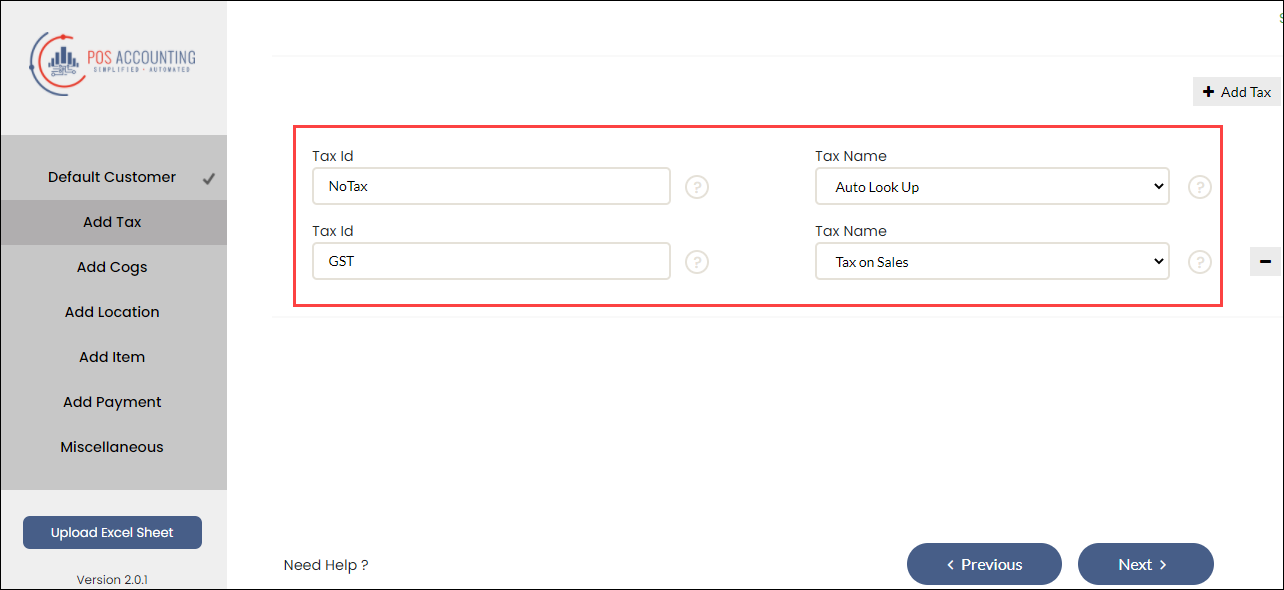

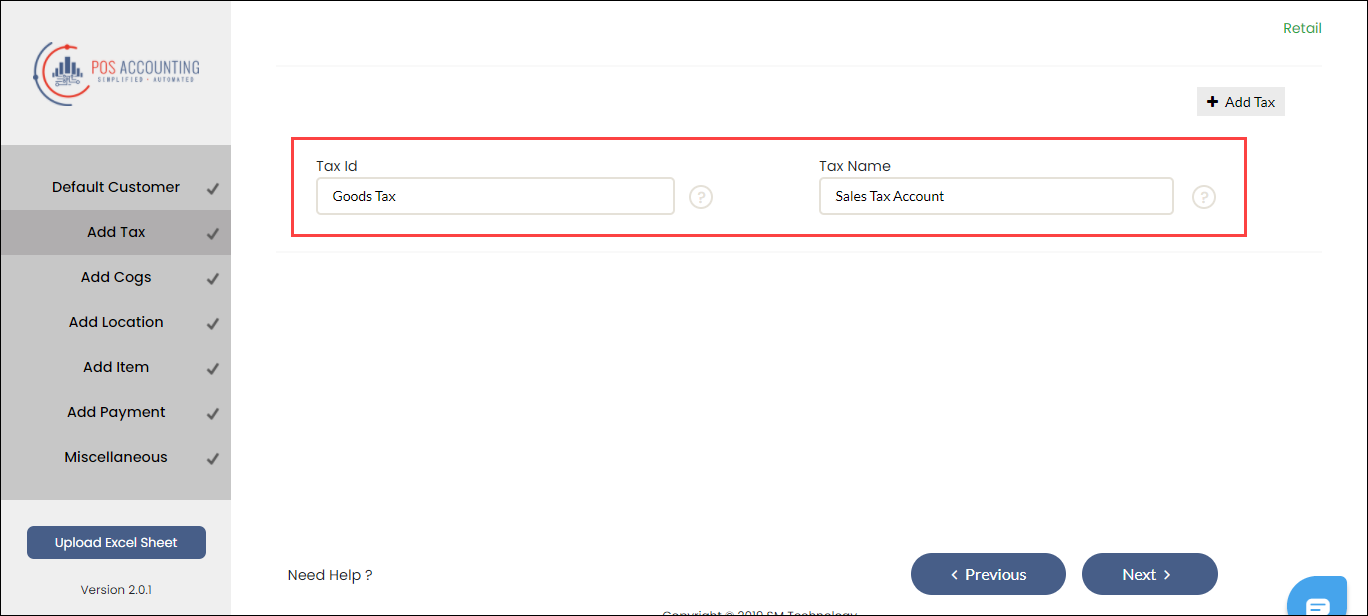

Add the tax details.

If you’ve configured to push tax by group name, enter the tax group code in Tax id and click Next.

However, if you’ve configured to push tax by components, enter the tax component name in Tax id and click Next.

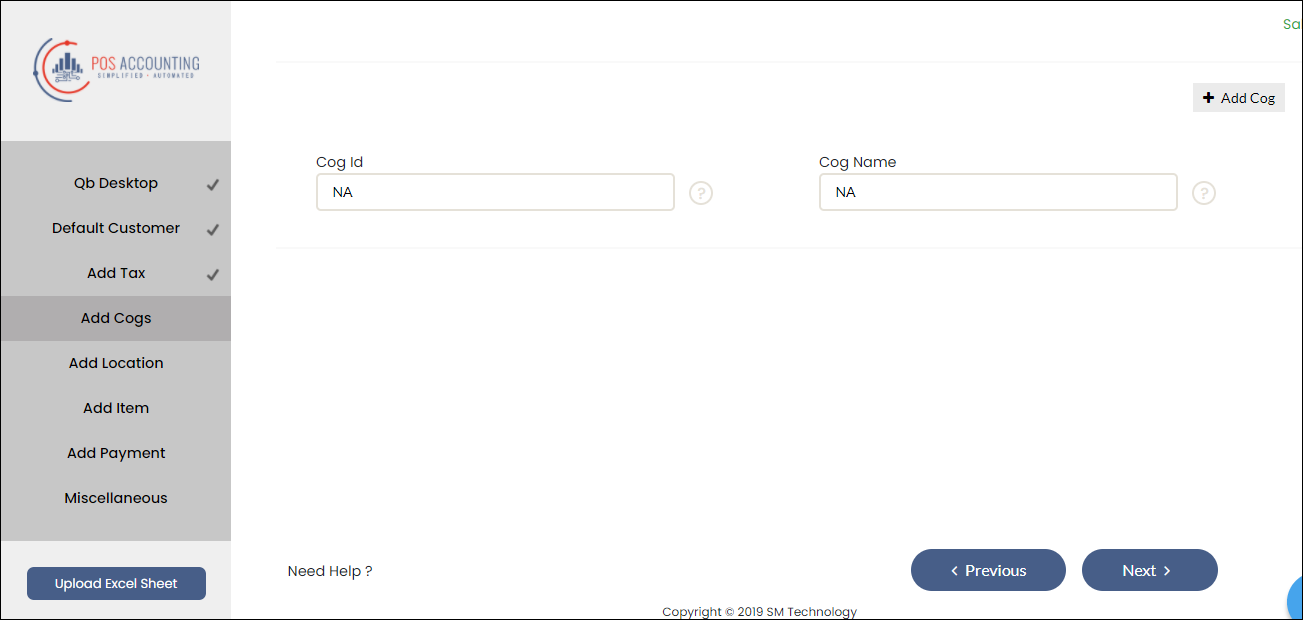

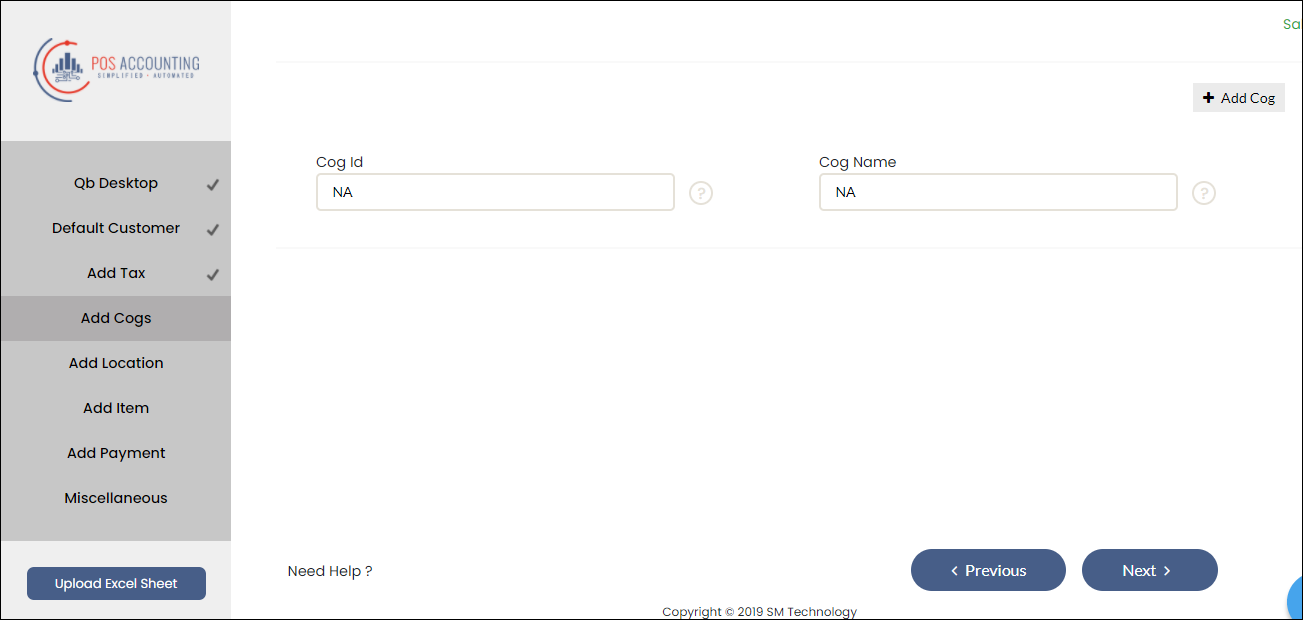

Currently, Zenoti does not post COGS data. You can ignore the Add Cogs section and enter any random values to continue.

To enable locations for your accounting platform, select locations, and enter the location details.

Read our help article on location mapping for Xero, QuickBooks Online, and QuickBooks Desktop.

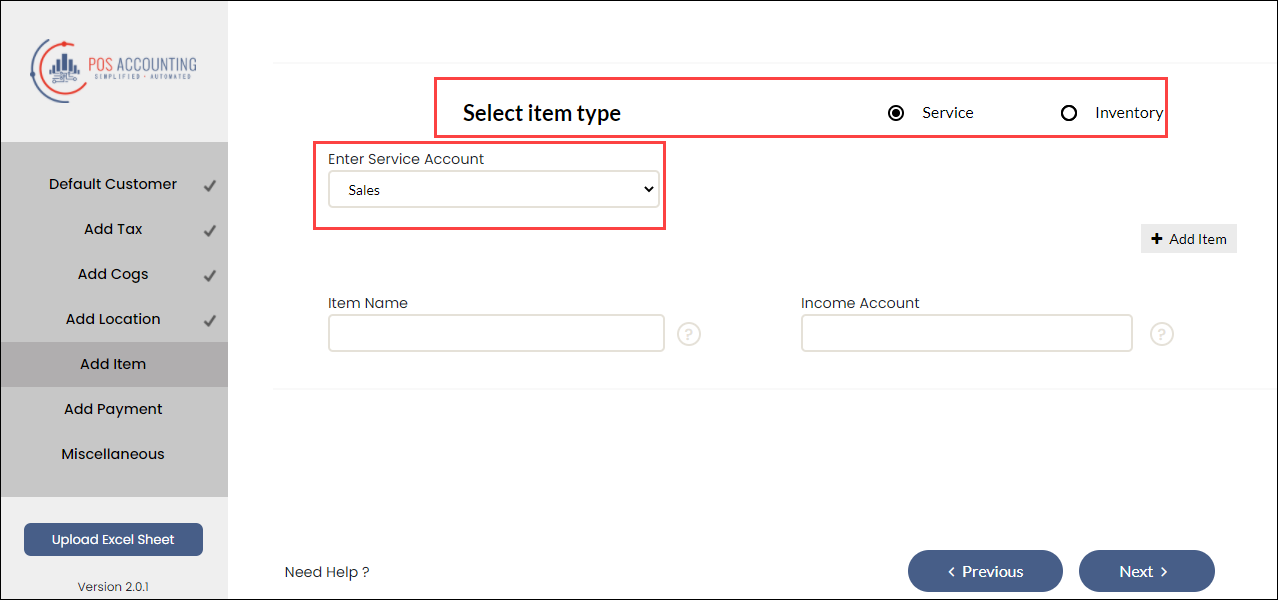

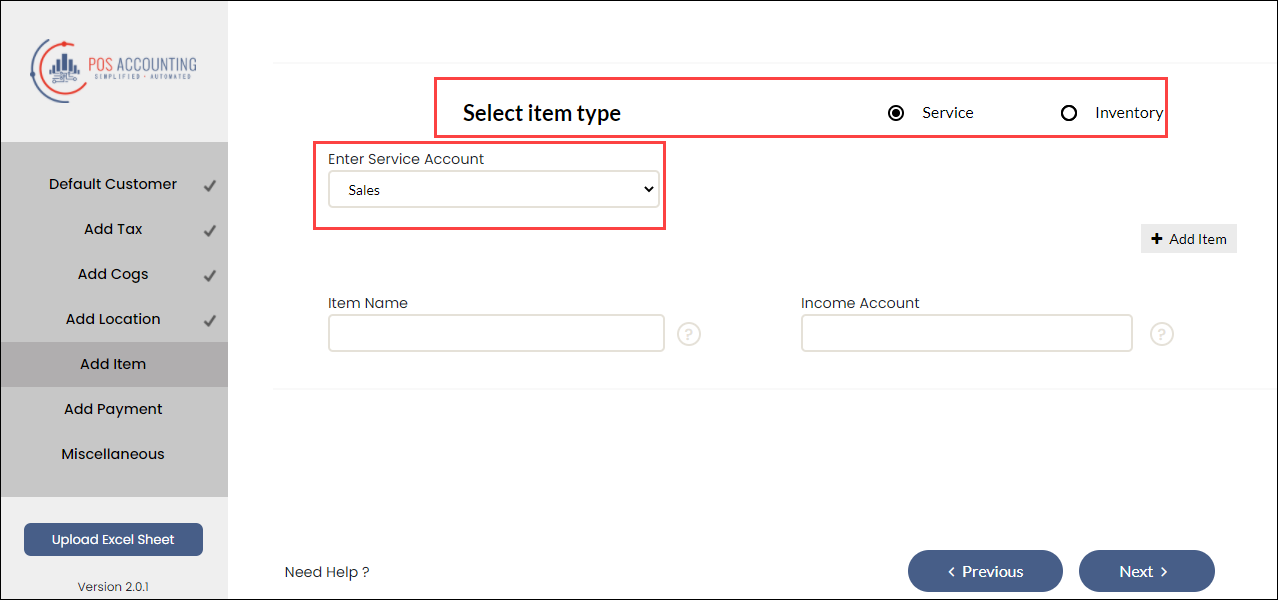

Enter the default sales account for Service and Inventory item types.

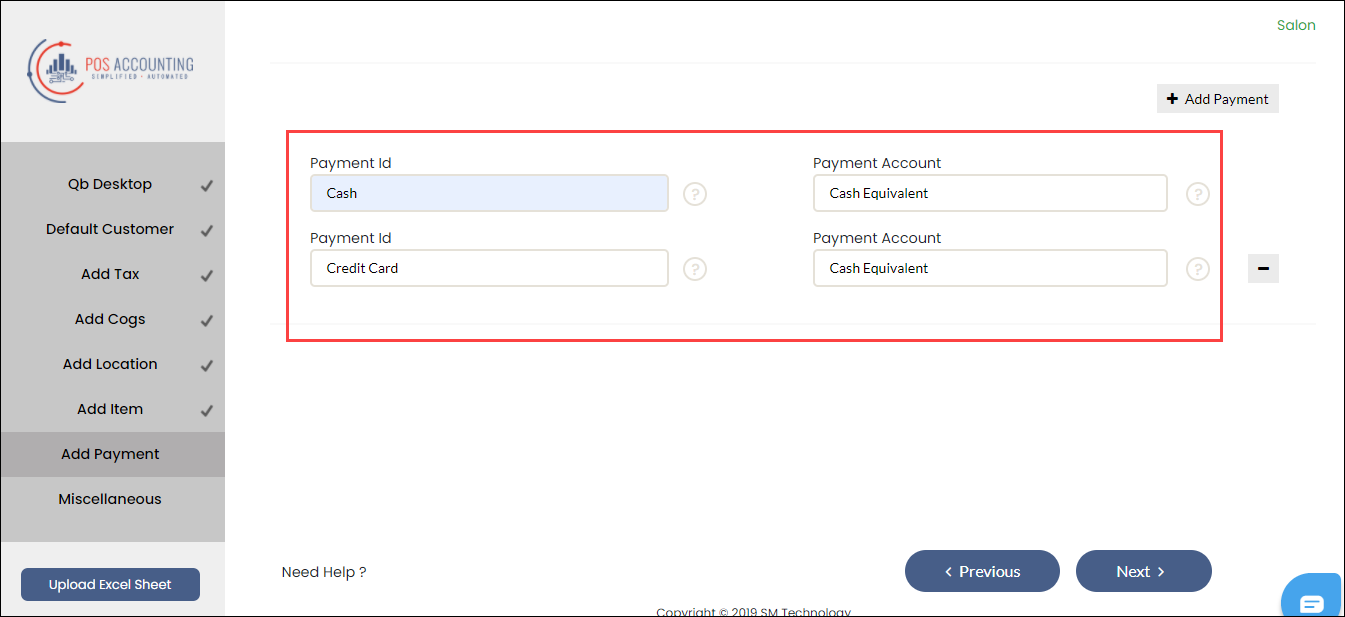

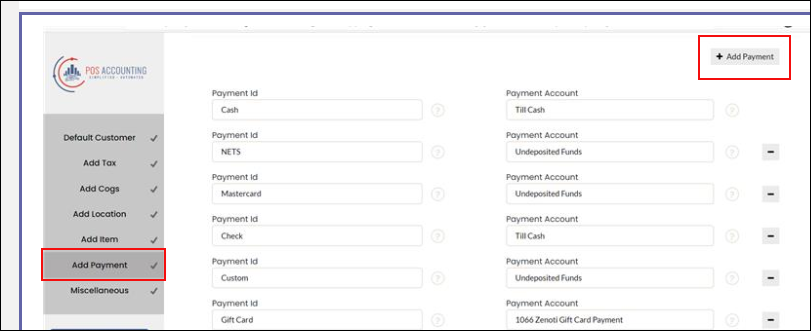

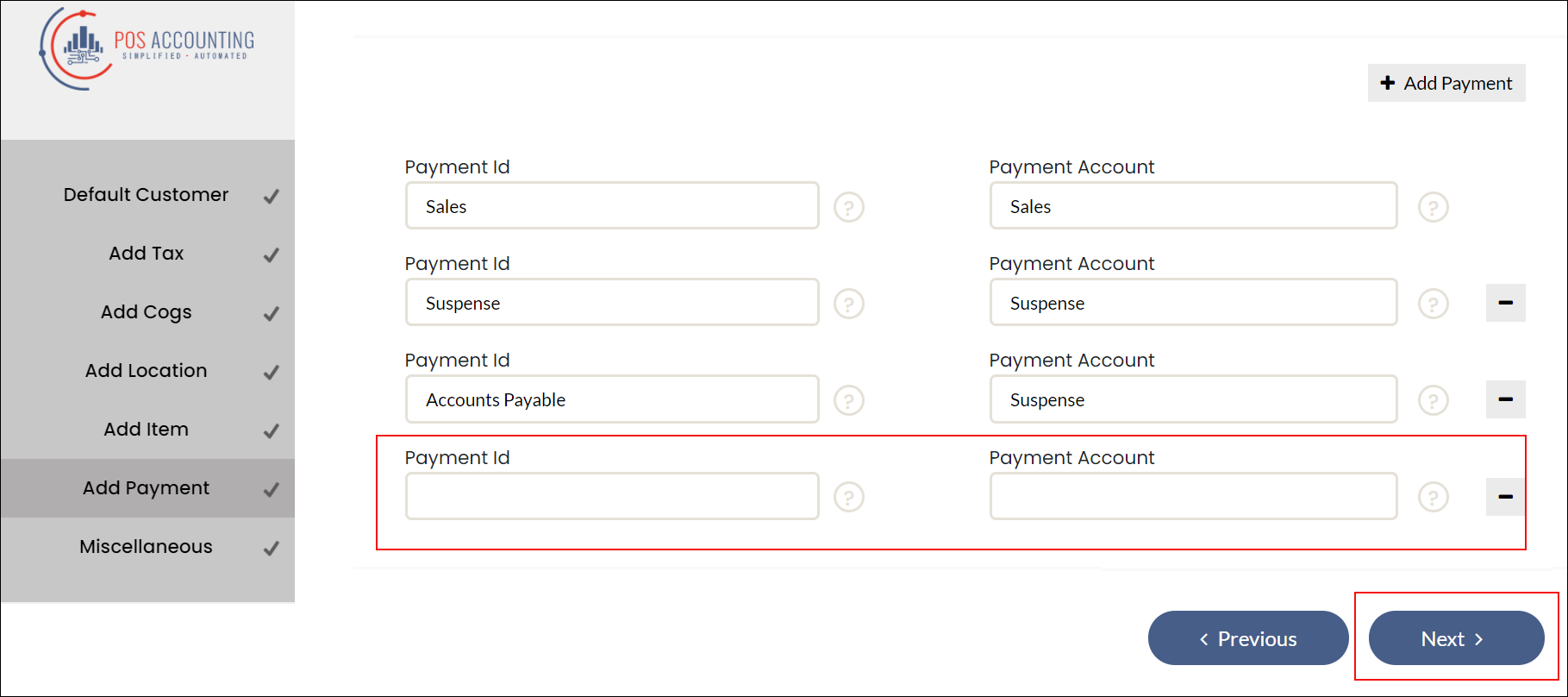

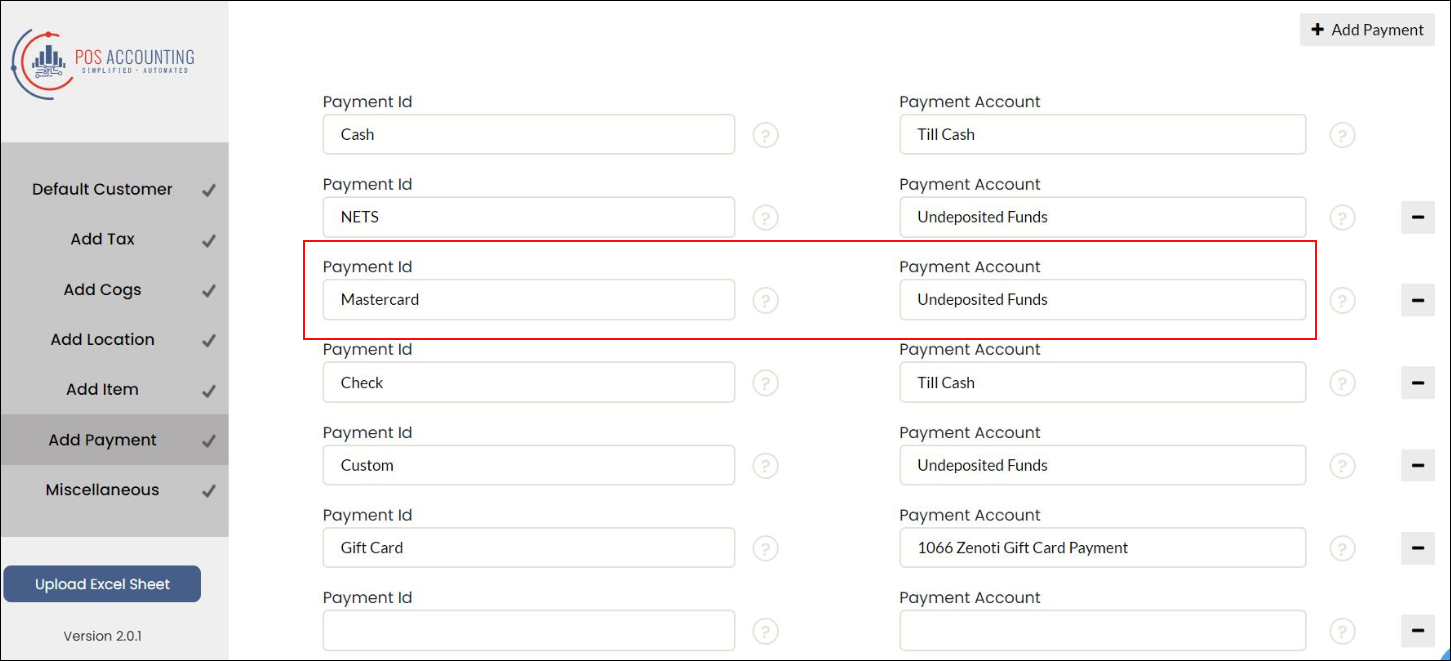

Enter the Zenoti payment type in the Payment Id box and the corresponding payment account (for Xero and NetSuite) or payment method (for Quickbooks Online and Quickbooks Desktop) in the Payment Account box.

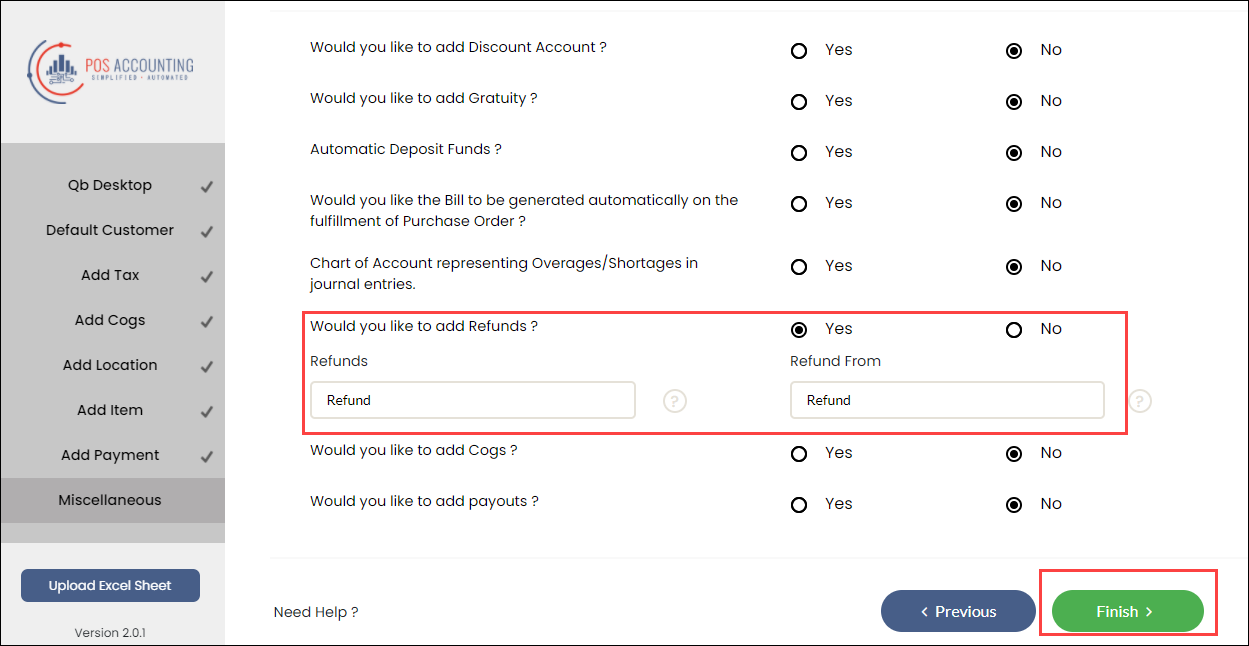

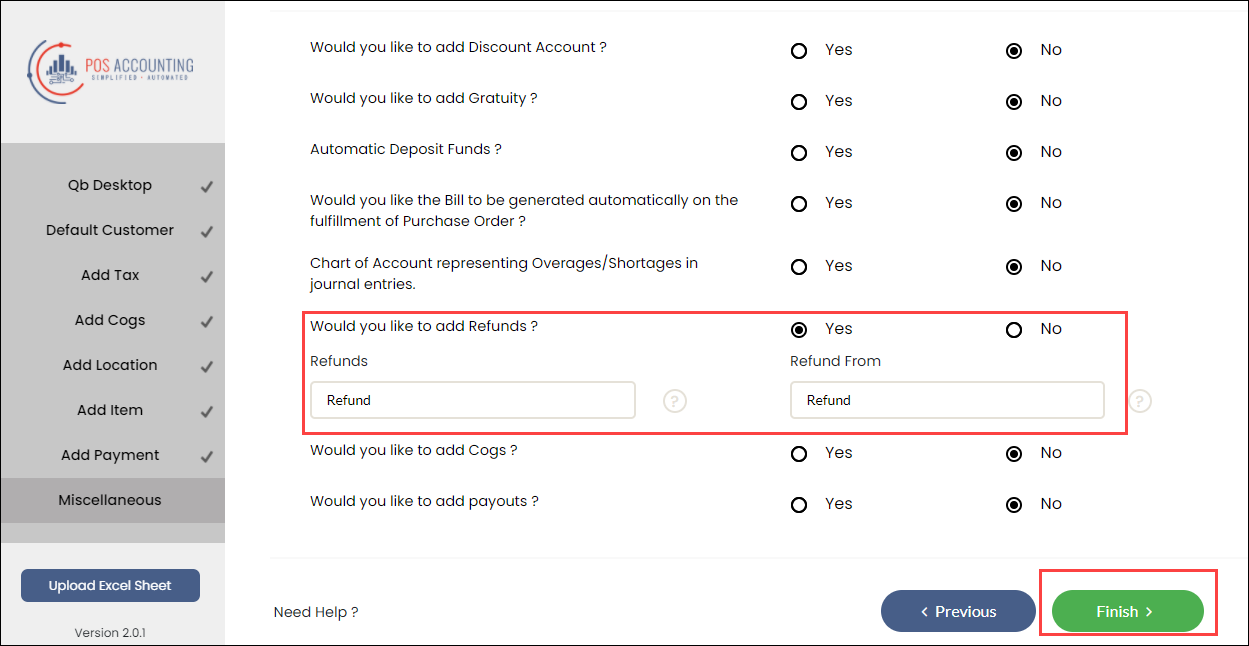

If you want to configure refunds, from the Miscellaneous tab, select Yes for refunds.

Click Finish.

You’ve mapped data as journal entries.

Next step

POSAccounting mapping by journal entries for accounting integration

After you’ve configured how data in Zenoti is pushed to the accounting platform, you are ready to map data in Zenoti to data in the accounting platform.

Zenoti partners with POSAccounting to push data from Zenoti to the accounting platform.

If you are not on the integration page, based on where you want to set up the integration, click Configuration > Integration.

Select Accounting.

Expand the POSAccounting Mapping tab.

Click Setup Customer Account.

The POSAccounting window opens.

Select the business type as Restaurant.

Enter the default customer name and click Next.

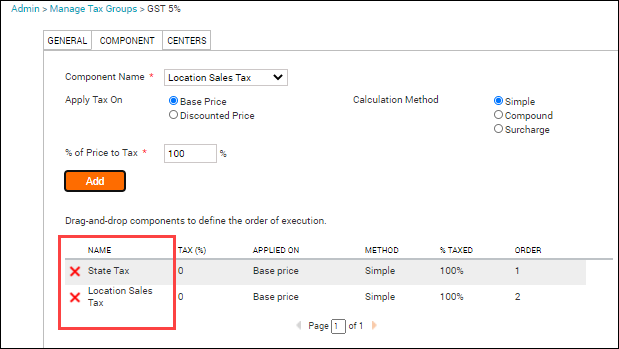

Add the tax details.

There are four ways you can push tax details to the accounting platform:

Tax at item-level: Not supported for journal entries.

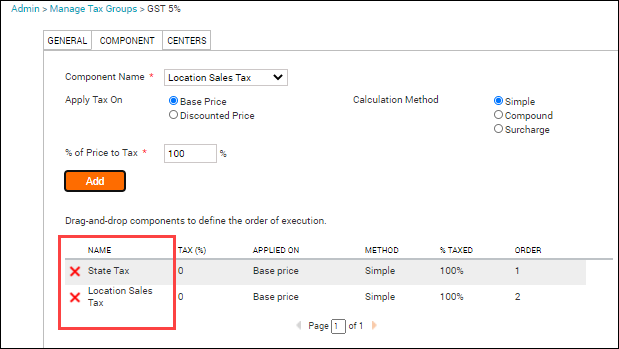

Tax at invoice-level: Enter the tax group code (from Zenoti) in Tax id and map each Tax Id to the respective Tax Name (tax account in the accounting platform).

Tax as a separate item (as tax group): You can map tax as a separate item to the respective tax account in the Add Item section (step-7 in this article) within the POSAccounting form.

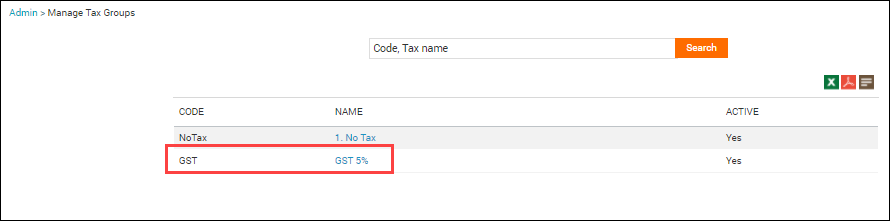

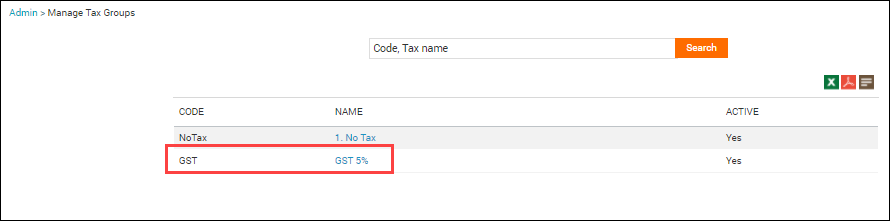

You can get the tax group code in Zenoti from the Business details > Business setup > Financials > Taxes > Tax groups at the organization level.

Tax as a separate item (as tax component): You can map tax as a separate item to the respective tax account in the Add Item section (step-7 in this article) within the POSAccounting form.

You can get the tax component name in Zenoti from the Configurations > Set Up > Tax Groups > Manage Tax Groups page at the organization level.

After you choose how you want to push tax details, click Next.

Currently, Zenoti does not post COGS data. You can ignore the Add Cogs section and enter random values to continue.

To enable locations for your accounting platform, click Add Locations, select the desired location, and enter the location detail. Repeat this process for all locations that you want to map.

Read our help article on location mapping.

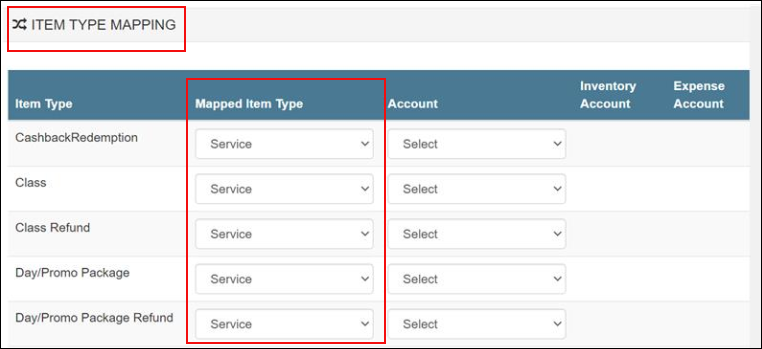

Enter the default sales account for the Service item type and map each item name (based on the configuration) with the respective account name. For example, if you’ve configured to post products based on category, you must enter the product category code from Zenoti in Item Name and map Item Name to the respective income account in the accounting platform.

Note

Do not select the Inventory item type as Zenoti does not support posting of data to COGS and asset accounts.

Enter the Zenoti payment type in the Payment Id box and the corresponding payment account (for Xero and NetSuite) or payment method (for Quickbooks Online and Quickbooks Desktop) in the Payment Account box.

If you want to configure refunds, from the Miscellaneous tab, select Yes for refunds.

Click Finish.

You’ve mapped data as journal entries.

Next step

Payment Mapping

Post cross-center redemption of gift cards as journal entries to the accounting platform

Notice

This enhancement is for businesses with the sale model or value model.

Generally, businesses with multiple centers allow guests to redeem gift cards across centers. For cross-center settlement, businesses need the amount to appear as payable for the center where the gift card is sold, and as receivable for the center where the gift card is redeemed.

Example: A guest purchased a $100 gift card from the Los Angeles center and redeemed it on a service worth $100 at the San Jose center. Based on the value model, when Zenoti syncs this redemption to the accounting platform, the value of the service $100 is posted as payable to the Los Angeles center and as receivable to the San Jose center.

To configure posting of gift card redemption based on value

At the organization or center level, click the Configuration icon

Click the Integrations tab and expand Accounting.

Expand the Configuration tab and navigate to the Invoice section.

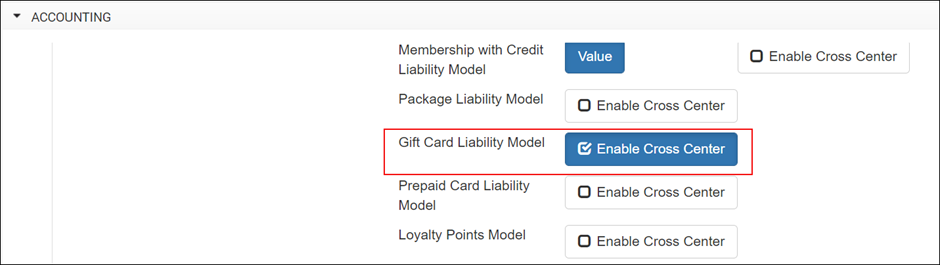

For Gift Card Liability Model, select the Enable Cross Center check box. The following fields appear.

Default Item for Gift Card

Note: If you select posting by Payment Type, you will not see this field for configuration.

Default Item for Gift Card Redemption (Receivable)Note: If you select posting by Payment Type, you will not see this field for configuration.

Default Item for Gift Card Liability (Payable)

Note: If you select posting by Payment Type, you will not see this field for configuration.

Default Item for Gift Card Redemption (Payable)

Under the Sync section, click Save. You can post the receivable amount as either an item or as payment. However, you can post the payable amount as only journal entries.

To post redemption amount as journal entries, expand the Payments Mapping tab and add and map the chart of accounts for receivable and payable.

To post redemptions as invoices, expand the Item Type Mapping tab and add and map the chart of accounts for receivable.

Click Save. The integration is configured to post cross-center redemptions for gift cards based on value.

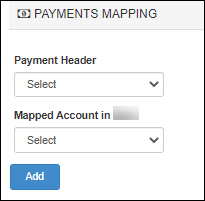

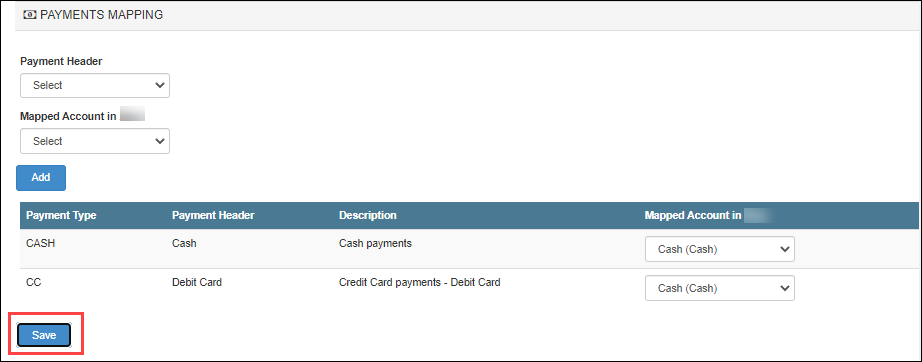

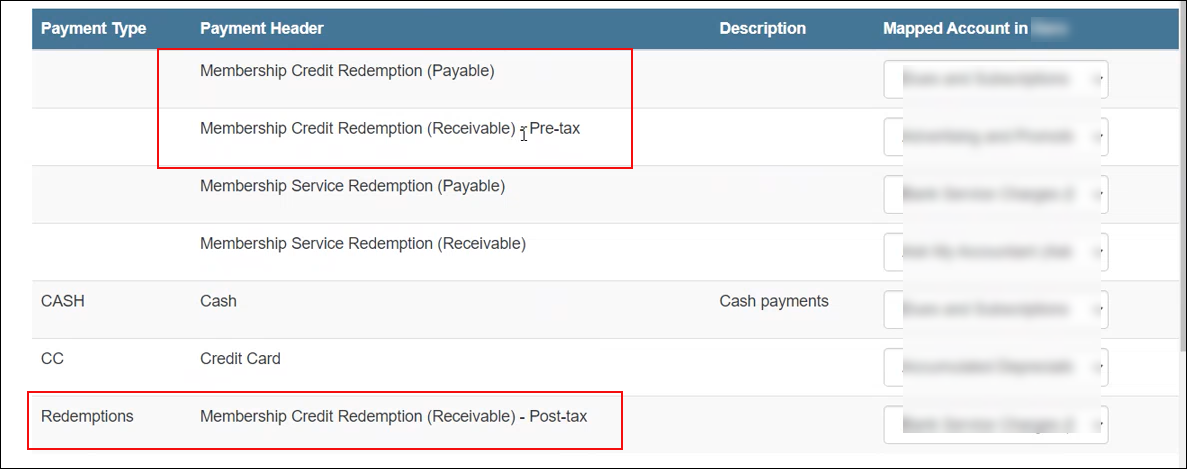

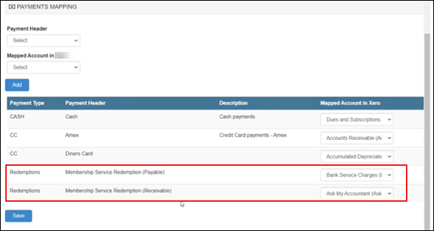

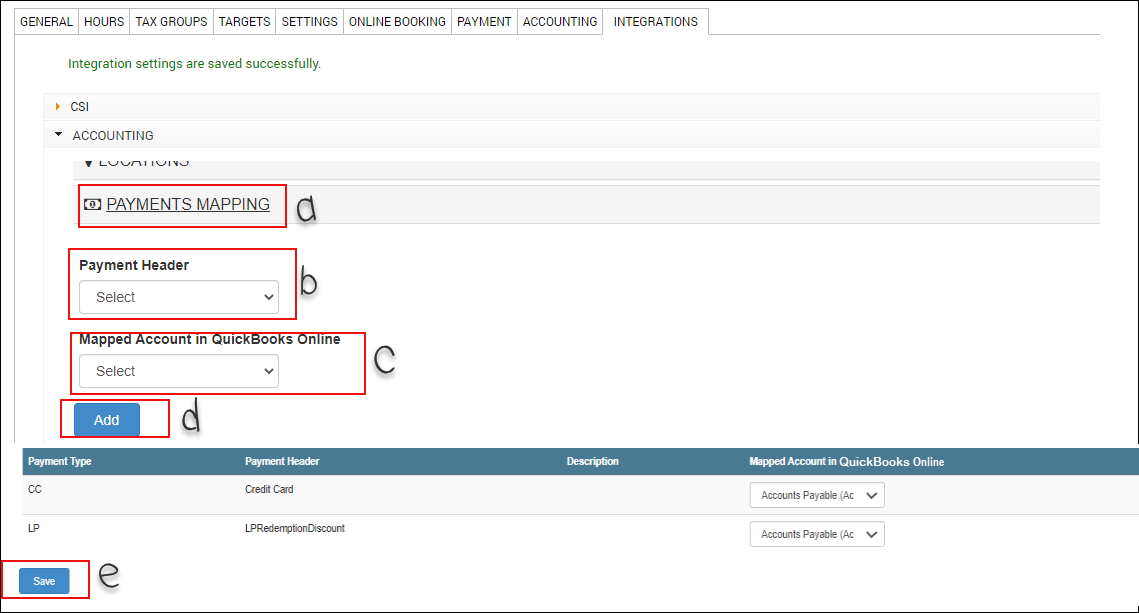

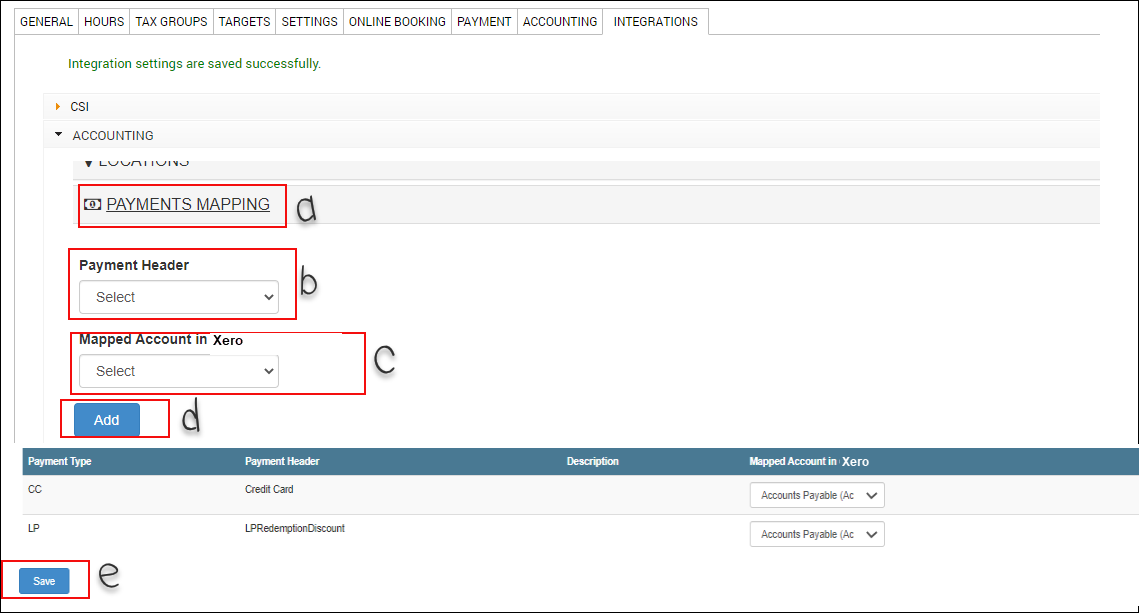

Payment mapping for accounting integration

After you’ve completed configuring (by invoice) how you want to push data from Zenoti to the accounting platform, you must map each payment type in Zenoti with the corresponding payment account (for Xero and NetSuite) or payment methods (for Quickbooks) in the accounting platform.

For example, if the payment type Cash in Zenoti is configured as the Cash payment account in the accounting platform, you must map these two payment types.

Important

Before you start mapping the payment types, you must sync the accounts in the Manual Sync tab.

At the organization level, click the Configurations icon.

Click the Integrations tab and expand Accounting.

Locate and expand the Payments Mapping tab.

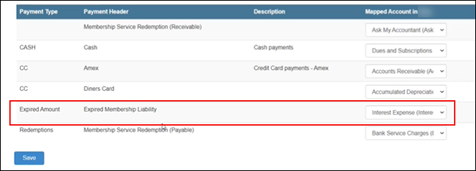

For each payment type in Zenoti, do the following: