Employee Payroll Details v2 Report

Note

This article is only for the latest version of Zenoti reports. Do not compare the data in this version with the data in the previous version.

The factors used to calculate service revenue in the employee payroll details v2 report vary from the ones used in other reports. We recommend you do not compare this report with other reports.

The Employee Payroll Details v2 report offers flexibility in the way you view reports, enables you to customize the columns in the report, and much more.

The Employee Payroll Details report provides details such as total salary, attendance, leave balance, tips, and commissions earned by one employee of a given center.

This report helps you to track:

Leave balances and attendance details

Commissions and tips earned

Number of service and other invoices (such as selling products, memberships, packages) closed by the employee

Salary details and the number of times the employee was specifically requested for by a guest and the bonus earned as a result.

Note

You must first run the employee payroll summary v2 report to ensure the accuracy of data in the employee payroll details v2 report and in the employee commissions v2 report.

You should have already configured pay periods from the Pay period employee configuration setting.

To run the employee payroll details report:

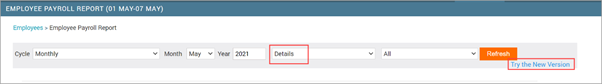

Click the Employee icon.

Navigate to Payroll Reports > Payroll Reports.

Select Details from the filter.

Click Try the New Version.

The Payroll Details report opens in a new tab.

Depending on your requirement, select the desired filters.

Note

You can view the report only for those centers to which you have access.

Click Refresh on subsequent attempts to view the latest data in the report.

In cases where there are changes to data in the given pay period, and you have run the payroll details report for the given pay period earlier, you will see the Calculate Commissions Now option.

Note

Alternately, you can run the Employee Payroll Details v2 Report by clicking the name of any one employee from the Employee Payroll Summary v2 Report.

Export data

Click the

icon to export the report with specific parameters. Options available are:

icon to export the report with specific parameters. Options available are:Export service category wise details

Export advanced overtime payroll details

To view all columns of the report, export the report - the UI shows fewer columns. Use the Excel or .CSV icons on the top right-hand corner to export the report.

Filters

Criteria | Description |

Cycle | Select the cycle based on your requirement:

|

Select a Report | Select Details from the drop-down list. NoteThe other options include Details and Hourly Pay/Service Commission that generate the employee payroll details report and the employee hourly pay/service commission report, respectively. |

Select an employee | Select the name of the employee for whom you want to generate this report. |

Column descriptions

Column Name | Short Description | Details and Examples |

|---|---|---|

Employee Code | Unique ID given to an employee. | A unique identifier assigned to the employee, typically used for internal tracking and reporting purposes. |

Employee Name | The employee’s full name. | Full name of the employee (First Name + Last Name) from the employee profile. |

Type | The type of sale. | Specifies the type of item or service the employee was responsible for on this invoice. Common types are “Service” (service performed), “Product” (product sold), “Package” (package sold), “Membership” (membership sold). |

First Name | The employee’s first name. | Employee’s first name from the employee profile. |

Last Name | The employee’s last name. | Employee’s last name from the employee profile. |

Job | The employee’s job. | Job associated with the employee in the profile |

Invoice No | The unique invoice number for the sale. | Unique invoice number generated for the appointment or point-of-sale (POS) transaction. |

Service Date | The date the service was performed. | The date on which the employee actually performed the service. |

Closed Date | The date when the invoice was fully paid and closed. | The date when the invoice was fully closed — meaning payment was received and the transaction finalized. Employees earn commissions only on closed invoices. |

Guest | The name of the guest | The name of the guest who purchased the product, service, membership, or package. |

New Guest | Shows whether the guest is new. | Indicates if the guest is new to the business. The system checks if the guest has any previously closed invoices. If none exist, they’re marked as “New Guest.” |

Item | The service, product, package, or membership sold. | The specific item name sold or serviced — such as the exact service performed, product sold, package sold, membership sold. |

Business Unit | The business segment the item belongs to. | The business unit to which the item belongs — helps categorize items under segments like “Haircare,” “Body Treatments,” or “Laser Services.” |

Category | The main category for the item sold. | The main category that the sold item falls under. |

Sub Category | A narrower subcategory for the item sold. | The sub category within the main category that the sold item falls under. |

Requested | Shows if the guest requested this employee. | Indicates whether the guest specifically requested this employee to perform the service. |

Split Commission % | Share of commission (in %) earned by the employee. | Shows what percentage of commission this employee earned when multiple employees shared a single service or sale. |

Deductions | The amount reduced from the employee’s commission for costs. | The amount deducted from the employee’s commission for business reasons like marketing, rent sharing, or other overhead costs. |

Revenue | Total revenue the employee generated from sales. Considers closed invoices only. | The total revenue amount earned by the employee from performing services and/or selling items. |

Free Service Revenue | Revenue value for free services performed. Considers closed invoices only. | Revenue amount recorded for services the employee performed that count as “free” for the business, such as, loyalty redemptions, discounts. Still used for commission calculations. |

Commission | The total commission earned for this sale or service. | The total commission amount the employee earned for this transaction, after applying the eligible percentage or flat amount. |

Commission Factor | A percentage multiplier applied to adjust commission up or down. | A multiplier that adjusts the base commission. For example, 200% doubles the payout, 50% halves it. |

Effective Commission% | Final commission percentage after adjustments. | The final percentage applied to revenue after adjustments like factors or overrides. |

Free Service Commission | Commission earned specifically from free service revenue. | The portion of commission earned based on free service revenue. |

Additional Bonus | Extra pay for good performance or meeting goals. | Extra money awarded beyond regular commission, often for hitting targets or good performance. |

Request Stylist Bonus | Bonus for guest requests. | A bonus earned when a guest specifically requests the employee for a service. |

Tips | Total tips earned across all payment types. | Total tips earned by the employee that is recorded in the system irrespective of payment type. |

Declared Tips | Cash tips declared by the employee at the time of checkout. | Cash tips declared by the employee at the end of the shift if tip declaration is enabled for the org. You can see this column only if you have organization level settings to declare cash tips enabled. |

Total Hourly Pay | Total amount earned from hourly pay for this pay period. | The total pay amount earned by the employee at an hourly rate for this pay period. |

Total Pay | The employee’s complete payout, including hourly pay, commission, bonuses, and tips. | The Total Pay column shows the final amount an employee earns for each type of earning — such as services, products, tips, classes, or hourly wages — after all applicable commissions, bonuses, declared tips, and deductions are calculated. How Total Pay is calculated depends on what type of item or activity the employee earned money for: For Services & Add-Ons: Total Pay includes the base commission plus any free service commission, request therapist bonus (RT Bonus), and extra bonus commission. For Products, Packages, Memberships, or Gift Cards: Total Pay equals the commission for that sale only. For Tips: Total Pay equals the tip amount received for that invoice. For SSG (Service Charge): Total Pay equals the collected service charge share paid to the employee. For Hourly Pay: Total Pay equals the sum of hourly wages for the pay period. For Classes: Total Pay equals the final class commission, including any class bonus. For Declared Tips: Total Pay equals the declared cash tips if your organization requires tip declaration. After these amounts are added up, any invoice-level deductions (like refunds or adjustments) are subtracted to get the final payout for that line. |

Service Deductions | Amount deducted from commission for service-specific costs. | The amount subtracted from an employee’s commission specifically for service-related costs. These deductions may include guest-related expenses, shop supply costs, or labor costs directly tied to delivering the service. These deductions appear in the detailed view from payroll summary report > employee wise details export. |

Invoice Deductions | Amount deducted from commission at the invoice level for refunds, discounts, or adjustments. | The amount subtracted from an employee’s commission for deductions applied at the invoice level — such as discounts, refunds, or other invoice-specific adjustments. These deductions appear in the detailed view from payroll summary report > employee wise details export. If your organization has enabled the Show commission amount in payroll post invoice-level deduction setting, then the commission shown will reflect these deductions. For example, if an employee earns $100 commission but has a $5 invoice deduction, the report will show $95 if this setting is ON. If the setting is OFF, the deduction won’t be factored in, and the commission will display as $100. |

Appointment Status | Status of the appointment — Closed, Canceled, or No Show. | Shows whether the appointment was completed (Closed), canceled by the guest, or marked as a No Show. |

Class Commission | Base pay for teaching a class. | The amount paid to the instructor for conducting the class — this is their base earnings for teaching. Example: Sarah teaches a “Morning Yoga Flow” session and earns $35 commission for that class. This is applicable only if classes are configured for the Organization |

Class Bonus | Extra bonus on top of the class commission for high attendance or performance. | Extra incentive money paid on top of the regular class commission — often tied to performance, attendance, or special promotions. Example: Sarah’s yoga session attracts 15 students, so she gets an extra $10 bonus for meeting the attendance target. This is applicable only if classes are configured for the Organization |

# of student | Number of students who attended the class session. | The total number of students who attended and participated in the class. Example: Sarah’s yoga class had 12 students present. This is applicable only if classes are configured for the Organization. |

Class name | Name or the title of the class taught. | The title or name of the class that was taught. Example: “Sunrise Vinyasa Yoga”, “Power Pilates”, “Mindful Meditation”. This is applicable only if classes are configured for the Organization |

Class date | The date the class was held. | The calendar date when the class was held. Example: March 15, 2024. This is applicable only if classes are configured for the Organization |

Class start time | Time the class started. | The exact time when the class started. Example: 9:00 AM. This is applicable only if classes are configured for the Organization |

Class end time | Time the class ended. | The exact time when the class ended. Example: 10:30 AM. This is applicable only if classes are configured for the Organization |