Manage taxes

Create tax groups

Tax groups define the tax amounts calculated on invoices while taking payments. A tax group can consist of one or more tax components. For instance, on the same invoice, businesses may apply a service tax and service charge on services and VAT on products purchased. You can combine these tax components under a tax group.

You can also define the order in which the taxes apply to the invoice. For example, you can configure service taxes to apply first, followed by a service charge. Further, Zenoti gives you the flexibility to define how you want to apply the tax and the calculation method.

At the organization level, click the Configuration icon.

Search for and select Tax groups from the Business details section.

Click Add,

In the General tab, add details such as the name of the tax group and code.

Select the Active checkbox.

Click Next.

Select and define the tax component applicable to the tax group.

Specify other details such as whether you want to apply tax on the base price or the discounted price.

Specify the calculation method you want to use - Simple, Compound or Surcharge.

Click Add.

Click Next.

Select the zone.

Select the center.

To add tax groups for other centers, repeat steps 12 and 13.

Click Finish.

Now you can associate the tax groups to services, classes, products, memberships, packages, gift cards, and inventory that are offered at your center.

Enter general details of a tax group

Required roles: Any role with access to the Administrator mode

Required permissions: None

At the organization level, click the Configurations icon.

Search for and select Tax Groups from the Business details section.

Click Add.

in the General section, enter details such as the name of the tax group and code. Also, select the Active checkbox to make the tax group active for the organization.

Click Save.

Enter or change tax component details of a tax group

Tax components allow you to combine different taxes into a single group, it might combine state-level and local-level tax. You can enter or change tax component details of a current tax group for your business based on various socio-economic changes.

For example, there is a 1% increase in the GST of the country where your business operates. You can add or change the GST percentage in the tax components section of that tax group.

At the organization level, click the Configurations icon.

Search for and select Tax Groups from the Business details section.

Select the Tax Group name.

Click the Component tab.

Edit the following information:

Component Name: This information is mandatory. Select a tax component from the list of available tax components. If you are shipping products within the US or Canada, pick Location Sales Tax. To create additional tax components, reach out to a person at Zenoti.

Tax: Based on the tax component you select, the tax % shows up automatically. Edit the tax %. if required.

Apply Tax On: Specify whether to apply tax on the Base price orDiscounted price of the service.

Calculation method: Select any one method Simple, Compound, or Surcharge.

Calculation method and definition

Example

Simple: Calculates the tax based on the net price.

Service cost = $100

Service tax = 5%

Total tax applicable = $5.

Guest must pay = $105 [cost of service ($100) + Service Tax ($5)].

Compound: Calculates tax on the subtotal after simple tax is applied.

Service cost = $100

Service tax = 5%

Subtotal = $105

Now add a 3% compound tax on the subtotal of $105.

The guest must pay a total $108.15 [3% of 105 = 3.15] .

Compound tax is calculated as: [(cost of service + Primary Tax) + Compound tax]

Surcharge: Calculates a surcharge on tax levied on the invoice.

Service cost = $100

Tax levied on the invoice = 8%.

The total tax payable for the service is $8 (8% of 100).

Now add a surcharge of 2.5% on the total tax, which amounts to $2.7.

The guest must pay a total of $110.7.

Surcharge is calculated as: [(cost of service) + (total tax levied on the invoice) + (surcharge on tax levied on the invoice)]

% of Price to Tax: Enter the percentage of the sale item that must be taxed. Typically, this is set to 100%.

Click Add to add multiple tax components to the tax group.

To change the order of execution after adding a tax component, drag the components in the window especially if you have chosen the ‘Compound’ or ‘Surcharge’ calculation methods.

To change the component name, tax percentage, or taxable amount after adding a tax component to the table, click the current value in the table.

Associate tax groups to various items in a center

Preconditions

Tax groups will first need to be created, defined, and enabled for centers from the organization level.

Impacts and considerations

After you have defined the tax groups, you can associate them with various items at your center such as services, classes, products, memberships, packages, gift cards, and inventory.

Selecting the tax groups here makes them available for selection when creating or modifying an individual item from the organization level. For example, if you select “Service Tax” as the tax group for “Services” at the center level, then when creating or modifying a service, “Service tax” will appear for selection when defining the price for the service.

You must go to the individual service, product, or package and select the applicable tax group. If you do not select the tax group at the individual item level, no tax component will apply to the invoice in the Point of Sale (POS) window.

At the center level, click the Configuration icon.

Search for and select Associate Tax Groups from the Business details section.

Select the tax group that is applicable for services, classes, products, memberships, packages, gift cards, and inventory.

Note

For gift cards, only a single tax group can be selected.

The tax group selected for inventory applies to purchase orders and transfer orders.

As tax groups cannot be disassociated or deleted, you can hide redundant tax groups by selecting the Hide option. However, this applies only to services, products, memberships, classes, and packages.

Default tax group for retail products: You can set a default tax group that will apply to all retail products sold at a center. This default tax group will be applied automatically when a new retail product is created.

Click Save.

Create and assign a zero-tax group

Consideration

If your business does not charge tax separately, you must create a tax group without any tax components (zero tax group).

At the organization level, click the Configuration icon.

Search for and select Tax groups from the Business details section.

Click Add.

In the General tab, add details such as the name of the tax group and code.

Select the Active checkbox.

Click Next.

Since we are creating a zero tax group, click Next.

Select the centers where you want this tax group to be applicable.

Click Finish.

Impacts and considerations: After the tax group is created, centers can assign or associate the tax group to services, packages, memberships, gift cards, products, and inventory.

Select Products if you do not want to charge tax separately for retail items and select Inventory if you do not pay taxes to purchase your inventory from vendors or suppliers.

When to use the location sales tax component

Locations sales tax component is used for products sold online in the United States and Canada. Here sales tax is calculated based on the location to which the products are shipped. For instance, products shipped to California attract 7.5% sales tax while products shipped to Florida are charged at 6%. When this tax component is selected, a list of states along with tax percentages for each state must be configured. To configure this, reach out to a person at Zenoti.

If you are shipping products within the US or Canada, you can pick Location Sales Tax from the component name drop-down menu when you create a tax group.

Add Swacch Bharat cess component to service tax

The Indian government's Ministry of Finance has announced a Swachh Bharat Cess at the rate of 0.5% on all services presently liable for service tax, with effect from 15 November, 2015. It implies that the service tax is set to increase from 14% to 14.50% on all services at your India centers.

To ensure that this change is reflected in your invoices, you must add a Swacch Bharat Cess component to the tax groups you apply for your services.

Note

Swacch Bharat Cess is accounted and must be paid separately under a separate accounting head, so it needs to be charged and shown separately in the invoice.

To add Swachh Bharat cess to tax groups

At the organization level, click the Configurations icon.

Search for and select Tax Groups from the Business details section.

Click the name of the tax group.

Click the Component tab.

Click the Component Name list and select any tax component.

The fields on the screen are filled with the values related to the selected component.

Replace them with the following values for Swacch Bharat Cess :

Tax: Enter the value as 0.5.

Shows the value of the tax applicable for the selected tax component.

Delete the number and type the tax percentage for Swacch Bharat Cess, which is 0.5.

Apply Tax On: Select Base Price or Discounted Price.

This field allows you to select whether you want to apply the tax on the base price or the discounted price of the service. Select the same option that you have selected for the service tax component.

- Calculation Method: Select the Simple radio button. - % of Price of Tax: This field shows the percentage of the base price of the service to be taxed.

Set it to 100 as the Swacch Bharat Cess applies to the complete base price of the service.

Click Add.

The component is added below the existing tax components in the group.

To rename the component, click the name of the component, and then type Swacch Bharat Cess.

If you use any other tax groups for some other centers, repeat the steps above to add the Swacch Bharat Cess to those tax groups.

To apply the tax changes to existing appointments

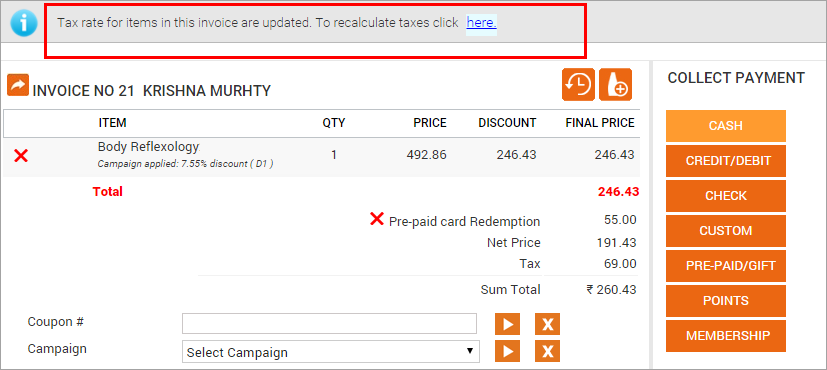

After you add the Swacch Bharat Cess component to the relevant tax groups in Zenoti, the system shows the following alert for all the open invoices related to services (including for partial payments).

Click the here link on the alert to apply the updated tax to the base prices of the services in the invoice. Note that even for partial payments, clicking the link results in applying the taxes to the whole base prices of the services, and not just on the remaining dues.

To change the prices of services that are inclusive of taxes

If the prices of any of your services are inclusive of taxes, the increase in the service tax reduces your net revenues from the services, until you update the prices to reflect the enhanced tax.

Modify the sale price of services that are inclusive of taxes as follows:

At the organization level, click the Master data icon.

Click Services.

Select a service.

Click the Price tab.

For each service that has the Tax Included checkbox selected, type the new price you want to apply in the Sale Price box. The new price is calculated as Existing sale price + (Base price of the service * 0.5/100). However, you can apply or round off the price to a more suitable value.

For example, if the base price of a service is ₹ 5000, the Swacch Bharat Cess on it would be 0.5% of ₹ 5000, which is ₹ 25. Previously, if the sale price of the service is fixed at ₹ 5500 including the taxes, to retain the same net revenues on the service, you now need to add ₹ 25 to the sale price towards Swacch Bharat Cess. The sale price then becomes ₹ 5525.

Add Krishi Kalyan cess component to service tax

The Indian government's Ministry of Finance has announced a Krishi Kalyan Cess at the rate of 0.5% on all services presently liable for service tax, with effect from June 1, 2016. It implies that the service tax is set to increase from 14.5% to 15% on all services at your India centers.

To ensure that this change is reflected in your invoices, you need to add a Krishi Kalyan Cess component to the tax groups you apply for your services.

Krishi Kalyan Cess is accounted for and must be paid separately under a separate accounting head, so it needs to be charged and shown separately in the invoice.

To add Krishi Kalyan cess to tax groups

At the organization level, click the Configurations icon.

Search for and select Tax Groups from the Business details section.

Click the name of the tax group.

Click the Component tab.

Click the Component Name list and select any tax component.

The fields on the screen are filled with the values related to the selected component.

Replace them with the following values for Krishi Kalyan Cess:

Tax: Enter the value as 0.5.

Shows the value of the tax applicable for the selected tax component.

Delete the number and type the tax percentage for Krishi Kalyan Cess, which is 0.5.

Apply Tax On: Select Base Price or Discounted Price. This field allows you to select whether you want to apply the tax on the base price or the discounted price of the service. Select the same option that you have selected for the service tax component.

- Calculation Method: Select the Simple radio button. - % of Price of Tax: This field shows the percentage of the base price of the service to be taxed.

Set it to 100 as the Krishi Kalyan Cess applies to the complete base price of the service.

Click Add.

The component is added below the existing tax components in the group.

To rename the component, click the name of the component, and then type Krishi Kalyan Cess.

If you use any other tax groups for some other centers, repeat the steps above to add the Krishi Kalyan Cess to those tax groups.

To apply the tax changes to existing appointments

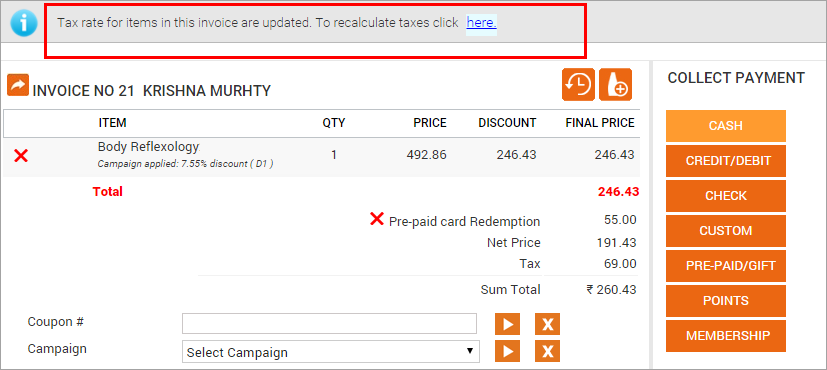

After you add the Krishi Kalyan Cess component to the relevant tax groups in Zenoti, the system shows the following alert for all the open invoices related to services (including for partial payments).

Click the here link on the alert to apply the updated tax to the base prices of the services in the invoice. Note that even for partial payments, clicking the link results in applying the taxes to the whole base prices of the services, and not just on the remaining dues.

To change the prices of services that are inclusive of taxes

If the prices of any of your services are inclusive of taxes, the increase in the service tax reduces your net revenues from the services, until you update the prices to reflect the enhanced tax.

Modify the sale price of services that are inclusive of taxes as follows:

At the organization level, click the Master data icon.

Click Services.

Click the name of the service.

Click the Centers tab.

For each service that has the Tax Included checkbox selected, type the new price you want to apply in the Sale Price box.

Important

The new price is calculated as Existing sale price + (Base price of the service * 0.5/100). However, you can apply or round off the price to a more suitable value.

For example, if the base price of a service is ₹ 5000, the Krishi Kalyan Cess on it would be 0.5% of ₹ 5000, which is ₹ 25. Previously, if the sale price of the service is fixed at ₹ 5500 including the taxes, to retain the same net revenues on the service, you now need to add ₹ 25 to the sale price towards Krishi Kalyan Cess. The sale price then becomes ₹ 5525.