Preliminary Review for Zenoti Integrated Payroll Set up

Before your business can begin processing payroll through Zenoti Integrated Payroll (ZIP), Check—Zenoti’s payroll setup partner—reviews your payroll data and account structure. This Preliminary Review ensures your system is ready for setup and helps avoid delays or unsupported configurations. This article explains what happens during Preliminary Review, what messages you may receive, and how to keep your setup on track.

Overview

Preliminary Review is the first step of the ZIP setup process for a Switcher company. Check is our payroll set up and migration partner who works with the customers to complete this review The process includes:

Report Intake: Check verifies that it can access to your previous provider account or verifies that all required reports have been uploaded in sufficient detail.

Report Review: Check evaluates the reports to identify unsupported features, and compiles questions for you to reduce delays during setup.

Setup Timeline Assignment: Check assigns a Standard or Extended timeline based on factors such as employee count and contractor involvement, tax jurisdictions, labor allocations, and more.

Notifications from Check during Preliminary Review

Check sends notifications to the company’s Signatories through support tickets.

These include:

Consolidated questions and information: Questions or clarifications that do not block Preliminary Review but require timely response to avoid delays.

Insufficient reports: Blocks for Preliminary Review to continue. The employer must take action to re initiate the review with a new 2 business day SLA.

Unsupported feature: If Check detects an unsupported feature, ZIP’s Embedded Setup is closed for the company.

Setup Timeline Assignment: Confirms completion of Preliminary Review and communicates to you of the Setup Timeline SLAs for your company.

Insufficient reports

If Check can’t access your payroll data - for example, if access to your previous payroll provider account fails or reports are missing- it will fail the requirement and notify you in the support ticket.

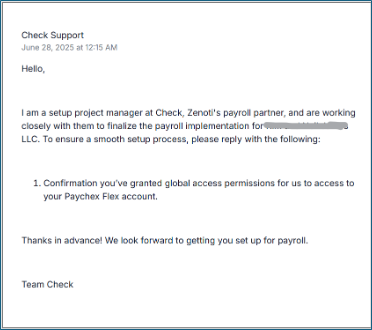

Example support ticket message:

Once you indicate in the Previous Provider Access step in Zenoti – Payroll Settings or confirm over email, that you have granted Check access to your previous provider or uploaded missing reports, Check will restart Preliminary Review with a new 2-business-day SLA.

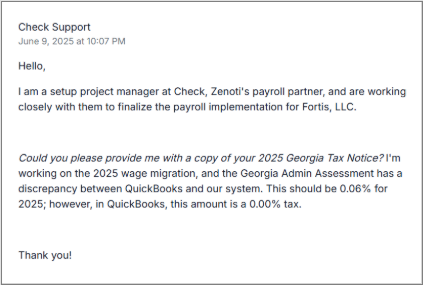

Consolidated questions & information

During Preliminary Review, Check will consolidate all questions and information pertinent to your payroll setup, and send them to you. These questions are intended to prevent future delays.

Respond to all questions promptly. Delays in replying could impact your company’s first payday.

Frequently Asked Questions (FAQs)

Q: What is the Preliminary Review for ZIP setup?

A: The Preliminary Review is the first step of the Zenoti Integrated Payroll (ZIP) setup process for a Switcher company. It includes report intake, report review, and setup timeline assignment.

Q: What is the role of Check in the ZIP setup process?

A: Check is Zenoti’s payroll setup and migration partner. They conduct the Preliminary Review and handles all setup-related evaluations.

Q: How long does the Preliminary Review take?

A: The Preliminary Review typically takes 2 business days, provided that all necessary reports and information are available.

Q: What happens if there are insufficient reports?

A: If Check does not have sufficient payroll and employer reports, they will notify you by failing the associated requirement and sending a follow-up message in the support ticket. Preliminary Review will be reinitiated with a new 2-business-day SLA once the necessary reports are provided.

Q: What should I do if I receive a notification about an unsupported feature?

A: If Check identifies that your company has an unsupported feature, it will close the Embedded Setup process. Contact Zenoti Support for further assistance.

Q: What factors determine the Setup Timeline Assignment?

A: The timeline is based on complexity factors such as employee and contractor count, local taxes, and labor allocations.