Manage Payroll settings for employee

This article explains how employees can access their payroll payouts and paystubs (or pay slips).

Zenoti Integrated Payroll helps employees to efficiently handle personal, tax, and payroll preferences while accessing paystub or pay slip information.

Key terms

Paystubs: Paystubs provide employees with detailed information about their earnings, deductions, and net pay. Paystubs are also called pay slips or paychecks.

Earnings: Breakdown of earnings that employee received which could usually be hourly pay, commissions, tips and bonuses.

Deductions: Break down of taxes, benefits, child support garnishment and other post tax deductions if relevant.

Net pay: Final amount that will be paid to employee.

Payment method: Either direct deposit or manual payment by employer.

Access Zenoti Integrated Payroll

To access Zenoti Integrated Payroll:

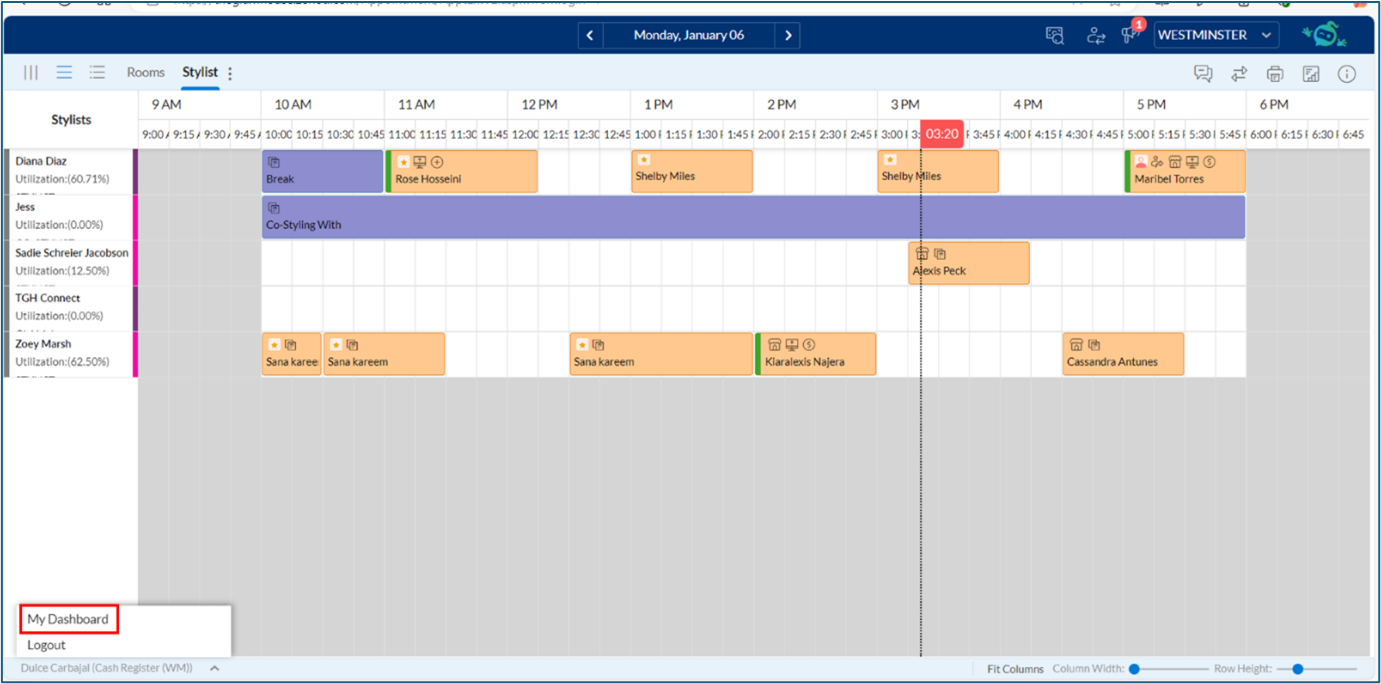

Log in and navigate to My Dashboard.

Depending on your role, you will either see the appointment book or Admin Dashboard page.

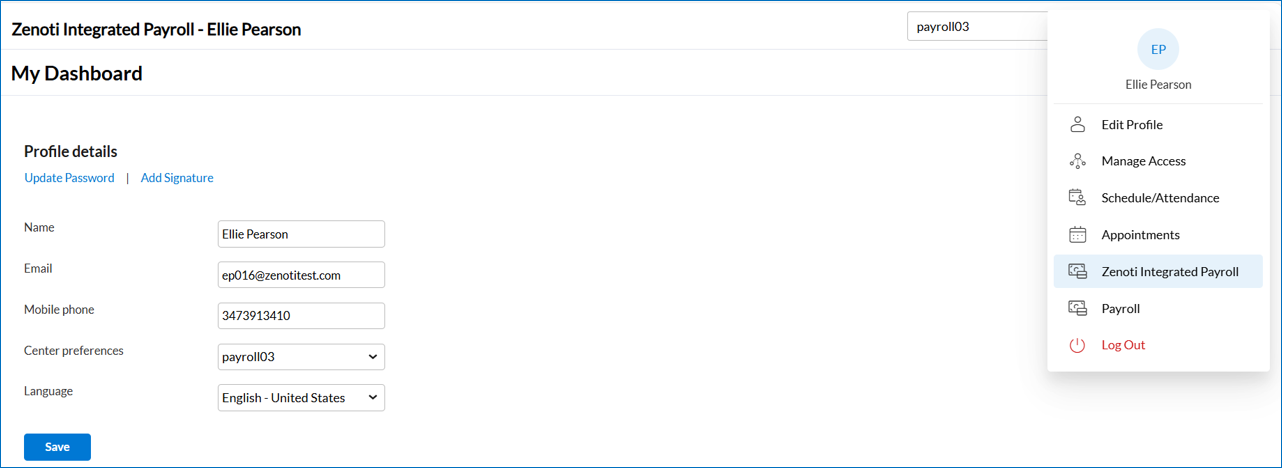

Navigate to your profile and click Zenoti Integrated Payroll.

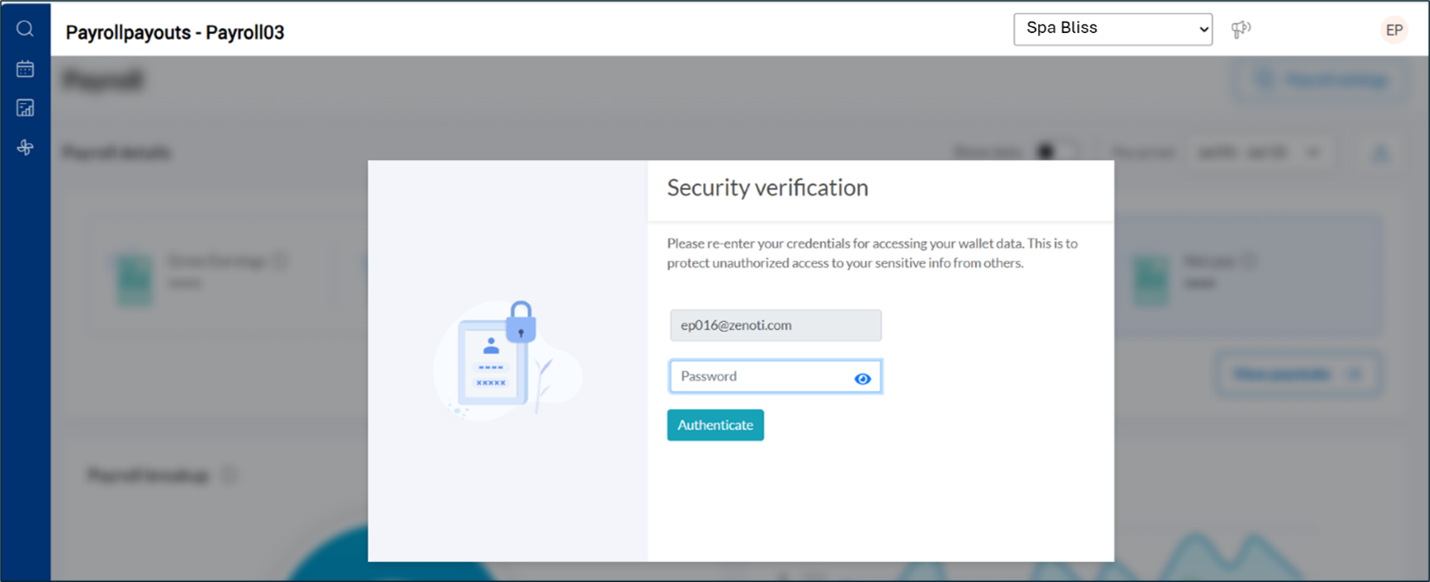

Complete the Security verification.

Enter your password and click Authenticate to view your payroll dashboard.

View and update Payroll settings

To view and update payroll settings:

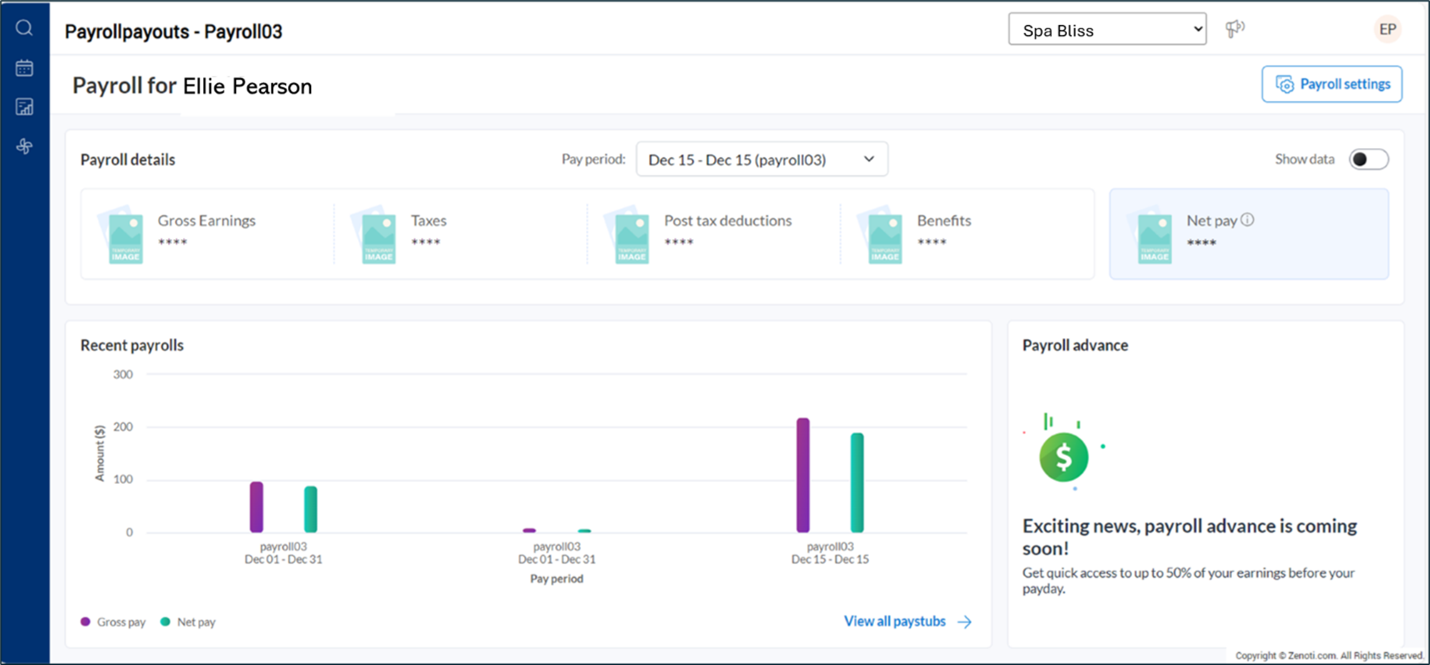

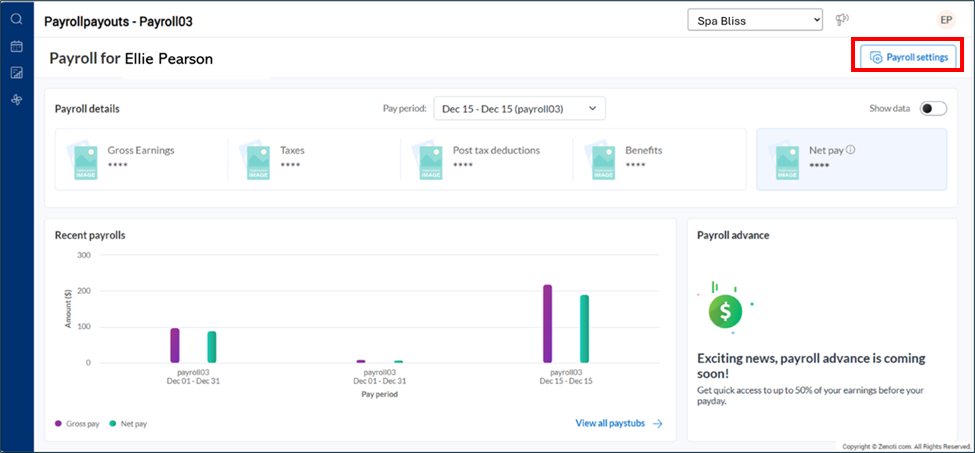

On your payroll dashboard, click Payroll settings (top-right corner).

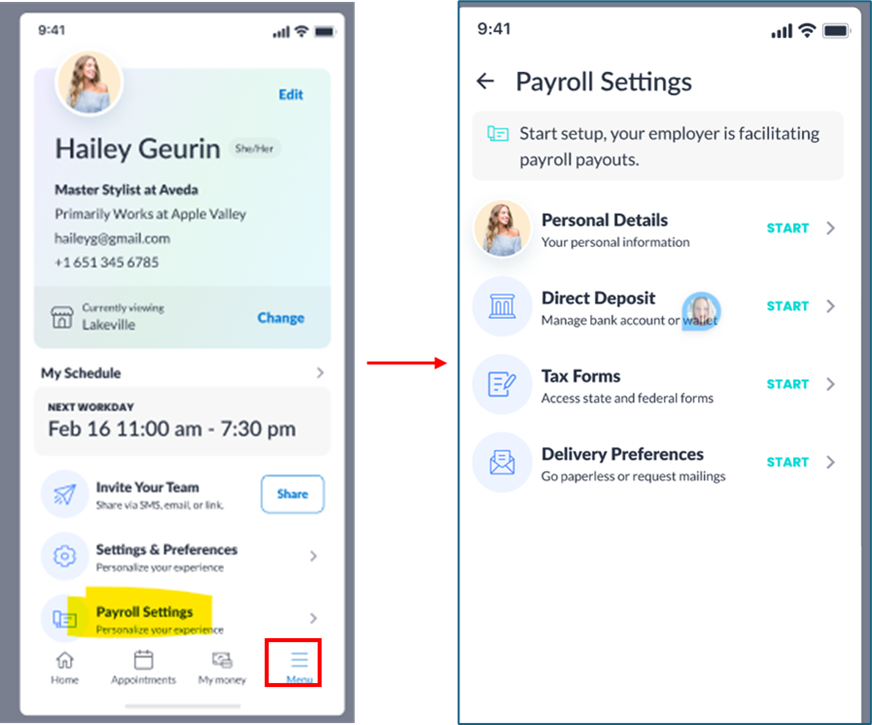

You can also access Payroll settings from myZen.

Login to myZen app.

Tap Menu at the bottom right.

Tap Payroll settings.

If you're logging in for the first time, review your migrated data to ensure all information is accurate.

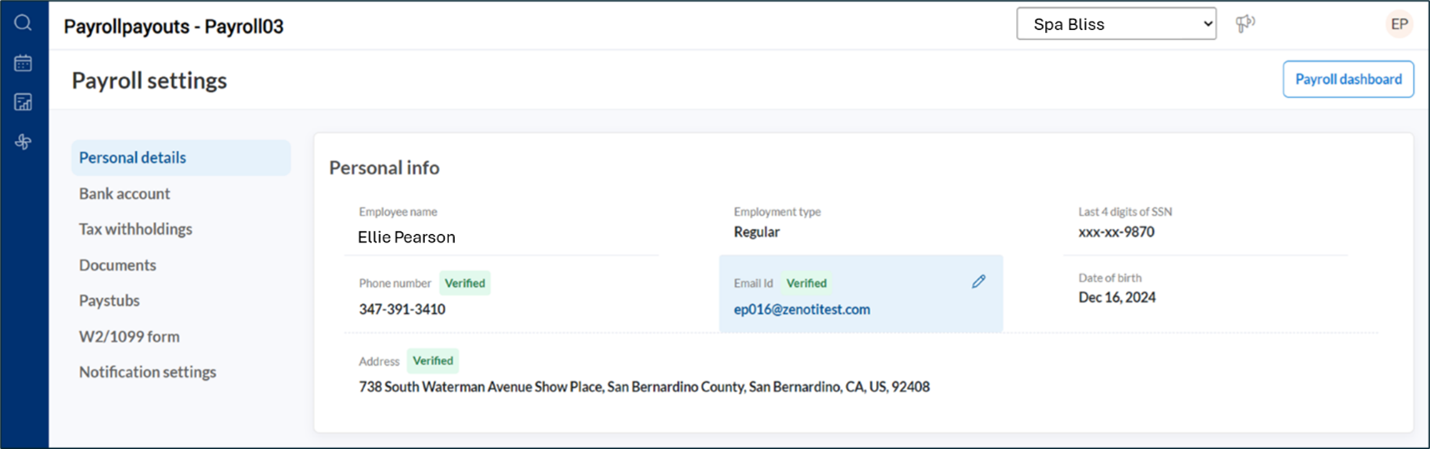

Use the left navigation bar to view or update the following sections:

Personal details: Update Mobile Number, Email ID, Pronouns, Date of Birth, Social Security Number, Billing Address (Line 1, Line 2, City, State, Country, ZIP).

Note: You cannot update First Name, Last Name, Role, Center.

Bank account: Add or update your bank account details for direct deposit. You can add your Zenoti Wallet to receive payroll direct deposits and enjoy additional benefits such as credit building, rewards on card spending, and other features.

Tax withholdings: Update federal and state tax preferences.

W2/1099 form delivery preference: Choose how to receive annual tax documents, either electronic or paper delivery options.

Note: Electronic delivery offers early access to W-2/1099 forms, reduces the risk of loss or theft, enables remote access, and supports eco-friendly practices.

Documents: Access important payroll-related documents uploaded by the employer or required for compliance.

Paystubs: View and download past paycheck records.

Notification settings: Manage preferences for payroll-related updates.

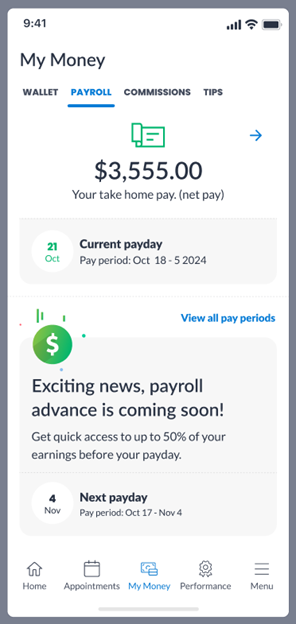

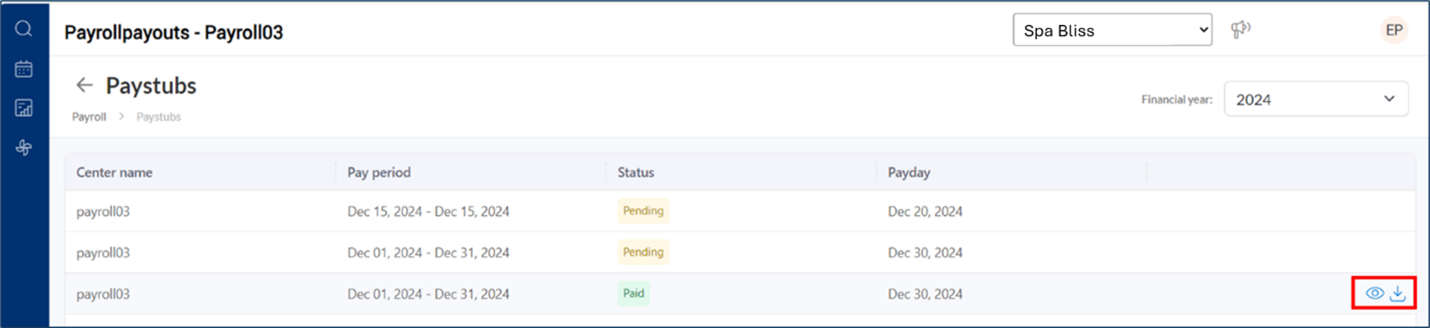

View and download paystubs

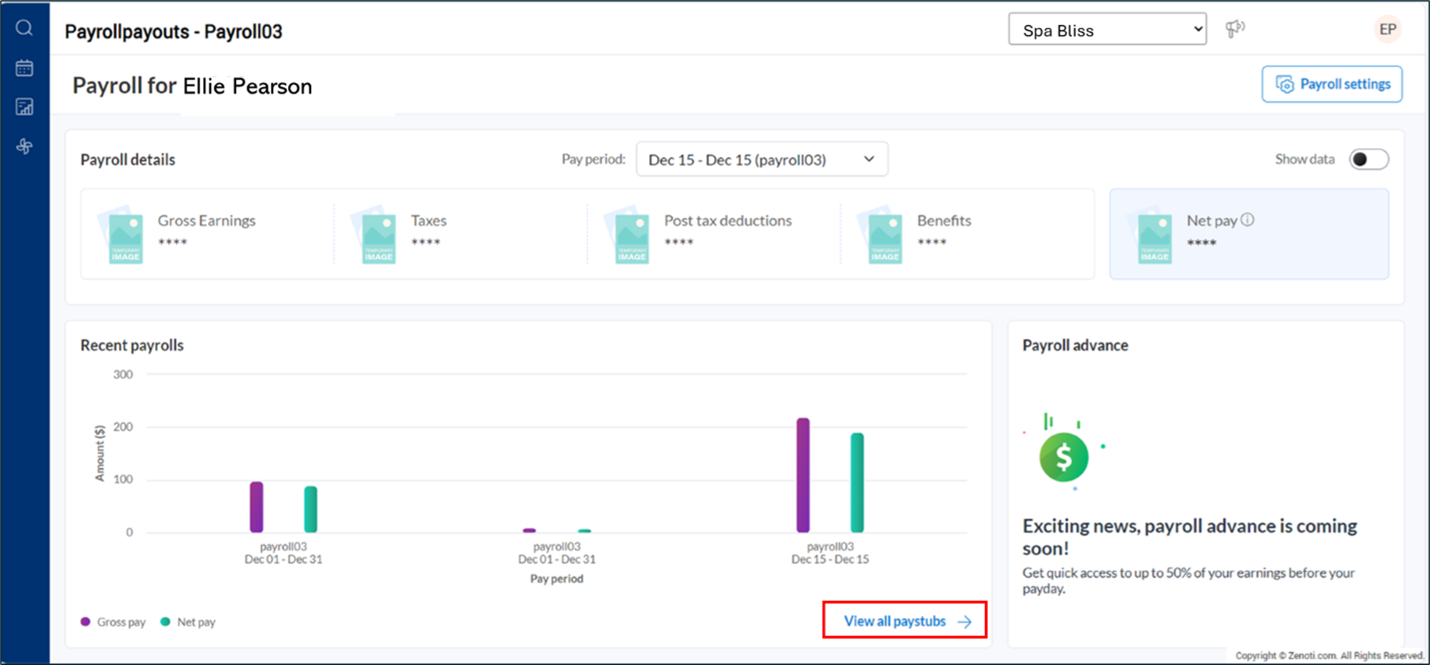

Paystubs offer a detailed record of earnings, deductions, and net pay. You can download paystubs as needed from both web and mobile apps.

The recent paystub details are displayed on your payroll dashboard. To view past data, click View all paystubs.

To view or download paystubs:

Click View all paystubs on your payroll dashboard.

You can seamlessly access the same details, including paystubs and a detailed view of your payroll settings, from both the web app and the myZen mobile app.

Select and download paystubs for the desired pay period.

Impacts and considerations

Verify your contact information to ensure you receive updates and documents.

Payroll Advance is an upcoming feature and will be available soon.