Bank Deposits report (v2)

Disclaimer

This article is only for the latest version of Zenoti Reports. Do not compare the data in this version with the data in the previous version.

Zenoti Payments is an easy way to accept credit card transactions in-store and online. To deposit the processed payments into the business's bank account, set up Zenoti Payments, and create a schedule in the Stripe account.

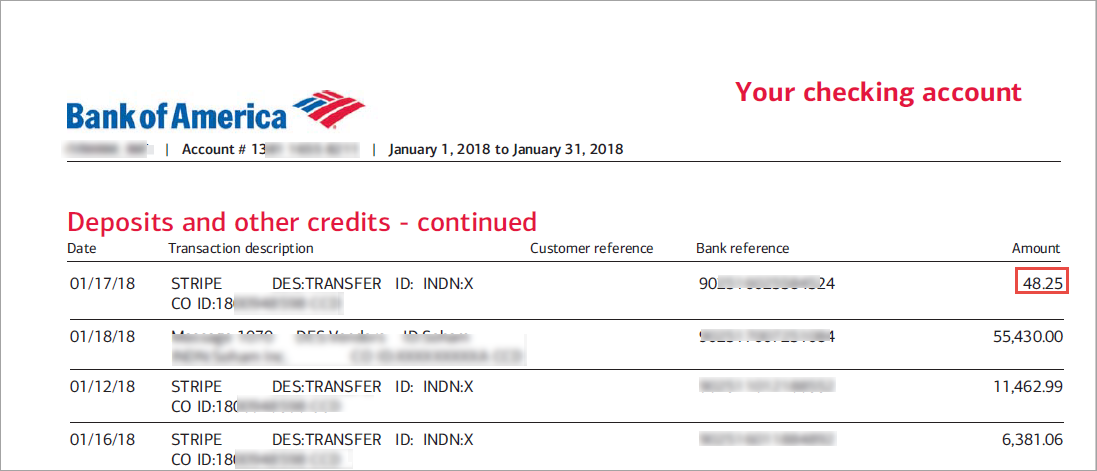

Accountants can use this report to reconcile the collections at a center with the bank deposits.

At the organization or center level, click the Reports icon.

Note: The Bank Deposit report is currently available only for Adyen customers. To access the report, users must have the Bank Deposit Report permission (permission must be enabled for the Manager role from the organization level in the Zenoti Payments section).

On the Reports page, search for and select the Payment- Bank Deposit report.

If the report has many columns, scroll horizontally to the right or left to view all columns.

To view specific data on the report, select the desired filters. For more information, refer to report features on Zenoti.

Click Refresh.

If you generate the report for over a year, click the Email button.

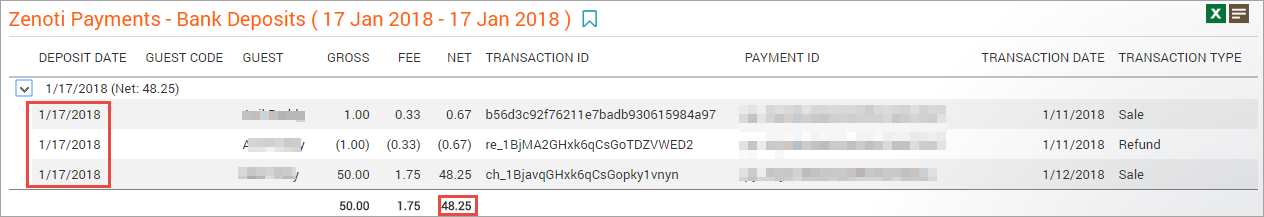

Column | Description |

|---|---|

Deposit Date | Date on which the amount was deposited to the business's account. |

Guest Code | Unique code that identifies the guest |

Guest | Guest whose card was charged |

Gross | Total amount charged to the guest’s card |

Fee | Amount charged for the card transaction |

Net | Amount deposited into the business's account after deducting the processing fee for the transaction Net = Gross - Fee |

Transaction ID | Unique code that identifies the transaction made at the center |

Payment ID | Unique code that identifies the payment made to the business's Stripe account for the transaction |

Transaction Date | Date on which the guest’s card was charged at the center |

Transaction Type | Transaction is a sale or refund |