Change the bank details of an existing account

This article explains how to change the bank details of an existing Zenoti Payments account. You’ll learn how to update your payout bank information, submit the required documents, and understand the verification process that follows a bank change request.

Overview

When you update your payout bank details in Zenoti Payments, the system triggers a mandatory KYC verification to confirm your new account. During this short verification period—typically up to two business days—payouts are temporarily paused, but you can continue to accept guest payments. Once verification is complete, your new bank account becomes active for payouts.

Zenoti Payments allows you to change the bank information for an existing account and update it with new bank information.

Notice

Changing bank account information will trigger KYC verification. If the KYC verification fails, you will see the details of the failed KYC verification here.

It may take up to two business days for your new account to be verified and made live. You will not receive any payouts during the verification period. However, you can still continue to accept payments from your guests.

At the organization or center level, click the Configuration icon.

Search for and select Payment processor onboarding.

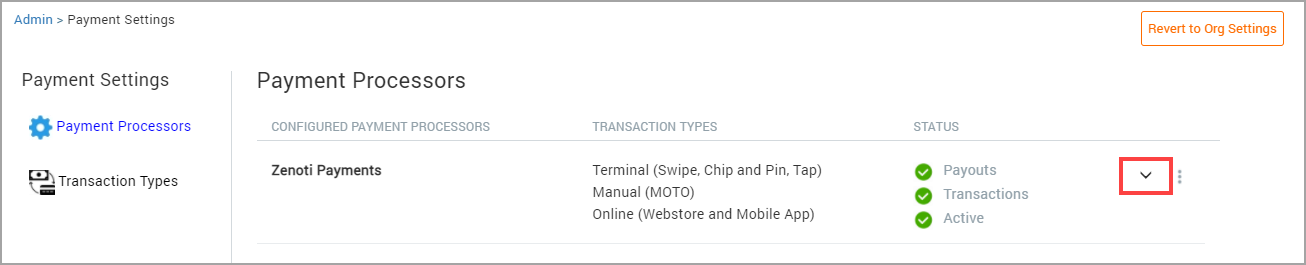

Under Payment settings > Payment processors, expand Zenoti payments.

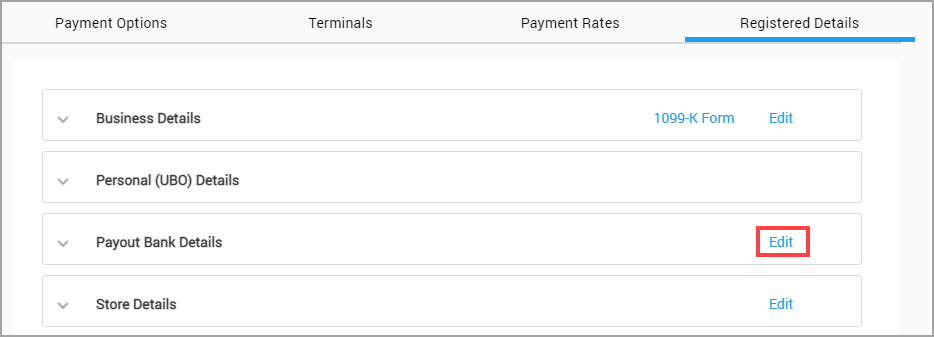

Click Registered details.

Click Sign in, and enter the verification code sent to your Zenoti Payments email address.

For Payout bank details, click Edit.

Enter the following details on the page:

ABA Routing Number: This is usually found at the bottom of your bank check.

The routing number is unique to the US & Canada. Check this list for requirements in other countries:

United Kingdom - Sort Code

Australia - ABA or Fedwire Number

Enter and confirm your bank account number here.

Proof of account: Upload any one of the following documents (issued within the last 3 months):

Bank statement

Voided check

Online Banking Screenshot.

Note

Make sure the uploaded document includes:

Bank Logo and Name

Routing Number

Account Number

Account Owner Name (must match the legal business name)

Recent Date and Signature (if it’s a bank letter)

The name of the account holder must match the Account owner name field.

Click Save.

Key terms

Term | Description |

|---|---|

KYC Verification | A compliance process that confirms the identity of the bank account owner before enabling payouts. |

ABA Routing Number | A nine-digit number used by U.S. and Canadian banks to identify financial institutions for transactions. |

Sort Code | A six-digit number used by banks in the United Kingdom to route payments correctly. |

Proof of Account | Documentation, such as a bank statement, voided check, or online banking screenshot, used to verify ownership of the payout account. |

Verification Period | The time (up to two business days) required to confirm and activate new bank details. |