Manage Disputes against Zenoti Payments

Dispute handling overview

A dispute or a chargeback occurs when a guest or cardholder raises a complaint with their bank or credit card company about a payment made to your business.

When the bank receives the complaint, the bank creates a formal dispute and reverses the payment. Your business is notified about the reversal, and the card network charges a dispute fee.

Sometimes a cardholder’s bank may investigate a complaint before a formal chargeback. In such a scenario, the bank raises a dispute with the status Inquiry and does not withdraw funds from your account.

When a dispute is raised, the disputed amount is returned to the cardholder's account automatically.

However, you have a chance to respond to the dispute and submit evidence to make your case that the payment was valid.

If you have received a dispute notification, this is what you need to do:

Understand the evidence you must submit for the dispute type.

Respond to the dispute by either accepting the dispute or submitting evidence to prove that the payment was valid.

Configure the Zenoti Payments Dispute notification

Dispute notifications can be configured either at the organization level (requiring Organization Owner permissions) or through the Dispute Management System (DMS) user interface.

Configure the Disputes notification from the organization level:

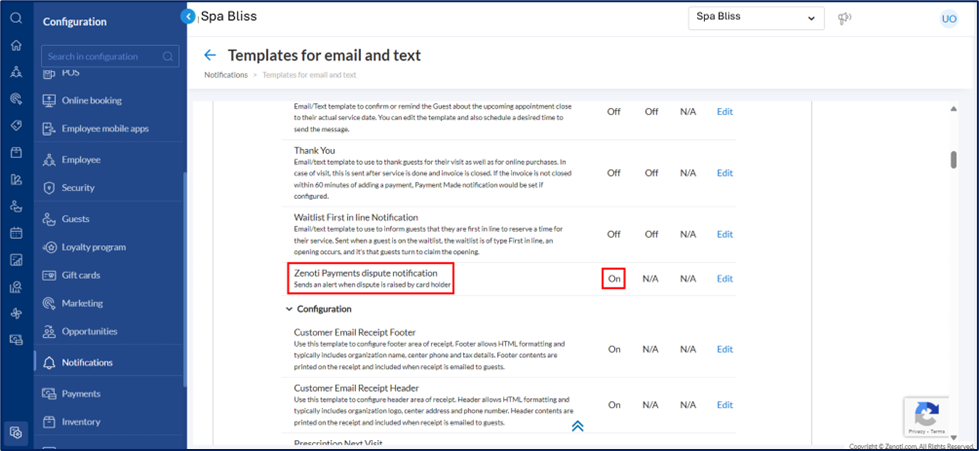

Navigate to Configuration > Notifications.

Select Templates for email and text.

Turn on Zenoti Payments dispute notification.

Click Save.

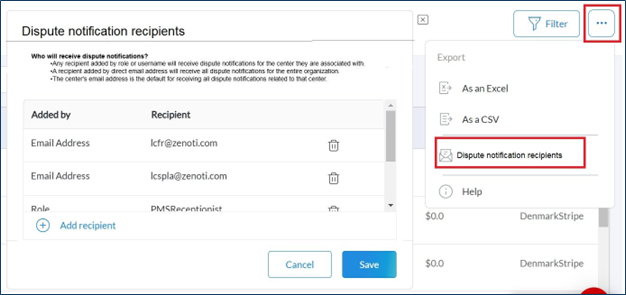

Alternatively, Configure the Disputes notification from the DMS (Dispute Management System).

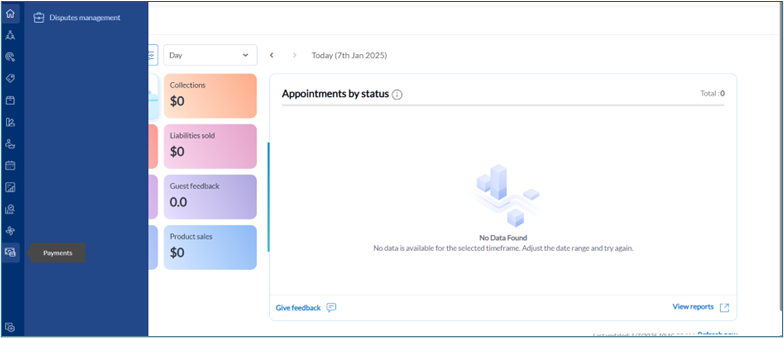

From the organization level, go to Payments and click Disputes Management.

Click the 3 dots on the top right hand side.

Select Dispute notification recipients.

Add recipients by role, email, or username.

Note:

Only organization owners can configure these settings.

Any recipient added by role or username will receive dispute notifications for the center they are associated with.

A recipient added by direct email address will receive all dispute notifications for the entire organization.

The center's email address is the default for receiving all dispute notifications related to that center.

Email Notifications for chargebacks

Notifications are sent for the following events to ensure efficient communication:

Request for Information (RFI): Triggered when issuers request additional details about a transaction. No money is withdrawn at this stage, but failure to respond may result in a chargeback and money being withdrawn.

Notification of chargeback: Sent when a cardholder disputes a credit card charge.

Dispute withdrawn: Sent when a cardholder formally withdraws the dispute.

Dispute won: Sent when the issuer resolves the dispute in favor of the business.

Dispute lost: Sent when the issuer resolves the dispute against the business.

Impacts and considerations

Disputes are handled by your guest's bank, so the bank’s decision is final. Zenoti does not influence the review of this payment.

In case of a dispute, the card network charges a dispute fee. Zenoti will collect the same on behalf of the payment processor.

The timing and the fee applied depend on your contract with Zenoti and can vary. Please review your agreement with Zenoti to understand how the dispute fee is handled for your business.

Note: The dispute fee will be automatically deducted from your net payable amount and will be reflected in the Digital Payments Report.

If the dispute is found in your favor, the disputed amount will be returned to you.

If a dispute is upheld, the cardholder’s payment remains in their account.

The defense document created by the system is in the best interest of the business with information available at hand. However, it is not guaranteed that the document will result in winning the dispute.

Dispute impacts on payouts and reporting

When a guest raises a dispute, the entire disputed amount—not just the net payout—is immediately deducted from your payable balance.

Example:

On January 1, a guest completes a $100 transaction.

Assuming a 2% Zenoti payment processing fee, the business receives $98 from the $100 transaction.

On March 31, the guest disputes the transaction → $100 is deducted from the business’s account (not just $98).

Note:

These deductions are reflected in the Digital Payments Report.

Guests may dispute:

The full amount (e.g., $100), or

A partial amount (e.g., $50), known as a Partial Dispute.

Role permissions to access the dispute management system

Role permission: Dispute payments

Important

If an employee already has the role permission Dispute payments report, they will automatically have the role permission Dispute payments. If not, you must enable the role permission Dispute payments for them manually.

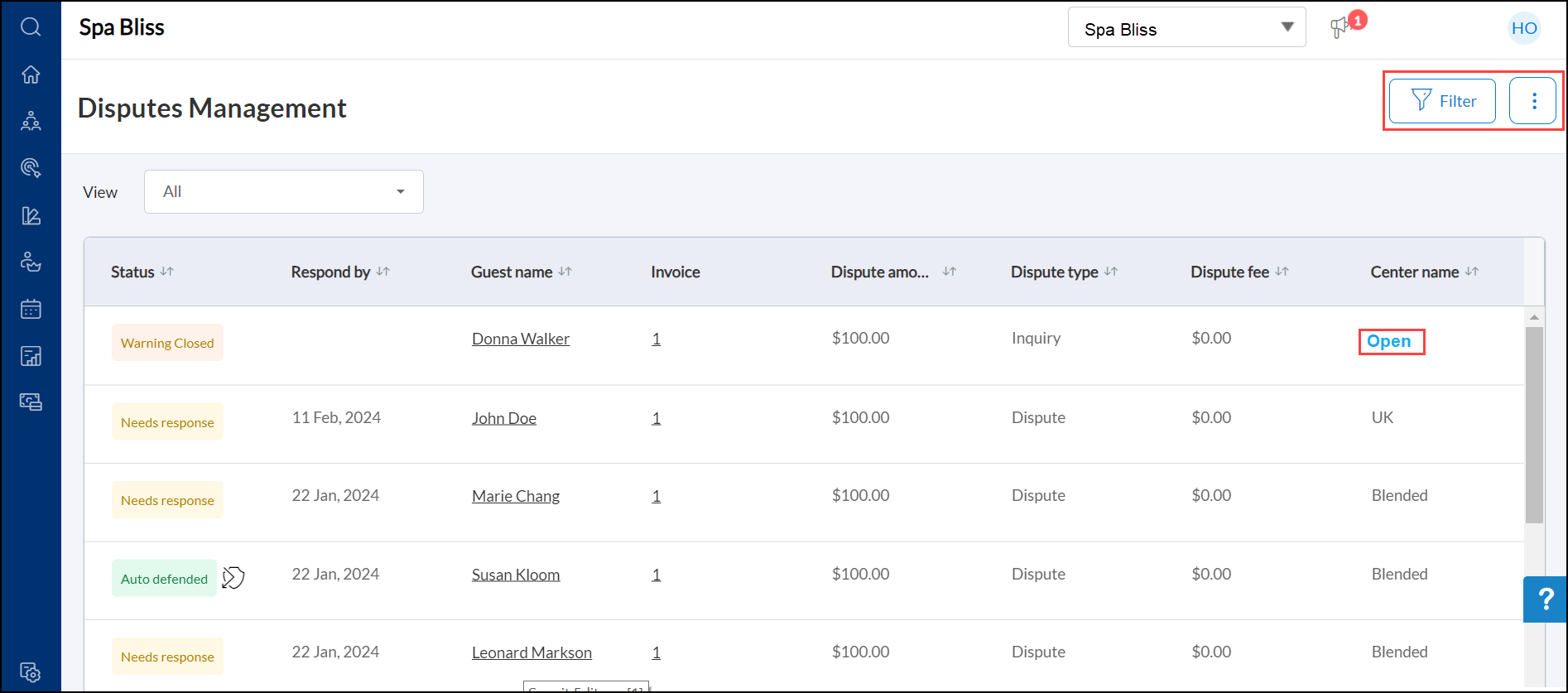

View disputes raised against your business

At the organization or the center level, click the Payments icon.

Select Disputes management.

Alternatively, you can also use the View list to view disputes from a predefined set of filters.

Quick filter

Description

Raised in the last seven days

List of disputes that have been created within the last seven days of the current day (the day on which you are accessing the dispute management system)

Needs to be defended

List of disputes for which evidence document has to be submitted (this filter doesn't consider the date of submission)

Needs to be defended today

List of disputes where an evidence document must be submitted on the current day (the day on which you are accessing the dispute management system)

If you fail to submit the evidence within the specified time, the system will submit the last saved evidence automatically on your behalf.

Won in the last 30 days

List of disputes that the business has won in the last 30 days from the current day (the day on which you are accessing the dispute management system)

To see the details of each dispute, against the dispute, click Open.

Depending on the status of the dispute you can either edit, save and submit the evidence document, or accept the dispute.

Zenoti automatically gathers the required information and drafts an evidence document on your behalf. This may take a few hours from the time when the dispute was raised.

Dispute statuses and respective actions

Dispute status | Meaning | Action |

|---|---|---|

Needs Response | Dispute has to be responded with an evidence document | Edit & submit the evidence document, or accept the dispute |

Warning Needs Response | When a dispute hasn't been raised yet, and the card holder's bank is investigating a complaint, they might reach out to you requesting evidence. This status represents the requirement of evidence even before a dispute is raised | Edit & submit the evidence document, or accept the dispute |

Accepted | You have accepted the dispute raised and are agreeing that the amount will be refunded to the guest | No action |

Responded | When you have submitted the required information against the dispute inquiry i.e. before the dispute is raised | No action |

Not Responded | When you have not submitted the required information before the dispute is raised This may result in a dispute being raised | No action |

Under Review | Submitted evidence and is being verified/reviewed | No action |

Under Review (Auto-defended) | The dispute has been automatically handled by the payment processor without the need of an evidence document submission from your end | No action |

Won | Submitted evidence is accepted by the issuing authority | No action |

Lost | Submitted evidence is not accepted by the issuing authority | No action |

Withdrawn | Guest has withdrawn the dispute They can withdraw their dispute before or after you submit the evidence | No action |

Non-defendable disputes

Non-defendable disputes (also called unchallengeable disputes) are chargebacks that can’t be contested. These are decided automatically by the card network—no evidence-submission is allowed, and the chargeback is final.

Common reasons include:

Fraud claims on transactions that weren’t authenticated with 3D Secure.

Services not rendered, with no delivery or completion proof.

Charges after a customer canceled a subscription or withdrew consent.

In these cases, the card network typically grants the chargeback to the customer automatically, and you, as the merchant, won’t be able to submit evidence. You will see those disputes in Zenoti as lost and no further actions are permitted.

Submit evidence in your defense

If you want to defend yourself from the dispute, you must submit an evidence document.

The system automatically gathers some basic information and generates an evidence document on your behalf. You can edit it and then submit the evidence document. If you do not submit the evidence document by the due date, the system will automatically submit it on the due date on your behalf.

Before you begin

If you have any image proof you'd like to add to the evidence document, you must have the image open in a folder on your device.

If the dispute is raised for a product sale, the system-generated evidence document will include the product sales history to ensure accuracy. This will also serve as evidence that the cardholder frequents your business.

You can choose to replace the system-generated evidence document entirely with a custom evidence document (only in pdf format), or edit parts of the system-generated document and customize it for your requirements.

You will still have the option to switch back to the default system-generated evidence document at any time before submission.

At the organization or the center level, click the Payments icon.

To review and submit the evidence document, you can:

Check for inaccuracies and edit any information mentioned in the document.

Drag and drop any image proofs you have onto the document.

Save the document for submitting it later.

Click Submit.

Cross-currency disputes

This article explains the concept of cross-currency disputes, how they arise, and the steps to manage them effectively. It includes examples to help businesses understand the impact of fluctuating exchange rates during chargeback and dispute resolution processes.

Overview

Cross-currency disputes occur when the chargeback amount is in a different currency than the original transaction amount. This typically happens when the presentment currency (cardholder's currency) differs from the transaction currency, leading to complications due to exchange rate fluctuations. Zenoti accurately records these disputes, ensuring financial transparency.

Key terms

Chargeback: A reversal of a card transaction initiated by the cardholder’s bank, often due to disputes over the transaction.

Settlement currency: The currency in which the merchant receives the final payment.

Cross-currency dispute: A dispute where multiple currencies are involved in the transaction and chargeback process.

Example

When a customer uses a card issued in one currency (example, USD) to make a purchase or refund in another currency (example, GBP), discrepancies may arise due to exchange rate differences.

For example, a customer swiping a USD card for a GBP 500 transaction might see $655.95 on their statement. If the customer disputes the charge or requests a refund, exchange rate fluctuations may lead to mismatched amounts. As a business owner or a center manager, you can identify cross-currency disputes. Zenoti gives clarity by:

Highlighting currency differences.

Providing accurate transaction details.

Displaying a history of payment and refund movements for transparency.

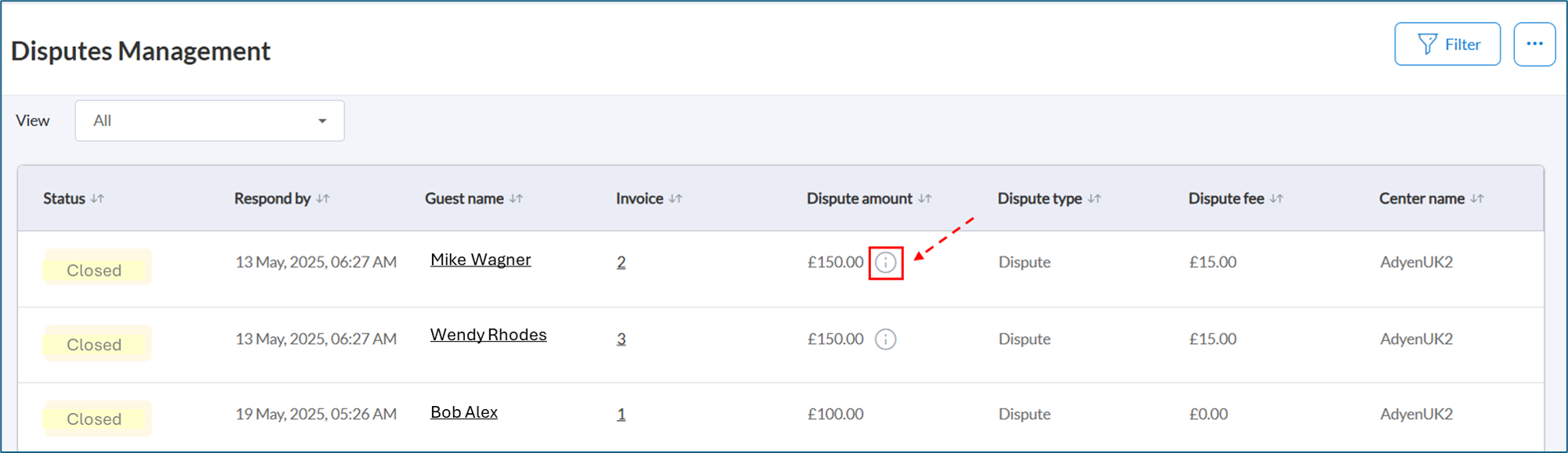

View cross-currency disputes

Navigate to the Payments section at the organization or center level.

Click Disputes Management.

Look for disputes that are flagged with an information icon.

Note: These represent cross-currency disputes where the currency of the transaction and the currency of settlement differ.

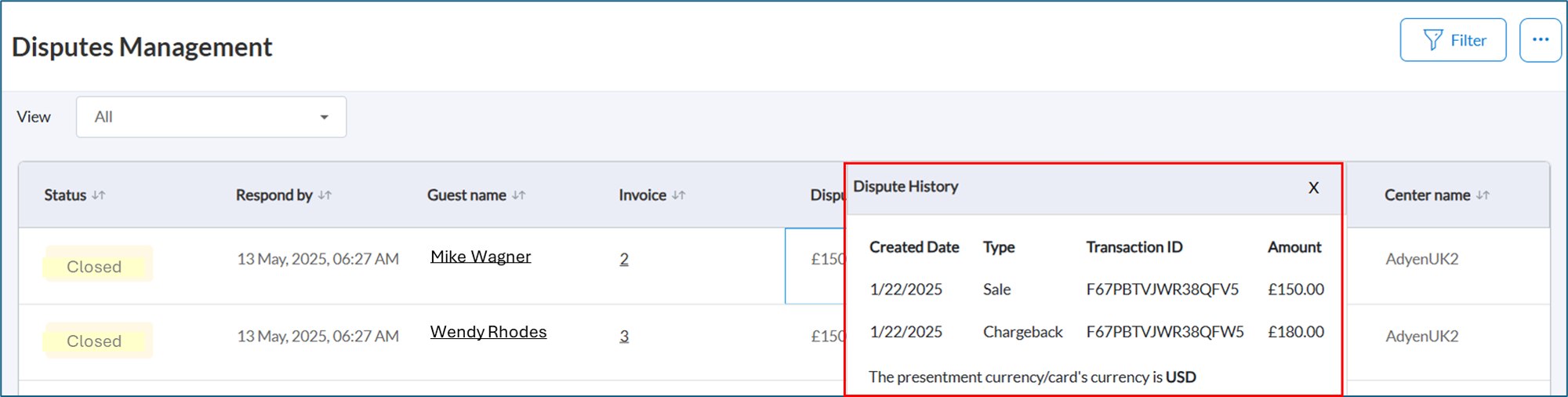

Click the information icon next to the dispute amount.

It opens up a pop-up window. The window displays transaction details such as Created Date, Type, Transaction ID and Amount.

Partially won disputes

A dispute is considered partially won when you, as a merchant, recover only a portion of the disputed amount.

For example, if a customer disputes a charge of $200 and, after reviewing the defense documents you submit, the card issuer returns only $120, the dispute is considered partially won in your favor.

The partially won status is displayed in both the Dispute Management System and the Digital Payments Report.

Email notifications show the exact amount recovered and the updated dispute status.

The amount recovered is reflected in your payments report, helping you reconcile it with your bank account credits.

The dispute fee continues to apply, even in partially won cases.

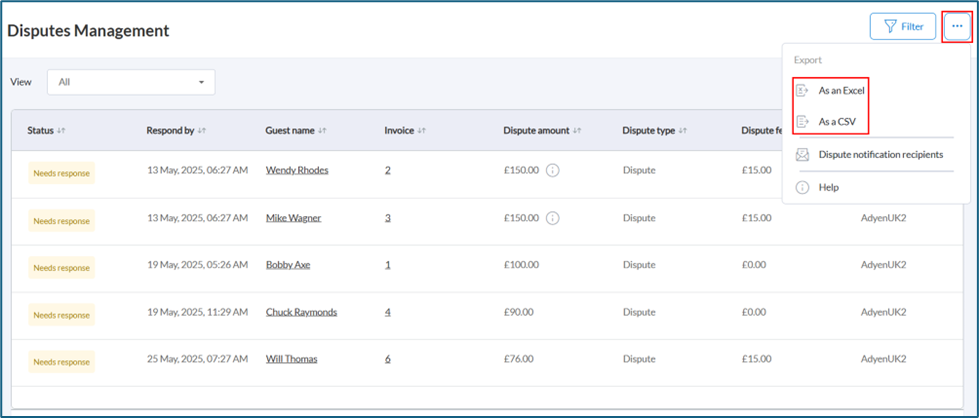

Export disputes report

Overview

The dispute report provides a comprehensive view of all disputes, including transaction details, dispute status, and financial information. You can export this report in CSV and Excel formats for auditing, downstream system processing, and financial tracking.

To export the report:

Click 3 dots on the Dispute Management page.

Click As an Excel or As a CSV to download the report.

Zenoti generates a report containing all relevant dispute data, which you can access for further analysis.

The exported report includes the following columns:

Center Name: Displays the name of the business center where the transaction occurs.

Dispute Type: Indicates the category of the dispute, such as Chargeback or an RFI (Request for Information).

Invoice Numbers: Lists the invoice associated with the disputed transaction.

Guest Name: Shows the name of the guest or customer involved in the dispute.

Transaction #: Displays the unique identifier for the disputed transaction.

Is Evidence Submit: Indicates whether the user submits supporting evidence for the dispute (Yes/No).

Submitted By: Displays the name of the user who submits the dispute evidence or indicates that it was auto-submitted by Zenoti.

Transaction Date: Shows the date when the transaction occurs.

Created Date: Displays the date when the dispute is created.

Dispute Amount: Indicates the amount disputed by the guest or customer.

Dispute Fee: Displays any fees associated with processing the dispute.

Dispute Reason: Specifies the reason for raising the dispute, such as duplicate transaction or billing error.

Dispute Status: Indicates the current status of the dispute, such as Needs Response, Under Review, Won, or Lost.

Respond By: Displays the deadline by which a response to the dispute is required.