Handle Garnishments with Zenoti Integrated Payroll

This article explains how Zenoti Integrated Payroll (ZIP) supports garnishments. It outlines deduction types, remittance options, set up steps and reporting guidance. Administrators can follow this guide to remain compliant with legal requirements and ensure accurate payroll deductions.

Overview

ZIP allows employers to apply post-tax deductions, including court-mandated child support garnishments.

Garnishments are always processed as post-tax deductions.

Garnishments handling is supported only for employees (W-2s). Employers must handle garnishments for contractors (1099) independently, outside Zenoti.

Zenoti supports automatic remittance only for child support garnishments. For other garnishments, Zenoti will withhold the deduction, but the employer is responsible for sending payments directly to agencies.

ZIP always prioritizes child support garnishments over other deduction types. It uses disposable income calculations to determine how much to deduct, ensuring legal compliance.

Supported deduction types in ZIP

Zenoti supports the following post-tax deduction types, all of which reduce an employee’s net pay but do not affect their tax liability. ZIP calculates and applies these amounts after taxes.

Deduction Type | Description | Remittance supported by Zenoti |

|---|---|---|

Child Support Garnishment | Court-ordered deductions for child support, | ✅ Yes – Zenoti remits payments to state agencies. |

Miscellaneous Garnishment | Other wage garnishments such astax liens calculated on disposable income, | ❌ No – Employer must remit manually. |

Miscellaneous (Other) | Non-garnishment deductions like union dues, charity contributions, and more. | ❌ No – Employer must remit manually. |

Employees can have multiple post-tax deductions applied simultaneously. All three deduction types are withheld as part of payroll submission, but only child support garnishments are remitted by Zenoti. For other garnishments and deductions, the employer is responsible for remitting payments directly to agencies or organizations.

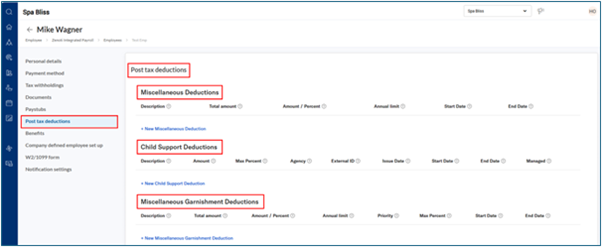

Where to configure deductions

Employers can configure deductions directly from an employee profile:

Go to the Payroll Dashboard.

Click Employees.

Select the employee and click View details.

Navigate to the Post-Tax Deductions tab.

Click Add to create a new deduction or Edit to update one.

Remittance: Zenoti-Managed vs Employer-Managed

When you add a child support garnishment, you decide who is responsible for sending the payment to the state agency:

Remittance Type | Who Sends the Payment | ZIP Behaviour |

|---|---|---|

Zenoti-Managed | Zenoti | Includes the deduction in payroll cash requirement. |

Employer-Managed | Employer | Excludes the deduction from payroll cash requirement. |

Note

By default, Zenoti sets child support deductions to Zenoti-Managed. If you wish to remit manually, change this during setup.

Zenoti supports remittance in all 50 U.S. states and D.C., but not to tribal or reservation agencies.

Other garnishments are always employer-managed. Zenoti withholds the deduction, but the employer must remit the payment directly to the respective agencies.

Add or update a child support garnishment

Use the steps below to create a new child support garnishment or modify an existing one in an employee’s payroll profile.

Go to the Payroll Dashboard.

Click Employees.

Select the employee and click View Details.

Navigate to the Post-Tax Deductions tab.

Click Add to create or Edit to update a deduction.

Select Child Support Garnishment as the deduction type.

Choose either Zenoti-Managed or Employer-Managed for remittance.

Frequently asked questions

Q. How does ZIP handle multiple deductions?

A. ZIP gives child support garnishments the highest priority. It applies them before any other post-tax or voluntary deductions to ensure legal compliance.

Q. Does Zenoti remit child support garnishments in all states?

A. Yes. Zenoti remits child support garnishment payments to state agencies in all 50 U.S. states and the District of Columbia (D.C.).

Note

Zenoti does not support remittance to tribal or reservation agencies.

Q. Can I change a garnishment from employer-managed to Zenoti-managed later?

A. Yes. You can edit an existing garnishment and update its remittance responsibility anytime through the Post-Tax Deductions tab in the employee's payroll profile.

Q. Is there a deadline for setting up garnishments before a payroll run?

A. Yes. To ensure proper processing, garnishments should be configured before running payroll. Changes made after payroll processing will apply to the next pay period.

Q. Does Zenoti track the garnishment payments?

A. Yes. Zenoti tracks and reports all post-tax deductions, including child support garnishments, in payroll reports and employee pay statements—whether Zenoti or the employer remits the payment.

Q. Can garnishments be deducted from bonuses or non-regular wages?

A. Yes. Child support garnishments can apply to any compensation processed through payroll such as bonuses, commissions, unless explicitly excluded in the garnishment order.

Q. Does Zenoti support garnishments for contractors (1099)?

A. No. Garnishment processing is only available for employees (W-2). Employers must handle garnishments for contractors outside Zenoti.