Define replacement or special tax for eligible guests

To comply with specific regional tax regulations, businesses may need to apply special taxes for certain guest categories.

Comparison of Standard Tax and Special Tax

Scenario 1: A standard guest purchases a product priced at $100. The standard tax rate is 13%, so an additional $13 in tax is applied, bringing the total to $113.

Scenario 2: A guest eligible for a special tax rate purchases the same product for $100. This guest is subject to a reduced tax rate of 5%, resulting in an additional $5 in tax, bringing the total to $105.

Important

To enable the application of special tax rates, please contact your administrator.

After the setting is enabled, you must select the Replacement Tax option while setting up the tax group and then associate the tax group to products at the center level. The tax can be applied on both Zenoti Web and ZMA.

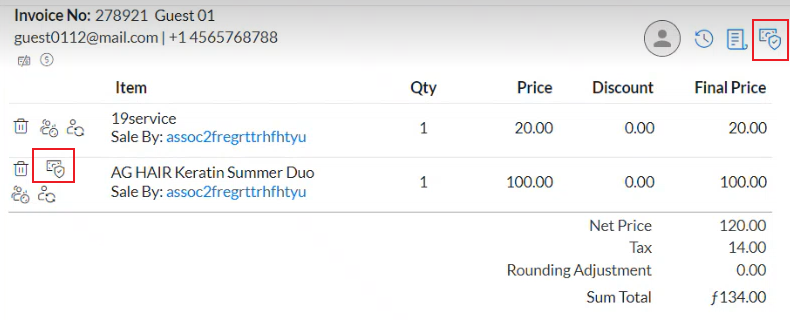

Open the invoice in Point of Sale and add a product.

To the product you want to add the replacement tax, next to the product in the invoice, click the replacement tax icon. The tax is applicable on both invoice and item level.

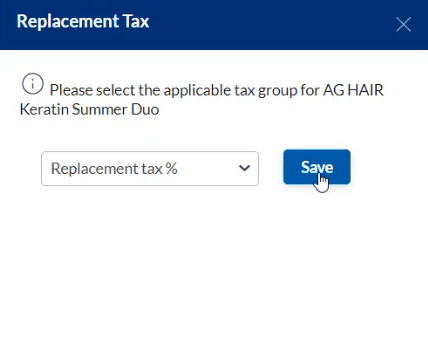

Select a tax group and click Save.

Proceed to close the invoice.