Zenoti Wallet and Smart Card Overview

Introduction

Ready to take control of your earnings and build your credit along the way? With Zenoti Wallet and Zenoti Smart Card, employees in the U.S. can access their tips fast, securely, and responsibly—especially when enrolled in same-day payouts.

In this article, you will discover how these tools work together, what they can do for you, and how to access them through the myZen app.

Overview of Zenoti Wallet

Think of the Zenoti Wallet as your personal, secure checking account—designed just for employees in the U.S. It’s issued through a trusted sponsor bank and is essential if your employer offers same-day tip payouts. With the Wallet, you can access your earnings quickly and manage them with ease.

Key features

Receive your tips and earnings the same day; no more waiting for payroll cycles.

Enjoy your own checking account with a U.S.-based sponsor bank, complete with an account and routing number.

Track your balance, review transactions, and update your settings anytime through the myZen app.

Access your Wallet with fingerprint or facial recognition, and rest easy knowing your data is encrypted and protected.

View your Wallet account details

You can find everything you need right inside the myZen app. Just follow these simple steps:

Open the myZen app on your mobile device.

Navigate to My Money > Wallet.

Tap Account Details to view the following:

Account Number

Routing Number

Sponsor Bank Name

Account Type

Reserve Amount

Zenoti Smart Card: Build credit while you spend smart

The Zenoti Smart Card is a secured credit card that acts like a debit card but with one powerful difference: it helps you build your credit score through responsible usage.

How it is different from Zenoti Wallet

Your Zenoti Wallet balance sets your credit limit.

Every purchase you make is automatically paid off at the end of the billing cycle.

On-time payments are reported to credit bureaus, helping you build or improve your credit score effortlessly.

How Zenoti Smart Card works

Simple, smart spending

Here’s how your spending works with the Smart Card:

You have $1000 in your Wallet.

You spend $200 using your Zenoti Smart Card.

That $200 is reserved immediately from your Wallet.

Your available balance now shows as $800.

This way, you're never at risk of overspending or incurring debt.

Automatic repayment

At the end of the billing cycle:

The reserved amount (in this case, $200) is used to automatically pay off your Zenoti Smart Card balance via AutoPay.

This on-time payment is then reported to credit bureaus, helping you build or improve your credit score without any manual effort.

Where you can use Smart Card

Anywhere visa is accepted:

In-store

Online

ATMs

Additional benefits

Access your money anytime with surcharge-free ATM withdrawals at any MoneyPass location.

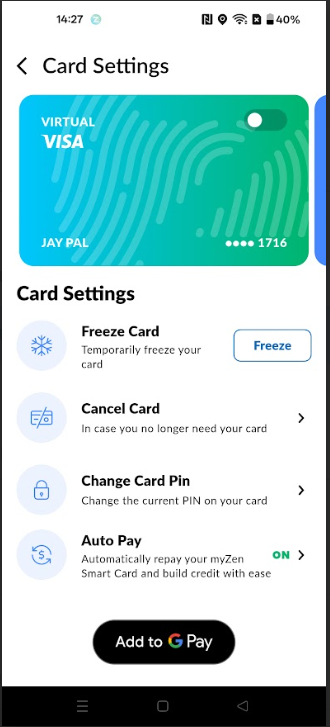

Don’t wait for the physical card—your virtual Smart Card is ready to use right away in the myZen app. Easily activate, freeze, set your PIN, or request a replacement card — all in one place, right from the app.

Seamlessly connect your Smart Card to Apple Pay, Google Pay, Venmo, or CashApp for fast, contactless payments.

With AutoPay enabled, your on-time payments are reported to credit bureaus—helping you boost your credit score effortlessly.

Comparison: Zenoti Smart Card vs. Other cards

Choosing the right payment card can be confusing—but it doesn't have to be. The table below gives you a quick, side-by-side comparison of the Zenoti Smart Card, a typical debit card, and a traditional credit card.

Feature | Zenoti Smart Card | Debit Card | Traditional Credit Card |

|---|---|---|---|

Spending Limit | Based on Wallet balance | Based on bank balance | Based on credit limit |

Risk of Debt | ❌ None (AutoPay enabled) | ❌ None | ✅ Yes |

Credit Reporting | ✅ Yes | ❌ No | ✅ Yes |

Overdraft Fees | ❌ No | ✅ Possible | ❌ Not applicable |

ATM Access | ✅ Yes (MoneyPass ATMs) | ✅ Yes | ✅ Limited |

Digital Wallet Provisioning (Add to Apple Pay, Google Pay, Venmo, CashApp etc.) | ✅ Yes | ✅ Yes | ✅ Yes |

Virtual Card Access | ✅ Yes | ❌ Rare | ✅ Sometimes |

View your Smart Card details

Perform the following quick steps to check your virtual card number or manage your card settings:

Open the myZen app on your device.

Navigate to My Money > Wallet.

Toggle on the virtual card image to view your Smart Card details, including:

Virtual card number

Expiration date

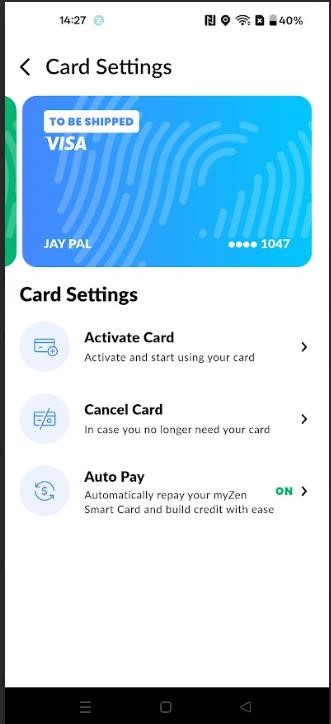

Card settings and controls

Swipe right to view physical card status and it's Card Settings.

Note

If there’s no virtual card, you’ll be taken directly to the Card Settings page for the physical card.