Enable buy now, pay later (BNPL) options with Zenoti Payments

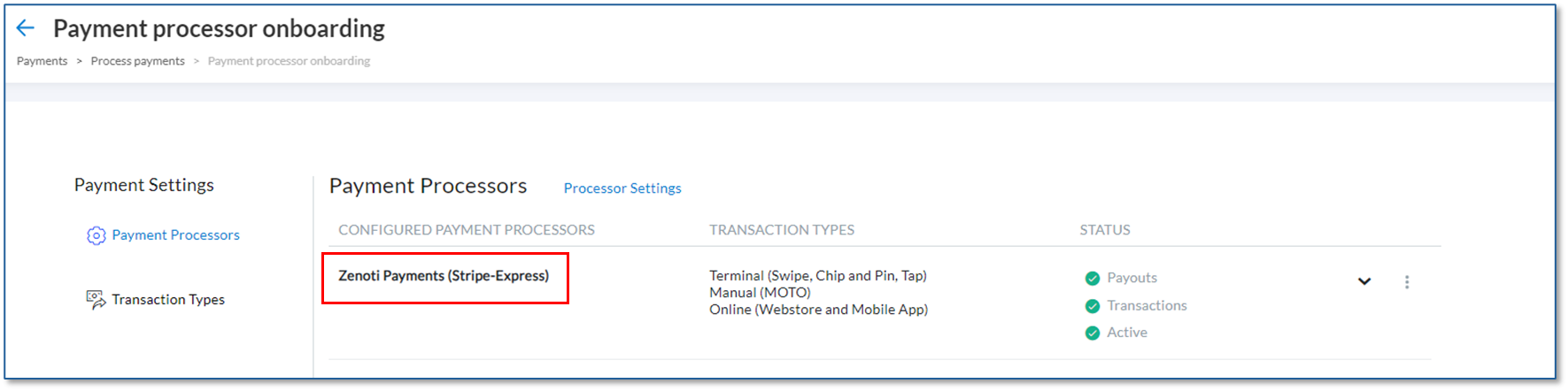

Zenoti Payments (Stripe Express) supports popular buy now, pay later (BNPL) options including Affirm, AfterPay, and Klarna.

These services allow your customers to make immediate purchases and pay overtime in fixed installments, providing them with greater financial flexibility.

Note: The following is a list of regions where BNPL partners are available:

Affirm: US and CA

Afterpay or Clearpay: US, CA, AUS, UK and NZ

Klarna: US, CA, AUS, UK and NZ

Overview

Affirm, AfterPay, and Klarna are leaders in consumer financing with their BNPL model.

They provide point-of-sale installment loans, allowing consumers to afford desired items without falling into unsustainable debt.

Customers can choose from a variety of repayment plans that suit their financial needs.

Criteria

Before you can offer BNPL options, ensure the following prerequisites are met:

Create a Zenoti Payments (Stripe Express) Account: To set up a Zenoti Payments account, follow the setup guide to get started.

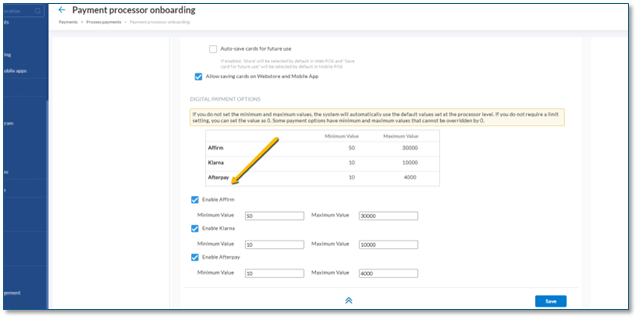

Enable Stripe buy now, pay later programs: After your account is active, ensure BNPL programs like Affirm, AfterPay, and Klarna are enabled in your payment options.

Enable and use payment links: Follow the payment link instructions to enable and start using payment links to facilitate transactions with BNPL options.

FCA license requirement for UK organizations

To provide financial options for guests in the UK, organizations need a valid Financial Conduct Authority (FCA) license. In the UK, credit brokering is regulated by the FCA. To introduce customers to regulated credit, FCA authorization is required. Merchants offering credit to customers are considered to be engaging in credit broking unless an installment credit exemption applies.

Note: This exemption only applies if the credit agreement lasts no more than 12 months and is completely free of interest, fees, or charges. Since Zenoti Payments’ account or term loans do not meet this exemption, financing can only be offered through merchants who hold a valid FCA Credit Broker license.

How to obtain an FCA credit broker license

Obtaining an FCA Credit Broker license can be facilitated through various third-party services in the UK that assist retailers with their FCA paperwork.

Below is what Klarna and other PSPs recommend, as they are reputable providers known for their quick turnaround and fair pricing.

Recommended contact for FCA license assistance:

Andrew Shuttlewood

https://www.consumercreditcentre.co.uk/

01484 443 413

Fees through a business like SimplyBiz (recommended):

SimplyBiz pre-authorization monthly fee (£10 + VAT) – applicable until authorization is obtained.

Standard DBS check (approximately £65–£85) – required prior to application submission.

FCA fee (£500) – payable upon submission of the application.

SimplyBiz application support fee (£300 + VAT) – billed on the 27th of the month following submission.

SimplyBiz regulatory support (£25 + VAT per month) – if required, begins once authorized.

Annual FCA fee – approximately £750 in 2024 and £1,100 in 2025, continuing at the same rate thereafter.

Expected Timeline:

The process typically takes 8-12 weeks.

Support Provided:

SimplyBiz offers comprehensive FCA Consumer Credit support, including help with completing the Consumer Credit Application and ongoing compliance support.